-

Applying M60 DAATS & GNASD Logic to Equities: GEMF – USA Sub‐Fund

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

No Comments

Learn how GEMF – USA Sub-Fund uses M60 DAATS and GNASD to set stop floors, breakeven triggers, and trailing stops on micro-timeframes (M30, M15, M5, M1) under the Daily MACD bias and M60 EMA regime.

-

Micro‐Timeframe Stop Floors & Breakeven Logic Using M60 DAATS & GNASD

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

In this lecture, we demonstrate how GATS leverages M60 DAATS and the portfolio’s one‐sigma noise unit (GNASD) to establish robust stop‐loss floors, breakeven triggers, and trailing stops on M30, M15, M5, and M1. By anchoring micro‐timeframe stops to hourly volatility and applying a 1.39% breakeven rule per pair, traders can avoid routine hourly whipsaw while still capturing high‐probability moves under the Daily MACD bias and M60 EMA regime filters.

-

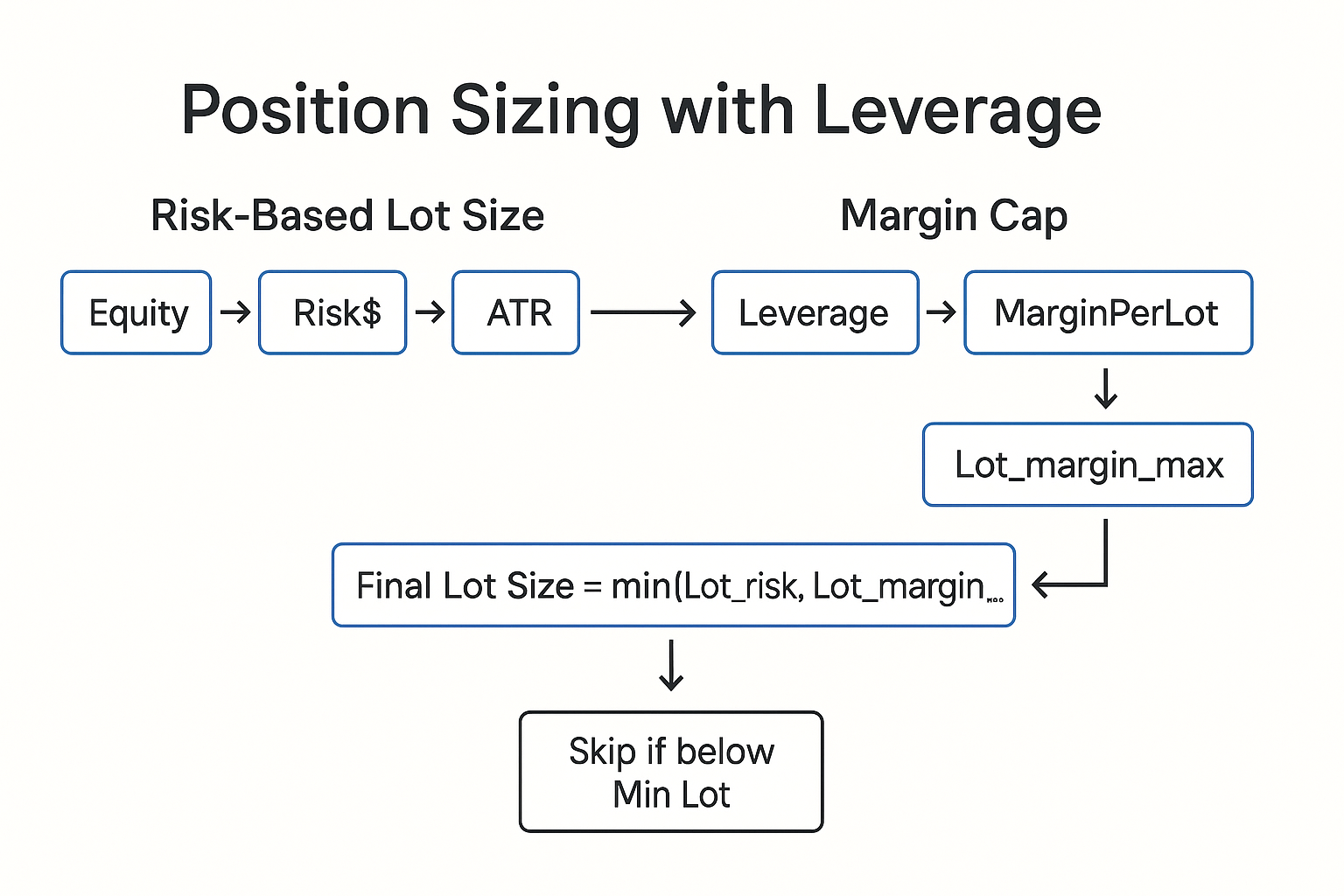

Position Sizing Under Extreme Leverage in Dr. Glen Brown’s Seven-Law Framework

- May 29, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Learn how to incorporate extreme leverage into Dr. Glen Brown’s Seven-Law volatility stop-loss framework for disciplined position sizing

-

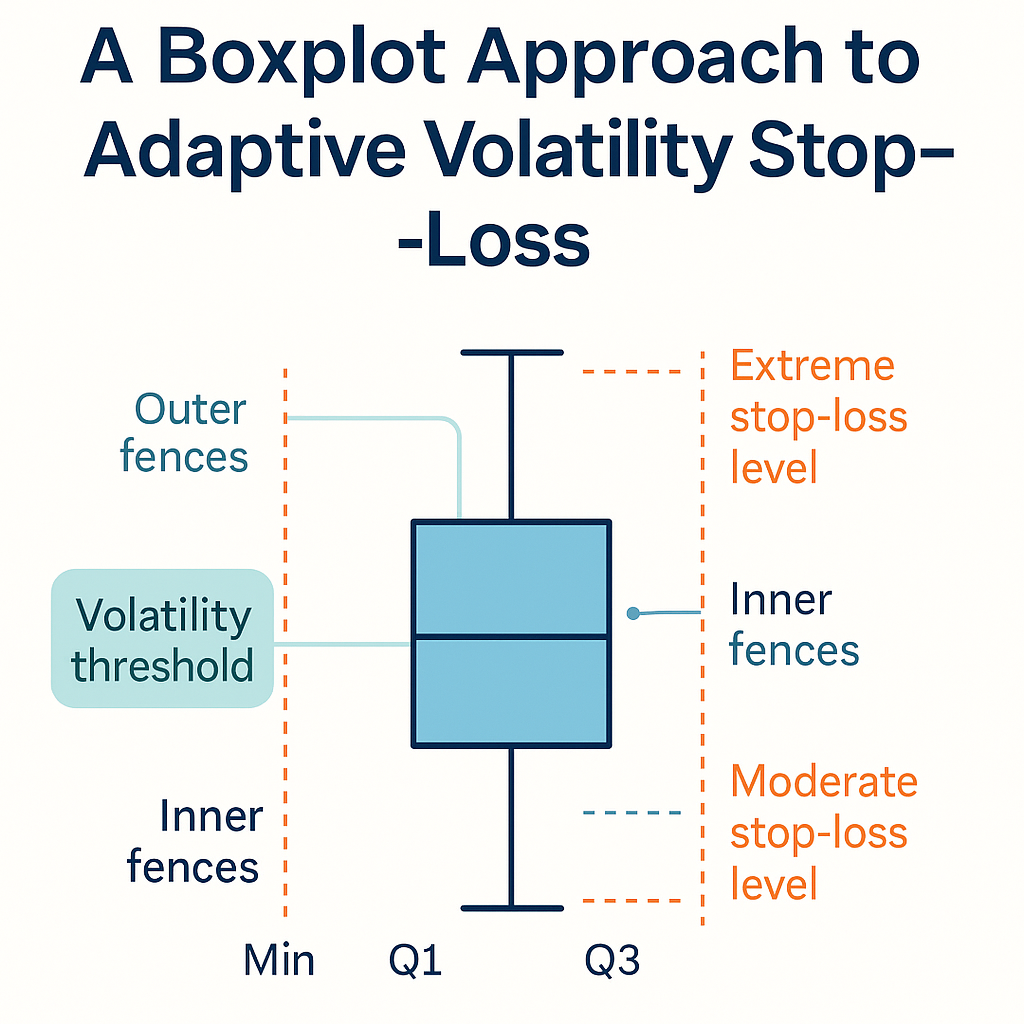

Whiskers & Fences: A Boxplot Approach to Adaptive Volatility Stop-Loss

- May 26, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to apply boxplot hinges, whiskers and fences to Dr. Glen Brown’s Seven Laws to detect regime shifts and dynamically adjust stop-loss buffers using ATR(200) exposures.

-

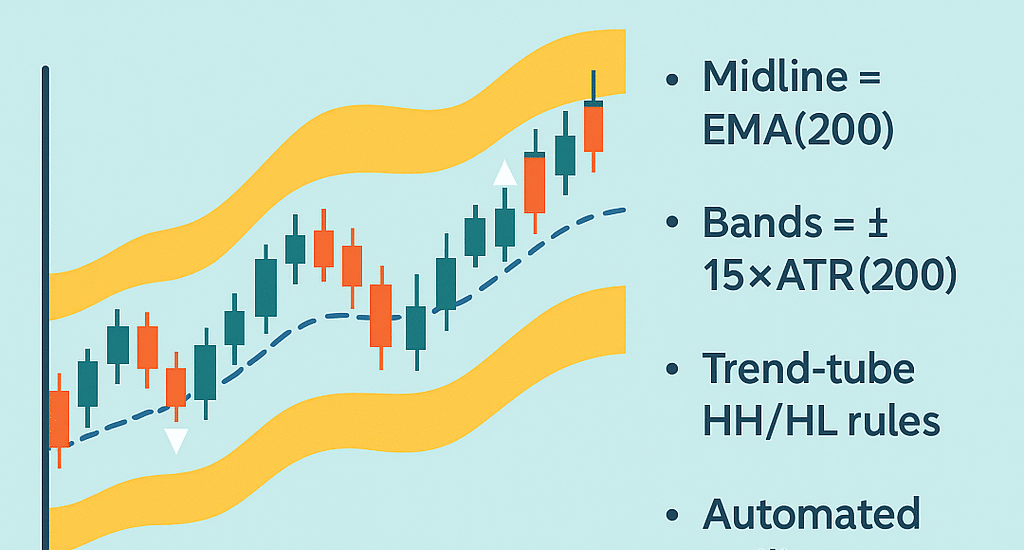

Keltner Reinvented: Embedding k = 15 into Your Trend Envelope

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to implement an adaptive Keltner Channel with EMA(200) midline and ±15×ATR(200) bands, including Pine/MT4 code, trend-tube rules, and automated trailing.

-

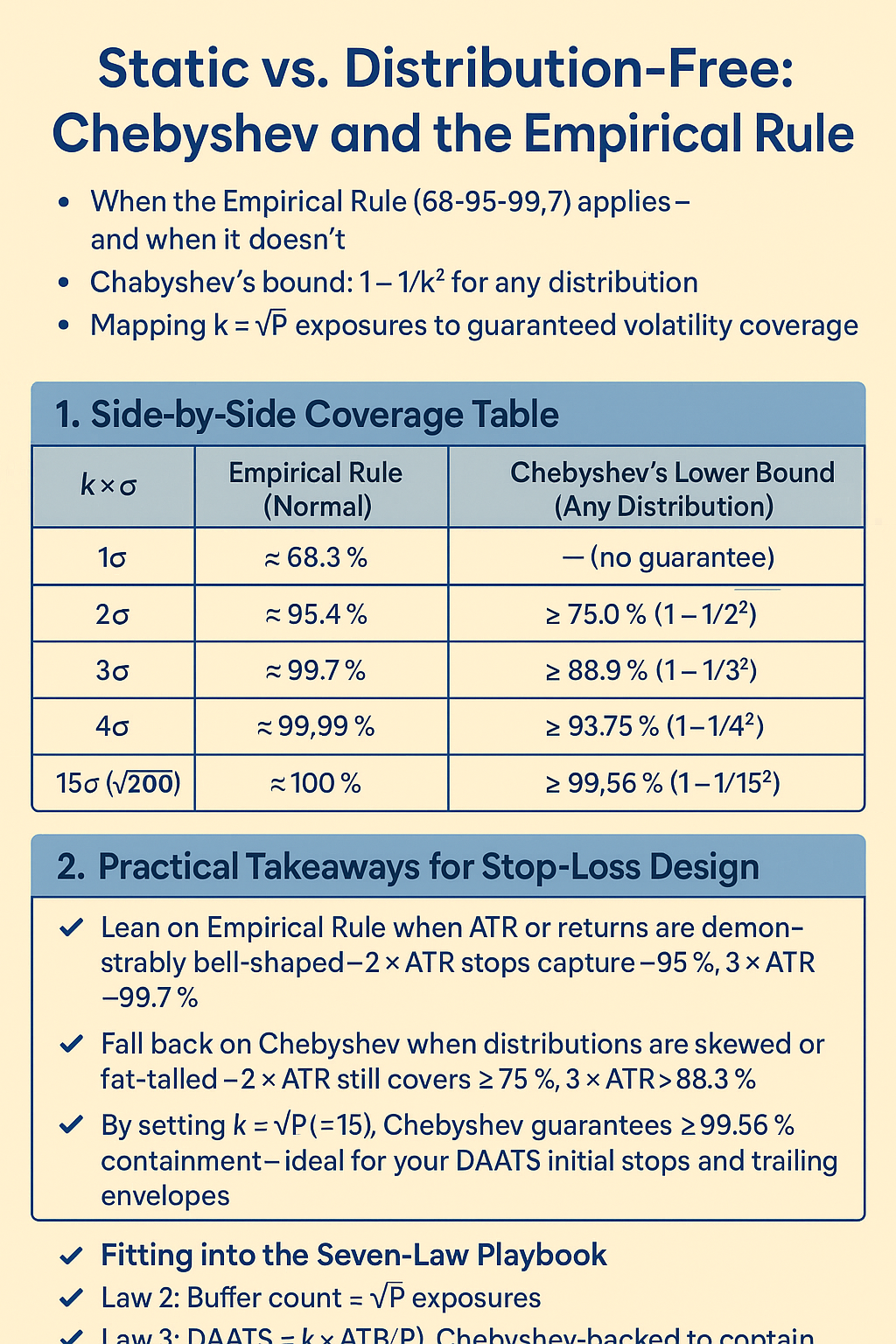

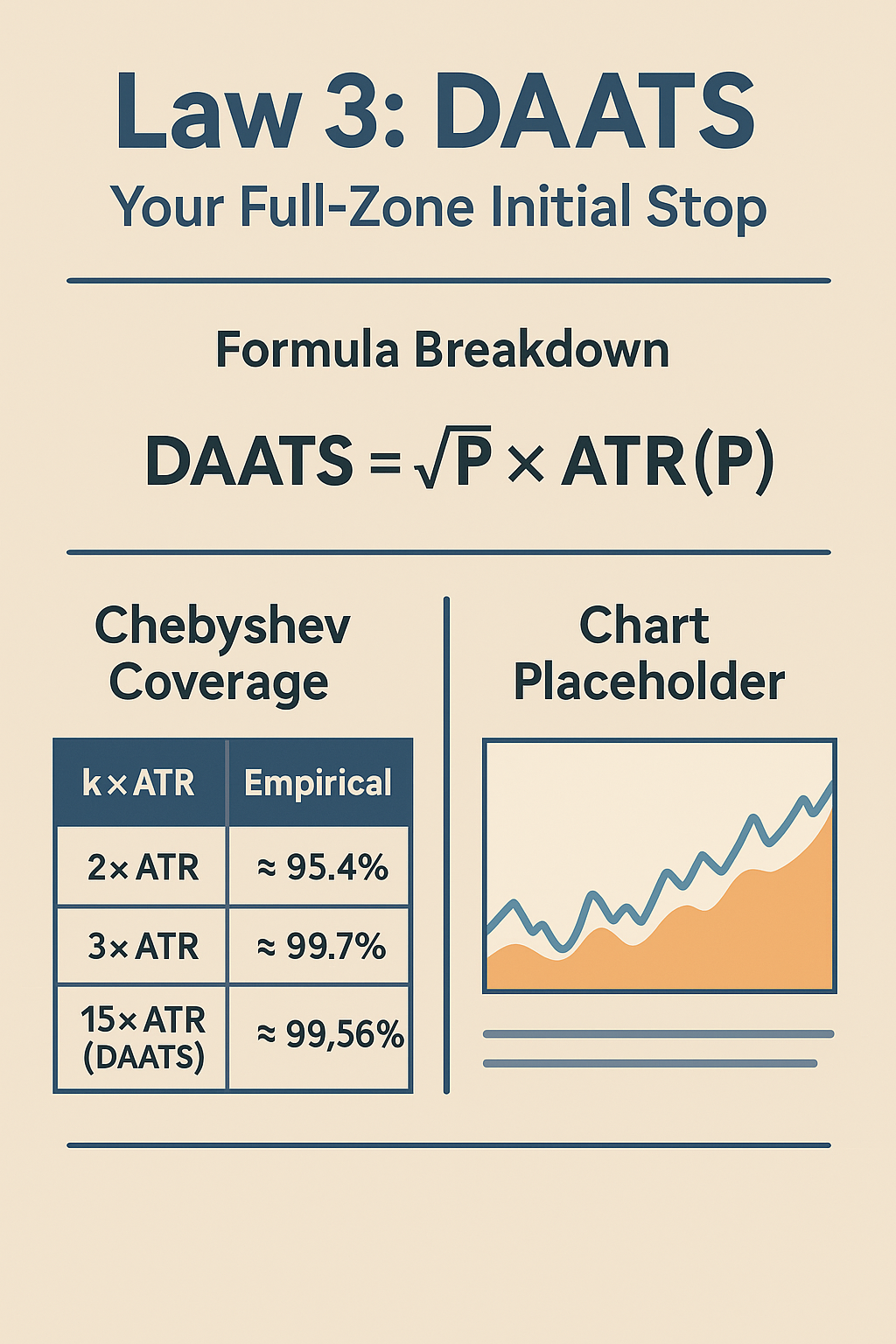

Static vs. Distribution-Free: Chebyshev and the Empirical Rule

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Compare the Empirical Rule for normal distributions with Chebyshev’s inequality for any distribution. Learn how k=√P exposures maps to guaranteed volatility coverage within Dr. Glen Brown’s Seven-Law framework.

-

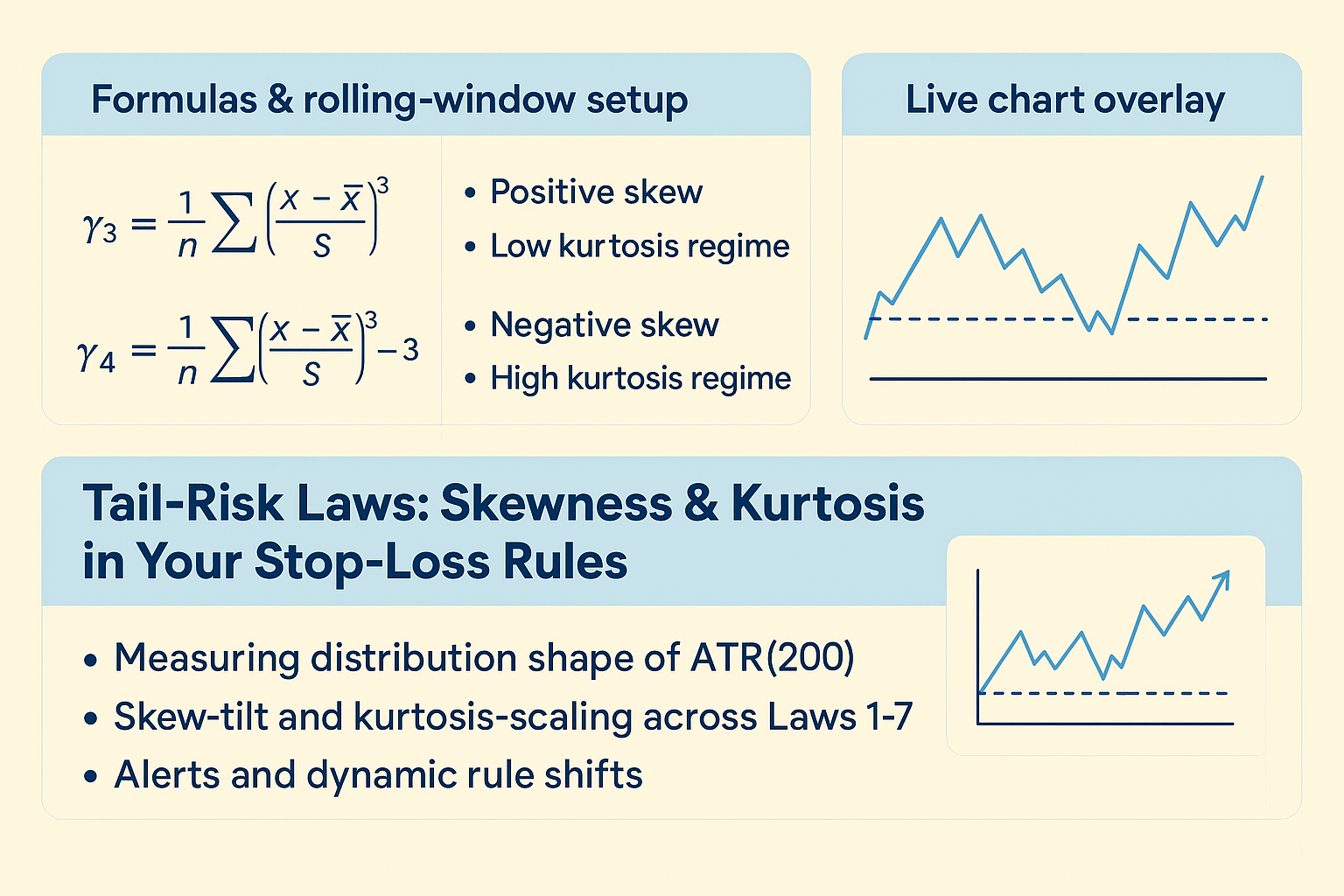

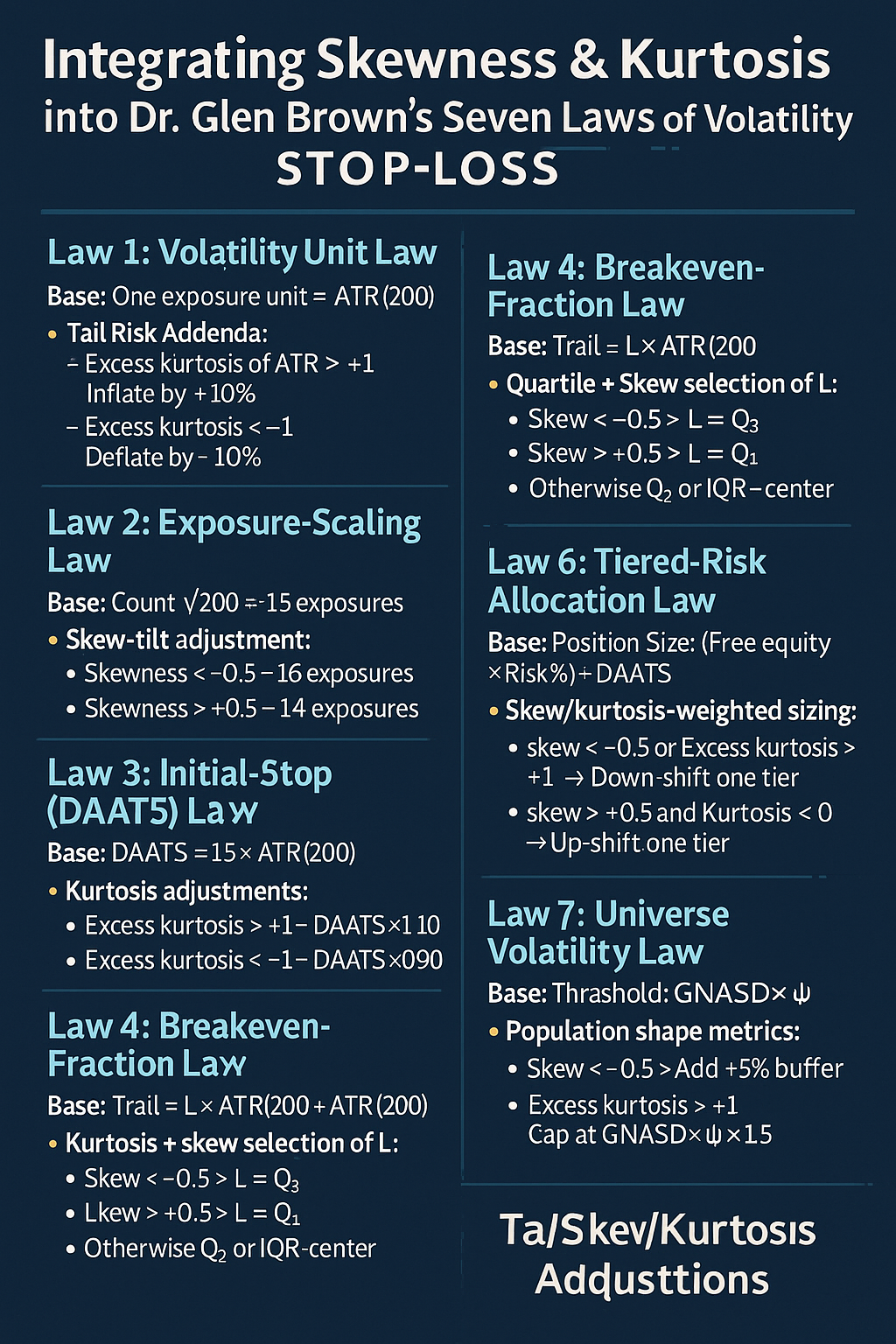

Tail-Risk Laws: Skewness & Kurtosis in Your Stop-Loss Rules

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to measure ATR(200) skewness and kurtosis, apply skew-tilt & kurtosis-scaling to Dr. Glen Brown’s Seven Laws, and view live chart overlays for dynamic stop adjustments.

-

Law 7: GNASD—Managing Cross-Asset Noise Budgets

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Law 7 of Dr. Glen Brown’s Seven Laws—GNASD for portfolio-level stops. Learn how to compute population σ, normalize by N, and apply global breakeven triggers with hybrid caps and cost floors.

-

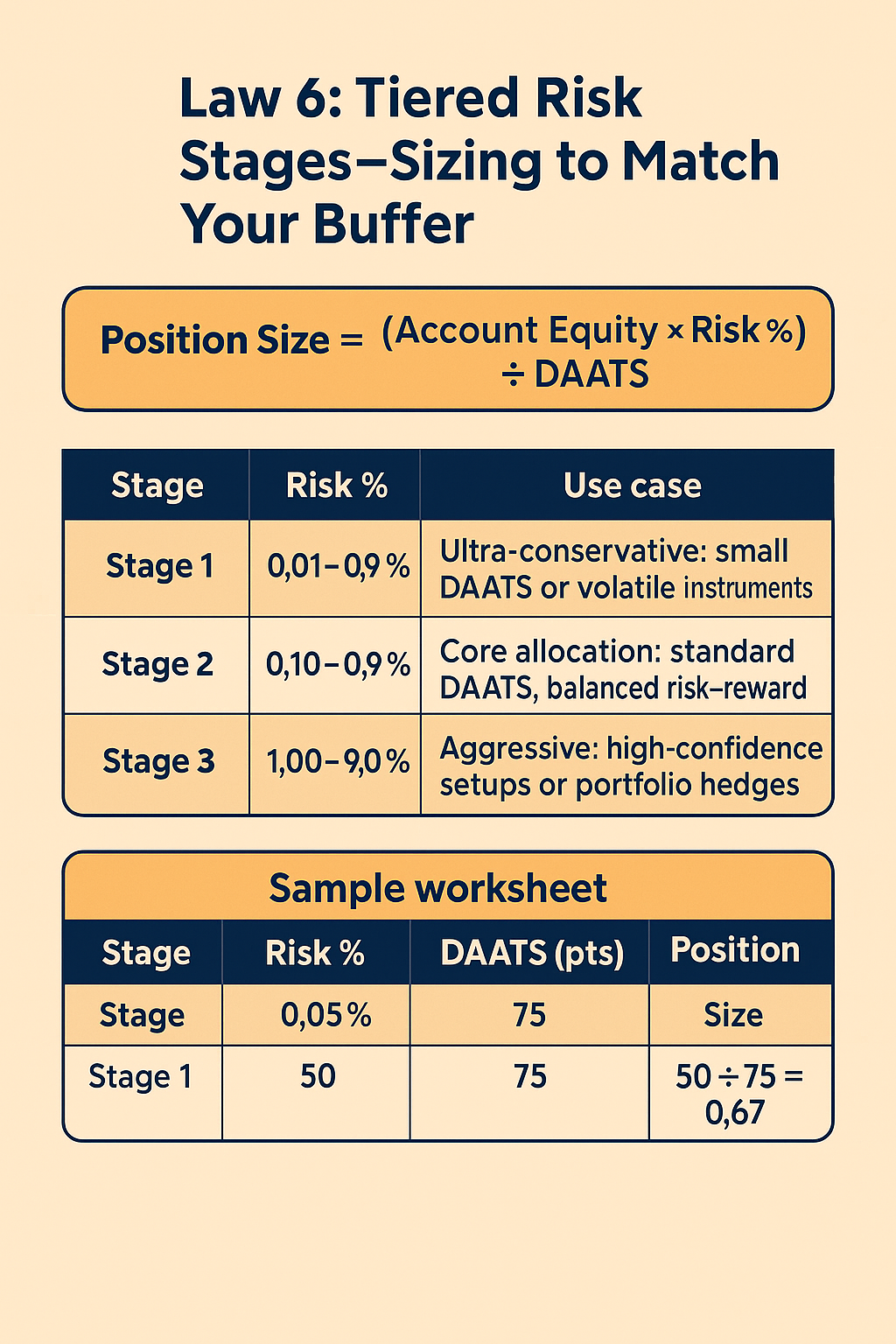

Law 6: Tiered Risk Stages—Sizing to Match Your Buffer

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn Law 6 of Dr. Glen Brown’s Seven Laws: position sizing via (Equity×Risk %) ÷ DAATS, explore Stage 1/2/3 risk tiers, and see case studies on dollar-at-risk levels.

-

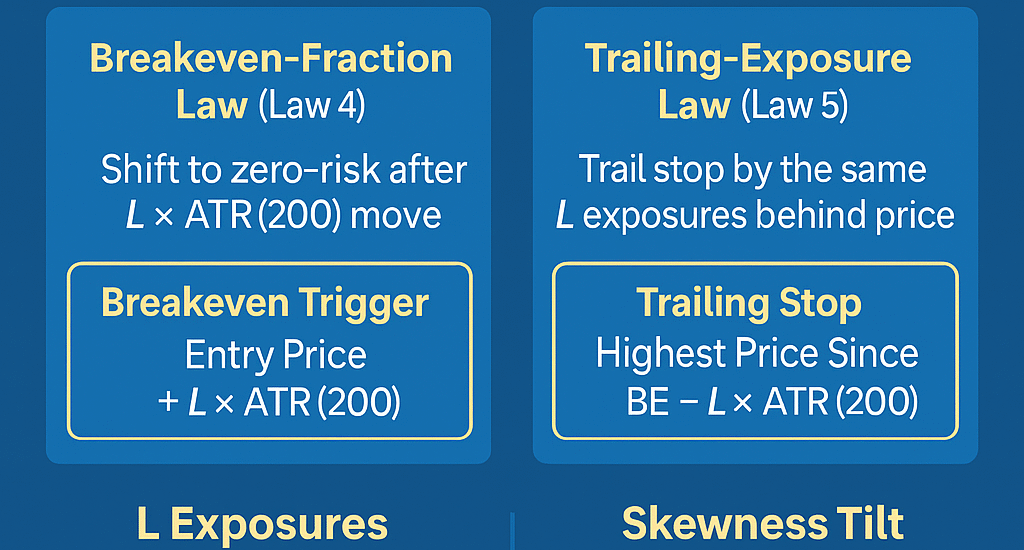

Laws 4–5: Lock in Zero-Risk & Let Winners Run

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Master Laws 4–5 of Dr. Glen Brown’s framework—adaptive breakeven triggers and trailing stops using quartile/IQR and skewness—to lock in zero risk and let winners run.

-

Law 3: DAATS—Your Full-Zone Initial Stop

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Law 3 of Dr. Glen Brown’s Seven Laws: DAATS = √P×ATR(P). Learn the formula, Chebyshev’s worst-case guarantee, and see an example trade with DAATS plotted.

-

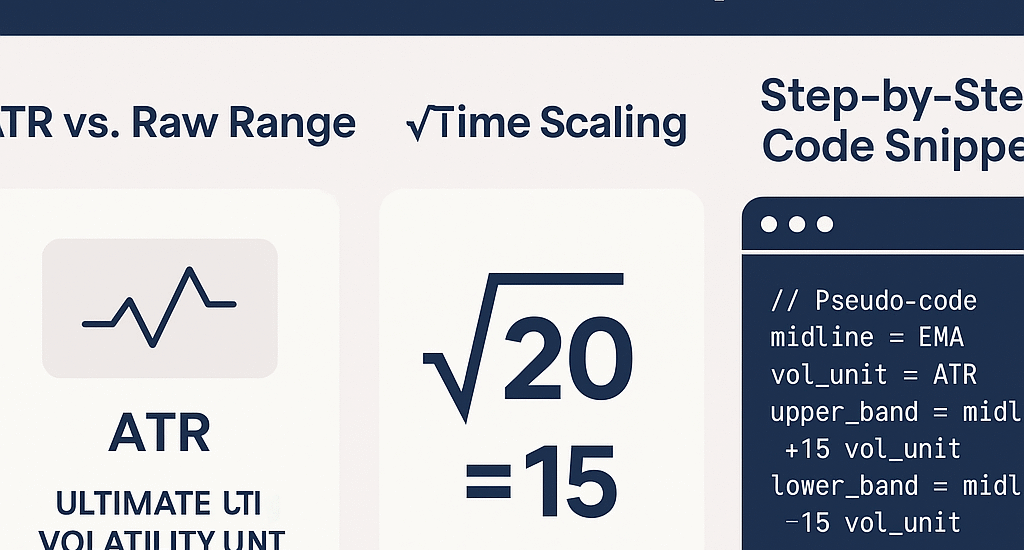

Law 1–2: Anchor Your Stops to ATR(200) & √Time Exposures

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn why ATR(200) is the ultimate volatility unit and how √time scaling (√200≈15 exposures) underpins adaptive stop-loss management, with step-by-step chart implementation.

-

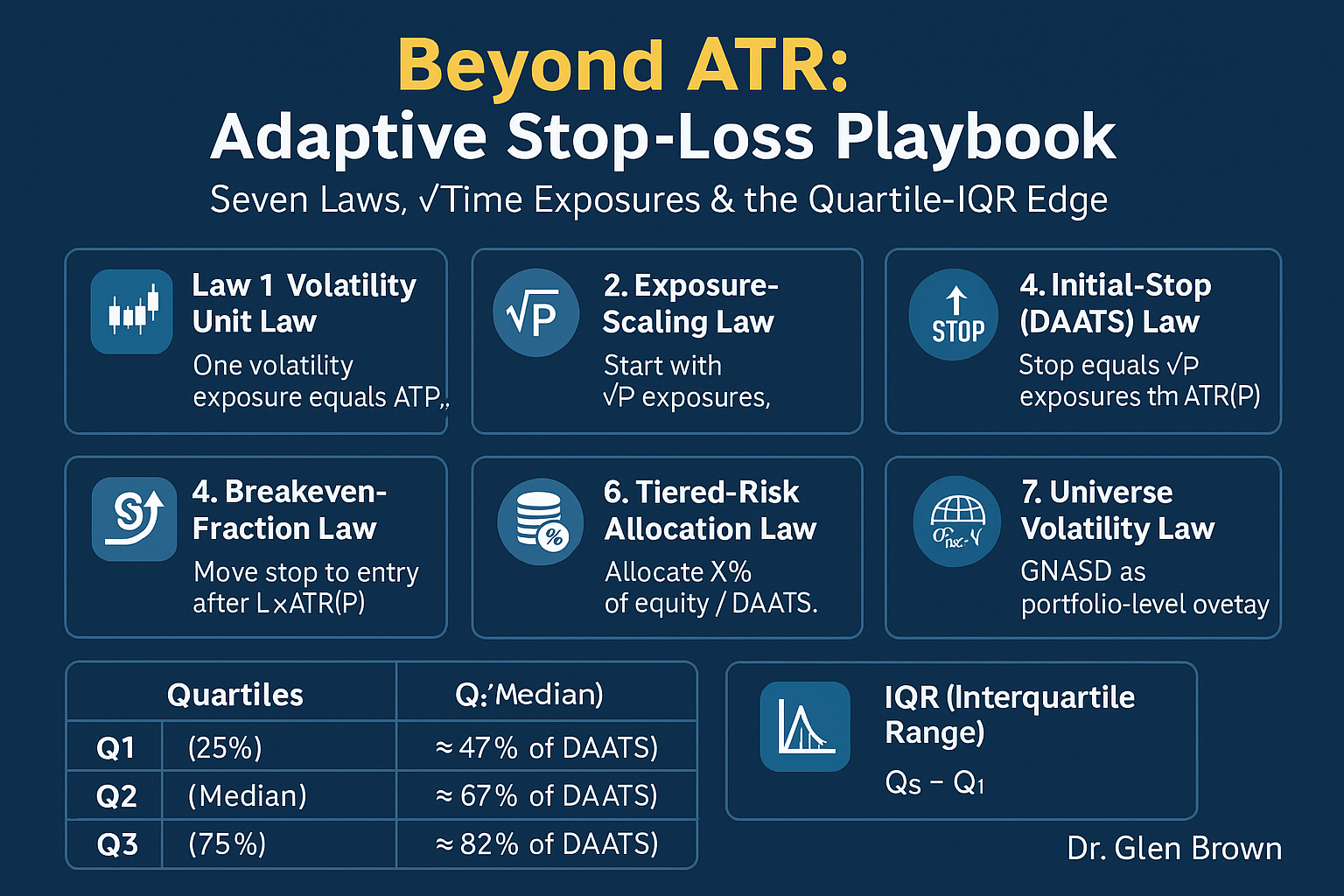

Beyond ATR: Introducing Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover why static ATR-based stops fail and explore Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—anchored by √time scaling, DAATS and GNASD—for a truly adaptive risk framework.

-

Integrating Skewness & Kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to integrate skewness and kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss within the GATS framework for truly adaptive, tail-aware stops and breakeven rules.

-

Beyond ATR: Dr. Glen Brown’s Adaptive Stop-Loss Playbook—Seven Laws, √Time Exposures & the Quartile-IQR Edge

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Dr. Glen Brown’s next-level stop-loss framework: seven universal laws, √time volatility exposures, and quartile/IQR techniques for adaptive breakeven and trailing stops.

-

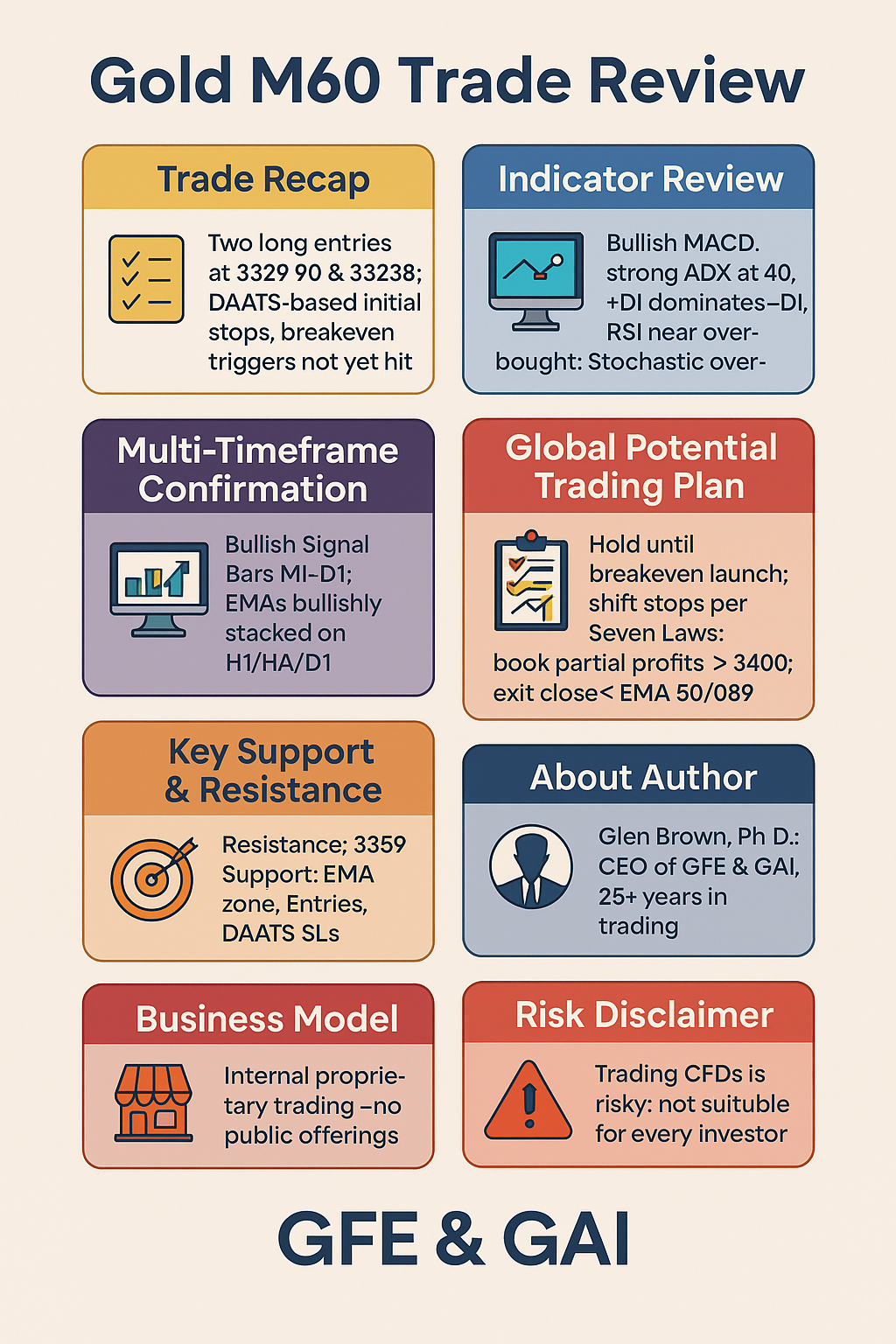

Gold M60 Trade Review (May 22 & 23 Entries)

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

Detailed Gold M60 trade review using Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—entry, stops, breakeven triggers, indicator deep-dive and next-session plan.

-

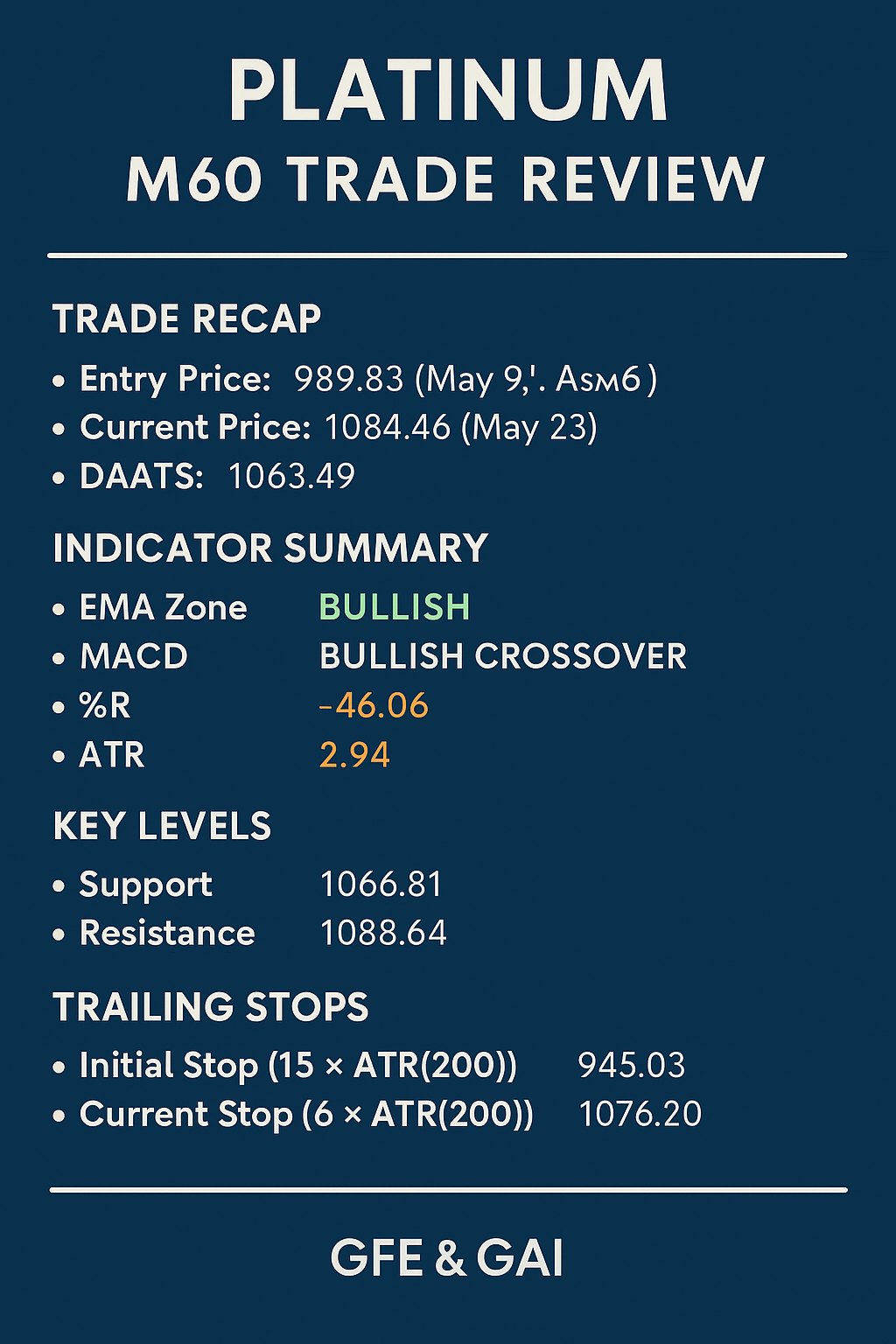

Platinum M60 Trade Review (May 9 Entry) Applying Dr. Glen Brown’s Seven Laws + Technical Indicator Deep-Dive

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

In-depth review of the May 9 Platinum M60 trade using Dr. Glen Brown’s seven Laws of Volatility Stop-Loss, plus multi-indicator analysis and next-session plan.

-

Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Dr. Glen Brown’s seven universal laws of volatility stop-loss—a zone-aligned, ATR(200)-based framework for adaptive stops, breakeven rules, and tiered risk management across all markets and timeframes.