-

Introduction to Dr. Glen Brown’s Nine‑Laws Framework for Adaptive Volatility and Risk Management

- June 9, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Finance / Risk Management

No Comments

-

Dr. Glen Brown’s Nine-Laws Framework for Adaptive Volatility and Risk Management

- June 6, 2025

- Posted by: Drglenbrown1

- Category: Risk Management / Quantitative Finance

Explore Dr. Glen Brown’s Nine-Laws Framework for Adaptive Volatility and Risk Management, featuring DAATS, GNASD, and break-even strategies designed to optimize portfolio performance in dynamic markets.

-

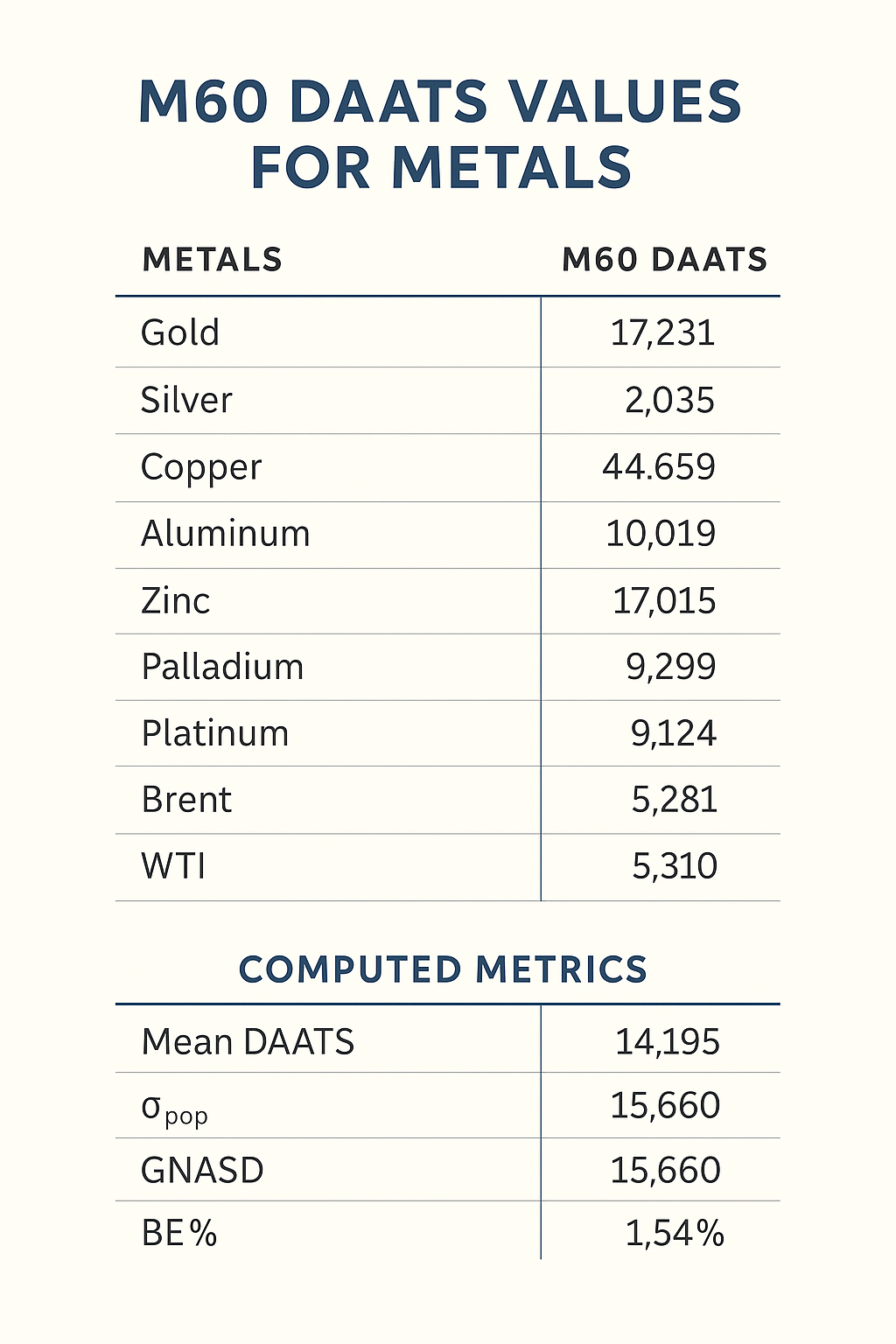

Calculating GNASD & BE% for M60 Metals Portfolio

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how to compute portfolio σpop, GNASD (one-sigma noise unit), and BE% for 10 metals (Gold, Silver, Copper, Aluminum, Zinc, Lead, Palladium, Platinum, Brent, WTI) using updated M60 DAATS values.

-

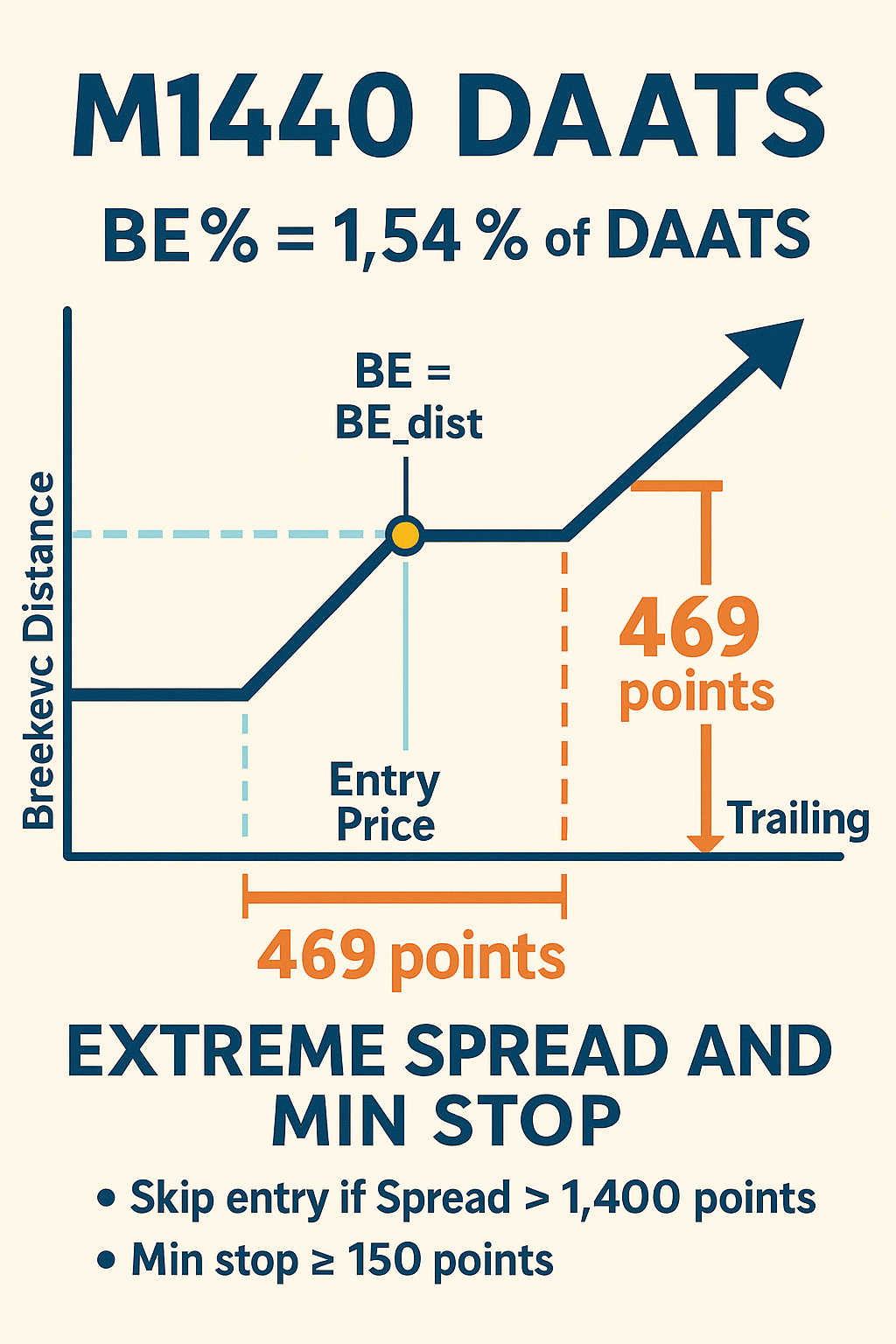

Final M1440 DAATS Lecture: Breakeven & Trailing Stops with Extreme Spread Handling

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn our final M1440 DAATS framework for 28 forex pairs: BE % = 1.54 % of DAATS, post‐BE trailing = 469 points, and skip entries if spread > 1 400 points, all aligned with Dr. Brown’s Seven Laws.

-

Recalculating BE% & GNASD for GEMF – USA Sub‐Fund (June 1, 2025)

- June 1, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how to recalculate portfolio BE% and GNASD (one-sigma noise unit) for GEMF – USA Sub-Fund using updated M60 DAATS values on June 1, 2025. Includes formulae, examples, and implementation linked to Dr. Brown’s Seven Laws.

- 1

- 2