-

Law 2 & Strategy 2 – Weighted Decay of DAATS & Global Quick Trend Trader: Quantum Smoothing in Action

- July 31, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

No Comments

Dive deep into quantum smoothing—time-varying half-lives, dissipative channels, and observer narratives—applied to the Global Quick Trend Trader’s default M5 logic in GATS.

-

Law 1 & Strategy 1 – Superposition Scalping with Quantum Observers

- July 31, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

See how your algorithm becomes the quantum observer, collapsing price superpositions into trades, and learn to wield measurement operators, entanglement, and decoherence for superior risk management.

-

Dr. Glen Brown’s Nine-Laws Framework: A Quantum Revolution in Volatility Risk Management

- July 31, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum mechanics concepts—superposition, density matrices, and Lindblad dynamics—to adaptively manage volatility and risk in forex, equities, commodities, and crypto strategies.

-

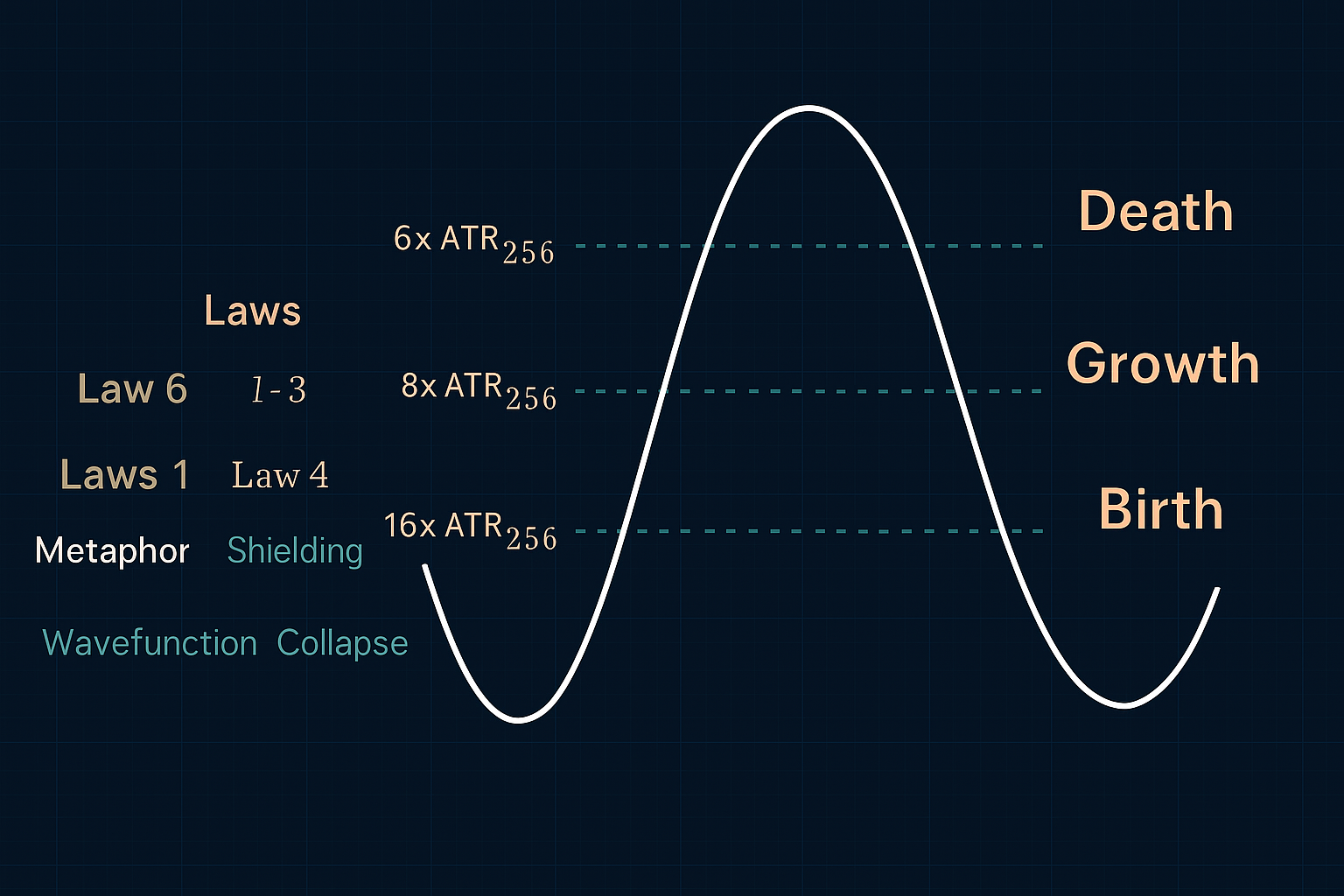

The Volatility Root Law – Part II: From Fractal Breakeven to Volatility-Defined Death

- July 20, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading, Risk Engineering

Part II of Dr. Glen Brown’s Volatility Root Law reveals a quantum volatility lifecycle framework that governs trade entry, breakeven, trailing stops, and exit using fractal amplitude theory and temporal anchoring—structured through the Nine Laws of Adaptive Risk.

-

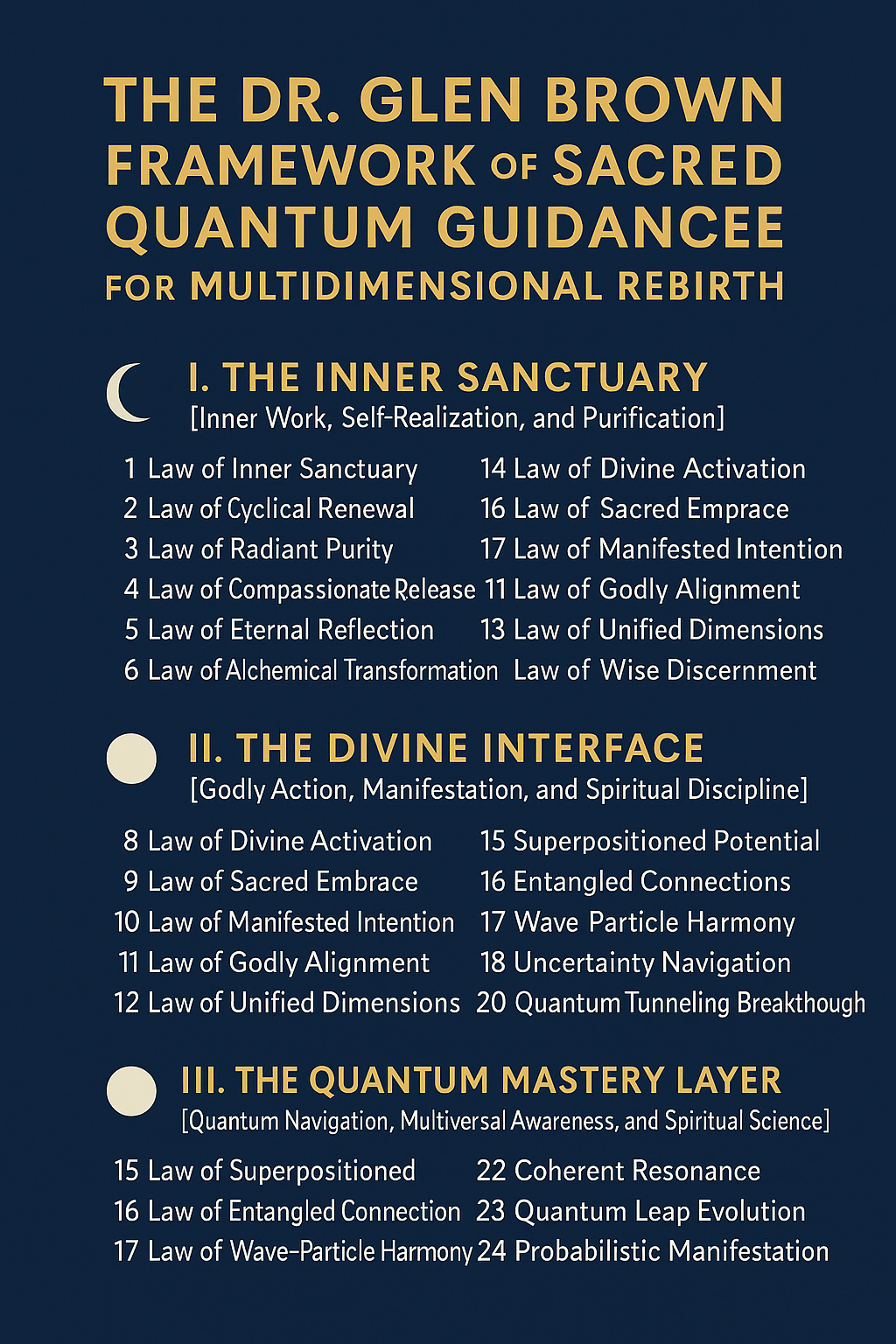

The Dr. Glen Brown Framework of Sacred Quantum Guidance for Multidimensional Rebirth

- July 18, 2025

- Posted by: Drglenbrown1

- Categories: Quantum Philosophy, Spiritual Frameworks

The Dr. Glen Brown Framework of Sacred Quantum Guidance for Multidimensional Rebirth is a doctrine of 24 universal laws designed to awaken higher consciousness. Fusing quantum physics, divine philosophy, and personal transformation, this framework offers a timeless path for self-mastery, spiritual alignment, and intentional manifestation.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Finance, Thought Leadership, GATS Series

Discover the foundation of Dr. Glen Brown’s Nine-Laws Framework as he applies quantum principles to market chaos. Learn how to trade with coherence, resilience, and engineered discipline.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

In Part 3 of his Quantum Intricacies series, Dr. Glen Brown explains Laws 7–9 for maintaining portfolio coherence through noise budgeting, slippage buffers, and adaptive model rebirth.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum principles to market exits, volatility, and time. Part 2 of the Quantum Mindset series.

-

Dr. Glen Brown’s Perspectives: The Empire of Death in 2025

- July 12, 2025

- Posted by: Drglenbrown1

- Category: Global Economic Outlook

Dr. Glen Brown exposes the Empire of Death dominating 2025—fueled by conflict, hunger, climate shocks, and high interest rates. A transformative call to action.

-

Building Your First GUQFXP Trade: From Signal to Death-Stop

- July 5, 2025

- Posted by: Drglenbrown1

- Category: Global Universal Quantum FX Portfolio (GUQFXP)

In this walkthrough, we step through a single GUQFXP trade from initial signal generation through to Death-Stop placement, adaptive break-even, and profit-target execution.

-

Global Weekly Forex Portfolio Risk Management Guide For Global Traders

- July 3, 2025

- Posted by: Drglenbrown1

- Category: Forex Portfolio Analysis, Quantum Risk Management

This weekly guide leverages Dr. Glen Brown’s quantum-inspired Nine-Laws Framework and GATS methodology to deliver adaptive, self-calibrating risk controls—stops, break-evens, and position sizing—across a global portfolio of 28 major FX pairs.