-

Law X: The Dual-Magnet Regime Commitment Engine

- December 23, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading & Market Doctrine

No Comments

Excerpt: A universal market law: constraint resolves before commitment. Law X combines Pin Basins, Commitment Basins, and the RC1–RC3 hierarchy to compute timeframe authority, permission commitment, and formalize non-participation as a correct decision state.

-

Why Most Traders Die by Their Own Stops

- December 17, 2025

- Posted by: Drglenbrown1

- Category: Trading Psychology & Risk Doctrine

Most traders do not fail because their strategies are wrong—they fail because their stops are structurally incompatible with volatility. This article challenges the myth of “tight risk,” reframes stop-losses as survival boundaries rather than safety devices, and introduces the critical distinction between drawdown and time. It lays the foundation for understanding why true risk management begins with how long a trade must be allowed to live.

-

The Square Root of Time Law (SRTL)

- December 17, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading & Financial Engineering

The Square Root of Time Law (SRTL) introduces a law-based framework for constructing Death Stops that scale correctly with volatility diffusion and trade lifecycle. By anchoring risk to time rather than execution timeframe, SRTL eliminates arbitrary stop placement, rejects heuristic ATR conventions, and establishes a universal survival doctrine integrated with the Nine-Laws Framework, DAATS, and TWVF.

-

The Global 365 Thought Leadership Series — Index

- December 10, 2025

- Posted by: Drglenbrown1

- Categories:

-

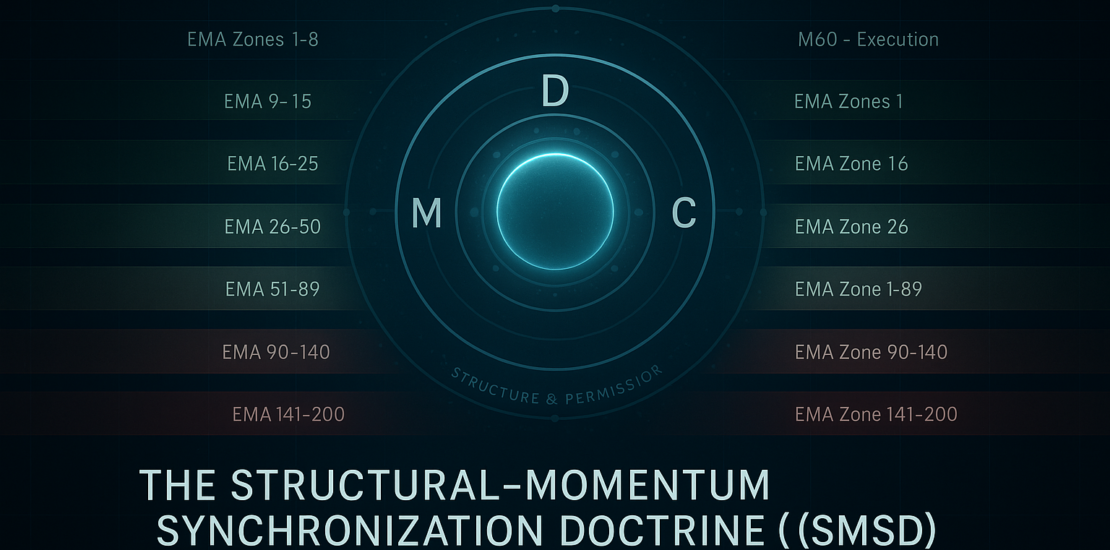

Structural–Momentum Synchronization Doctrine (SMSD) — Master Document

- December 7, 2025

- Posted by: Drglenbrown1

- Categories: Global Algorithmic Trading Software (GATS), Institutional Frameworks, Volatility & Risk Doctrine

This master document compiles Sections 1–15 of the Structural–Momentum Synchronization Doctrine (SMSD), detailing how Dr. Glen Brown unifies momentum, structural drift, EMA zones, market identity, and the Nine-Laws Framework into a complete, volatility-aware execution architecture for GATS and G9TTS.