-

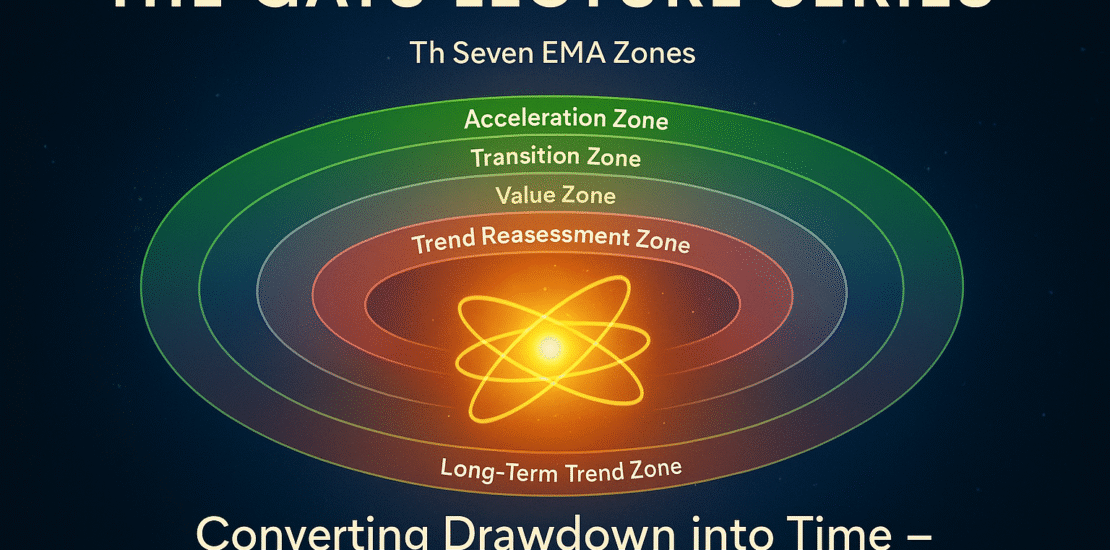

The Foundations of GATS: From EMA Zones to Quantum Risk Dynamics

- October 31, 2025

- Posted by: Drglenbrown1

- Categories:

No Comments

Discover the foundational principles of GATS — Dr. Glen Brown’s advanced algorithmic trading framework that fuses EMA Zones, ATR-based risk logic, and quantum-inspired volatility management.

-

Temporal Liquidity Fields: The Geometry of Volatility Flow — Dr. Glen Brown

- October 27, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

Dr. Glen Brown maps liquidity currents across timeframes in GATS, offering equations, metrics, and protocols to trade volatility flow safely and effectively.

-

The Entropy-Negentropy Continuum: Quantifying Market Life Cycles — Dr. Glen Brown

- October 26, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

Dr. Glen Brown quantifies market life cycles through the Entropy-Negentropy Continuum, applying volatility thermodynamics and temporal intelligence to GATS

-

Fractal Temporal Synchronization: The Law of Time-State Alignment — Dr. Glen Brown

- October 26, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

A detailed paper by Dr. Glen Brown revealing how multi-timeframe phase alignment generates exponential coherence through the GATS Framework.

-

Negentropic Pulse Dynamics: Rebirth within Macro Entropy — Dr. Glen Brown

- October 25, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

Dr. Glen Brown unveils Negentropic Pulse Dynamics within the GATS Framework—how order forms inside macro entropy through multi-timeframe energy realignment and volatility geometry.

-

Inter-Timeframe Structural Dislocation (ITSD): The Science of Nested Volatility States — Dr. Glen Brown

- October 25, 2025

- Posted by: Drglenbrown1

- Categories:

Inter-Timeframe Structural Dislocation: The Science of Nested Volatility States

-

Compression within Containment: Transforming Drawdown into Time — Dr. Glen Brown

- October 25, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

A detailed paper by Dr. Glen Brown showing how GATS turns drawdown into time through the M1440-anchored Death Stop and temporal elasticity during volatility compression

-

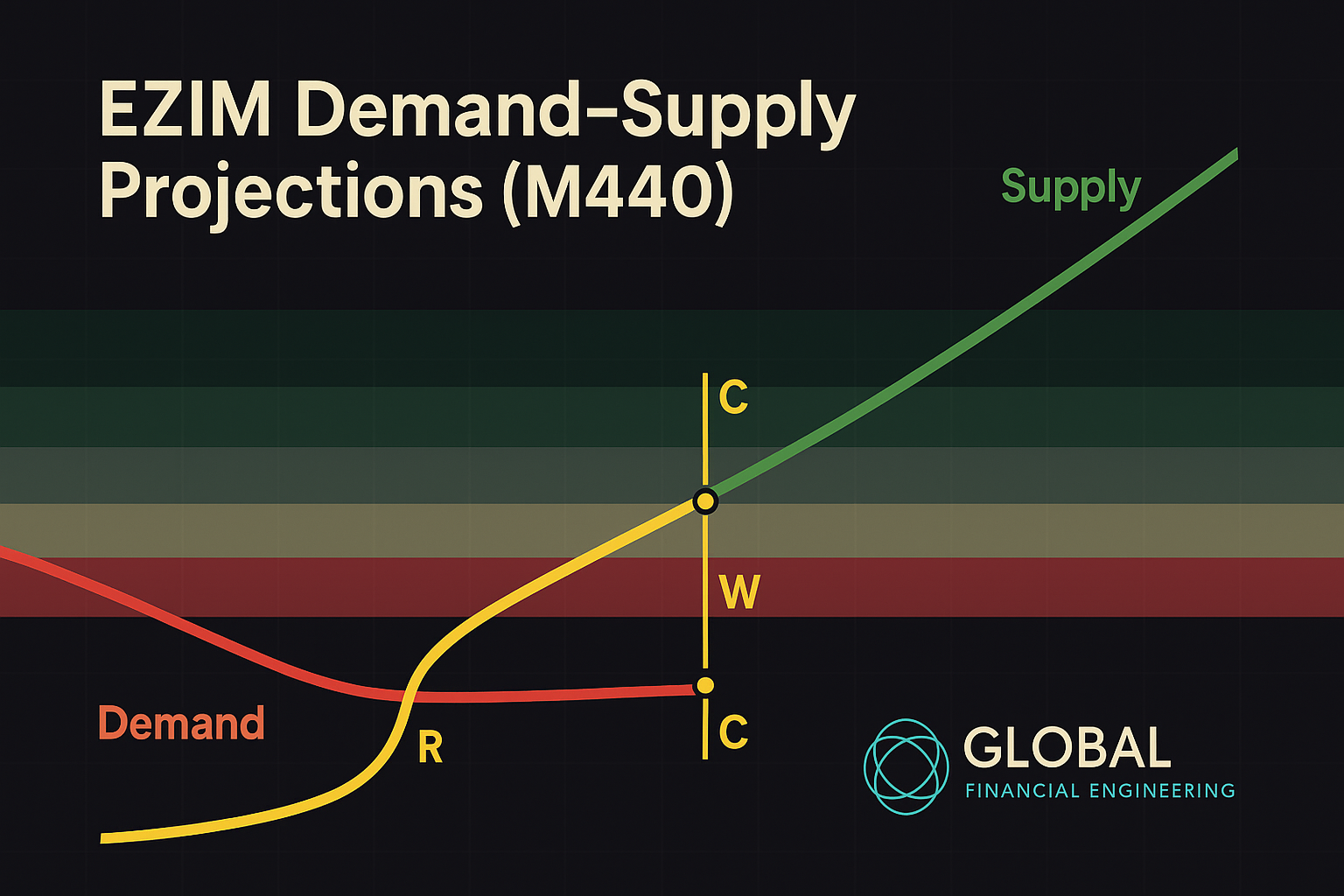

EZIM Demand–Supply Projections (M1440)

- September 28, 2025

- Posted by: Drglenbrown1

- Category: GATS / EZIM

EZIM interactions with downward-sloping demand and upward-sloping supply lines on M1440. Includes readable formulas, compression/energy metrics, MACD governance, signals, and coding hooks for GATS.

-

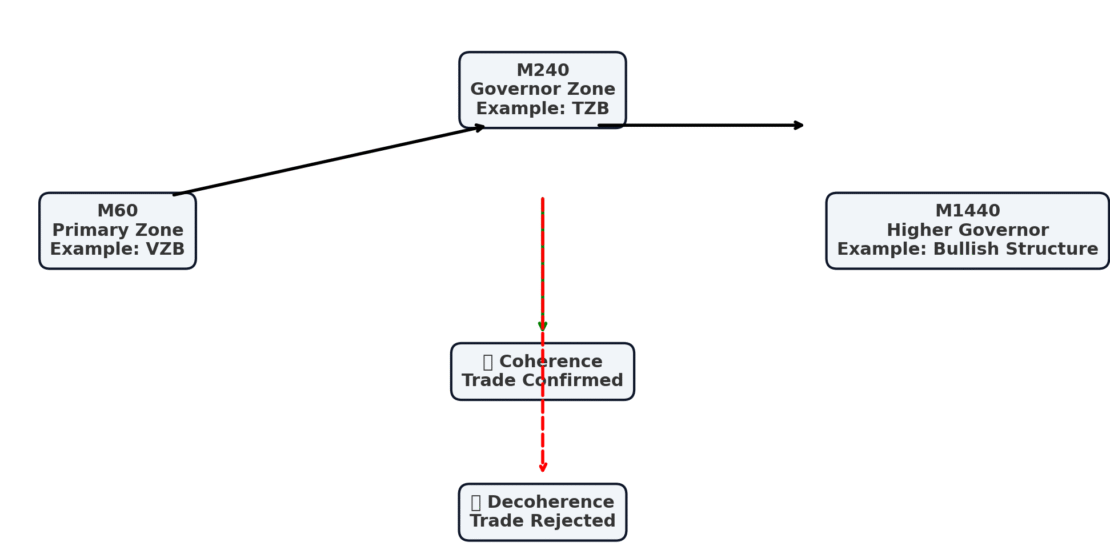

Multi-Timeframe Synergy in EZIM — Coherence Across Market Structures

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Multi-Timeframe Synergy in EZIM

Multi-Timeframe Synergy in EZIM explains how Bounces and Rejections across M60, M240, and M1440 align to create coherence and filter noise.

-

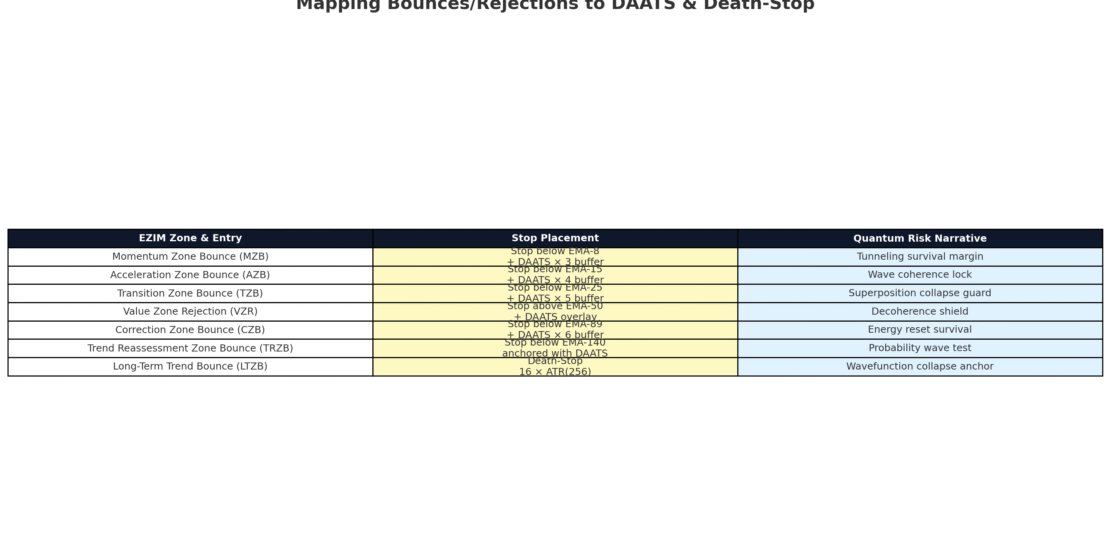

Risk & EZIM — Anchoring Stops, DAATS, and Death-Stop

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Risk & EZIM

Risk is the backbone of EZIM. This article shows how DAATS and Death-Stop anchor the Bounce & Rejection Paradigm into disciplined survival rules.

-

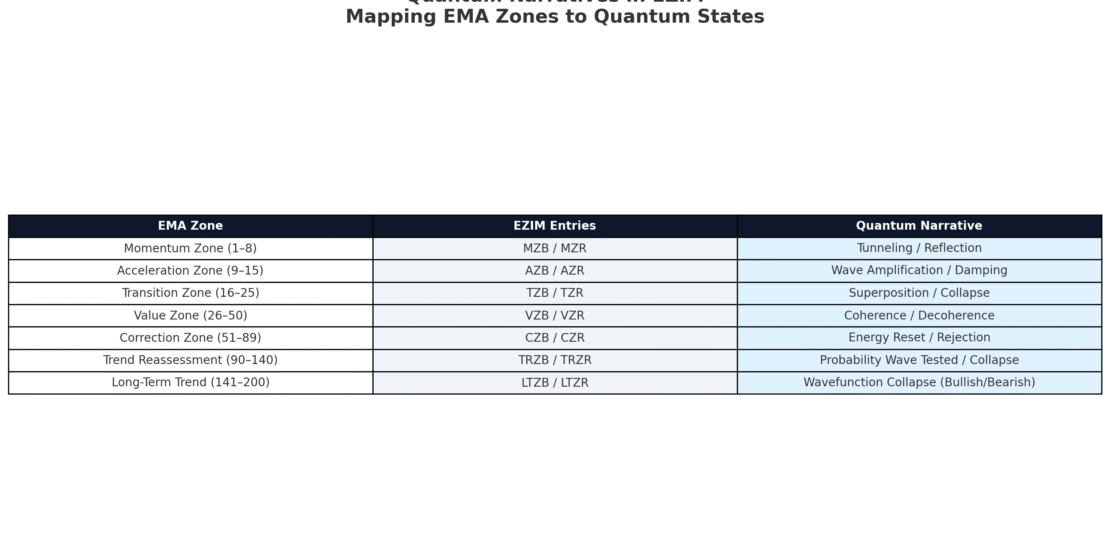

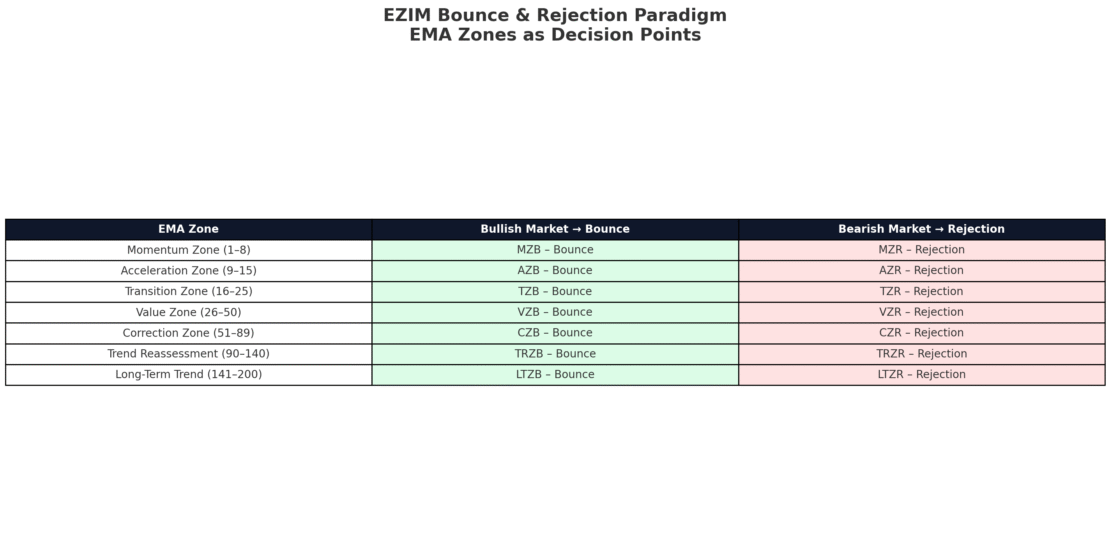

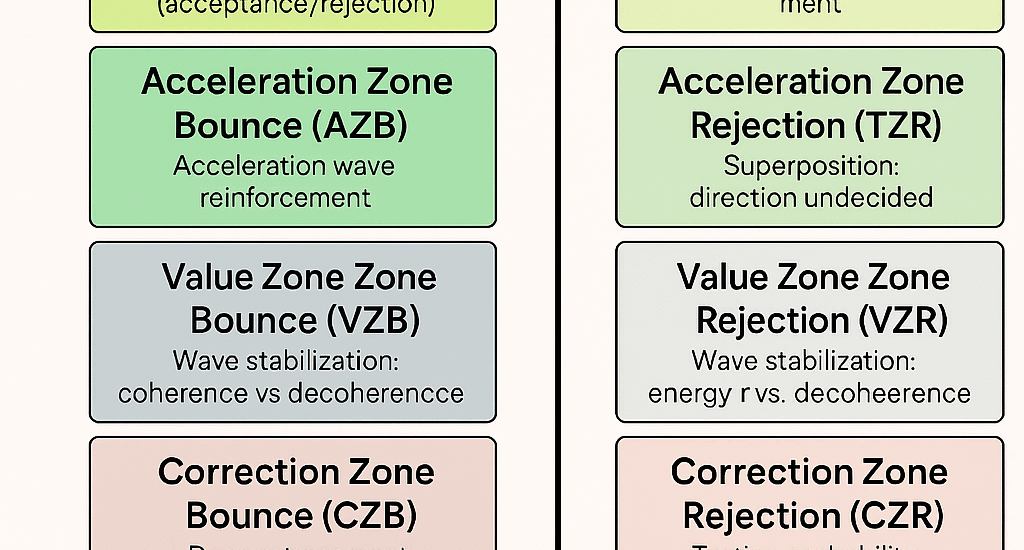

Quantum Narratives in EZIM — Mapping EMA Zones to Market States

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Quantum Narratives in EZIM

-

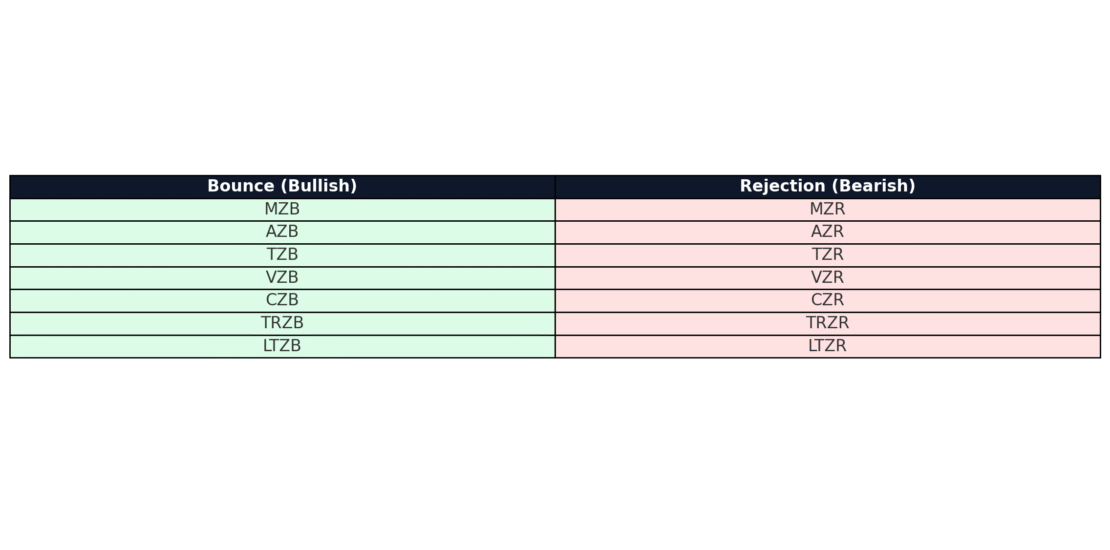

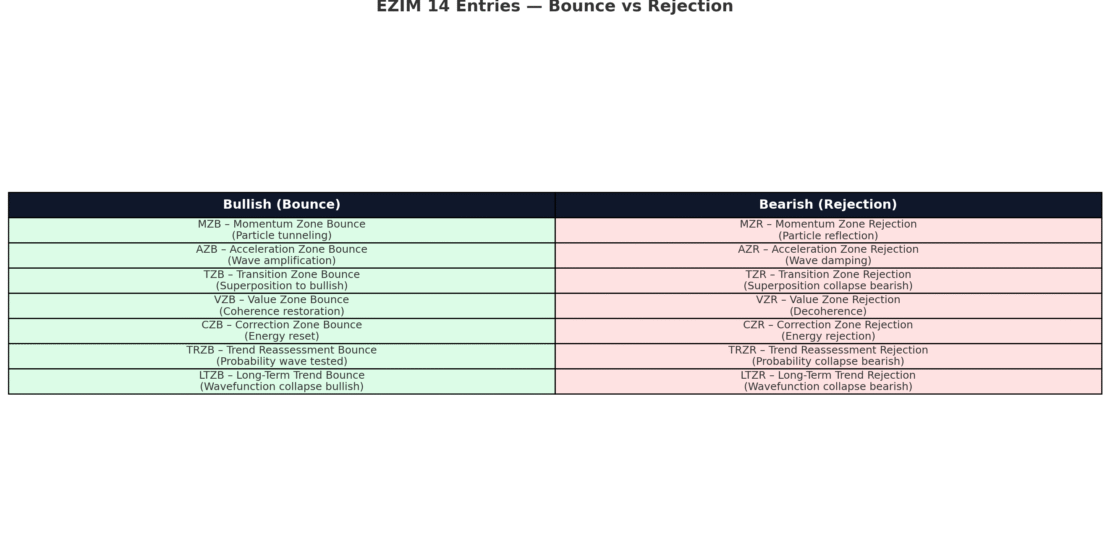

The 14 EZIM Entries — Bounce & Rejection Taxonomy

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM 14-entry taxonomy provides traders with a structured field manual of entries across bullish and bearish market structures, linked with quantum metaphors.

-

Introduction to EZIM — The Bounce & Rejection Paradigm

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM Bounce & Rejection Paradigm classifies EMA zone interactions into bullish Bounces and bearish Rejections, creating a powerful taxonomy enriched with quantum metaphors.

-

The 14 EZIM Entries: Quantum Narratives of Bounces and Rejections

- September 14, 2025

- Posted by: Drglenbrown1

- Category: Trading Frameworks / Quantum Narratives

The EZIM 14-entry taxonomy provides traders with precise entry definitions across bullish and bearish structures, enriched with quantum metaphors to enhance execution and psychology.

-

EMA Zone Interaction Model (EZIM) — GATS Bounce & Rejection Framework

- September 12, 2025

- Posted by: Drglenbrown1

- Category: Trading Frameworks / GATS Methodology

The EMA Zone Interaction Model (EZIM) defines price interactions at EMA boundaries as Bounces in bullish markets and Rejections in bearish markets, providing clarity for traders with quantum-inspired narratives.

-

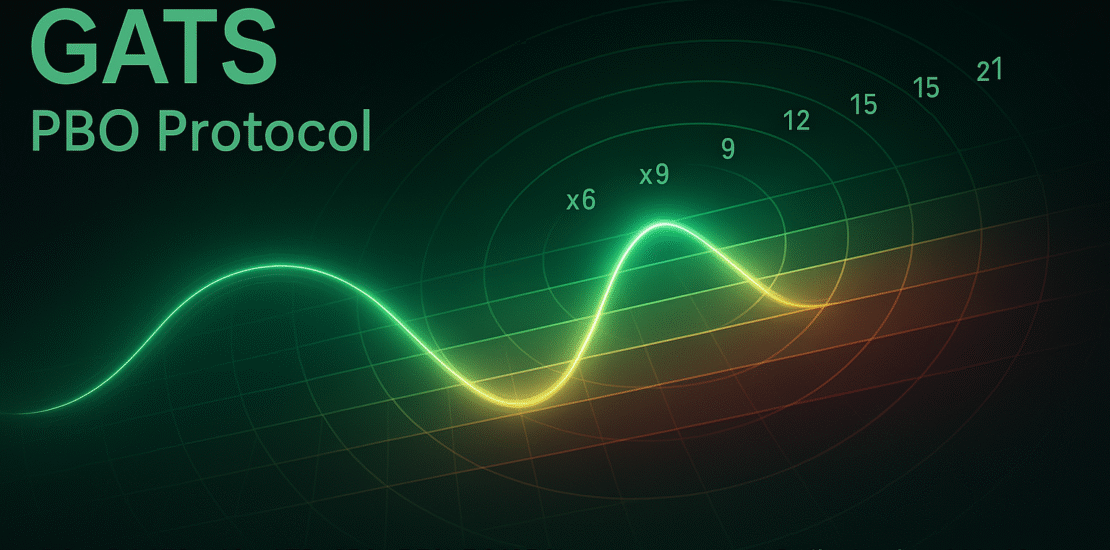

🌌 GATS Profit-Banking Overlay (PBO) Protocol — Quantum Narrative Edition

- September 7, 2025

- Posted by: Drglenbrown1

- Category: GATS Handbook

A desk-ready GATS protocol: DS=DAATS=16×ATR-256 (M1440), BE% at 7.8125%, and staged Profit-Banking at GSC wells (×6, ×9, ×12) to recycle capital while letting the final 25% ride into deep wells (×15–×21).

-

The Quantum Narrative of EMA Zones and MACD(15,25,8) – Part II

- August 31, 2025

- Posted by: Drglenbrown1

- Category: Quantum Trading Philosophy

Explore Bitcoin and EURUSD case studies, fractal uncertainty geometry, and the metaphysical laws of trading. A sacred quantum philosophy emerges, uniting financial engineering with the Nine Laws.

-

The Quantum Narrative of EMA Zones and MACD(15,25,8)

- August 31, 2025

- Posted by: Drglenbrown1

- Category: Quantum Trading Philosophy

A deep exploration of EMA Zones, MACD, and the Nine Laws reimagined as quantum mechanics operators and wavefunctions. A transformative trading philosophy.