Position Sizing Under Extreme Leverage in Dr. Glen Brown’s Seven-Law Framework

- May 29, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Introduction

In modern FX trading, eye-watering leverage (e.g. 10 000:1) can make tiny accounts feel like they control huge sums. But no matter how big your notional buying power, your true risk budget remains your actual equity. Dr. Glen Brown’s Seven-Law Volatility Stop-Loss system always sizes positions off real capital—and then simply uses leverage as a margin cap, never as a risk enabler. This article shows you exactly how to marry your equity-based risk target, your volatility-scaled stop (DAATS), and your available margin into one airtight position-sizing recipe.

1. The Seven-Law Sizing Pillars (Risk-First)

- Law 1 – Volatility Unit: ATR(P) defines one volatility unit.

- Law 2 – Exposure Scaling: k = ⌈√P⌉ exposures. For P = 200, √200 ≈ 14.14 → 15 exposures.

- Law 3 – Initial Stop (DAATS): DAATS = k × ATR(P).

- Law 4 – Breakeven-Fraction: Choose L exposures (e.g. 47 %×k ≈ 7) to shift to breakeven at L×ATR.

- Law 5 – Trailing-Exposure: Trail the stop by L×ATR once breakeven is hit.

- Law 6 – Tiered-Risk Allocation: PositionSizerisk = (Equity × Risk %) ÷ DAATS.

- Law 7 – Universe Volatility: GNASD for portfolio-wide noise budgeting (not covered here).

The critical point: Law 6 gives you a lot size purely from your equity and volatility stop—ignoring leverage entirely.

2. Calculating Your Leverage Cap

Notional Power: Equity × Leverage (e.g. \$1 000 × 10 000 = \$10 000 000)

Margin per Standard Lot: ContractSize ÷ Leverage (100 000 ÷ 10 000 = \$10)

Max Lots by Margin: Equity ÷ MarginPerLot

Your margin-based maximum lot size ensures you never open more contracts than your broker will allow—but it never raises your risk allowance.

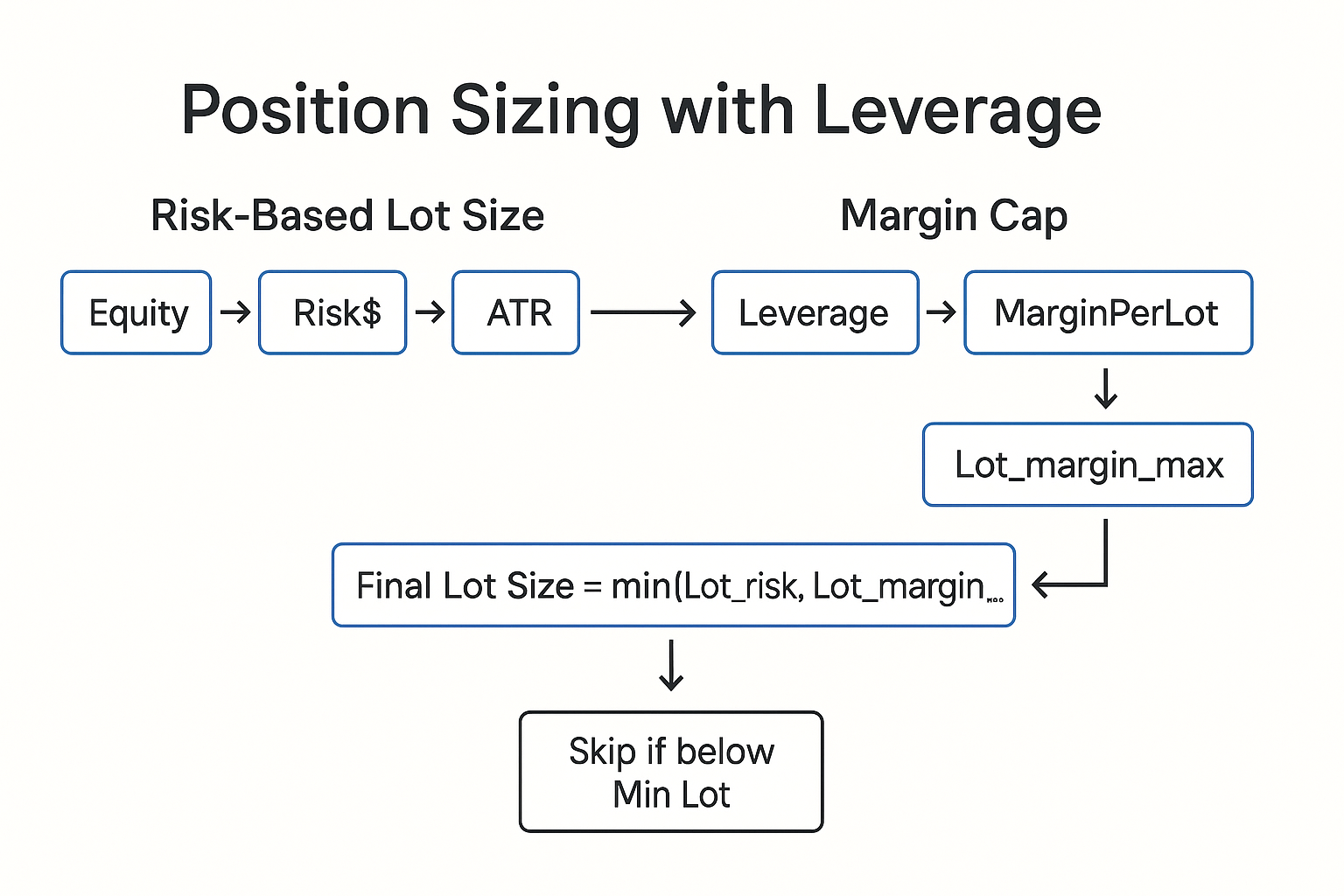

3. Two-Step Position-Sizing Recipe

Step 1: Compute Risk-Based Lot Size

Risk$ = Equity × Risk%

Stop(pips) = DAATS (Law 3) in pips

PipValue = ContractSize ÷ 10 000 ; e.g. \$10 per pip on EURUSD

Lot_risk = Risk$ ÷ (Stop(pips) × PipValue)

Step 2: Compute Margin-Based Max Lot Size

MarginPerLot = ContractSize ÷ Leverage

Lot_margin_max = Equity ÷ MarginPerLot

Final Lot Size

LotSize = min(Lot_risk, Lot_margin_max)

Minimum Lot Rule: If this final figure is below your broker’s minimum (0.01 lots), pass on the trade.

4. Worked Examples with ATR(200)=16 pips & Equity=\$1 000

Stop (DAATS): 15×16 = 240 pips

Leverage: 10 000:1 → MarginPerLot = \$10

PipValue: \$10 per pip (100 000-unit contract)

| Scenario | Risk % | Risk \$ | Lot_risk | Lot_margin_max | Final LotSize |

|---|---|---|---|---|---|

| Example A | 0.5 % | \$5 | 5 ÷ (240×10) ≈ 0.0021 | 1 000÷10 = 100 | 0.0021 → Skip trade (< 0.01) |

| Example B | 5 % | \$50 | 50 ÷ (240×10) ≈ 0.0208 | 100 | 0.0208 → 0.02 lots |

5. Key Takeaways

- Risk-first sizing: Always reference actual equity; leverage only caps your size.

- Round √P up to 15 exposures for P=200.

- Enforce a 0.01-lot minimum: if risk dictates less, skip the setup.

- This method integrates seamlessly with DAATS, breakeven, trailing, and all Seven Laws to keep you disciplined and margin-safe.

About the Author

Dr. Glen Brown

Founder, President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. A 25-year veteran in proprietary trading and quantitative strategy design, Dr. Brown runs a fully closed research-and-trade model powered by the Seven-Law framework and GATS platform—deriving all revenue directly from the markets.

Business Model Clarification

All research and risk-management methods remain in-house. No management fees or licenses are sold, as trading returns alone fund operations.

Risk Disclaimer

This article is educational only and does not constitute financial advice. Trading involves substantial risk of loss. Past performance is not indicative of future results. Consult a qualified advisor and trade only with capital you can afford to lose.