EMA Zone Interaction Model (EZIM) — GATS Bounce & Rejection Framework

- September 12, 2025

- Posted by: Drglenbrown1

- Category: Trading Frameworks / GATS Methodology

EMA Zone Interaction Model (EZIM) — Bounce & Rejection Taxonomy

This article introduces a new dimension to the Global Algorithmic Trading Software (GATS) Framework: the EMA Zone Interaction Model (EZIM). By defining price action at EMA boundaries as Bounces in bullish markets and Rejections in bearish markets, EZIM provides traders with a precise taxonomy for journaling, execution, and mindset alignment.

1. Bounce & Rejection Framework

EZIM classifies price interactions at each EMA Zone boundary according to market direction:

- Bullish Market: Price interaction = Bounce (support).

- Bearish Market: Price interaction = Rejection (resistance).

This ensures traders have a shared vocabulary to describe setups consistently: e.g., a long entry at EMA 50 in a bullish market becomes a VZB (Value Zone Bounce).

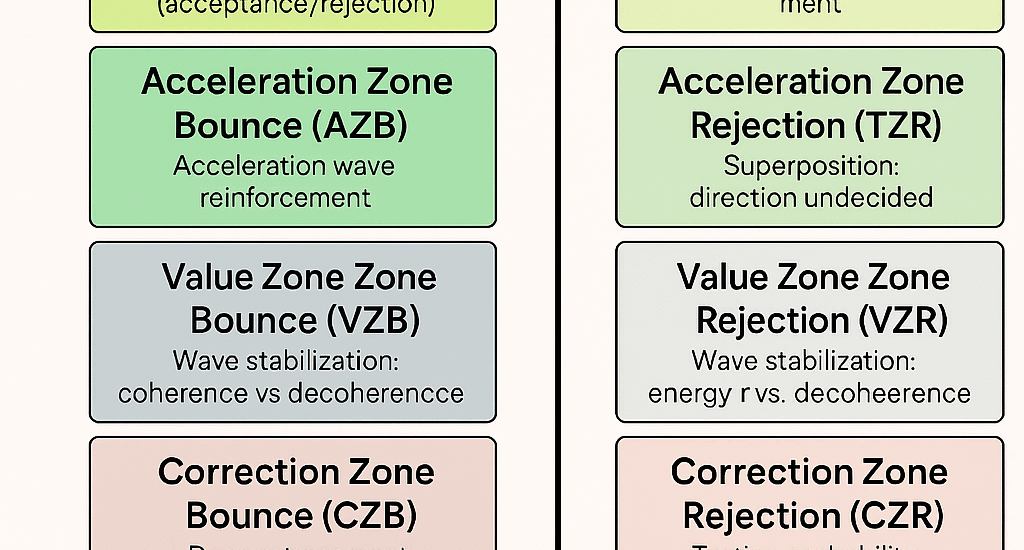

2. Taxonomy of EMA Zone Interactions

Momentum Zone (EMAs 1–8)

MZB / MZR — Momentum energy tunneling (acceptance/rejection).

Acceleration Zone (EMAs 9–15)

AZB / AZR — Acceleration wave reinforcement.

Transition Zone (EMAs 16–25)

TZB / TZR — Superposition: direction undecided.

Value Zone (EMAs 26–50)

VZB / VZR — Wave stabilization: coherence vs decoherence.

Correction Zone (EMAs 51–89)

CZB / CZR — Deep retracement, energy reset.

Trend Reassessment Zone (EMAs 90–140)

TRZB / TRZR — Testing probability wave resilience.

Long-Term Trend Zone (EMAs 141–200)

LTZB / LTZR — Collapse of wavefunction → macro decision.

3. Quantum Narrative Layer

- Expansion (Bounce): Coherence — price wave aligns with dominant trend energy.

- Rejection: Decoherence — energy scattered, rejecting trend reversal attempts.

- Transition: Superposition — probability state undecided until breakout resolves.

- Long-Term Zones: Wavefunction collapse — final confirmation or invalidation of macro trend.

4. Practical Applications

- Trade Journaling: Label trades as VZB, CZR, etc. for precision in reviews.

- Algorithmic Execution: GATS can trigger based on EZIM states aligned with MACD & DAATS.

- Risk Management: Bounce entries → stops below boundary; Rejection entries → stops above boundary.

- Backtesting: Historical EZIM tagging improves expectancy analysis.

About the Author

Dr. Glen Brown — President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. Visionary financial engineer advancing multi-asset proprietary trading frameworks.

Business Model Clarification

Global Accountancy Institute, Inc. & Global Financial Engineering, Inc. are closed-loop proprietary trading firms. We do not offer external services or products. Materials are for internal professional development only.

General Risk Disclaimer

Trading financial instruments involves high risk and may not be suitable for all investors. Losses can exceed deposits. This material is provided for educational purposes within our internal framework and does not constitute financial advice.

Published: September 12, 2025 · Framework: GATS / EZIM · Module: EMA Zone Interaction Model