Introduction to EZIM — The Bounce & Rejection Paradigm

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

Introduction to EZIM — The Bounce & Rejection Paradigm

Markets breathe in cycles. They expand and contract, oscillating between acceptance and denial of directional energy. Within the Global Algorithmic Trading Software (GATS) Framework, this dynamic crystallizes into the EMA Zone Interaction Model (EZIM), a taxonomy where each EMA boundary is defined as a Bounce in bullish structure or a Rejection in bearish structure. This is the Bounce & Rejection Paradigm.

1. Why EZIM Matters

Traditional moving average systems often treat EMAs as dynamic support or resistance. However, this approach is fragmented and subjective. EZIM unifies these observations by classifying interactions into a consistent vocabulary of Bounces and Rejections. This transforms scattered signals into a structured taxonomy that can be journaled, automated, and scaled across timeframes.

2. The Bounce & Rejection Taxonomy

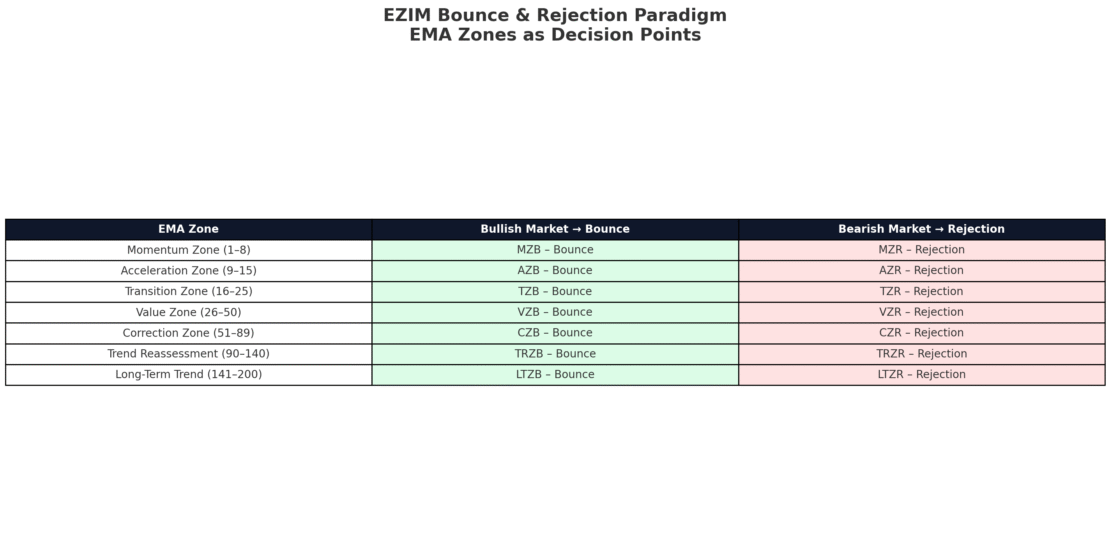

Each EMA Zone — from the Momentum Zone (1–8) to the Long-Term Trend Zone (141–200) — represents a different state of market energy:

- Bounce (Bullish): Price interaction signals continuation of trend energy.

- Rejection (Bearish): Price interaction signals denial and redirection of energy.

This taxonomy gives traders 14 potential entry points — seven Bounces and seven Rejections — across bullish and bearish market structures.

3. The Quantum Narrative Layer

Markets are not static; they behave like quantum systems, existing in states of probability until resolution. EZIM adopts quantum metaphors to sharpen trader psychology:

- Momentum Zone — Particle tunneling or reflection: instant acceptance or denial.

- Acceleration Zone — Wave reinforcement or damping: energy amplified or dissipated.

- Transition Zone — Superposition: undecided state until breakout resolves.

- Value Zone — Coherence vs decoherence: alignment or scattering of trend energy.

- Correction Zone — Energy reset or rejection: redistribution of probabilities.

- Reassessment Zone — Probability wave tested: resilience affirmed or denied.

- Long-Term Trend Zone — Wavefunction collapse: final macro confirmation.

By embedding these metaphors into execution, EZIM elevates trading from mechanics to philosophy, anchoring decisions in objective narratives rather than emotions.

4. From Paradigm to Practice

The Bounce & Rejection Paradigm is more than a theoretical model. Within GATS, it becomes executable logic:

- Automation: Algorithmic triggers activate on EZIM states aligned with MACD and DAATS.

- Risk Management: Stops are anchored just beyond EMA boundaries, guided by DAATS and Death-Stop protocols.

- Trader Journaling: Entries are labeled as VZB, CZR, etc., for post-trade analysis.

Thus, EZIM is both a map of structure and a playbook of execution.

About the Author

Dr. Glen Brown — President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. Visionary financial engineer advancing multi-asset proprietary trading frameworks.

Business Model Clarification

Global Accountancy Institute, Inc. & Global Financial Engineering, Inc. are closed-loop proprietary trading firms. We do not offer external services or products. Materials are for internal professional development only.

General Risk Disclaimer

Trading financial instruments involves high risk and may not be suitable for all investors. Losses can exceed deposits. This material is provided for educational purposes within our internal framework and does not constitute financial advice.

Published: September 12, 2025 · Framework: GATS / EZIM · Series: Part 1 of 7