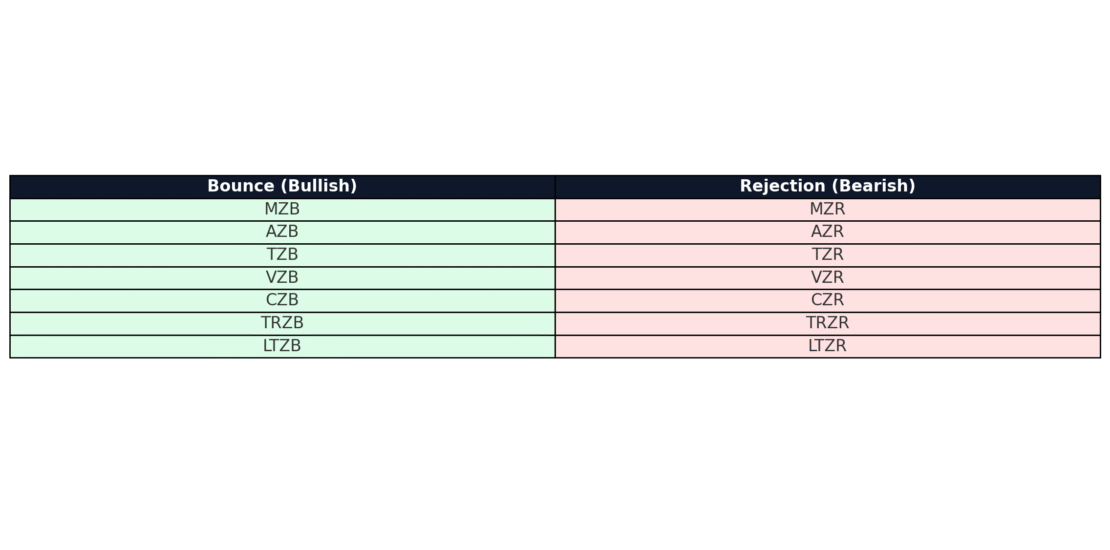

The 14 EZIM Entries — Bounce & Rejection Taxonomy

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The 14 EZIM Entries — Bounce & Rejection Taxonomy

The EMA Zone Interaction Model (EZIM) provides a structured map of market entry points. Across bullish and bearish structures, price action interacts with EMA boundaries as either Bounces or Rejections. Together, these create 14 potential entries, each linked to a technical setup and a quantum narrative. This taxonomy transforms chaos into clarity.

1. The Seven Bounces (Bullish Market Structure)

When the trend is confirmed bullish (EMA stack ascending, Daily MACD positive, DAATS support), price interactions at EMA boundaries manifest as Bounces:

MZB — Momentum Zone Bounce (1–8)

Scalper re-entry. Quantum metaphor: Particle tunneling, instant energy acceptance.

AZB — Acceleration Zone Bounce (9–15)

Momentum continuation. Quantum metaphor: Wave amplification, reinforcing upward flow.

TZB — Transition Zone Bounce (16–25)

Early re-alignment. Quantum metaphor: Superposition, probabilities converging to bullish realization.

VZB — Value Zone Bounce (26–50)

Primary re-entry. Quantum metaphor: Coherence restoration, wave regains alignment.

CZB — Correction Zone Bounce (51–89)

Deep pullback support. Quantum metaphor: Energy reset, redistribution of momentum.

TRZB — Trend Reassessment Zone Bounce (90–140)

Stress-test entry. Quantum metaphor: Probability wave tested, resilience confirmed.

LTZB — Long-Term Trend Zone Bounce (141–200)

Macro confirmation. Quantum metaphor: Wavefunction collapse, bullish path secured.

2. The Seven Rejections (Bearish Market Structure)

When the trend is confirmed bearish (EMA stack descending, Daily MACD negative, DAATS resistance), EMA boundaries become rejection points:

MZR — Momentum Zone Rejection (1–8)

Immediate continuation short. Quantum metaphor: Particle reflection, instant denial of momentum.

AZR — Acceleration Zone Rejection (9–15)

Momentum confirmation short. Quantum metaphor: Wave damping, energy dissipates downward.

TZR — Transition Zone Rejection (16–25)

Failed bullish attempt. Quantum metaphor: Superposition collapse into bearish outcome.

VZR — Value Zone Rejection (26–50)

Primary short re-entry. Quantum metaphor: Decoherence, bullish attempts scattered.

CZR — Correction Zone Rejection (51–89)

Deep pullback rejection. Quantum metaphor: Energy rejection, system expels bullish surge.

TRZR — Trend Reassessment Zone Rejection (90–140)

Long-term bearish confirmation. Quantum metaphor: Probability collapse, reversal denied.

LTZR — Long-Term Trend Zone Rejection (141–200)

Macro rejection. Quantum metaphor: Wavefunction collapse, bearish dominance secured.

3. The Symmetry of Opposites

The Bounce and Rejection taxonomy is symmetrical. Every bullish entry has a bearish counterpart. This duality reflects the principle of wave duality in quantum mechanics: one phenomenon, two manifestations. By recognizing this symmetry, traders embrace both sides of market reality.

4. From EZIM to Execution

Within GATS, the 14 entries become programmable states:

- Algorithmic triggers fire on Bounces or Rejections aligned with MACD and DAATS.

- Stops are positioned just beyond EMA boundaries, respecting volatility expansion and compression.

- Traders journal each entry type (VZB, CZR, etc.), creating precise feedback loops for learning and improvement.

This taxonomy transforms EZIM from a paradigm into a living execution protocol.

About the Author

Dr. Glen Brown — President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. Visionary financial engineer advancing multi-asset proprietary trading frameworks.

Business Model Clarification

Global Accountancy Institute, Inc. & Global Financial Engineering, Inc. are closed-loop proprietary trading firms. We do not offer external services or products. Materials are for internal professional development only.

General Risk Disclaimer

Trading financial instruments involves high risk and may not be suitable for all investors. Losses can exceed deposits. This material is provided for educational purposes within our internal framework and does not constitute financial advice.

Published: September 13, 2025 · Framework: GATS / EZIM · Series: Part 2 of 7