Multi-Timeframe Synergy in EZIM — Coherence Across Market Structures

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Multi-Timeframe Synergy in EZIM

Markets are fractal. A Bounce on M60 is only as strong as the coherence it shares with M240 and M1440. In Part 5 of the EZIM Series, we integrate Bounces and Rejections across multiple timeframes, creating a unified view of probability and risk.

1. Why Multi-Timeframe Matters

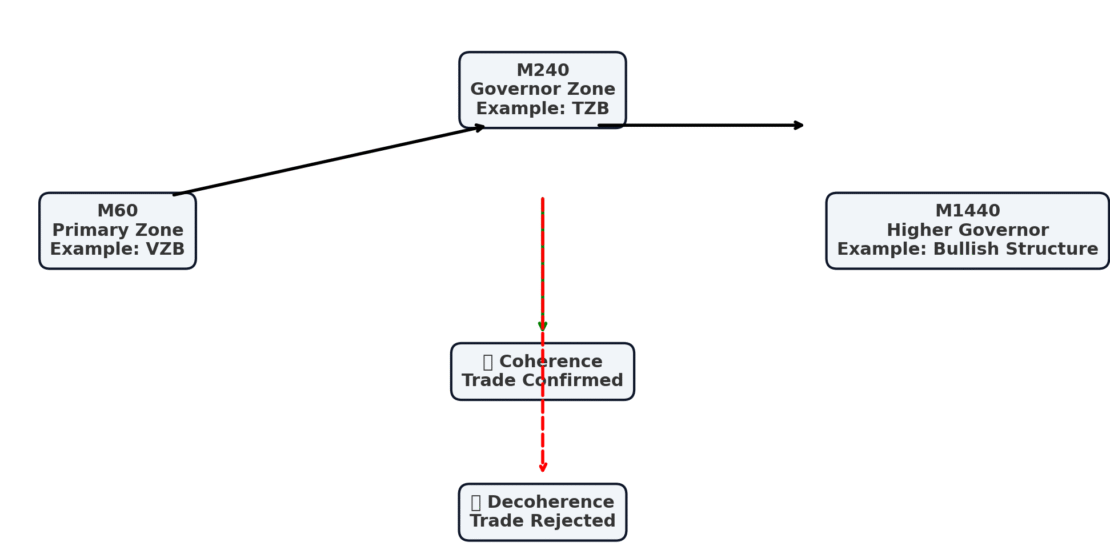

No timeframe exists in isolation. The M60 chart might show a Value Zone Bounce (VZB), but unless the M240 and M1440 structures confirm coherence, that entry may dissolve into noise. Multi-timeframe analysis acts as a filter — removing false signals and magnifying high-probability alignments.

Quantum analogy: A particle wave has both local oscillations and global envelopes. Price action on a lower timeframe is a local oscillation; the higher timeframe trend is the envelope that governs it.

2. Fractal Harmony of EMA Zones

Each timeframe’s EMA Zones form a local field of probabilities. The law of coherence states that lower timeframes respect higher timeframe structures most of the time. Thus:

- M60 Bounce is valid only if M240 trend structure supports continuation.

- M240 Bounce is stronger if M1440 trend confirms long-term coherence.

This fractal hierarchy ensures that entries are not isolated reactions but part of a structural wave sequence.

3. Multi-Timeframe EZIM Rules

To systematize multi-timeframe coherence, GATS applies the following rules:

- Primary Zone: Trading timeframe (e.g., M60).

- Governor Zone: Higher timeframe (e.g., M240 or M1440).

- Confirmation: Bounce/Rejection in the Primary is valid only if Governor Zone trend aligns.

Example: M60 VZB confirmed by M240 TZB → continuation setup.

Counter-Example: M60 VZB against M240 CZR → low-probability setup, avoid entry.

4. Quantum Narrative — Coherence & Decoherence

When timeframes align, they create coherence — waves reinforce each other, energy concentrates, probability of success increases. When timeframes diverge, they create decoherence — interference destroys alignment, false signals proliferate.

Trader psychology: Instead of being confused by mixed signals, the EZIM practitioner recognizes decoherence and steps aside. Waiting becomes a strategy.

5. DAATS & Death-Stop Across Timeframes

Stops and risk anchors must reference the higher timeframe to avoid premature exits:

- M1–M30 trades use M60 as their Death-Stop anchor (16 × ATR(256) of M60).

- M60 trades may anchor to M240 or M1440 Death-Stop levels.

- DAATS adapts within each timeframe but respects higher timeframe expansion/compression.

This ensures survival through noise and respects the Minimum Trade Lifetime Before Death clause.

6. Practical Example — EURUSD Case Study

Consider EURUSD:

- M60 chart shows a Value Zone Bounce (VZB).

- M240 confirms with a Transition Zone Bounce (TZB).

- M1440 trend remains bullish with EMA-25 above EMA-200.

Result: High-probability coherence cluster. Entry executed with stop anchored at M240 DAATS × 5 buffer, profit target set at 5 × ATR risk unit.

If M240 had shown a Correction Zone Rejection (CZR), the M60 VZB would be ignored — decoherence detected.

7. Conclusion — The Fractal Advantage

The synergy of EZIM across timeframes embodies the principle of fractal markets. By aligning entries with higher timeframe structures, traders achieve coherence, filter noise, and protect capital with quantum-informed risk anchors. This is the fractal advantage that powers GATS globally.

About the Author

Dr. Glen Brown — President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. Visionary financial engineer advancing multi-asset proprietary trading frameworks.

Business Model Clarification

Global Accountancy Institute, Inc. & Global Financial Engineering, Inc. are closed-loop proprietary trading firms. We do not offer external services or products. Materials are for internal professional development only.

General Risk Disclaimer

Trading financial instruments involves high risk and may not be suitable for all investors. Losses can exceed deposits. This material is provided for educational purposes within our internal framework and does not constitute financial advice.

Published: September 16, 2025 · Framework: GATS / EZIM · Series: Part 5 of 7