Structural–Momentum Synchronization Doctrine (SMSD) — Master Document

- December 7, 2025

- Posted by: Drglenbrown1

- Categories: Global Algorithmic Trading Software (GATS), Institutional Frameworks, Volatility & Risk Doctrine

This master document compiles all 15 sections of the Dr. Glen Brown Structural–Momentum Synchronization Doctrine (SMSD) and links each section to its standalone page on Global Financial Engineering.

Table of Contents

- Section 1 — Introduction to the Dr. Glen Brown Structural–Momentum Synchronization Doctrine (SMSD)

- Section 2 — Formal Theory of Structural–Momentum Synchronization

- Section 3 — The Momentum Engine (MACD 5 & MACD 2)

- Section 4 — Structural Drift Indicator (SDI: EMA 25 vs EMA 26)

- Section 5 — Structural Confirmation (EMA 8)

- Section 6 — The Synchronized State (SS) Model

- Section 7 — EMA Zone Integration Under SMSD

- Section 8 — Market Identity Model (SR–PZ–EAS)

- Section 9 — Permission Logic for GATS Under SMSD

- Section 10 — Multi-Timeframe Execution Flow (Daily–M60–M240)

- Section 11 — Bitcoin Case Study Under SMSD

- Section 12 — Comparative Framework: SMSD vs Traditional Trend Models

- Section 13 — SMSD Integration With the Nine-Laws Framework

- Section 14 — Full SMSD–GATS Workflow (From Detection to Execution to Death)

- Section 15 — SMSD Failure Modes, Edge Cases & Anomaly Protocol

- Section X — Dual-Drift Containment Channel (DDCC) & False Drift Breakouts

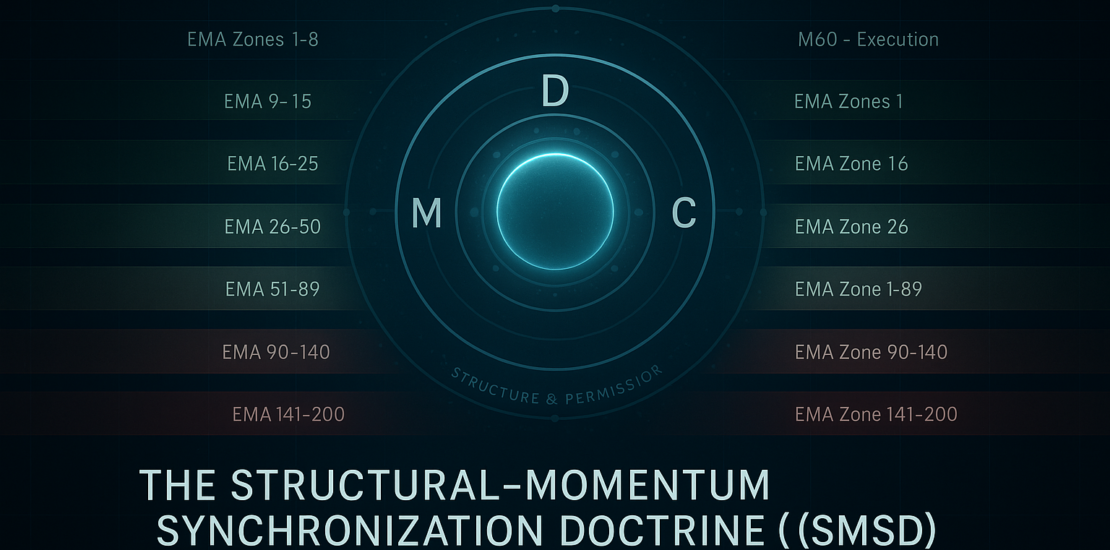

Section 1 — Introduction to the Dr. Glen Brown Structural–Momentum Synchronization Doctrine (SMSD)

The Dr. Glen Brown Structural–Momentum Synchronization Doctrine (SMSD) is a unified decision framework designed to determine when a financial market is structurally ready for directional engagement. Rather than relying on isolated indicators or simple moving average crossovers, SMSD integrates three core dimensions of market behavior:

- Momentum — internal impulse and directional energy,

- Structural Drift — curvature and evolving bias of the EMA structure,

- Structural Confirmation — price acceptance relative to key EMA boundaries.

Only when all three dimensions are aligned does SMSD declare that the market has entered a Synchronized State (SS), granting permission for the Global Algorithmic Trading Software (GATS) to deploy capital.

1.1 The Core Motivation Behind SMSD

Traditional trading systems frequently suffer from:

- Timeframe confusion — conflicting signals between intraday and higher timeframes,

- Momentum illusions — MACD or oscillator flips that fail to translate into trends,

- Structural blindness — entries taken without understanding the EMA zone context,

- Noise-driven exits — premature closing of trades due to volatility spikes.

SMSD was developed to eliminate these weaknesses by defining a precise, mathematically coherent doctrine for structural–momentum alignment on the Identity Timeframe (Daily), which then governs all lower timeframe execution.

1.2 The Three Pillars of SMSD

SMSD stands on three interconnected pillars:

- Momentum Engine

A dual-speed MACD structure (e.g., MACD 5 and a faster MACD 2) that detects the onset and confirmation of directional impulse. - Structural Drift Indicator (SDI)

A micro-structural signal based on EMA 25 vs EMA 26, revealing the “curvature” or drift of the underlying EMA structure and identifying early shifts in directional bias. - Structural Confirmation Layer

A price-based confirmation using EMA 8 as the first structural boundary. Until EMA 8 is reclaimed (for bulls) or lost (for bears) on the Daily close, no structural confirmation is granted.

These three pillars form the SMSD synchronization triad:

M (Momentum) + D (Drift) + C (Confirmation) = Synchronized State (SS)1.3 Identity Timeframe and Execution Timeframe

SMSD operates with a clear separation of responsibilities across timeframes:

- Daily — Identity & Permission Timeframe (SS determination)

- M60 — Execution Timeframe (precise entry location)

- M240 — Structural Risk Timeframe (DAATS and Death-Stop governance)

Regardless of what lower timeframes are doing, only the Daily timeframe is allowed to define whether the market is structurally synchronized.

If Daily SS = FALSE,

every lower timeframe signal is considered illegal under SMSD.

1.4 Role of EMA Color-Coded Zones in SMSD

SMSD is built on top of the existing EMA Color-Coded Zone Architecture, where:

- Momentum Zone — EMA 1 to 8

- Acceleration Zone — EMA 9 to 15

- Transition Zone — EMA 16 to 25

- Value Zone — EMA 26 to 50

- Correction Zone — EMA 51 to 89

- Trend Reassessment Zone — EMA 90 to 140

- Long-Term Trend Zone — EMA 141 to 200

Rather than using these zones purely descriptively, SMSD converts them into formal structural inputs for:

- Market Identity classification (SR–PZ–EAS),

- Trend health evaluation,

- Contextual interpretation of SS quality.

EMA 8, EMA 25, EMA 50, EMA 89, EMA 140, and EMA 200 function as key structural boundaries in later sections of the doctrine.

1.5 SMSD as the Legal Doctrine for GATS

Within the Global Algorithmic Trading Software (GATS), SMSD acts as a legal doctrine that governs when the system is allowed to trade.

In operational terms:

- SS = TRUE → Trade Permission Granted

- SS = FALSE → Trade Permission Denied

Even if lower timeframes suggest attractive opportunities, GATS must respect SMSD as the superior structural authority. No SS, no trade — without exception.

1.6 Relationship Between SMSD and the Nine-Laws Framework

SMSD is primarily concerned with:

- market identity,

- structural synchronization,

- directional permission.

The Nine-Laws Framework governs:

- volatility interpretation,

- DAATS evolution,

- death-stops and breakeven logic,

- portfolio-level noise budgeting.

Thus:

SMSD decides when GATS may engage.

The Nine Laws decide how GATS must survive and evolve within that engagement.

1.7 Structure of the SMSD White Paper

The remainder of this white paper is organized as follows:

- Section 2 — Formal Definition of SMSD and Core Concepts

- Section 3 — Momentum Engine (MACD 5 & MACD 2)

- Section 4 — Structural Drift Indicator (SDI: EMA 25 vs EMA 26)

- Section 5 — Structural Confirmation (EMA 8)

- Section 6 — The Synchronized State (SS) Model

- Section 7 — EMA Zone Integration Under SMSD

- Section 8 — Market Identity Model (SR–PZ–EAS)

- Section 9 — Permission Logic for GATS Under SMSD

- Section 10 — Multi-Timeframe Execution Flow (Daily–M60–M240)

- Section 11 — Bitcoin Case Study Under SMSD

- Section 12 — Comparative Framework: SMSD vs Traditional Trend Models

- Section 13 — SMSD Integration With the Nine-Laws Framework

- Section 14 — Full SMSD–GATS Workflow (From Detection to Execution to Death)

- Section 15 — SMSD Failure Modes, Edge Cases & Anomaly Protocol

Together, these sections define SMSD as a complete institutional doctrine, ready to be implemented within GATS and integrated across the Global 9-Tier Trading System (G9TTS).

Section 2 — Formal Theory of Structural–Momentum Synchronization

Section 2 formalizes the conceptual core of SMSD. It defines what it means for a market to be “synchronized” and introduces the three-layer logic — momentum (M), drift (D), and confirmation (C) — in mathematical and operational terms.

2.1 The SMSD State Space

At any point in time on the Daily timeframe, the instrument occupies one of several structural–momentum states determined by the tuple:

S(t) = (M(t), D(t), C(t))Where:

- M(t) ∈ {+1, −1, 0} captures net momentum direction:

+1 → Bullish momentum (MACD 5 & MACD 2 bullish)

−1 → Bearish momentum (MACD 5 & MACD 2 bearish)

0 → Mixed or neutral (no coherent momentum state)

- D(t) ∈ {+1, −1, 0} captures structural drift via EMA 25 vs EMA 26:

+1 → Bullish drift (EMA25 > EMA26)

−1 → Bearish drift (EMA25 < EMA26)

0 → Flat or noisy drift (EMA25 ≈ EMA26 or frequent flips)

- C(t) ∈ {+1, −1, 0} captures structural confirmation via EMA 8:

+1 → Bullish structural confirmation (Close ≥ EMA8)

−1 → Bearish structural confirmation (Close ≤ EMA8)

0 → No confirmation (Close oscillating around EMA8)

The synchronized state for a bullish regime requires all three to agree positively, and for a bearish regime all three to agree negatively.

2.2 Definition of the Synchronized State (SS)

Formally, the market is in a bullish synchronized state when:

SS_bull = 1 if (M = +1) AND (D = +1) AND (C = +1)

SS_bull = 0 otherwise

And in a bearish synchronized state when:

SS_bear = 1 if (M = −1) AND (D = −1) AND (C = −1)

SS_bear = 0 otherwise

The general synchronized condition is:

SS = 1 if (M = D = C ≠ 0)

SS = 0 otherwise

This is the core mathematical definition that later sections operationalize inside GATS.

2.3 Partial Synchronization and Pre-Synchronization States

SMSD recognizes intermediate states where one or two layers align but the third has not yet confirmed:

- Momentum-Drift Alignment (M + D, no C) → early development phase.

- Momentum Only (M, no D, no C) → reactive countertrend impulses.

- Drift Only (D, no M, no C) → slow structural rotation without momentum.

These states are important diagnostically, but they do not authorize trades. They are monitored as “pre-synchronization” phases. GATS is allowed to observe and update internal expectations but must not deploy fresh risk.

2.4 Identity Timeframe Dominance

The Daily timeframe is designated as the Identity Timeframe under SMSD. All synchronized state detection, as well as Market Identity (SR–PZ–EAS), is computed here.

Lower timeframes (M60, M240, etc.):

- execute trades,

- manage volatility and DAATS,

- optimize entries and exits,

but they do not redefine the synchronized state.

Only the Daily timeframe decides whether the instrument is legally in SS under SMSD.

2.5 Structural–Momentum Symmetry

SMSD is symmetric with respect to bull and bear regimes. The same definitions apply with sign reversal:

- Bullish SS requires M = D = C = +1.

- Bearish SS requires M = D = C = −1.

This symmetry allows the same doctrine to be applied to long and short strategies, trend-following and reversal detection, and across any liquid asset class.

2.6 From Theory to Implementation

Sections 3–7 translate this theoretical definition into specific indicator configurations:

- Section 3 — defines how MACD 5 and MACD 2 generate M.

- Section 4 — defines SDI (EMA 25 vs EMA 26) as D.

- Section 5 — defines EMA 8 confirmation as C.

- Section 6 — formalizes SS as a practical signal.

- Section 7 — embeds SS inside the EMA zone architecture.

Together, they create the operational backbone of SMSD on the Daily timeframe.

Section 3 — The Momentum Engine (MACD 5 & MACD 2)

The Momentum Engine of SMSD is built on a dual-speed MACD structure that uses two carefully selected settings to detect the onset, persistence, and exhaustion of directional impulse on the Daily timeframe.

3.1 Rationale for Two MACD Speeds

A single MACD setting often either:

- reacts too slowly to turning points, or

- reacts too quickly and produces excessive noise.

SMSD solves this by pairing:

- MACD 5 — the primary “Trend MACD”,

- MACD 2 — the “Quick MACD”, capturing the earliest momentum shifts.

A momentum state (M) is considered valid only when both MACDs agree directionally.

3.2 Momentum State Definition (M)

On the Daily timeframe:

- MACD 5 histogram > 0 and MACD 2 histogram > 0 → M = +1 (bullish)

- MACD 5 histogram < 0 and MACD 2 histogram < 0 → M = −1 (bearish)

- Any other combination → M = 0 (no synchronized momentum)

This removes situations where the fast MACD flips early but the primary MACD remains in the previous regime — a frequent source of confusion and false entries in traditional models.

3.3 Handling Divergences Between MACD 5 and MACD 2

When MACD 2 flips bullish while MACD 5 remains bearish (or vice versa), SMSD interprets this as:

- an early signal of potential change,

- but not yet a legitimate momentum state.

GATS may log this internally as a pre-momentum event, but M stays 0 until both MACDs align.

3.4 Momentum and Trade Permission

Momentum is a necessary but not sufficient condition for SS:

- Without M, no SS can exist.

- With M alone (no D, no C), SS is still FALSE.

Momentum is therefore the gateway into the SMSD process, but drift and structure must agree before GATS is authorized to act.

3.5 Momentum Exhaustion and Reversal

When MACD 2 flips before MACD 5, SMSD treats this as a potential early exhaustion signal. When both flip and remain aligned, the momentum state changes sign:

Mold = +1, Mnew = −1 → Bull trend momentum exhausted, new bearish momentum

Mold = −1, Mnew = +1 → Bear trend momentum exhausted, new bullish momentum

However, such changes still require D and C to confirm before SS switches from bull to bear or vice versa.

Section 4 — Structural Drift Indicator (SDI: EMA 25 vs EMA 26)

The Structural Drift Indicator (SDI) provides a micro-structural view of how the EMA stack is “bending” beneath the price. It captures slow, deterministic shifts in structural bias that pure momentum signals often miss.

4.1 Why EMA 25 vs EMA 26?

EMA 25 marks the upper boundary of the Transition Zone. EMA 26 marks the start of the Value Zone. The relationship between these two adjacent EMAs acts like a curvature detector:

- When EMA 25 > EMA 26, the structure is bending upward.

- When EMA 25 < EMA 26, the structure is bending downward.

This small offset is extremely sensitive to structural rotation while still being less noisy than pure price-based triggers.

4.2 Drift State Definition (D)

On the Daily timeframe:

- EMA 25 > EMA 26 → D = +1 (bullish drift)

- EMA 25 < EMA 26 → D = −1 (bearish drift)

- |EMA 25 − EMA 26| very small or frequently changing sign → D = 0 (no stable drift)

SMSD treats D as the slow backbone beneath momentum. If momentum flips but drift does not, SMSD interprets momentum as reactive or countertrend.

4.3 Drift vs Momentum

The interaction between M and D defines three important regimes:

- M and D same sign → aligned impulse and structure; high potential for SS.

- M and D opposite signs → countertrend momentum; high risk of failure.

- D = 0 → structural ambiguity; SS cannot form.

SDI thus prevents GATS from confusing a sharp, short-term move with a genuine structural trend.

4.4 SDI as Early Warning of Structural Rotation

In many markets, EMA 25 vs EMA 26 may flip before longer EMAs (50, 89, 200) begin to respond. SMSD uses SDI as a:

- pre-rotation signal,

- context layer for interpreting MACD flips,

- filter to suppress entries against dominant drift.

When both M and D align and remain stable, the environment becomes highly favorable for SS formation.

Section 5 — Structural Confirmation (EMA 8)

The Structural Confirmation Layer is the third and final requirement in SMSD’s triad. It answers a simple question: Has price actually accepted the new structural direction?

5.1 EMA 8 as the First Structural Boundary

EMA 8 sits at the upper boundary of the Momentum Zone. It is the first meaningful structural line that price must reclaim (for bulls) or lose (for bears) to signal participation in the new regime.

For SMSD:

- Daily close above EMA 8 → C = +1 (bullish confirmation)

- Daily close below EMA 8 → C = −1 (bearish confirmation)

- Daily close straddling EMA 8 → C = 0 (no confirmation)

5.2 Why Close Above/Below EMA 8 Matters

Momentum and drift can change internally without price fully committing. EMA 8 acts as the “line of engagement”:

- Reclaiming EMA 8 after a bear phase signals buyers are gaining structural control.

- Breaking below EMA 8 after a bull phase signals sellers are gaining structural control.

Without this reclaim/loss, SMSD will not recognize a synchronized structural state.

5.3 Structural Confirmation vs Noise

Intra-day spikes above EMA 8 do not count. SMSD requires a Daily close above or below EMA 8 to qualify as confirmation.

This prevents:

- whipsaw entries based on intraday volatility,

- reacting to spikes that fade by the session close,

- over-trading around news events.

5.4 Role of EMA 8 in SS Formation

The relationship between EMA 8 and price is what transforms momentum and drift agreement into a legally recognized Synchronized State:

If M = +1, D = +1, C = +1 → SS_bull = TRUE

If M = −1, D = −1, C = −1 → SS_bear = TRUE

Otherwise SS = FALSE

EMA 8 thus acts as the “final gate” before GATS receives permission to engage in new structural trends.

Section 6 — The Synchronized State (SS) Model

The Synchronized State (SS) Model is the central decision output of SMSD. It compresses the three-layer logic (M, D, C) into a simple binary permission signal: SS = TRUE or SS = FALSE.

6.1 Binary Definition of SS

On the Daily timeframe:

SS_bull = 1 if (M = +1, D = +1, C = +1)

SS_bear = 1 if (M = −1, D = −1, C = −1)

SS = 1 if SS_bull = 1 or SS_bear = 1

SS = 0 otherwise

This simple binary is what GATS reads to decide whether directional entries are allowed.

6.2 Interpretation of SS States

- SS = 1 → The market is structurally synchronized; trend and momentum agree.

- SS = 0 → The market is not synchronized; any momentum is considered reactive or noise.

SMSD mandates that:

If SS = 0, GATS must not open new directional positions.

6.3 SS Persistence and Trend Quality

The quality of a trend can be measured by how long SS remains TRUE:

- Short-lived SS bursts → reactionary or weak trends.

- Long, stable SS periods → strong structural trends.

GATS can use SS persistence statistics to adapt risk allocation and aggressiveness across strategies.

6.4 SS and Trade Lifecycle

SS governs:

- when new trades may be initiated (entry),

- how confident entries are,

- whether multiple entries can be layered into the same structural trend.

Once a trade is open, however, exit decisions are governed by DAATS, Death Stops, and the Nine Laws, not by SS alone. SS may flip before DAATS is hit, but the trade remains protected by volatility-based logic.

6.5 SS as a Legal Doctrine

In the internal language of GATS:

- SS = TRUE → “The market has passed structural and momentum due diligence.”

- SS = FALSE → “The market has not passed due diligence; we must not engage.”

This legal framing prevents emotional or discretionary overrides and keeps SMSD at the top of the decision hierarchy.

Section 7 — EMA Zone Integration Under SMSD

Section 7 integrates the SMSD triad (M, D, C) with the full EMA Color-Coded Zone Architecture, turning descriptive zones into a structural engine that contextualizes every SS event.

7.1 Recap of EMA Zones

The EMA stack is divided into seven zones:

- Momentum Zone — EMA 1–8

- Acceleration Zone — EMA 9–15

- Transition Zone — EMA 16–25

- Value Zone — EMA 26–50

- Correction Zone — EMA 51–89

- Trend Reassessment Zone — EMA 90–140

- Long-Term Trend Zone — EMA 141–200

SMSD uses these zones to classify where price sits structurally at the moment an SS event occurs.

7.2 EMA Zones and SS Quality

The location of price at the time of SS formation strongly influences trend quality:

- SS in or near the Value Zone → often powerful trend initiation areas.

- SS in the Momentum Zone → potential continuation or late-stage extension.

- SS in the Correction or Reassessment Zones → rebuilding, reversal, or complex transitions.

SMSD records the zone context at SS formation and embeds it into the Market Identity model described in Section 8.

7.3 EMA Alignment and Health of Structure

SMSD evaluates whether the EMA stack is aligned:

- Bullish health → shorter EMAs above longer EMAs (8 > 15 > 25 > 50 > 89 > 140 > 200).

- Bearish health → shorter EMAs below longer EMAs (8 < 15 < 25 < 50 < 89 < 140 < 200).

Disordered stacks indicate structural distortion or transition, which later map into the EMA Alignment Score (EAS) in Section 8.

7.4 EMA Zones as Structural Filters Around SS

Even when SS is TRUE, zone context matters:

- SS + price near EMA 50/89 → potentially early trend phase.

- SS + price far beyond EMA 8 and 25 → late momentum extension; higher risk of exhaustion.

GATS can use zone context to adjust risk size, target expectations, and aggressiveness of trade layering.

7.5 Foundation for Market Identity (SR–PZ–EAS)

EMA zones feed directly into:

- PZ (Price Zone) — where price sits relative to key zone boundaries.

- EAS (EMA Alignment Score) — how clean the EMA structure is.

- SR (Structural Regime) — determined largely by position relative to EMA 200.

Section 8 formalizes this into a code — SR–PZ–EAS — that gives every SS event a structural “passport” describing the world it lives inside.

Section 8 — Market Identity Model (SR–PZ–EAS)

The Market Identity Model under the Structural–Momentum Synchronization Doctrine (SMSD) provides a precise way to label the structural state of any financial instrument using three core dimensions:

- SR — Structural Regime

- PZ — Price Zone

- EAS — EMA Alignment Score

Together, these form a compact identity code:

Market Identity = SR–PZ–EASThis identity code becomes the official language through which GATS and SMSD describe the market’s structural state across all nine default strategies.

8.1 Purpose of the Market Identity Model

While the Synchronized State (SS) determines whether trades are permitted, the Market Identity Model determines:

- what kind of market we are trading (macro bull, macro bear, transition),

- where price sits within the EMA zone architecture,

- how clean or distorted the EMA structure is,

- whether SS events are likely to be strong, weak, reactive, or exhausted.

In other words, SS answers: “Can we trade?”

The Market Identity answers: “What kind of world are we trading inside?”

8.2 Component 1 — Structural Regime (SR)

The Structural Regime (SR) is defined using the relationship between price and EMA 200 on the Identity Timeframe (Daily):

- SR = BULL if Price > EMA 200 and EMA 200 is rising or stable.

- SR = BEAR if Price < EMA 200 and EMA 200 is falling or stable.

- SR = TRANS if Price is oscillating around EMA 200 or EMA 200 is flat and noisy.

EMA 200 serves as the Structural Trend Boundary, distinguishing long-term bullish, bearish, and transitional environments.

SR defines the gravitational field of the market.

SS defines the moment of engagement within that field.

8.3 Component 2 — Price Zone (PZ)

The Price Zone (PZ) specifies where current price resides within the EMA zone structure. It provides a positional label that describes the stage of the trend or cycle.

Using the primary EMA boundaries (8, 25, 50, 89, 140, 200), SMSD maps the following non-overlapping zones:

- PZ1: Price > EMA 8 (Hyper-Momentum Extension)

- PZ2: EMA 15 < Price ≤ EMA 8 (Momentum Decay / Upper Acceleration)

- PZ3: EMA 25 < Price ≤ EMA 15 (Acceleration–Transition Band)

- PZ4: EMA 50 < Price ≤ EMA 25 (Upper Value Zone)

- PZ5: EMA 89 < Price ≤ EMA 50 (Lower Value / Upper Correction)

- PZ6: EMA 140 < Price ≤ EMA 89 (Correction / Early Reassessment)

- PZ7: EMA 200 < Price ≤ EMA 140 (Deep Reassessment / Long-Term Value)

- PZ8: Price ≤ EMA 200 (Structural Breakdown Region or Deep Bear Value)

PZ encodes the vertical location of price within the structural hierarchy.

8.4 Component 3 — EMA Alignment Score (EAS)

The EMA Alignment Score (EAS) describes how well the EMA stack is aligned in relation to a bullish or bearish structure.

For a bullish structure, the ideal alignment is:

EMA 8 ≥ EMA 15 ≥ EMA 25 ≥ EMA 50 ≥ EMA 89 ≥ EMA 140 ≥ EMA 200For a bearish structure, the ideal alignment is reversed.

EAS is computed as the ratio of EMA pairs that are correctly ordered vs total adjacent pairs.

SMSD classifies EAS into qualitative buckets:

- A+ — Perfect or near-perfect bullish or bearish stacking (≥ 90% alignment).

- A — Strong structural alignment (≥ 75% alignment).

- B — Mixed or partially aligned (≈ 50–75%).

- C — Weak or distorted structure (≈ 25–50%).

- I — Inverted structure (< 25% correct stacking).

EAS describes whether the trend is healthy, maturing, distorted, or collapsing.

8.5 Combining SR, PZ, and EAS

The full Market Identity code is expressed as:

SR–PZ–EASExamples:

- BULL–2–A+ → Strong bullish regime, price in upper acceleration zone, perfectly aligned EMAs.

- BULL–5–B → Bullish regime, price in Value–Correction buffer, mixed EMA alignment.

- BEAR–8–I → Deep bear structure, price below EMA 200, fully inverted EMA stack.

- TRANS–4–C → Transitional regime, price in upper value area, weak structure.

This terse code becomes the canonical description of the market’s structural state.

8.6 How Market Identity Interacts with SS

SMSD uses SS to decide when trades are permitted, and SR–PZ–EAS to determine:

- position sizing priorities,

- which GATS strategy archetypes are favored,

- whether the environment is trend-following or mean-reverting biased,

- how aggressive or conservative the execution should be.

Example:

- SS_bull TRUE + BULL–2–A+ → Ideal environment for aggressive trend-following.

- SS_bull TRUE + BEAR–7–B → Counter-trend, transitional environment; caution required.

- SS_bear TRUE + BEAR–8–I → Strong continuation downtrend.

8.7 Identity Stability and Volatility

The stability of a Market Identity can be quantified by monitoring:

- how long SR remains unchanged,

- how often PZ oscillates across major boundaries (e.g., EMA 50, 89, 200),

- how persistent EAS remains in A/A+ vs frequent drops to C/I.

A stable identity (e.g., BULL–3–A+ for many days) favors trend-following entries aligned with SS.

A highly unstable identity (e.g., SR flipping, PZ jumping, EAS oscillating) warns of structural turbulence and advises minimal exposure.

8.8 Application to Bitcoin Example

Consider the earlier Daily BTC example where:

- Price is below EMA 200 → SR = BEAR

- Price is below all EMAs, including EMA 200 → PZ = 8

- EMA stack is deeply inverted → EAS = I

The Market Identity becomes:

BEAR–8–IThis is the most extreme form of bearish structural identity under SMSD.

In such a state:

- A bearish SS will be treated as strong continuation.

- A bullish SS (if it forms) will be treated as a high-risk reversal attempt.

8.9 GATS Integration: Using SR–PZ–EAS in Strategy Logic

For GATS developers and strategy designers, the SR–PZ–EAS model can be integrated to:

- enable or disable certain strategies based on identity (e.g., disable breakout strategies during TRANS–x–C states),

- scale risk up during A+/A identities and down during C/I identities,

- prioritize pullback strategies in BULL–4/5–A states,

- permit counter-trend strategies only during TRANS–6–B states with special filters.

SR–PZ–EAS thus becomes a universal routing layer for decision logic inside GATS.

8.10 Summary of Section 8

The Market Identity Model (SR–PZ–EAS) provides SMSD and GATS with a powerful, compact framework for describing the structural state of any market at any time. It answers the question: “What kind of structural world am I trading inside?”

When combined with the Synchronized State (SS), it allows for:

- precise trade permission logic,

- context-aware strategy selection,

- and structurally informed risk deployment.

Section 9 — Permission Logic for GATS Under SMSD

The Structural–Momentum Synchronization Doctrine (SMSD) governs all trade authorization inside the Global Algorithmic Trading Software (GATS). While many systems treat entries as a function of a single indicator or price pattern, SMSD elevates permission to a doctrinal level: trades are either legal or illegal under the doctrine.

Section 9 formalizes how:

- the Synchronized State (SS),

- the Market Identity Model (SR–PZ–EAS), and

- the Nine-Laws Framework

interact to produce a precise permission matrix for GATS.

9.1 Core Principle — SS as the Legal Gate

At the heart of SMSD is a non-negotiable principle:

If SS = 0 on the Daily timeframe, GATS is forbidden from opening new directional positions.

No lower timeframe, no alternative indicator, and no discretionary override may circumvent this rule. SS is the legal gate that protects GATS from trading in structurally incoherent environments.

9.2 Permission States

GATS recognizes three high-level permission states on the Daily timeframe:

- FULL PERMISSION — SS = 1 and identity is structurally healthy.

- RESTRICTED PERMISSION — SS = 1 but identity is structurally stressed.

- NO PERMISSION — SS = 0 (no synchronization).

These are determined by combining SS with SR–PZ–EAS.

9.3 Mapping SS and Market Identity to Permission

Let:

Identity = SR–PZ–EASThen:

- FULL PERMISSION typically requires:

- SS = 1,

- SR ∈ {BULL, BEAR} (not TRANS),

- EAS ∈ {A+, A},

- PZ within structurally coherent bands (e.g., PZ2–PZ6).

- RESTRICTED PERMISSION applies when:

- SS = 1,

- SR = TRANS or EAS ∈ {B, C}, or

- PZ in extreme extension or deep breakdown (PZ1 or PZ8).

- NO PERMISSION applies whenever:

- SS = 0 — regardless of identity.

Within RESTRICTED PERMISSION, GATS may:

- downscale risk per trade,

- disable certain aggressive strategies,

- require stronger confirmations and tighter filters.

9.4 GATS Permission Logic Pseudocode

If SS = 0: PERMISSION = "NONE" Disable all new directional entries If SS = 1: If SR in {BULL, BEAR} AND EAS in {A+, A} AND PZ in {2,3,4,5,6}: PERMISSION = "FULL" Else: PERMISSION = "RESTRICTED"This canonical logic can be extended with asset-specific or strategy-specific nuances, but the doctrinal hierarchy remains: SS first, identity second, execution last.

9.5 Strategy-Level Permissions

Different strategies within GATS can be selectively enabled based on identity:

- Momentum Trend Followers Preferred during:

- SS = 1 and SR = BULL, PZ2–PZ4, EAS = A+/A (for longs).

- SS = 1 and SR = BEAR, PZ6–PZ8, EAS = A+/A (for shorts).

- Pullback Strategies Favored during:

- SS = 1, PZ4–PZ5, EAS = A/B.

- Reversal / Countertrend Probes Only considered under:

- Special frameworks, typically in TRANS regimes,

- subject to tighter volatility constraints and separate doctrine.

SMSD thereby becomes a routing layer that directs which strategies may operate under which market identities.

9.6 Interaction with the Nine-Laws Framework

Once GATS receives PERMISSION = FULL or PERMISSION = RESTRICTED, the Nine-Laws Framework takes over the volatility, stop, and lifecycle governance.

The key separation:

- SMSD → Determines if trading is allowed and how aggressively.

- Nine Laws → Determine how trades evolve, survive, or die.

9.7 Permission and Existing Positions

Permission states affect:

- new entries, but

- not necessarily the continuation of existing positions.

For example:

- If SS later flips to 0 while a trade is open, GATS does not auto-exit.

- Instead, DAATS and Death Stops (Law 4 & Law 5) remain in control.

This prevents knee-jerk exits and maintains doctrinal consistency:

SS controls entry legality. Death Stops and DAATS control exit legality.

9.8 Summary of Section 9

SMSD’s permission logic for GATS ensures:

- no trades occur without structural and momentum due diligence,

- identity-aware risk deployment,

- clean separation between whether GATS trades and how trades are managed afterward.

This forms the regulatory foundation for the multi-timeframe execution model described in Section 10.

Section 10 — Multi-Timeframe Execution Flow (Daily–M60–M240)

Section 10 describes how Daily, M60, and M240 interact to form a coherent execution stack within GATS under SMSD.

The core idea:

Daily decides who we are and whether trading is allowed. M60 decides where we enter. M240 decides how we survive.

10.1 Roles of the Three Timeframes

- Daily (Identity & Permission Layer)

- Computes SS (M, D, C).

- Computes SR–PZ–EAS identity.

- Outputs PERMISSION state for GATS.

- M60 (Execution Layer)

- Locates precise entries: breakouts, pullbacks, micro-structures.

- Aligns intraday flow with Daily SS direction.

- Avoids trading against Daily identity.

- M240 (Structural Risk Layer)

- Defines DAATS, Death Stop, and volatility envelope.

- Anchors stop-loss decisions to structural volatility, not noise.

- Ensures trades have room to breathe across sessions.

10.2 Daily → M60: From Permission to Execution

Only when SS = 1 and GATS has at least RESTRICTED or FULL permission does M60 become active for that instrument.

M60 then:

- scans for price patterns consistent with the Daily SS direction,

- checks Mini-EMA stack alignment (e.g., EMA 8/15/25 on M60),

- uses local MACD/price action to time entries.

Key Constraint

M60 may never open a long trade against a bearish SS, nor a short trade against a bullish SS.

10.3 Execution Triggers on M60

Depending on strategy, M60 may enter on:

- breakout above M60 consolidation aligned with SS direction,

- pullback to EMA 25 or EMA 50 with rejection in the SS direction,

- microstructural retest of broken levels.

All M60 triggers must pass a directional filter:

If SS_bull = 1: Only long-biased entry templates are allowed If SS_bear = 1: Only short-biased entry templates are allowed

10.4 M60 → M240: Risk Anchor Handover

Once an entry is executed on M60, the trade is formally handed over to the M240 timeframe for risk and lifecycle management.

On M240, GATS computes:

- ATR-based DAATS (e.g., 12 × ATR50 or chosen multiplier),

- Death Stop (e.g., 16 × ATR256),

- Noise floor and macro volatility context.

From this point, M60 no longer defines stop-loss placement; it only defines potential add-on or scale-in logic, subject to SMSD and the Nine Laws.

10.5 Lifecycle Governance

The trade’s lifecycle proceeds as:

- Daily SS grants permission.

- M60 triggers the entry.

- M240 sets DAATS and Death Stop.

- Nine Laws modulate stop evolution, breakeven, and shock handling.

- Exit occurs only via DAATS or DS (Law 4 & Law 5).

SS may later flip, but exit remains governed by volatility laws, not SS.

10.6 Higher Timeframe Integration

While SMSD is defined on Daily and execution on M60/M240, higher timeframes (e.g., Weekly, Monthly) can:

- frame macro context for portfolio allocation,

- determine whether Daily trends are part of larger super-trends,

- influence which strategies are active in G9TTS.

However, the legal synchronized state for trading remains anchored to Daily SS.

10.7 Summary of Section 10

The Daily–M60–M240 stack resolves the classic problem of timeframe confusion by:

- assigning identity and permission to the Daily timeframe,

- assigning tactical execution to M60,

- anchoring structural risk to M240.

This architecture is the operational foundation for the concrete case study in Section 11.

Section 11 — Bitcoin Case Study Under SMSD

Section 11 applies SMSD to a real-world asset: Bitcoin on the Daily and Weekly timeframes, illustrating how structural–momentum synchronization, Market Identity, and GATS permissions function concretely.

11.1 Structural Snapshot (Conceptual Example)

Assume a Bitcoin Daily environment where:

- Price is trading below EMA 200.

- EMA 8, 15, 25, 50, 89, 140 are all stacked below EMA 200.

- MACD 5 and MACD 2 recently flipped from bearish to bullish.

From this:

- SR = BEAR (price under EMA 200)

- PZ = 8 (price at or below EMA 200 and the long-term zones)

- EAS = I (inverted stack; deep bear structure)

Market Identity:

BEAR–8–I

11.2 SMSD Evaluation

Now evaluate the SMSD triad:

- M — MACD 5 & MACD 2 turned bullish (M = +1).

- D — EMA 25 still below EMA 26 (D = −1, bearish drift).

- C — Price still below EMA 8 (C = −1, no bullish structural reclaim).

Thus:

M = +1 D = −1 C = −1 → SS = 0 (no synchronized state)Momentum has reacted, but drift and structure remain bearish.

11.3 Interpretation Under SMSD

SMSD interprets this as:

- a bullish reaction within a deep bearish structure,

- countertrend momentum against a still-declining drift and unrecaptured EMA 8.

GATS is therefore:

- forbidden to deploy long trend-following positions,

- allowed only to observe and update future expectations.

Bitcoin may be “rallying”, but under SMSD, the structure has not yet given permission to treat this as a new bull trend.

11.4 Conditions for a Legitimate Bullish SS in a Bear Identity

For Bitcoin to form a legitimately bullish SS from this state, the following sequence is typically required:

- MACD 5 and MACD 2 remain bullish (M = +1 persists).

- EMA 25 rises above EMA 26 (D flips from −1 to +1).

- Daily closes reclaim and hold above EMA 8 (C flips from −1 to +1).

Once all three conditions are satisfied:

M = +1, D = +1, C = +1 → SS_bull = 1Even then, the underlying identity may still be BEAR–7–B or BEAR–6–B, signaling a high-risk bullish reversal attempt, not a fully matured bull trend.

11.5 Tactical Translation for GATS

For GATS:

- In the initial BEAR–8–I + SS = 0 state:

- no bullish entries allowed;

- bears may still be favored in M60/M240 timeframes.

- As Bitcoin migrates toward BEAR–6–B, then TRANS–5–B, with SS_bull eventually forming:

- GATS may grant Restricted Permission for cautious bullish entries.

- Full risk is only allowed when identity improves (e.g., BULL–4–A).

SMSD thus transforms an emotional bullish narrative (“Bitcoin is flying!”) into a disciplined structural assessment.

11.6 Weekly–Daily Harmony

Weekly structure further refines this reading:

- If Weekly still shows a strong bear identity (e.g., BEAR–7–A), Daily bullish SS is treated as a tactical countertrend window within a macro bear.

- If Weekly is transitioning (e.g., TRANS–5–B), the same Daily SS may be interpreted as an early phase of macro reversal.

GATS can weight risk allocation based on the harmony between Weekly and Daily identities.

11.7 Summary of Section 11

The Bitcoin case study demonstrates how SMSD:

- separates momentum reactions from true structural trend shifts,

- uses SR–PZ–EAS to classify structural depth and risk,

- prevents premature reversal trading in deep bear regimes,

- and stages permission cautiously as structure evolves.

This concrete example sets the stage for Section 12, where SMSD is compared with traditional trend models.

Section 12 — Comparative Framework: SMSD vs Traditional Trend Models

The Structural–Momentum Synchronization Doctrine (SMSD) reshapes how trend participation is defined by requiring the alignment of momentum, drift, and structural confirmation. Section 12 contrasts SMSD with the major trend models used historically.

12.1 The Five Major Traditional Trend Models

SMSD is compared to:

- Moving Average Crossovers

- Traditional MACD Trend Models

- Price Action Trend Models

- Breakout & Channel-Based Models

- Classic EMA Zone Interpretation

Each captures part of the picture; SMSD integrates them into a higher-order framework.

12.2 SMSD vs Moving Average Crossovers

Classic crossovers (e.g., 50/200) identify major trend changes, but:

- they are slow,

- they whipsaw in ranges,

- they ignore momentum quality,

- they ignore EMA zone context.

SMSD improves this by:

- using dual MACD (M) for momentum quality,

- using SDI (D) for early structural rotation,

- using EMA 8 (C) for structural confirmation,

- embedding everything in EMA zones and identity.

12.3 SMSD vs Traditional MACD Trend Models

Single MACD models often:

- flip frequently in choppy markets,

- signal “trends” that are structurally unsupported,

- lack deeper context about EMA zones or drift.

SMSD:

- requires agreement of MACD 5 and MACD 2,

- filters through SDI to avoid countertrend impulses,

- requires EMA 8 reclamation or loss to confirm structure.

12.4 SMSD vs Price Action Trend Models

Price action methods (higher highs/lows, trendlines) can be powerful but:

- are subjective,

- hard to encode consistently into algorithms,

- often disagree between traders.

SMSD replaces subjectivity with:

- strict mathematical definitions of M, D, and C,

- binary SS logic,

- structural codes (SR–PZ–EAS) that machines can interpret precisely.

12.5 SMSD vs Breakout & Channel Models

Breakout systems enter when price moves beyond predefined channels or ranges. They:

- can catch strong trends, but

- also enter at exhaustion points,

- often misinterpret volatility spikes as structural breaks.

SMSD insists that:

- no breakout is tradable without SS = 1,

- identity must support trend continuation,

- volatility must be routed through DAATS/Nine Laws.

12.6 SMSD vs Classic EMA Zone Interpretation

Many traders use EMA zones to judge phases (momentum, value, correction) but:

- lack a formal doctrine linking zones to permission,

- do not integrate drift or MACD in a unified way.

SMSD converts zones into:

- structured identities (PZ),

- alignment scores (EAS),

- formal risk and strategy-routing signals.

12.7 Summary Comparison Table

Model Core Input Weakness SMSD Enhancement MA Crossovers MA relationships Lag, whipsaws, no momentum layer Momentum+Drift+Confirmation before engagement Traditional MACD Momentum only False flips, no structure Dual MACD + SDI + EMA 8 Price Action Swings & patterns Subjective, inconsistent Objective, codified state space (SS, SR–PZ–EAS) Breakouts Range/Channel breaks Exhaustion traps Require SS + Identity + Nine Laws EMA Zones Zone phases Descriptive only Converted to actionable identity & filters

12.8 Conclusion of Section 12

SMSD does not discard traditional models; it subsumes and integrates them into a higher-order doctrine. By requiring structural–momentum synchronization and explicit market identity classification, SMSD:

- reduces false participation,

- converts descriptive tools into legal decision engines,

- and provides a consistent platform for algorithmic implementation.

Section 13 extends this by binding SMSD to the Nine-Laws volatility framework.

Section 13 — SMSD Integration With the Nine-Laws Framework

The Structural–Momentum Synchronization Doctrine (SMSD) determines when a market is structurally synchronized and thus eligible for engagement. The Nine-Laws Framework determines how volatility, risk, and lifecycle dynamics must be governed once a position exists.

Section 13 formalizes this integration.

13.1 Permission vs Persistence

SMSD and the Nine Laws divide responsibility:

- SMSD: Entry permission and directional legitimacy.

- Nine Laws: Stop width, breakeven, survival, response to shocks, and portfolio noise.

Once SS = 1 and a trade is opened, exit decisions no longer depend on SS but on:

- DAATS,

- Death Stop,

- volatility regimes (Law 1–3),

- and portfolio-level constraints (Law 7–9).

13.2 Identity-Guided Volatility Interpretation

Market Identity (SR–PZ–EAS) shapes how the Nine Laws interpret volatility:

- BULL–2–A+ → High-confidence continuation; DAATS may tighten slowly.

- BEAR–8–A+ → Deep bear trend; DS and DAATS must accommodate extended moves.

- TRANS–4–C → Transitional; Nine Laws adopt a more defensive posture.

Thus the Nine Laws are not blind; they operate within the structural lens SMSD defines.

13.3 Direction vs Amplitude

SMSD supplies the directional vector (bull or bear). The Nine Laws supply the amplitude envelope (how far price may roam before trade death).

This decomposition prevents:

- mixing directional conviction with volatility risk,

- confusing a directional flip with a mandatory exit.

13.4 EMA 8 and Law 5 (Exit Only on Death)

EMA 8 (C layer) is critical for SS, but once in a trade:

- a violation of EMA 8 does not automatically terminate the trade.

Law 5 — Exit Only on Death — dictates:

Trades may exit only on DAATS or Death Stop, not on EMA violations alone.

This prevents exits from being driven by transient structural noise.

13.5 SDI, DAATS, and Breakeven Evolution

The Structural Drift Indicator (D) ties into:

- Law 2 (Weighted Decay of DAATS) — smoothing how stops evolve with drift.

- Law 6 (Adaptive Breakeven Decision) — deciding when to move to breakeven based on drift stability and noise floor.

Drift shifts can trigger:

- slower tightening of stops when structure weakens,

- faster tightening when structure strengthens in the trade’s favor.

13.6 Lifecycle: From SS to Death

The combined SMSD–Nine-Laws lifecycle:

- Daily SMSD → SS decision.

- If SS = 1 → GATS permission (Full/Restricted).

- M60 → entry.

- M240 + Nine Laws → DAATS, DS, BE, regime adaptation.

- Exit only upon DAATS or DS hit.

- Law 9 → weekly renormalization of parameters.

13.7 Example: Bitcoin Under SMSD + Nine Laws

For Bitcoin in a BEAR–8–A+ identity with no SS:

- SMSD denies new bullish entries.

- Nine Laws remain dormant for new positions (but still govern any pre-existing trades).

Once a bullish SS eventually forms:

- Law 1 examines correlation and systemic volatility (CRTL).

- Law 2/3 define how DAATS and DS adjust to expansion/compression.

- Law 6 determines when breakeven is triggered.

13.8 Summary of Section 13

SMSD and the Nine Laws together form a dual-governance system:

- SMSD → Whether and in what direction to participate.

- Nine Laws → How to survive, evolve, and terminate positions once open.

Section 14 consolidates this into a single end-to-end workflow from detection to execution to death.

Section 14 — Full SMSD–GATS Workflow (From Detection to Execution to Death)

Section 14 unites all components of the doctrine into a single operational pipeline, showing how SMSD and the Nine Laws drive GATS from initial detection to trade termination.

14.1 Seven Phases of the SMSD–GATS Workflow

- Detection — Daily synchronization scan (M, D, C).

- Permission — SS-based authorization for GATS.

- Execution — M60 entry logic.

- Transfer — M240 risk anchor initialization.

- Evolution — DAATS, BE, drift and volatility adaptation.

- Termination — Death (DAATS/DS) or survival.

- Validation — Law 9 weekly renormalization.

14.2 Detection Phase

Compute M via MACD 5 & MACD 2 Compute D via EMA25 vs EMA26 Compute C via EMA8 vs Close If M = D = C ≠ 0: SS = 1 Else: SS = 0Only Daily SS = 1 can activate the rest of the workflow.

14.3 Permission Phase

Once SS = 1:

GATS_PERMISSION ∈ {FULL, RESTRICTED}as defined in Section 9 using SR–PZ–EAS. If SS = 0:

GATS_PERMISSION = NONEand all directional entries are disabled.

14.4 Execution Phase (M60)

M60 identifies tactical entries:

- aligned breakouts,

- pullbacks to structural EMAs,

- microstructure confirmation with the SS direction.

A trade can only be executed if:

M60_trigger = TRUE AND SS = 1

14.5 Transfer Phase (M240)

After entry:

- M240 computes DAATS (e.g., 12 × ATR50),

- M240 computes Death Stop (e.g., 16 × ATR256),

- the trade is now governed structurally rather than microscopically.

14.6 Evolution Phase

Over time, Law 2, Law 3, and Law 6:

- adjust DAATS with volatility and drift,

- respond to macro shocks,

- decide when to move stops to breakeven.

SS may flip during this phase, but exit remains a function of DAATS and DS.

14.7 Termination Phase

A trade ends only when:

- DAATS is hit (volatility-defined trailing stop), or

- Death Stop is hit (structural failure),

consistent with Law 4 and Law 5.

After exit, SMSD may later create a new SS event, starting a fresh lifecycle.

14.8 Validation Phase (Law 9)

Law 9 ensures continuous refinement:

- parameters are recalibrated weekly,

- DAATS and DS multipliers can be adjusted,

- model performance feeds back into future parameter choices.

14.9 Summary of Section 14

The full SMSD–GATS workflow creates a complete trading organism:

- structurally aware,

- volatility-aware,

- timeframe-coherent,

- and doctrinally consistent from detection to death.

Section 15 — SMSD Failure Modes, Edge Cases & Anomaly Protocol

Section 15 defines what happens when the assumptions behind SMSD are stressed: when inputs conflict, volatility behaves abnormally, or data itself becomes unreliable. It introduces the Anomaly Protocol to ensure capital is preserved in structurally ambiguous environments.

15.1 Categories of Failure Modes

- Momentum–Structure Conflicts (M vs D vs C disagreements).

- EMA Zone Distortions & Inversions (EAS instability).

- Timeframe Desynchronization (Daily vs M60 vs M240 conflict).

- Volatility Anomalies (ATR shocks, persistent extremes).

- Data & Feed Irregularities (gaps, bad ticks, corrupted bars).

15.2 Momentum–Structure Conflicts

Occur when:

- M turns bullish while D and C remain bearish (or vice versa),

- MACD flips early inside a still-intact opposite structure.

Anomaly Protocol:

- SS remains 0.

- GATS forbids new entries in the conflicting direction.

- Existing trades remain managed via DAATS and DS.

15.3 EMA Distortions & EAS Instability

Signs include:

- EMA knots (8/15/25/50 compressing and crossing repeatedly),

- rapid PZ shifts across key boundaries (50, 89, 200),

- EAS oscillating frequently between A/B/C/I.

Anomaly Protocol:

- SS events during such instability are downgraded to Conditional.

- New entries may be temporarily disabled or risk-reduced.

- Identity must stabilize for a minimum number of bars before full permission returns.

15.4 Timeframe Desynchronization

Examples:

- Daily SS = 1 but M60 repeatedly fails to produce viable entries.

- M240 volatility expands sharply while Daily structure appears unchanged.

Anomaly Protocol:

- Reduce frequency of new entries or pause them temporarily.

- Re-validate SR–PZ–EAS and SS after a cooling-off period.

15.5 Volatility Anomalies

These include:

- ATR shocks from macro events,

- ATR collapses in illiquid or holiday sessions.

Anomaly Protocol (via Nine Laws):

- Law 3 applies superlinear adjustments to DS and DAATS during shocks.

- Law 2 smooths DAATS evolution to avoid overreaction.

- Risk per trade may be scaled down until volatility normalizes.

15.6 Data & Feed Irregularities

Example issues:

- isolated price spikes far outside normal ATR,

- missing bars or overlapping timestamps,

- disconnected OHLC values.

Anomaly Protocol:

- perform sanity checks on incoming bars,

- flag and ignore suspicious ticks where possible,

- invalidate SS events driven solely by anomalous bars.

15.7 Anomaly Flags

SMSD uses anomaly flags:

- Flag 0 — Normal (no anomaly).

- Flag 1 — Structural conflict (M/D/C mismatch).

- Flag 2 — EMA/EAS instability.

- Flag 3 — Volatility anomaly.

- Flag 4 — Data irregularity.

Any non-zero flag forces GATS to:

- tighten entry criteria or pause new entries,

- ensure exits remain governed by volatility laws,

- prioritize preservation over participation.

15.8 SMSD Failsafe Rule

If SMSD cannot verify structural synchronization with high confidence, it must assume that no valid SS exists.

This ensures that ambiguity leads to non-participation rather than forced, low-quality trading.

15.9 Summary of Section 15

The Failure Modes & Anomaly Protocol make SMSD more than a trend-engagement tool; they turn it into a protective doctrine. When structure, momentum, volatility, or data become unreliable, SMSD defaults to caution, ensuring that the Global 9-Tier Trading System (G9TTS) always prioritizes survivability over unnecessary exposure.

Section X — Dual-Drift Containment Channel (DDCC) & False Drift Breakouts

The Dual-Drift Containment Channel (DDCC) extends the Structural Drift Indicator (SDI) by transforming the EMA 25 vs EMA 26 relationship from a simple sign into a structural envelope around which price is allowed to breathe without forcing a regime change. It allows SMSD to:

- distinguish true drift transitions from false drift breakouts,

- quantify how far price stretched against the prevailing drift,

- derive structurally grounded entry zones and hard stop-loss levels.

This section formalizes the DDCC, defines False Drift Breakouts (FDB), and introduces the Drift Rejection Entry Protocol (DREP), integrating DDCC with GATS entries and SMSD’s broader doctrine.

X.1 Construction of the Dual-Drift Containment Channel (DDCC)

Let:

E25(t)= EMA 25 at bart,E26(t)= EMA 26 at bart,P(t)= closing price at bart.For each bar, define the instantaneous drift band:

U_inst(t) = max(E25(t), E26(t)) L_inst(t) = min(E25(t), E26(t))Choose a structural lookback window

N(naturallyN ≈ 25–26bars on the Daily). Over that window:U_DDCC(t) = max{ U_inst(t-k) : k = 0..N-1 } L_DDCC(t) = min{ L_inst(t-k) : k = 0..N-1 }The DDCC is then defined as the channel:

[L_DDCC(t), U_DDCC(t)]Intuition:

- U_DDCC is the highest “drift band high” EMA value observed in the last N bars.

- L_DDCC is the lowest “drift band low” EMA value observed in the last N bars.

As long as price oscillates within this band, the underlying EMA 25–26 drift structure is considered intact, even if price is volatile.

X.2 Drift Sign and Regime

The Structural Drift Indicator (SDI) defines the drift sign:

if E25(t) > E26(t): D(t) = +1 (bull drift) elif E25(t) < E26(t): D(t) = -1 (bear drift) else: D(t) = 0 (flat/transition)The DDCC does not replace D(t); it wraps D(t) with structural context by asking: “Is price currently contained by, testing, or violating the drift envelope?”

X.3 Price States Relative to the DDCC

For a given bar

t:

- Contained:

L_DDCC(t) ≤ P(t) ≤ U_DDCC(t)

Price is breathing within the structural drift envelope.- Drift Break Attempt Up (DBA-UP):

P(t) > U_DDCC(t)

Price is attempting to push above the historical drift envelope.- Drift Break Attempt Down (DBA-DOWN):

P(t) < L_DDCC(t)

Price is attempting to push below the historical drift envelope.These are attempts. Whether they become true regime changes or false breakouts depends on how the drift responds over time.

X.4 True Drift Transitions vs False Drift Breakouts

To classify a drift break attempt, SMSD uses a confirmation window

W(e.g., 5–10 Daily bars) and a minimum persistence parameterK(e.g., 3–5 bars of sustained new drift).X.4.1 True Drift Transition (TDT)

A True Drift Transition occurs when:

- Price closes outside the DDCC in the direction of a potential new regime.

- The SDI drift sign D(t) flips (e.g., from −1 to +1) within the next W bars.

- The new drift sign persists for at least K consecutive bars.

Example (Bear → Bull):

- At bar

t0:D(t0) = -1, Bitcoin in bear drift.P(t0) > U_DDCC(t0)→ Drift Break Attempt Up.- Within

t0+1..t0+W, EMA 25 crosses above EMA 26 andD(t) = +1for at least K bars.This event is classified as a TDT-UP (True Drift Transition Up). The inverse case defines TDT-DOWN.

X.4.2 False Drift Breakout (FDB)

A False Drift Breakout (FDB) occurs when price breaks the DDCC but the drift sign stubbornly refuses to rotate.

Example (Bear Drift, Upward Spike):

D(t0) = -1(bear drift).P(t0) > U_DDCC(t0)→ upward Drift Break Attempt.- Over the next W bars, EMA 25 never rises above EMA 26;

D(t) = -1persists.This is labeled:

FDB-UP (False Drift Breakout Up)The symmetric case in a bull drift where price pierces below L_DDCC but drift does not flip is labeled FDB-DOWN.

X.5 Drift Overshoot & Severity of the Break

DDCC also provides a way to quantify how serious the breakout attempt was.

Define the channel height:

H_DDCC(t) = U_DDCC(t) - L_DDCC(t)Define the Drift Overshoot at bar

t0:

- For an upside break:

Δ_UP(t0) = P(t0) - U_DDCC(t0)- For a downside break:

Δ_DOWN(t0) = L_DDCC(t0) - P(t0)The Drift Overshoot Ratio (DOR) is:

DOR(t0) = |Δ(t0)| / H_DDCC(t0)DDCC classifies FDB severity as:

- Mild FDB:

DOR < 0.25- Moderate FDB:

0.25 ≤ DOR < 0.75- Severe FDB:

DOR ≥ 0.75For example, an FDB with

DOR = 0.80represents a deep spike outside the drift envelope that was still structurally rejected.

X.6 Drift Rejection Entry Protocol (DREP)

The Drift Rejection Entry Protocol (DREP) converts FDB signals into structured trade opportunities. The doctrine is simple:

When price violently challenges the drift channel but the drift refuses to rotate, we respect the drift and trade in its original direction — using the DDCC as the structural anchor for risk.

X.6.1 DREP for Bear Drift (Short Bias)

Setup: Bear drift (

D = -1) with an FDB-UP.

- Condition 1 — Bear Drift:

On the Daily timeframe,E25 < E26→D = -1.- Condition 2 — FDB-UP Detected:

P(t0) > U_DDCC(t0)and drift does not flip to +1 within W bars.- Condition 3 — Rejection Trigger:

After the FDB-UP, price must re-enter or reject the DDCC:

- Either a Daily close back below U_DDCC,

- or a rejection candle (long upper wick) failing to sustain above the channel.

Entry Logic (Short):

- Open short positions as price closes back inside the DDCC or shows clear rejection from above.

- Direction is always aligned with drift: short in bear regimes only.

Stop-Loss Logic for Shorts (DDCC-based):

- Primary structural stop = a buffer above

U_DDCC(e.g., U_DDCC + x·ATR).- Alternative for more conservative systems: above the FDB spike high, if that high > U_DDCC.

Exit may still be governed by DAATS / Death Stops under the Nine Laws, but DDCC provides the structural anchor for the initial hard stop.

X.6.2 DREP for Bull Drift (Long Bias)

Setup: Bull drift (

D = +1) with an FDB-DOWN.

- Condition 1 — Bull Drift:

On the Daily timeframe,E25 > E26→D = +1.- Condition 2 — FDB-DOWN Detected:

P(t0) < L_DDCC(t0)and drift does not flip to −1 within W bars.- Condition 3 — Rejection Trigger:

After the FDB-DOWN, price must re-enter or reject the DDCC from below:

- Either a Daily close back above L_DDCC,

- or a rejection candle (long lower wick) failing to sustain below the channel.

Entry Logic (Long):

- Open long positions as price closes back inside the DDCC or shows clear rejection from below.

- Direction is aligned with drift: long in bull regimes only.

Stop-Loss Logic for Longs (DDCC-based):

- Lower DDCC boundary as structural hard stop:

The lower channelL_DDCCserves as the core structural floor. A practical implementation:

- Set the initial hard stop at

L_DDCC − x·ATR(e.g., x = 0.5–1.0),- or just below the FDB spike low if that low is further down.

In doctrinal terms:

In a bull drift, the lower DDCC boundary is the structural line in the sand. As long as price remains above that floor (after an FDB-DOWN), the bull drift is presumed intact and long positions remain structurally justified.

X.7 DDCC as a Structural Stop Framework

DDCC-based stops align perfectly with SMSD’s emphasis on structure rather than noise.

X.7.1 Long Trades in Bull Drift

- Direction: Long only when

D = +1and SS_bull = 1.- Entry: Typically after pullback to DDCC or DREP following FDB-DOWN.

- Hard Structural Stop:

UseL_DDCCas the primary boundary:

- Base stop: just below L_DDCC (L_DDCC − x·ATR),

- DAATS/Death Stop may be further below per Nine Laws; L_DDCC acts as the “structural alert”.

X.7.2 Short Trades in Bear Drift

- Direction: Short only when

D = -1and SS_bear = 1.- Entry: Typically after pullback toward DDCC or DREP following FDB-UP.

- Hard Structural Stop:

UseU_DDCCas the primary ceiling:

- Base stop: just above U_DDCC (U_DDCC + x·ATR),

- DAATS/Death Stop may sit even further away in extreme trend environments.

Thus, the DDCC gives SMSD a clear geometric framework for initial hard stops, while the Nine Laws still govern the evolution of DAATS and ultimate Death Stops over the life of the trade.

X.8 Integration with SMSD Permission Logic & Anomaly Protocol

DDCC enriches the SMSD state space with additional fields:

- D_sign: −1, 0, +1 (bear, flat, bull).

- D_event: {None, TDT-UP, TDT-DOWN, FDB-UP, FDB-DOWN}.

- DOR: numerical measure of overshoot severity.

These fields feed into:

- Permission Logic (Section 9):

FDB events prevent GATS from chasing breakouts against the prevailing drift.- Anomaly Protocol (Section 15):

Severe FDB events (high DOR) can raise an additional drift anomaly flag recommending risk reduction or temporary pause.Example rules:

- If FDB-UP in bear drift and DOR ≥ threshold:

- Forbid new longs; shorts allowed only via DREP or conservative setups.

- If FDB-DOWN in bull drift:

- Forbid new shorts; longs allowed via DREP with L_DDCC-based structural stops.

X.9 Bitcoin Illustration Under DDCC

Consider Bitcoin on the Daily timeframe during a period where:

- EMA 25 remains below EMA 26 → bear drift (

D = -1),- Price rallies sharply toward ~94,500, temporarily challenging the EMA cluster.

Under DDCC:

- Compute

U_DDCCandL_DDCCover the last N = 25 bars.- If 94,500 > U_DDCC, classify as a Drift Break Attempt Up.

- Monitor D(t) for W bars:

- If EMA 25 never crosses above EMA 26, D stays −1.

- Label the move as FDB-UP.

- Measure DOR:

- If DOR is large (e.g., ≥ 0.5), call it a Moderate/Severe FDB-UP.

- Once price re-enters the DDCC or forms a strong rejection candle:

- DREP authorizes a structurally justified short entry,

- with stops above U_DDCC (plus volatility buffer) or above the spike high.

SMSD thus interprets the move not as a new bull market, but as a strong but structurally rejected counter-drift impulse — a classic FDB-UP with clear protocols for engagement and risk.

X.10 Summary of Section X

The Dual-Drift Containment Channel (DDCC) and the False Drift Breakout (FDB) framework elevate EMA 25 vs EMA 26 from a simple crossover logic to a full structural doctrine:

- DDCC encodes where drift is allowed to breathe without a regime change.

- TDT vs FDB distinguishes true structural rotations from failed attempts.

- DOR quantifies the severity of those challenges.

- DREP provides disciplined entry protocols aligned with the prevailing drift.

- DDCC-based hard stops use the lower channel as a structural floor for longs and the upper channel as a structural ceiling for shorts.

Integrated into SMSD and the Nine-Laws Framework, DDCC ensures that the Structural Drift Indicator is not only directional but also geometrically grounded, allowing GATS to translate drift into precise, institutionally robust trade decisions.

About the Author — Dr. Glen Brown

Dr. Glen Brown is the President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., two interconnected proprietary trading entities operating under a closed-loop capital model.

Holding a Doctor of Philosophy (Ph.D.) in Investments and Finance, Dr. Brown has over a quarter-century of experience spanning:

- multi-asset trading (FX, equities, indices, commodities, crypto, ETFs),

- quantitative finance and financial engineering,

- algorithmic trading system design,

- advanced volatility and risk frameworks.

He is the chief architect of the Global Algorithmic Trading Software (GATS), the Global 9-Tier Trading System (G9TTS), and several institutional doctrines including the Nine-Laws Framework, Timeframe-Weighted Volatility Framework (TWVF), and now the Structural–Momentum Synchronization Doctrine (SMSD).

Dr. Brown’s work integrates quantitative rigor with structural, philosophical, and macroeconomic insight — always guided by his core conviction that “we must consume ourselves in order to transform ourselves for our rebirth.”

Business Model Clarification

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate as closed-loop proprietary trading firms. They:

- trade only internal capital,

- do not solicit or accept external client funds,

- do not provide personalized investment advice to the public,

- design frameworks, doctrines, and systems principally for internal use.

All frameworks described — including GATS, SMSD, G9TTS, the Nine Laws, and TWVF — are developed for internal research, training, and proprietary deployment within Global Financial Engineering’s ecosystem.

General Risk Disclaimer

The material contained in this document is provided strictly for educational and informational purposes. Nothing herein should be interpreted as:

- personalized investment, legal, tax, or financial advice,

- a solicitation or recommendation to buy or sell any financial instrument,

- a guarantee of performance, profit, or risk outcome.

Trading and investing in foreign exchange, equities, indices, commodities, cryptocurrencies, derivatives, and other leveraged products involve a substantial degree of risk. Losses can exceed initial capital. Past performance, whether backtested or live, is not necessarily indicative of future results.

All readers and practitioners are fully responsible for:

- their own trading decisions,

- assessing the suitability of any strategy or method,

- obtaining independent professional advice where necessary.

By engaging with this material, you acknowledge that you understand the high risks involved in financial markets and agree that neither the author nor any affiliated entity shall be held liable for any direct or indirect loss arising from the use or misuse of the concepts discussed herein.

In Dr. Glen Brown’s methodology, a “free bar above the Daily DDCC” signifies that the daily price bar (candlestick) has closed entirely above the DDCC channel, indicating a strong bullish signal.

Meaning of a Free Bar Above the DDCC

The DDCC (Dual-Drift Containment Channel) acts as a structural envelope or a “filter” for market intent.

** DDCC as a filter**: The DDCC’s primary function is to filter out market “noise” and distinguish between true market transitions and temporary price anomalies. It provides a measure of structural honesty.

A “free bar” indicates strength: When a price bar (candle) closes completely above the DDCC, it signifies that the buying pressure was significant enough to overcome the existing (likely bearish or neutral) structural resistance provided by the channel. The market has “earned conviction” by sustaining price levels above the channel over an entire trading session (in this case, daily).

Bullish reversal confirmation: Dr. Brown emphasizes that this “free bar” confirmation is necessary to consider a move a true bullish reversal, rather than a mere temporary rally or “false breakout” within an ongoing bearish trend.

Actionable signal: Without a free bar, price movement above the DDCC may be seen as a retracement or a volatile spike, but not a confirmed, sustained change in market sentiment that would warrant a confident long position entry. The clear close above the channel acts as a permission filter for entering bullish trades

How to enter a manual trade using the free bar after a drift-shift

To enter a trade using the “free bar” signal above the Dual-Drift Containment Channel (DDCC), Dr. Brown’s methodology typically involves waiting for the confirmation of the close of that specific price bar and entering on the open of the next trading period.

Here is a step-by-step guide on how you would execute a trade based on this signal:

Entry Strategy with a “Free Bar”

The strategy is built on prudence and waiting for structural confirmation rather than chasing immediate price action.

Identify the “Free Bar”: You observe the market throughout the trading period (e.g., the Daily chart).

A “free bar” is one where the entire candlestick (both body and wick) finishes above the upper boundary of the Daily DDCC channel at the market close.

Wait for Confirmation of the Close: The key is patience. You do not enter the trade while the bar is still forming (intraday), as the price could fall back into the channel before the period ends. You wait for the official daily market close to confirm the signal is valid.

Enter on the Next Open: The entry point is typically at the open of the very next daily trading session .

This ensures you are acting on the confirmed structural conviction that the market has demonstrated.

Risk Management (Stop Loss and Target)

Dr. Brown’s approach incorporates strict risk management principles alongside the entry signal:

Stop Loss Placement: The protective stop-loss order is strategically placed below the lower boundary of the DDCC channel .

The logic is that if the price action returns inside the channel or breaches the bottom of the structural envelope, the bullish conviction is likely invalidated, and the trade hypothesis is wrong.

Target (Take Profit): The profit target is generally based on a calculated risk-to-reward ratio (often 16:1 or greater) or using other proprietary methodologies within the Structural–Momentum Synchronization Doctrine (SMSD) framework, such as the Nine-Laws targets or TWVF (Time, Volume, Volatility, Force) calculations.

Summary of Execution

This method avoids emotional, reactive entries by requiring the market to “earn” the bullish signal over an entire trading period, providing a high-conviction entry point that is filtered for true structural change.