Drglenbrown1

-

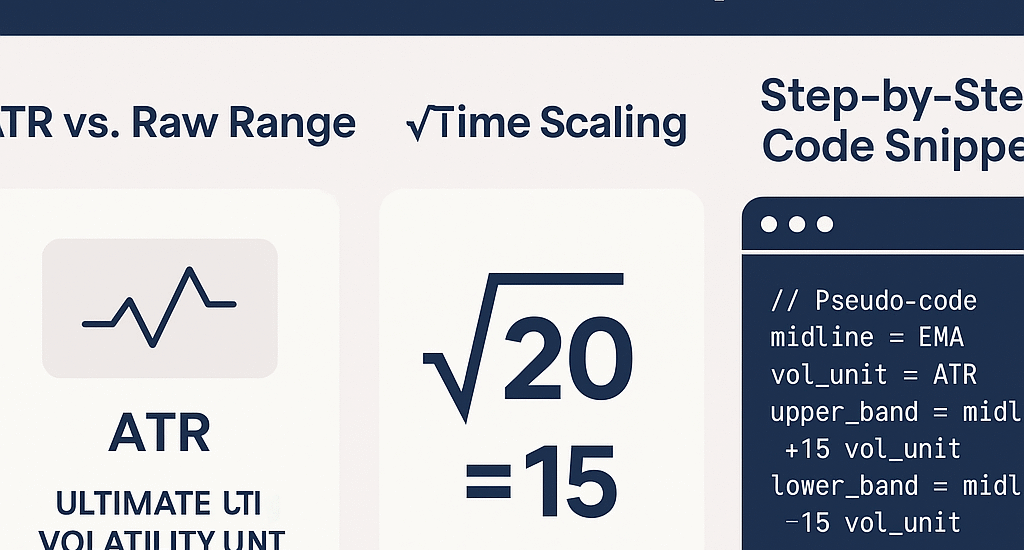

Law 1–2: Anchor Your Stops to ATR(200) & √Time Exposures

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

No Comments

Learn why ATR(200) is the ultimate volatility unit and how √time scaling (√200≈15 exposures) underpins adaptive stop-loss management, with step-by-step chart implementation.

-

Beyond ATR: Introducing Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover why static ATR-based stops fail and explore Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—anchored by √time scaling, DAATS and GNASD—for a truly adaptive risk framework.

-

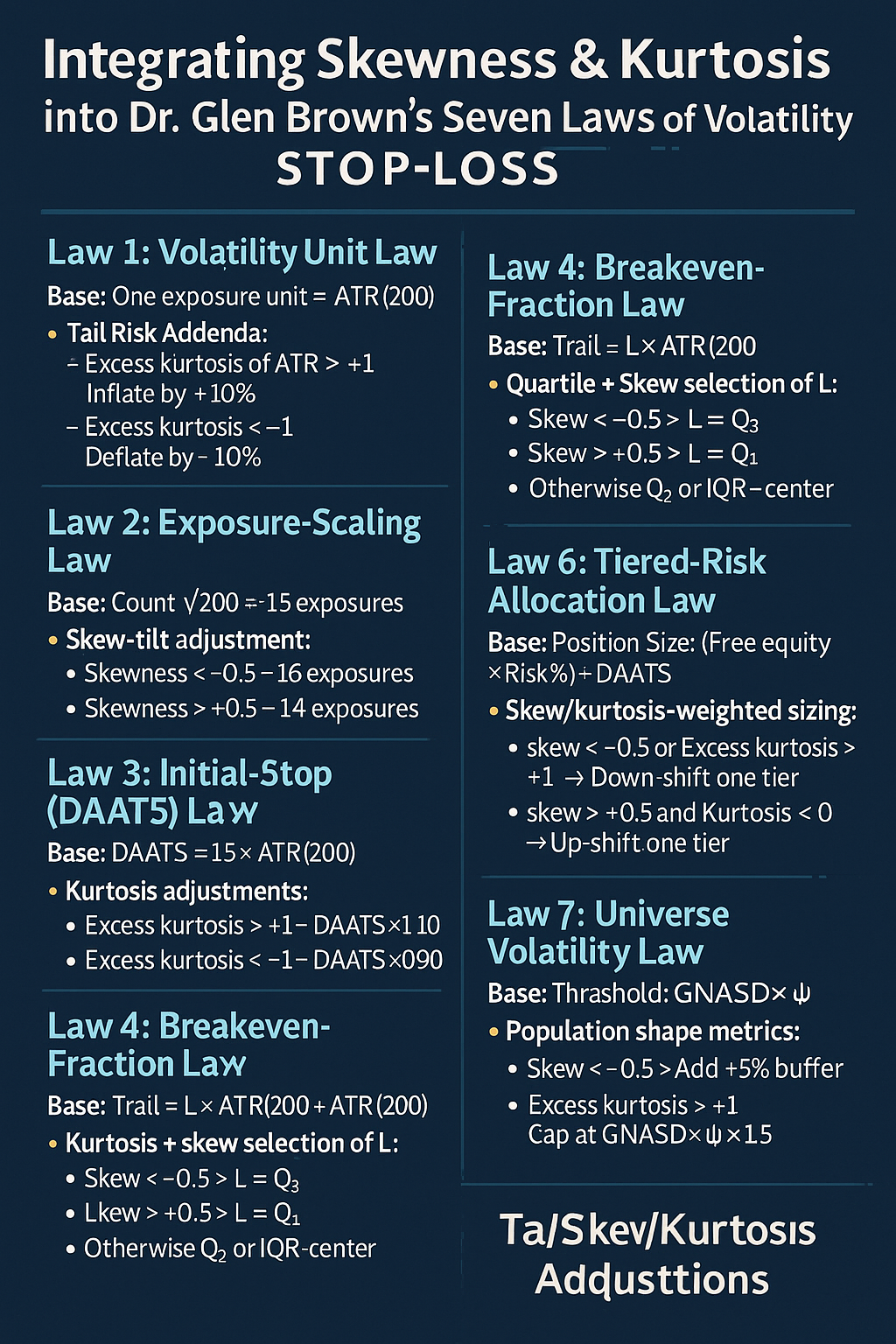

Integrating Skewness & Kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to integrate skewness and kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss within the GATS framework for truly adaptive, tail-aware stops and breakeven rules.

-

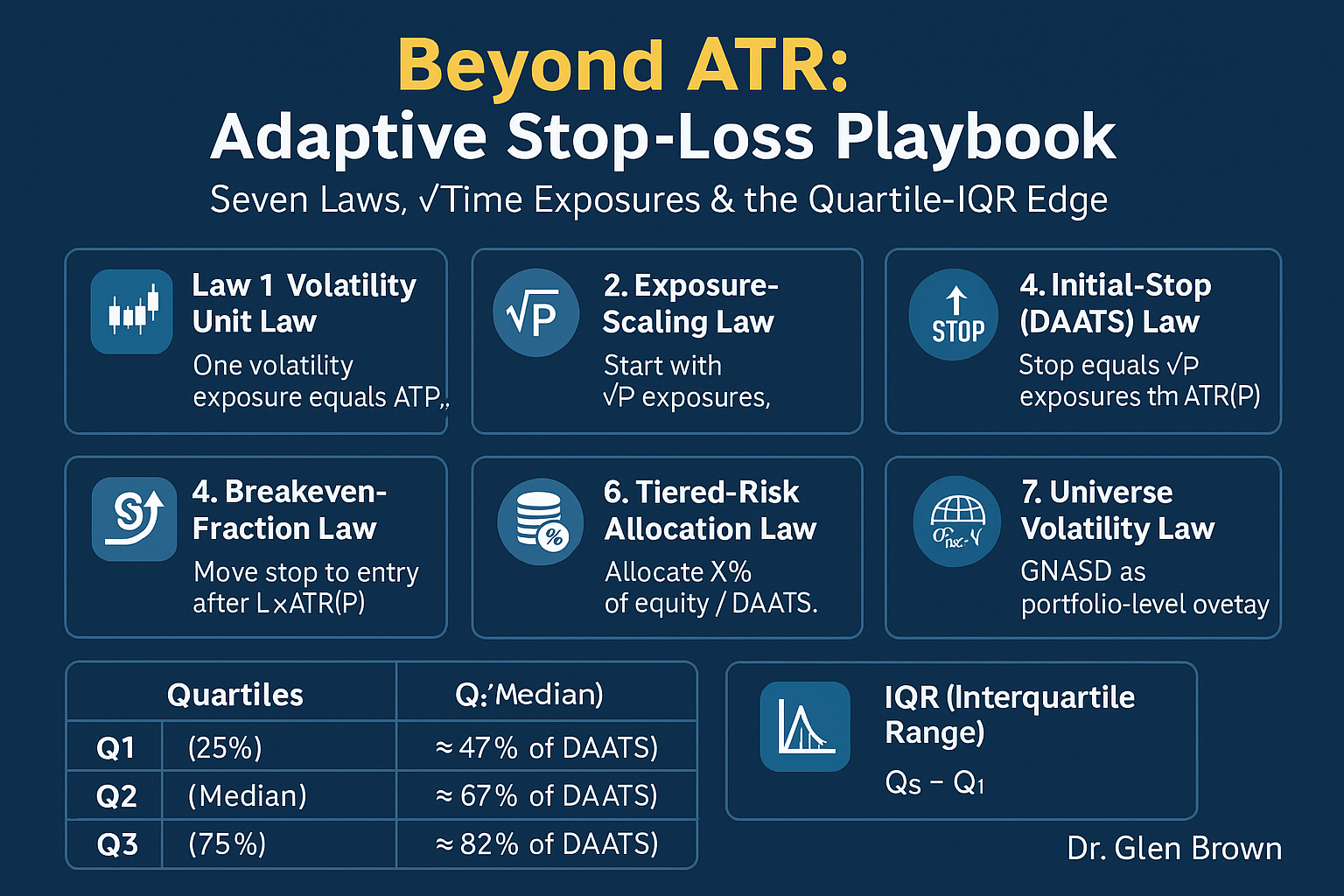

Beyond ATR: Dr. Glen Brown’s Adaptive Stop-Loss Playbook—Seven Laws, √Time Exposures & the Quartile-IQR Edge

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Dr. Glen Brown’s next-level stop-loss framework: seven universal laws, √time volatility exposures, and quartile/IQR techniques for adaptive breakeven and trailing stops.

-

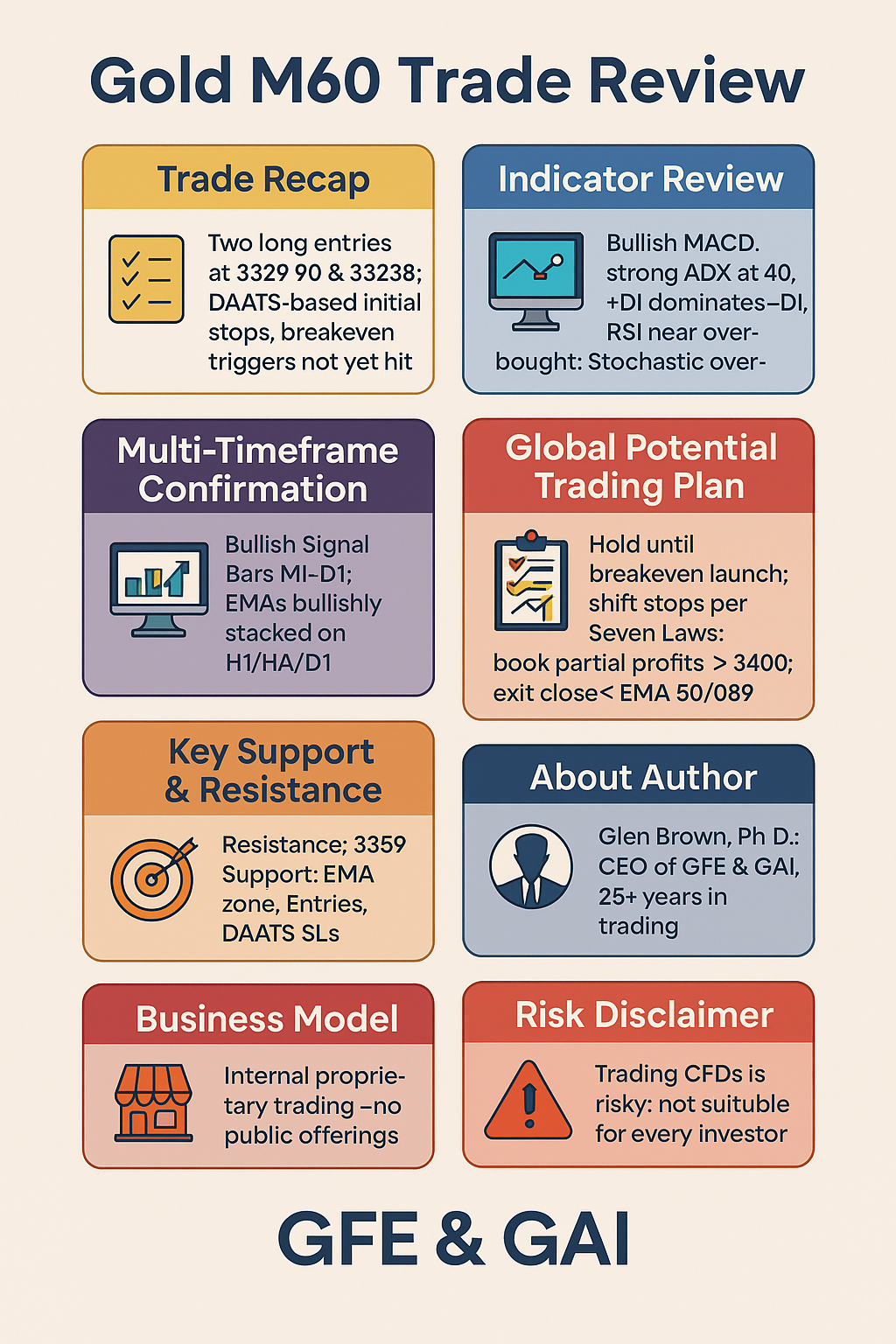

Gold M60 Trade Review (May 22 & 23 Entries)

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

Detailed Gold M60 trade review using Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—entry, stops, breakeven triggers, indicator deep-dive and next-session plan.

-

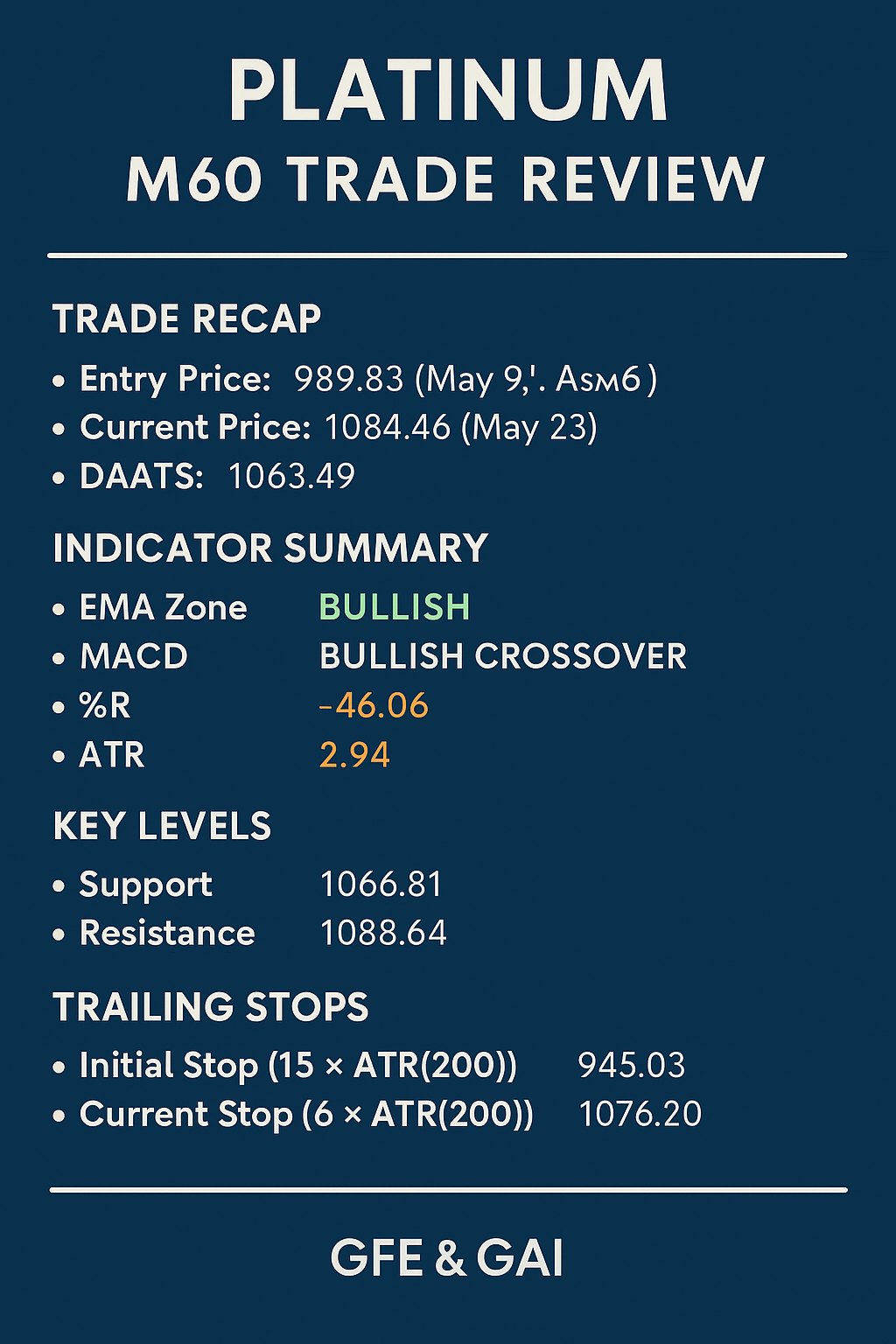

Platinum M60 Trade Review (May 9 Entry) Applying Dr. Glen Brown’s Seven Laws + Technical Indicator Deep-Dive

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

In-depth review of the May 9 Platinum M60 trade using Dr. Glen Brown’s seven Laws of Volatility Stop-Loss, plus multi-indicator analysis and next-session plan.

-

Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Dr. Glen Brown’s seven universal laws of volatility stop-loss—a zone-aligned, ATR(200)-based framework for adaptive stops, breakeven rules, and tiered risk management across all markets and timeframes.

-

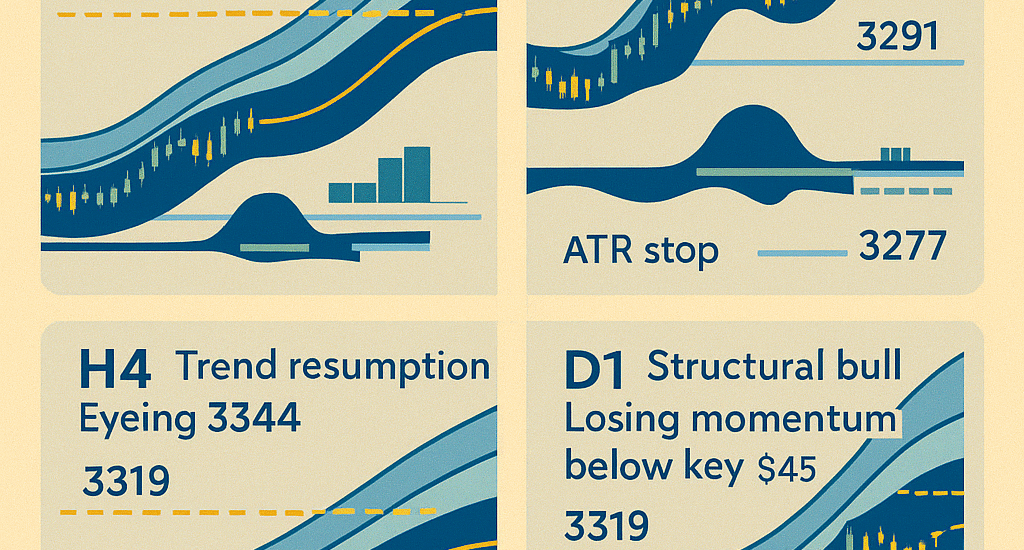

Gold (XAU/USD) Multi-Timeframe End-of-Day Analysis & GPTP

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Market Analysis

Discover the end-of-day multi-timeframe analysis for Gold across M30, H1, H4, and D1 using GATS WaveSafe ATR & EMA-Zone frameworks with actionable GPTP.

-

WaveSafe ATR Keltner Channel

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Integrate the WaveSafe ATR Exit Model with Keltner Channels—EMA(25), ATR(25), √25-based multipliers—for volatility-adaptive bands across all timeframes.

-

GATS “WaveSafe ATR” Universal Exit Model

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the WaveSafe ATR Exit Model—a universal, volatility-adaptive trailing stop framework using ATR(25) & √time for any timeframe, delivered with a 5:1 reward-to-risk structure.

-

Platinum Daily “High-Conviction Bullish Blueprint”

- May 20, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the Platinum Daily “High-Conviction Bullish Blueprint” using the GATS framework—EMA zones, MACD, oscillators & tactical trade plan.

-

WTI Crude Oil “Multi-Frame Confluence Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the WTI Crude Oil “Multi-Frame Confluence Blueprint”—a step-by-step guide combining daily, 4H, and 1H EMA zones, MACD, oscillators & tactical trade plans.

-

NVIDIA (NVDA) Daily “Precision Breakout Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the NVIDIA Daily “Precision Breakout Blueprint” with the GATS framework—EMA zones, MACD, oscillators & tactical trade plan for NVDA.

-

S&P 500 Daily “Broad Bull Momentum Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Explore the S&P 500 Daily “Broad Bull Momentum Blueprint” using our proprietary GATS framework—EMA zones, MACD, oscillators & tactical trade planning.

-

Gold Daily “Resilient Bull Under Pressure Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the Gold Daily “Resilient Bull Under Pressure Blueprint” using the GATS framework—EMA zones, MACD, oscillators & tactical trade planning.

-

Adaptive Breakeven Triggers for Index CFDs on M30 Part 1

- May 16, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading, Index CFDs

Uniform 8,073.06 DAATS-unit breakeven trigger for 19 index CFDs on M30 timeframe.

-

Global Top 14 Stocks to Watch

- May 16, 2025

- Posted by: Drglenbrown1

- Category: Equity Momentum, Trading Signals

A systematic approach combining population volatility and cost floors to lock in momentum-driven stock moves.

-

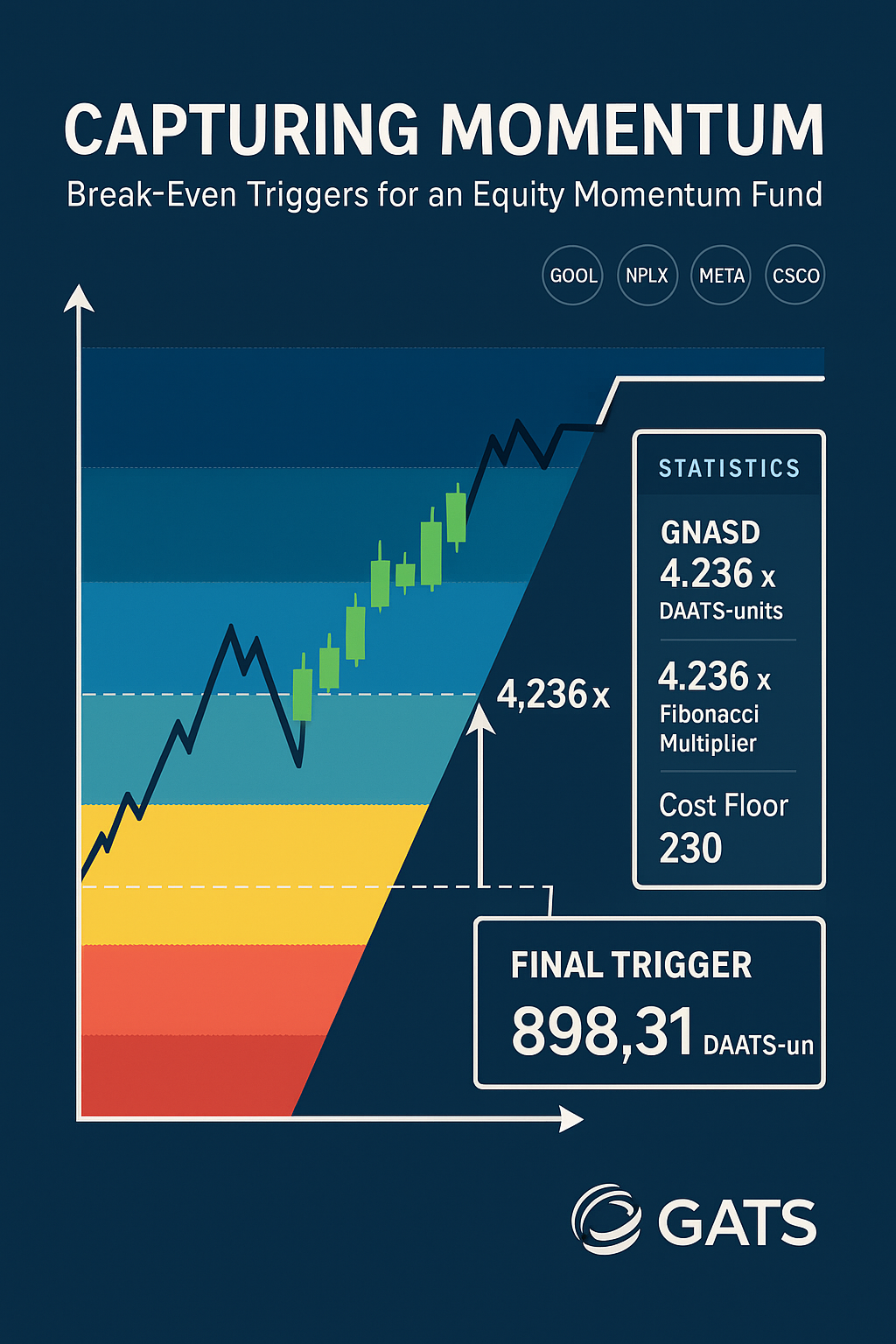

Capturing Momentum: GEMF USA Sub-Fund Adaptive Breakeven Model on M60

- May 16, 2025

- Posted by: Drglenbrown1

- Categories:

A systematic approach combining population volatility and cost floors to lock in momentum-driven stock moves.