Drglenbrown1

-

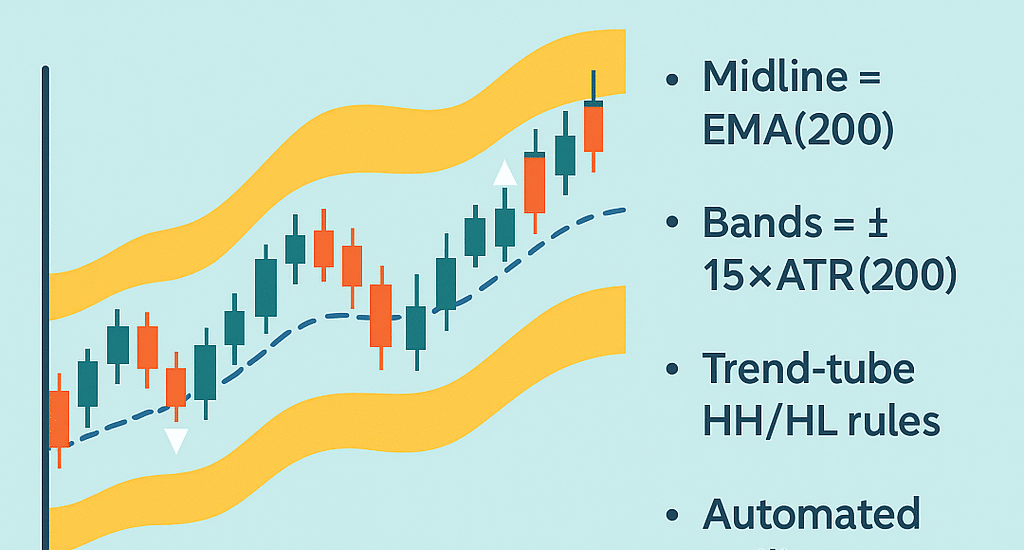

Keltner Reinvented: Embedding k = 15 into Your Trend Envelope

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

No Comments

Learn how to implement an adaptive Keltner Channel with EMA(200) midline and ±15×ATR(200) bands, including Pine/MT4 code, trend-tube rules, and automated trailing.

-

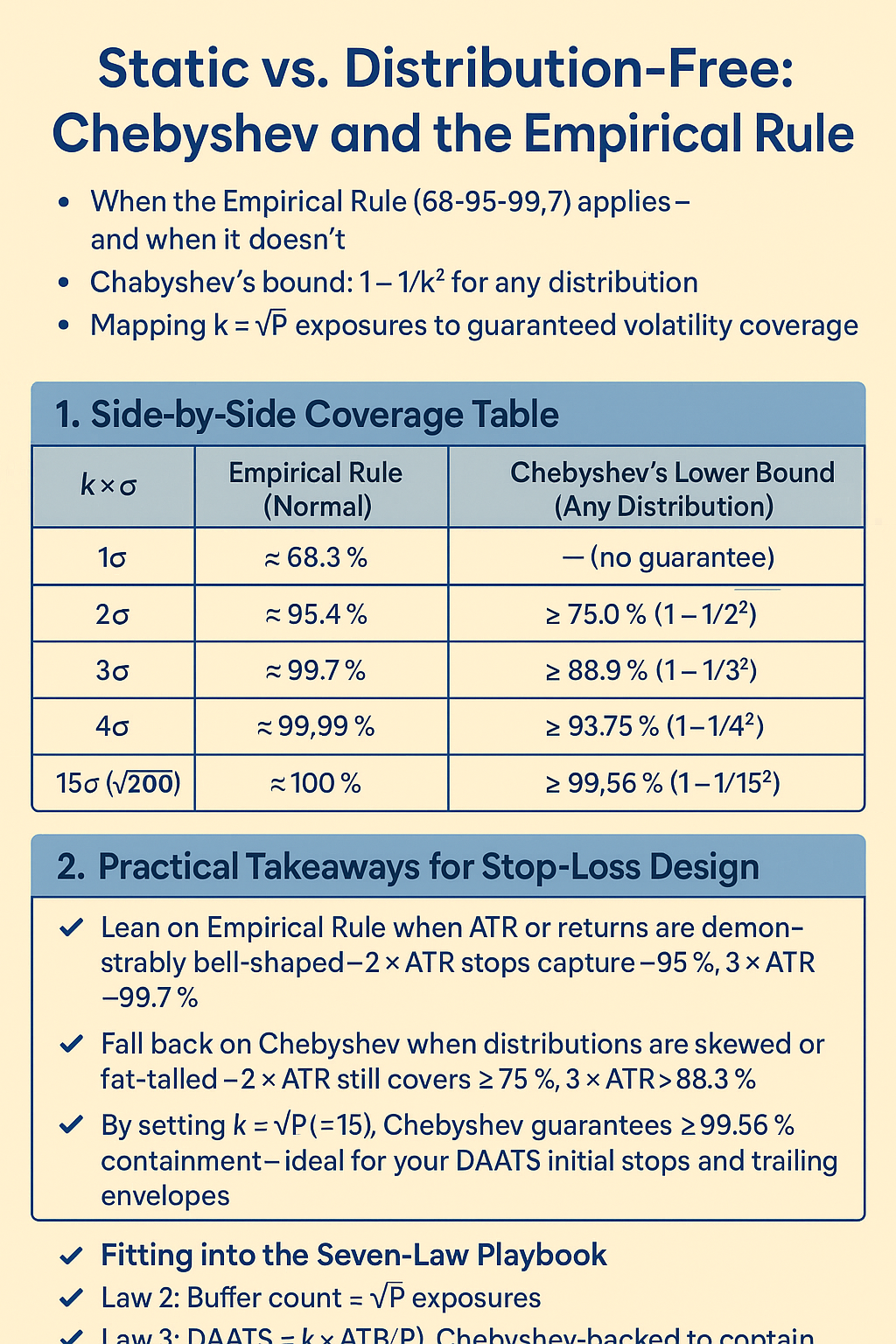

Static vs. Distribution-Free: Chebyshev and the Empirical Rule

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Compare the Empirical Rule for normal distributions with Chebyshev’s inequality for any distribution. Learn how k=√P exposures maps to guaranteed volatility coverage within Dr. Glen Brown’s Seven-Law framework.

-

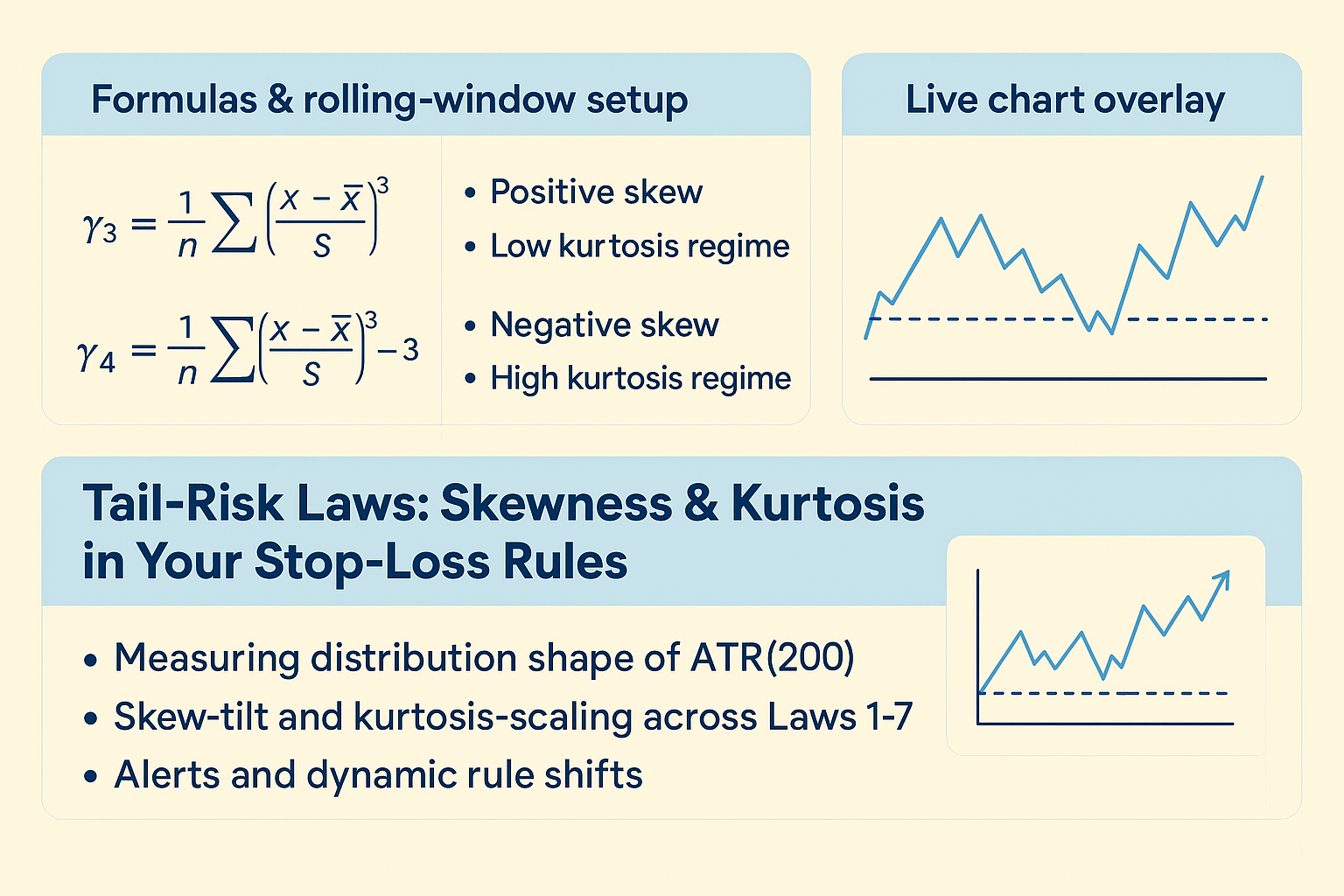

Tail-Risk Laws: Skewness & Kurtosis in Your Stop-Loss Rules

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to measure ATR(200) skewness and kurtosis, apply skew-tilt & kurtosis-scaling to Dr. Glen Brown’s Seven Laws, and view live chart overlays for dynamic stop adjustments.

-

Law 7: GNASD—Managing Cross-Asset Noise Budgets

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Law 7 of Dr. Glen Brown’s Seven Laws—GNASD for portfolio-level stops. Learn how to compute population σ, normalize by N, and apply global breakeven triggers with hybrid caps and cost floors.

-

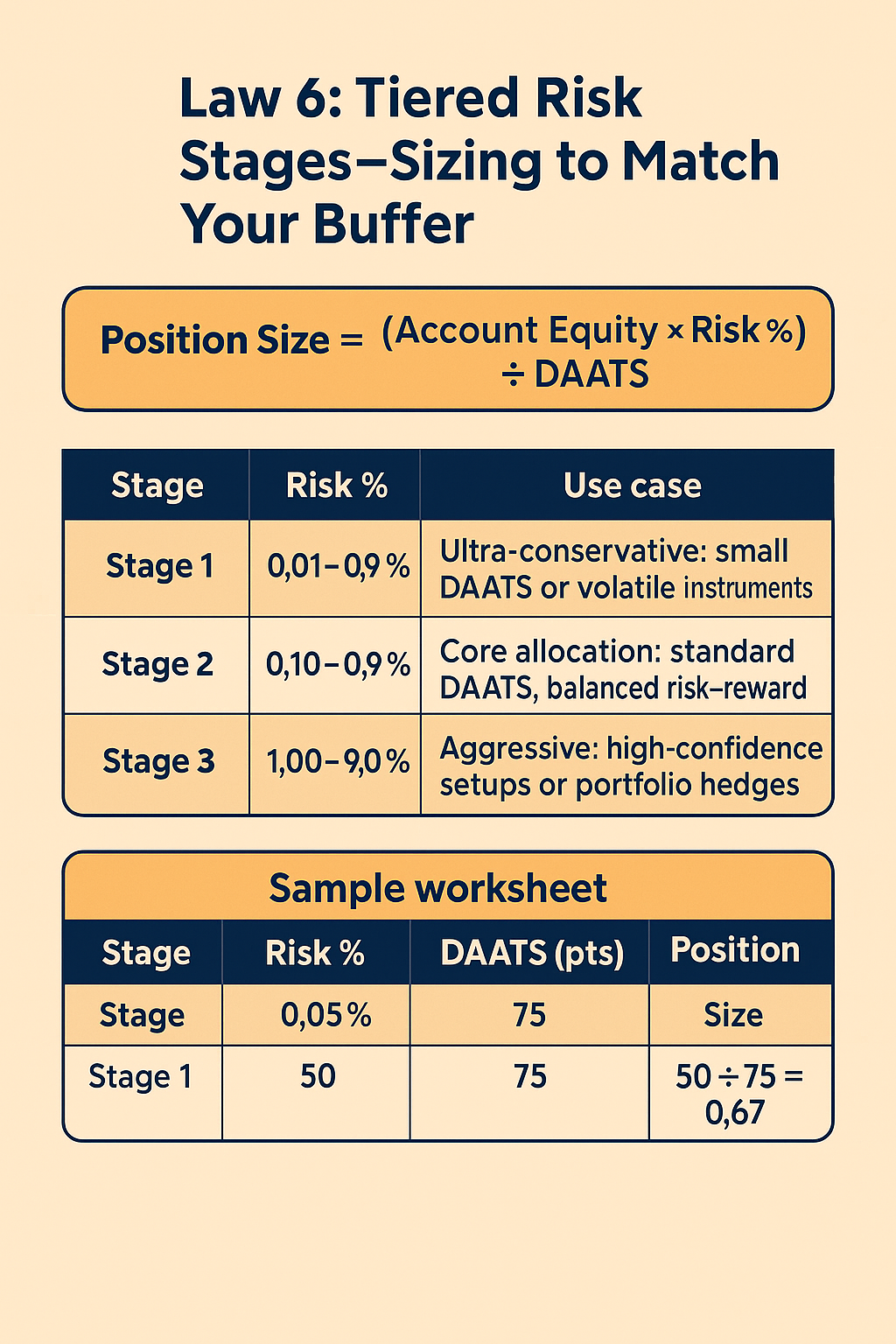

Law 6: Tiered Risk Stages—Sizing to Match Your Buffer

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn Law 6 of Dr. Glen Brown’s Seven Laws: position sizing via (Equity×Risk %) ÷ DAATS, explore Stage 1/2/3 risk tiers, and see case studies on dollar-at-risk levels.

-

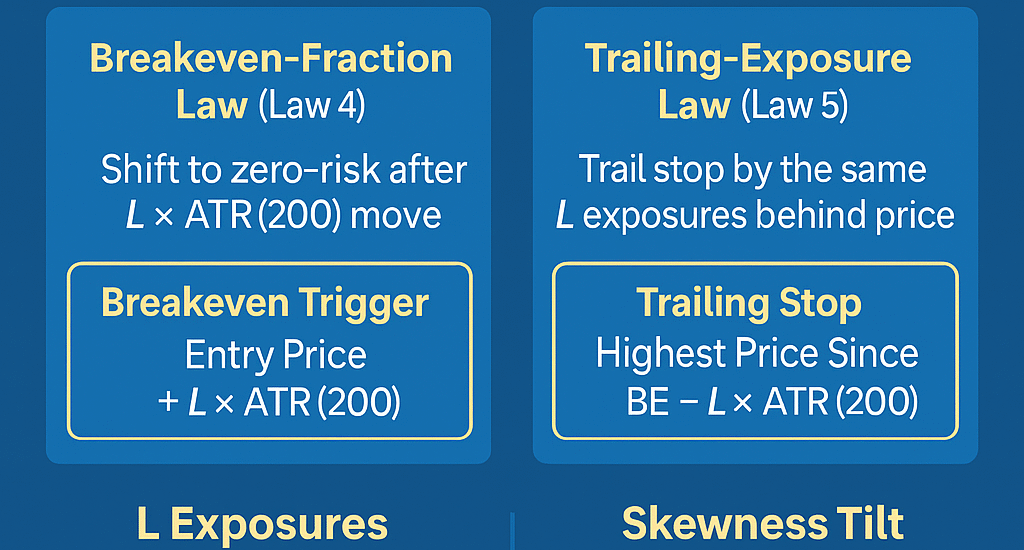

Laws 4–5: Lock in Zero-Risk & Let Winners Run

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Master Laws 4–5 of Dr. Glen Brown’s framework—adaptive breakeven triggers and trailing stops using quartile/IQR and skewness—to lock in zero risk and let winners run.

-

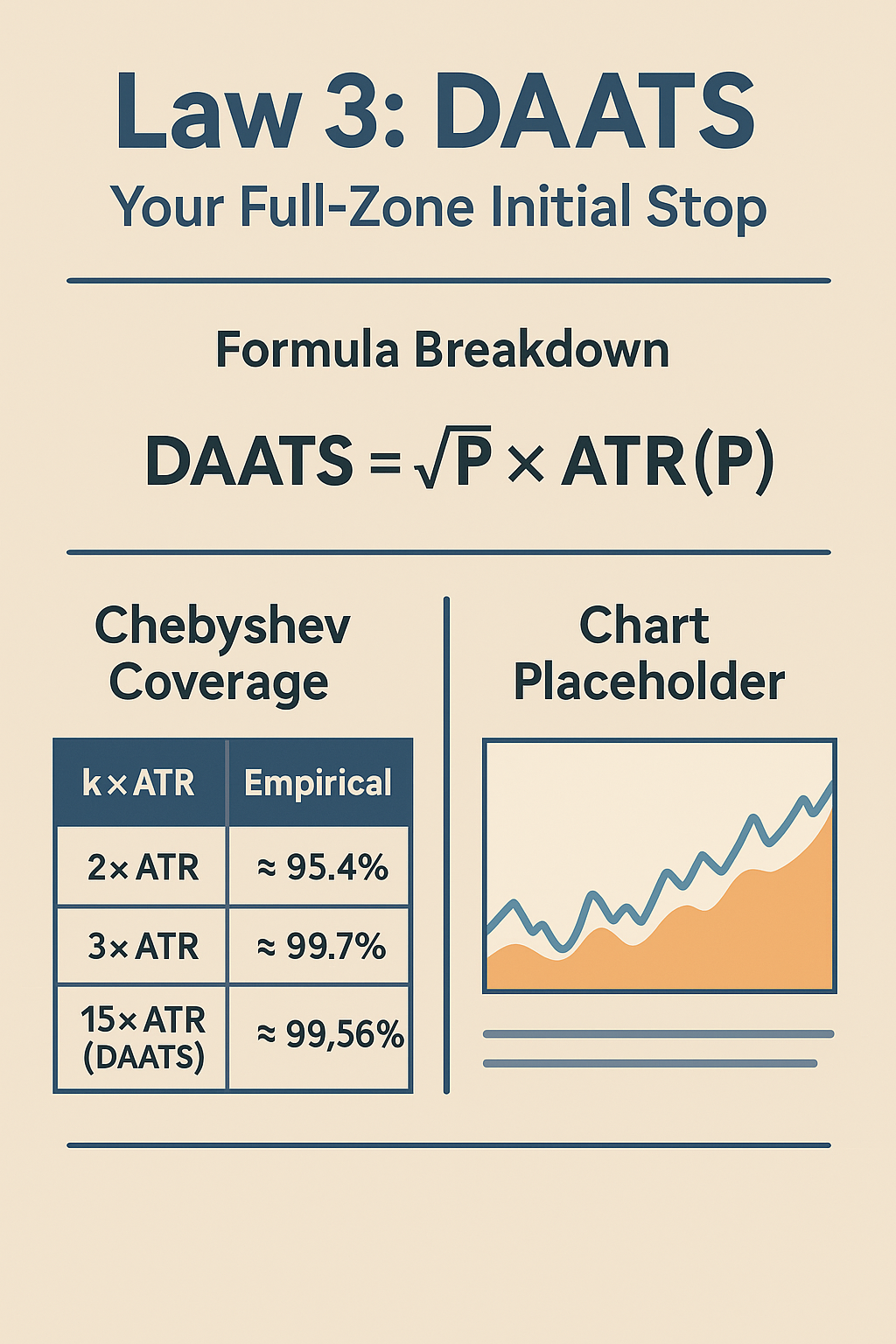

Law 3: DAATS—Your Full-Zone Initial Stop

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Law 3 of Dr. Glen Brown’s Seven Laws: DAATS = √P×ATR(P). Learn the formula, Chebyshev’s worst-case guarantee, and see an example trade with DAATS plotted.

-

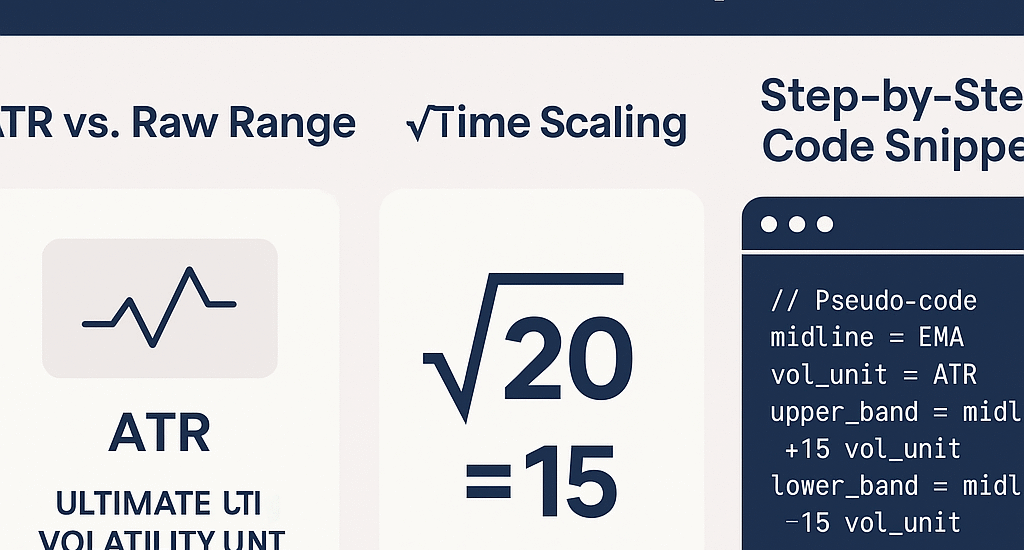

Law 1–2: Anchor Your Stops to ATR(200) & √Time Exposures

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn why ATR(200) is the ultimate volatility unit and how √time scaling (√200≈15 exposures) underpins adaptive stop-loss management, with step-by-step chart implementation.

-

Beyond ATR: Introducing Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover why static ATR-based stops fail and explore Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—anchored by √time scaling, DAATS and GNASD—for a truly adaptive risk framework.

-

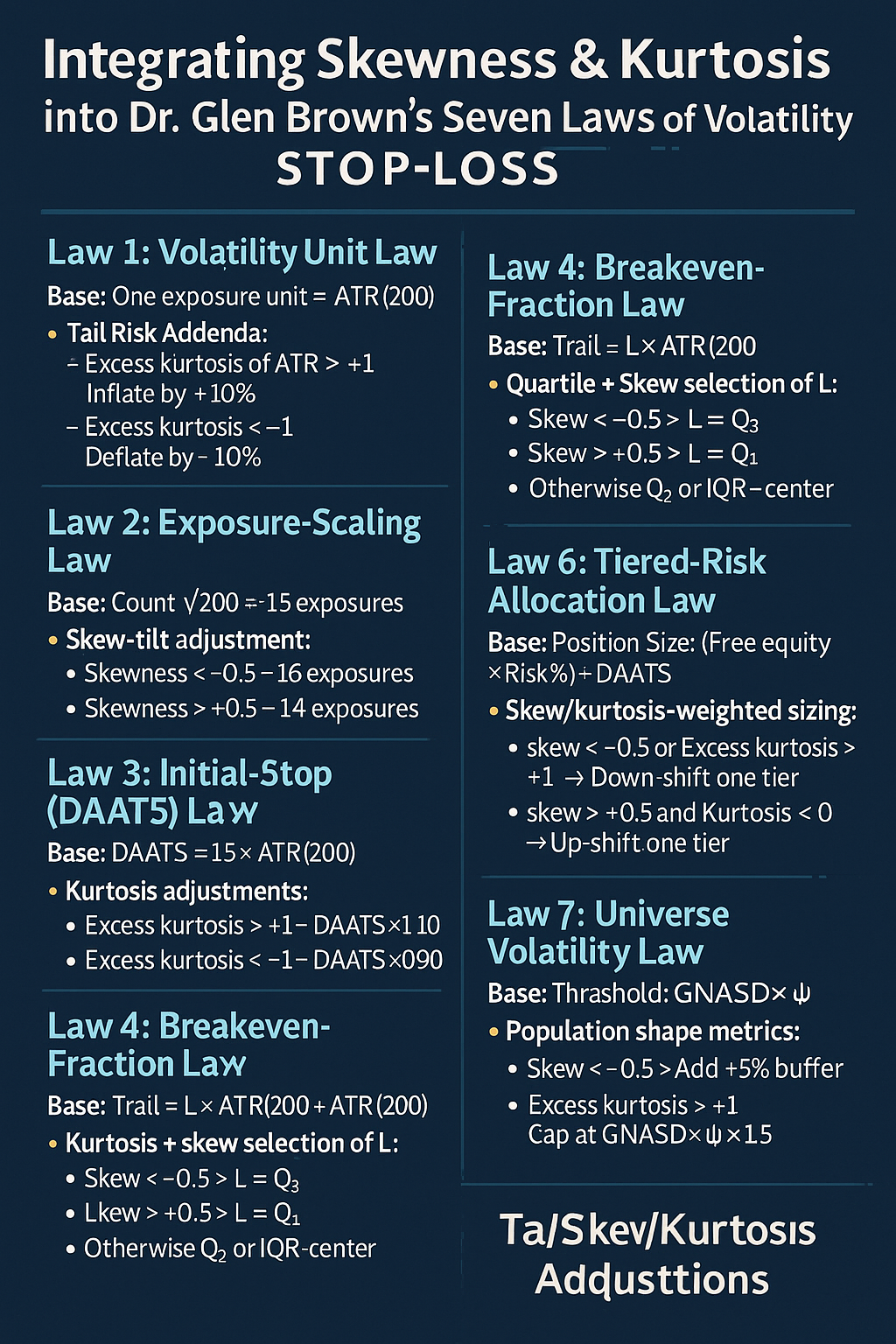

Integrating Skewness & Kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to integrate skewness and kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss within the GATS framework for truly adaptive, tail-aware stops and breakeven rules.

-

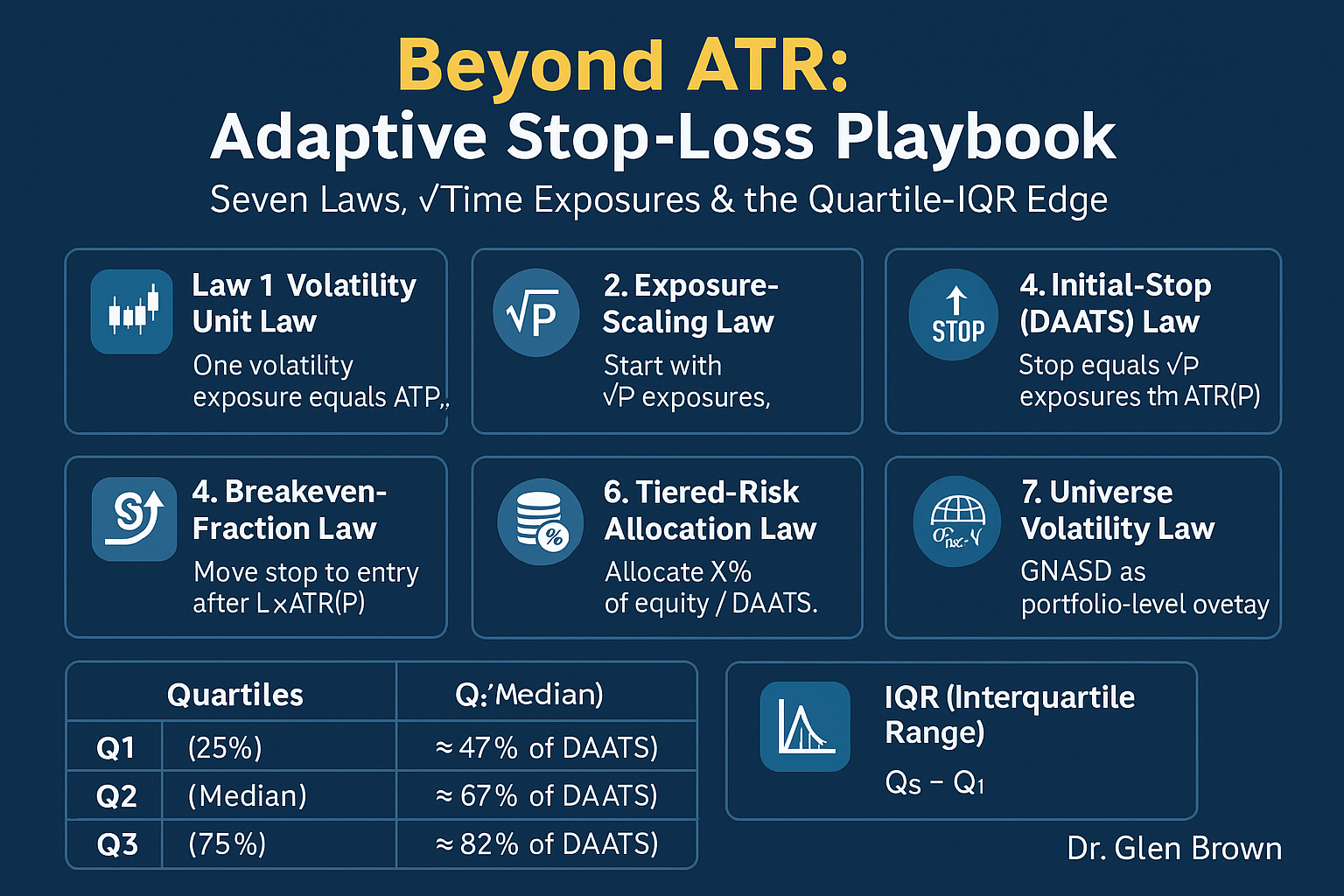

Beyond ATR: Dr. Glen Brown’s Adaptive Stop-Loss Playbook—Seven Laws, √Time Exposures & the Quartile-IQR Edge

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Dr. Glen Brown’s next-level stop-loss framework: seven universal laws, √time volatility exposures, and quartile/IQR techniques for adaptive breakeven and trailing stops.

-

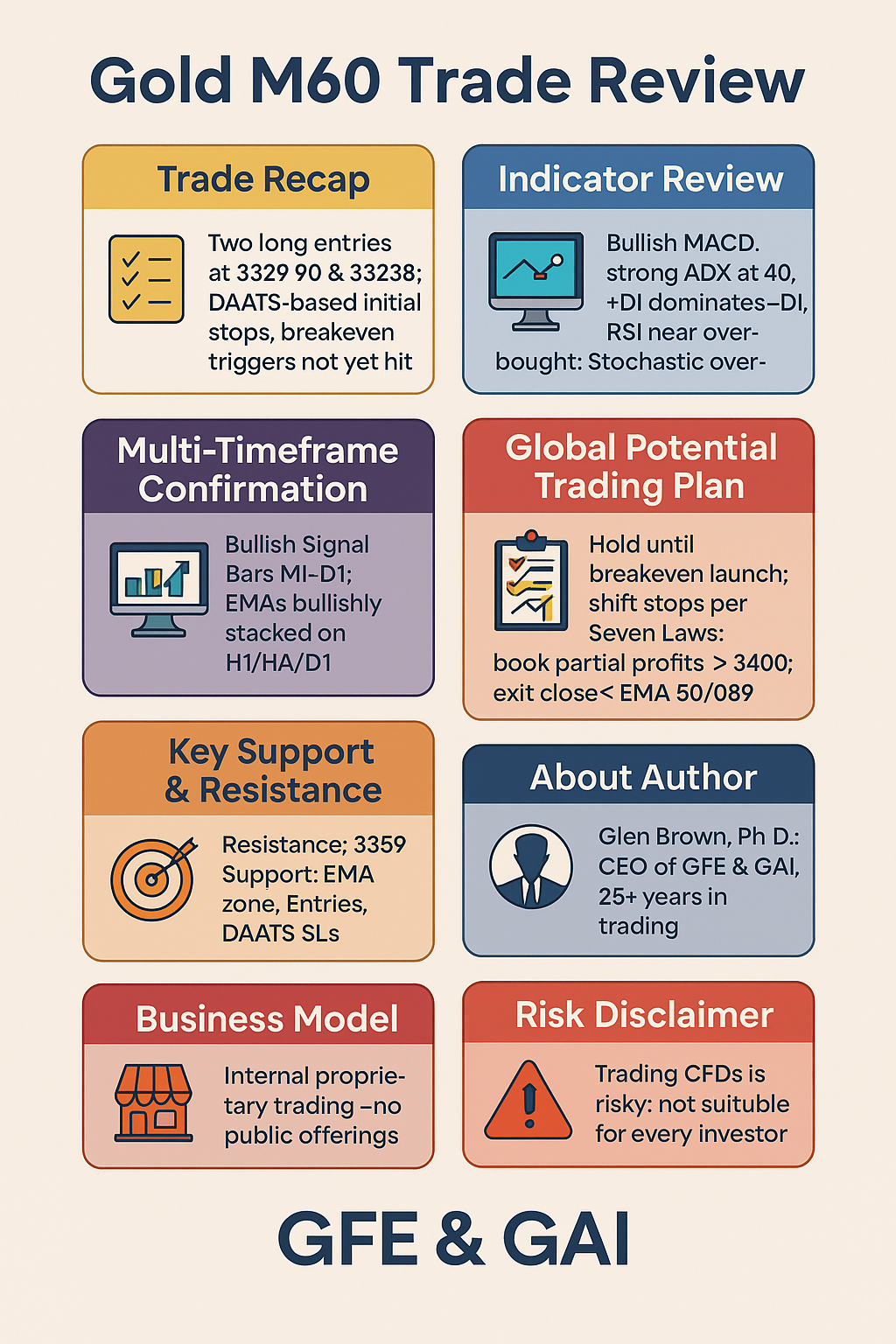

Gold M60 Trade Review (May 22 & 23 Entries)

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

Detailed Gold M60 trade review using Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—entry, stops, breakeven triggers, indicator deep-dive and next-session plan.

-

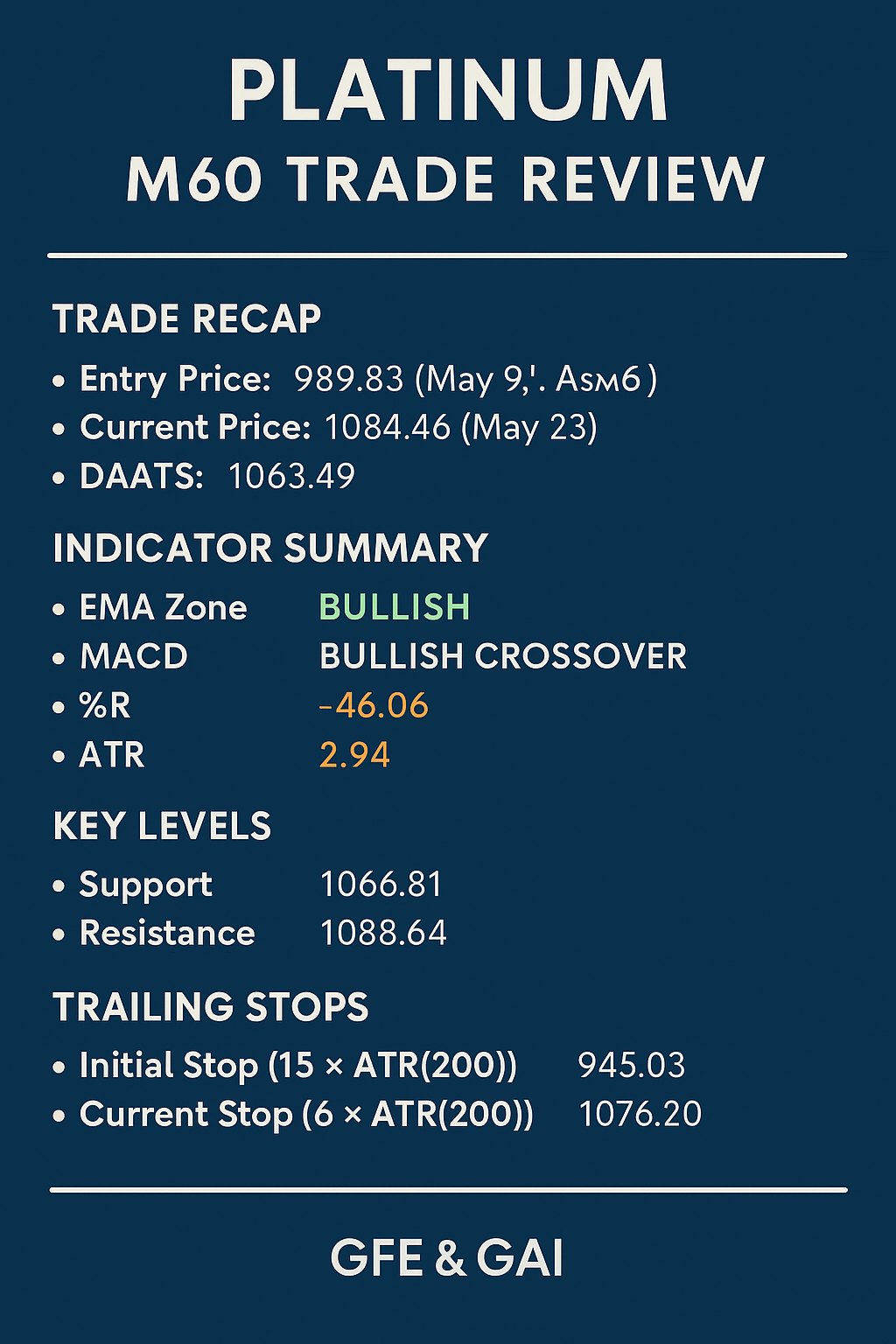

Platinum M60 Trade Review (May 9 Entry) Applying Dr. Glen Brown’s Seven Laws + Technical Indicator Deep-Dive

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

In-depth review of the May 9 Platinum M60 trade using Dr. Glen Brown’s seven Laws of Volatility Stop-Loss, plus multi-indicator analysis and next-session plan.

-

Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Dr. Glen Brown’s seven universal laws of volatility stop-loss—a zone-aligned, ATR(200)-based framework for adaptive stops, breakeven rules, and tiered risk management across all markets and timeframes.

-

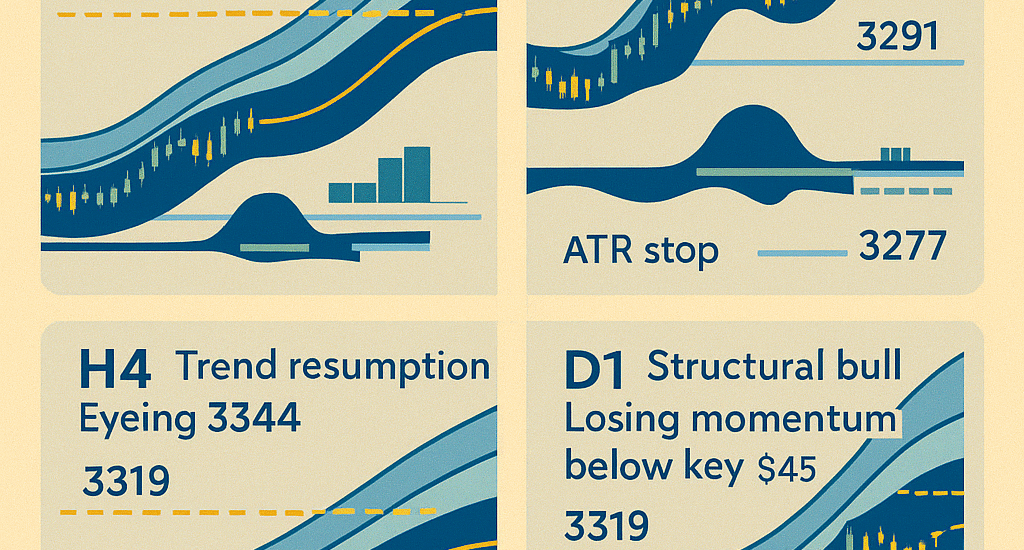

Gold (XAU/USD) Multi-Timeframe End-of-Day Analysis & GPTP

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Market Analysis

Discover the end-of-day multi-timeframe analysis for Gold across M30, H1, H4, and D1 using GATS WaveSafe ATR & EMA-Zone frameworks with actionable GPTP.

-

WaveSafe ATR Keltner Channel

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Integrate the WaveSafe ATR Exit Model with Keltner Channels—EMA(25), ATR(25), √25-based multipliers—for volatility-adaptive bands across all timeframes.

-

GATS “WaveSafe ATR” Universal Exit Model

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the WaveSafe ATR Exit Model—a universal, volatility-adaptive trailing stop framework using ATR(25) & √time for any timeframe, delivered with a 5:1 reward-to-risk structure.

-

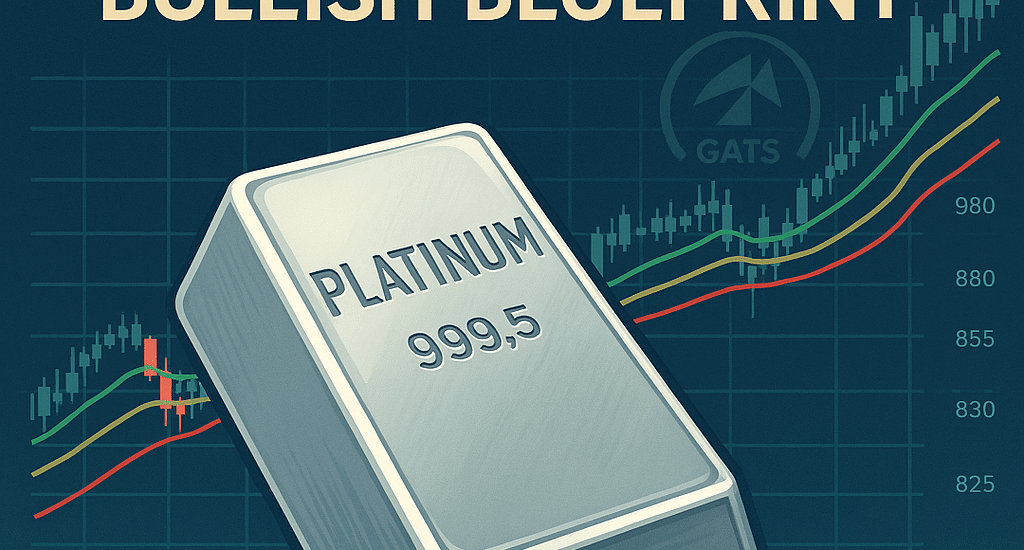

Platinum Daily “High-Conviction Bullish Blueprint”

- May 20, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the Platinum Daily “High-Conviction Bullish Blueprint” using the GATS framework—EMA zones, MACD, oscillators & tactical trade plan.