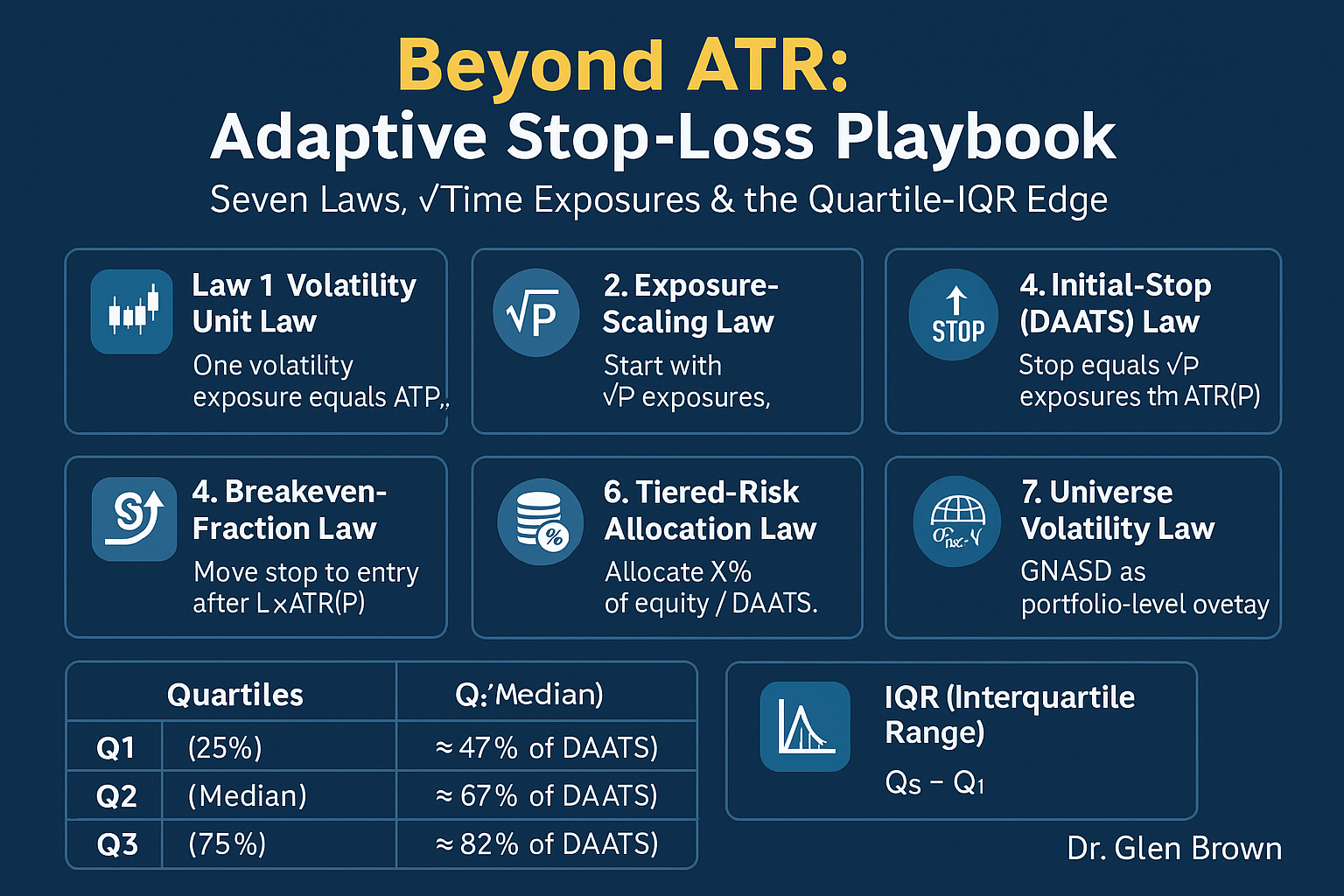

Beyond ATR: Dr. Glen Brown’s Adaptive Stop-Loss Playbook—Seven Laws, √Time Exposures & the Quartile-IQR Edge

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Financial markets today demand more than static ATR-based stops. Dr. Glen Brown’s playbook fuses a rigorous statistical foundation with pragmatic cost controls, delivering an adaptive stop-loss and breakeven system that scales with volatility and lets winners run.

Introduction

Traditional 1–3×ATR stops often fall victim to whipsaw or fat spreads. The GATS framework defines a single “volatility unit”—ATR(P), where P is your maximum EMA period (typically 200). From there, seven universal laws guide every initial stop, breakeven trigger, and trailing rule. We then refine those exposures with a quartile-and-IQR lens, giving you a graduated toolkit for calm, normal, or stormy markets.

Law 1: Volatility Unit Law

Definition: One Volatility Exposure = ATR(P).

Purpose: Anchors every stop and breakeven decision to the average range of your full EMA 1→P zone.

Law 2: Exposure-Scaling Law

Definition: Initial buffer count = √P (rounded).

Example: √200 ≈ 14.14 → 15 exposures.

Purpose: Leverages the √time law of volatility for full-zone protection.

Law 3: Initial-Stop (DAATS) Law

Definition: DAATS = (√P exposures) × ATR(P).

Purpose: Places your stop outside even the deepest one-leg retracement.

Law 4: Breakeven-Fraction Law

Definition: Choose Local Exposures L (empirically driven). When price moves L×ATR(P), shift your stop to entry (zero-risk).Breakeven Trigger = Entry Price + L × ATR(P)

Purpose: Locks in profit only after covering the full-zone buffer.

Law 5: Trailing-Exposure Law

Definition: After breakeven, trail the stop by L×ATR(P) behind price—never loosening.

Purpose: Ensures winners run under proven local volatility conditions.

Law 6: Tiered-Risk Allocation Law

Definition:Position Size = (Free Equity × Risk %) ÷ DAATS

Risk tiers:

• Stage 1: 0.01 %–0.09 %

• Stage 2: 0.10 %–0.90 %

• Stage 3: 1.00 %–9.00 %

Purpose: Balances large stop buffers with strict capital-at-risk control.

Law 7: Universe Volatility Law

Definition:

1. Compute each instrument’s DAATS.

2. Treat all N instruments as a population; calculate population σpop (divide by N).

3. Normalize: GNASD = σpop ÷ N.

Application: Use GNASD (and Fibonacci multiples) for portfolio-level breakeven overlays—never for single-trade stops.

Purpose: Provides a unified “noise budget” across your trading universe.

Quartile & IQR Edge

Rather than a single L, derive L from the quartiles of √EMA-index exposures:

- Q₁ (25 %): √50 ≈ 7 exposures (≈47 % of DAATS)

- Q₂ (Median): √100 = 10 exposures (≈67 % of DAATS)

- Q₃ (75 %): √150 ≈ 12 exposures (≈82 % of DAATS)

The IQR = Q₃ – Q₁ ≈ 5.18 exposures. Use this band to smoothly interpolate L (e.g. ~9.7 exposures) or detect regime shifts (spikes beyond Q₃ + 1.5 IQR). Embed into Laws 4 & 5 for dynamic breakeven and trailing.

Implementation Checklist

- Compute ATR(P) and DAATS.

- Determine L via quartile or IQR rules based on volatility regime.

- Set initial stop = DAATS (Law 3).

- When price moves L×ATR(P), shift to breakeven (Law 4) and begin trailing (Law 5).

- Size positions per Law 6; monitor portfolio-level triggers via Law 7.

Conclusion

Dr. Glen Brown’s Adaptive Stop-Loss Playbook combines seven universal laws, √time exposures, and quartile/IQR techniques to deliver a disciplined, volatility-responsive framework. Applicable on any timeframe or market, it transforms stop management from guesswork into a precise science.

About the Author

Dr. Glen Brown, Ph.D. in Investments and Finance, is President & CEO of Global Accountancy Institute (GAI) and Global Financial Engineering (GFE). With 25+ years in proprietary trading, quantitative research, and education, he created GATS, GEPTP, and this seven-law stop-loss architecture—melding visionary insight with disciplined execution.

Business Model Clarification

GAI & GFE are internal proprietary trading firms. We do not offer public courses or advisory services; all content is for in-house research and professional desk development.

Risk Disclaimer

Trading derivatives and CFDs involves significant risk and may not suit all investors. This article is educational only and not financial advice. Always perform due diligence and consult a licensed professional. Past performance does not guarantee future results; you assume full responsibility for your trades.

Hashtags: #GATS #ATR #StopLoss #Volatility #Quartiles #IQR #RiskManagement #TradingLaws #DrGlenBrown

Sponsored Content