-

Lecture 5: Portfolio-Level Calibration — From FX to Indices and Beyond

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Global Daily Insights, Global Financial Engineers, Global Financial Insights, Trading Psychology, Algorithmic Trading

No Comments

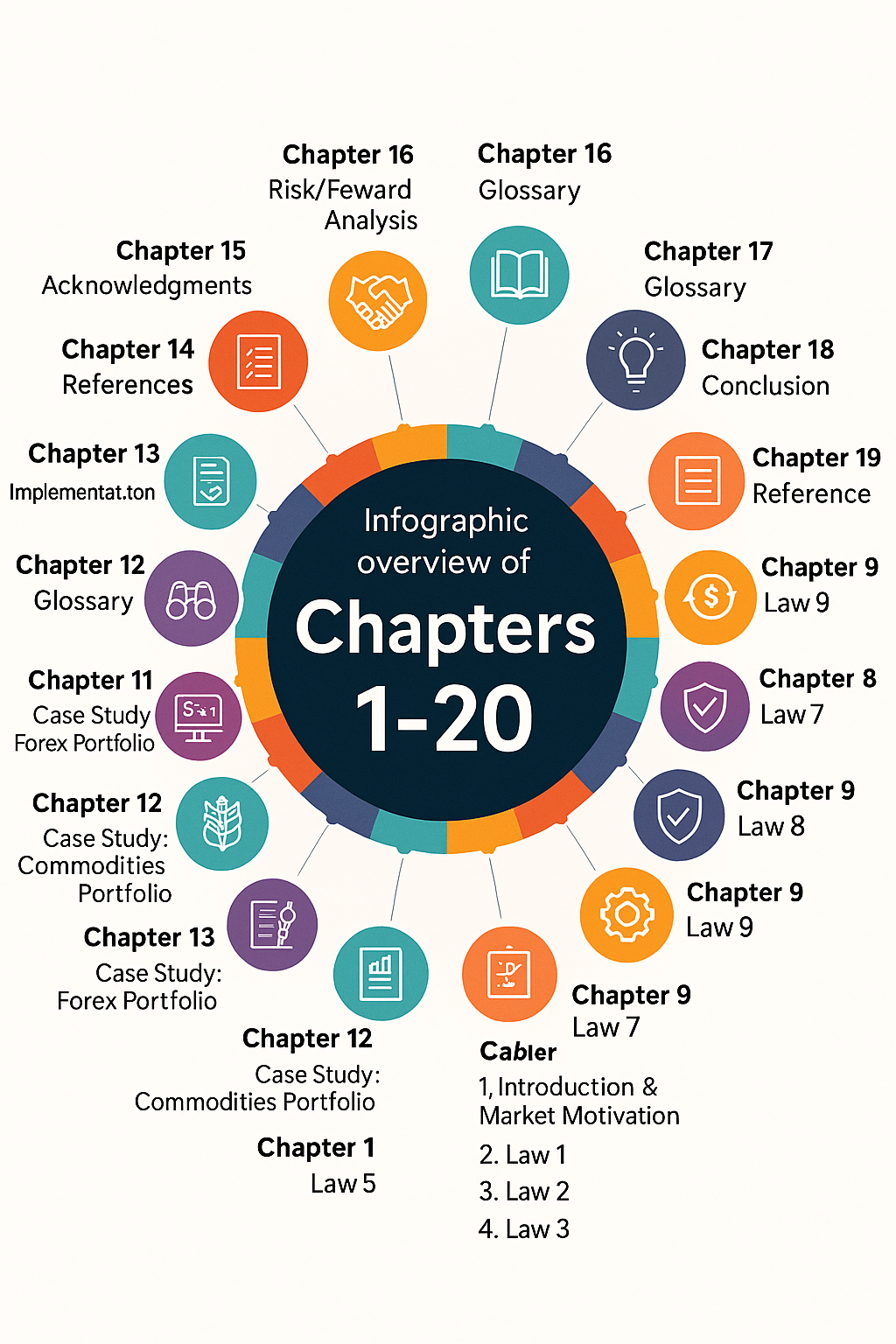

This lecture extends the foundational GATS risk geometry from individual trade logic to full portfolio orchestration. Through Portfolio-Level Resonance Calibration (PLRC), the system harmonizes volatility, risk, and trail parameters across multiple asset classes—FX, indices, metals, energies, and crypto. Using normalized ATR ratios, DS=DAATS initialization, and the 18.75% Law, GATS achieves coherent risk expression across diverse markets. The result is a unified field of temporal risk symmetry where each instrument breathes proportionally within a portfolio’s collective rhythm.

-

Dr. Glen Brown’s Nine-Laws Framework Adaptive Volatility & Risk Management for Global Markets

- June 16, 2025

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, ATR Trailing Stops, Model Validation “Law Rebirth”, Portfolio Construction, Risk Management, Volatility Modeling

Explore Dr. Glen Brown’s Nine-Laws Framework for Adaptive Volatility and Risk Management: an in-depth guide to regime detection, adaptive stops, break-even logic, portfolio noise budgeting & continuous model rebirth.”

-

The 9 Default Trading Strategies in Global Algorithmic Trading Software (GATS)

- December 7, 2024

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Financial Technology, Risk Management, Trading Strategies

The Global Algorithmic Trading Software (GATS) offers nine powerful default trading strategies, catering to traders across multiple timeframes. Learn how these strategies use cutting-edge tools like DAATS and MEMH to navigate diverse markets effectively.

-

Algorithmic Trading Explained: Harnessing Technology for Profits

- November 2, 2024

- Posted by: Drglenbrown1

- Category: Algorithmic Trading

Discover the power of algorithmic trading and how technology is transforming the way we trade. Learn the benefits, strategies, and role of algo trading in financial markets.

-

Inside the Engine Room: The Role of GATS in Our Market-Driven Business Model

- April 11, 2024

- Posted by: Drglenbrown1

- Category: Algorithmic Trading

Take an in-depth look at GATS and its pivotal role in our market-driven trading strategy, enhancing both efficiency and responsiveness.

-

Mastering Market Trends: The GATS60 Strategy 5 Unveiled

- February 19, 2024

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Algorithmic Trading Strategies, Algorithmic Trading Strategies, Financial Education, Forex Trading Strategies, Technical Analysis

Unlock the secrets of the Forex market with the Global Hourly Trend Follower strategy. This meticulously crafted approach, embedded within the Global Algorithmic Trading Software (GATS60), leverages sophisticated technical analysis and risk management tools to align with the secondary trend, revealed through Weekly Time Bars. Experience trading evolution with a strategy that combines the precision of color-coded EMA zones, the clarity of Heiken Ashi Smoothed candles, and the security of a Dynamic Adaptive ATR Trailing Stop. Designed by Dr. Glen Brown, this strategy promises a disciplined, emotion-free trading journey, aiming for consistency and efficiency in capturing hourly market trends. Embrace the future of trading with a strategy that’s not just about making trades, but about making smarter trading decisions.

-

Decoding Algorithmic Trading: Strategies for the Modern Prop Trader

- February 10, 2024

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Finance Education, Financial Education

Dive into the cutting-edge of proprietary trading with insights on algorithmic strategies, from machine learning innovations to high-frequency tactics