Dr. Glen Brown’s Nine-Laws Framework Adaptive Volatility & Risk Management for Global Markets

- June 16, 2025

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, ATR Trailing Stops, Model Validation “Law Rebirth”, Portfolio Construction, Risk Management, Volatility Modeling

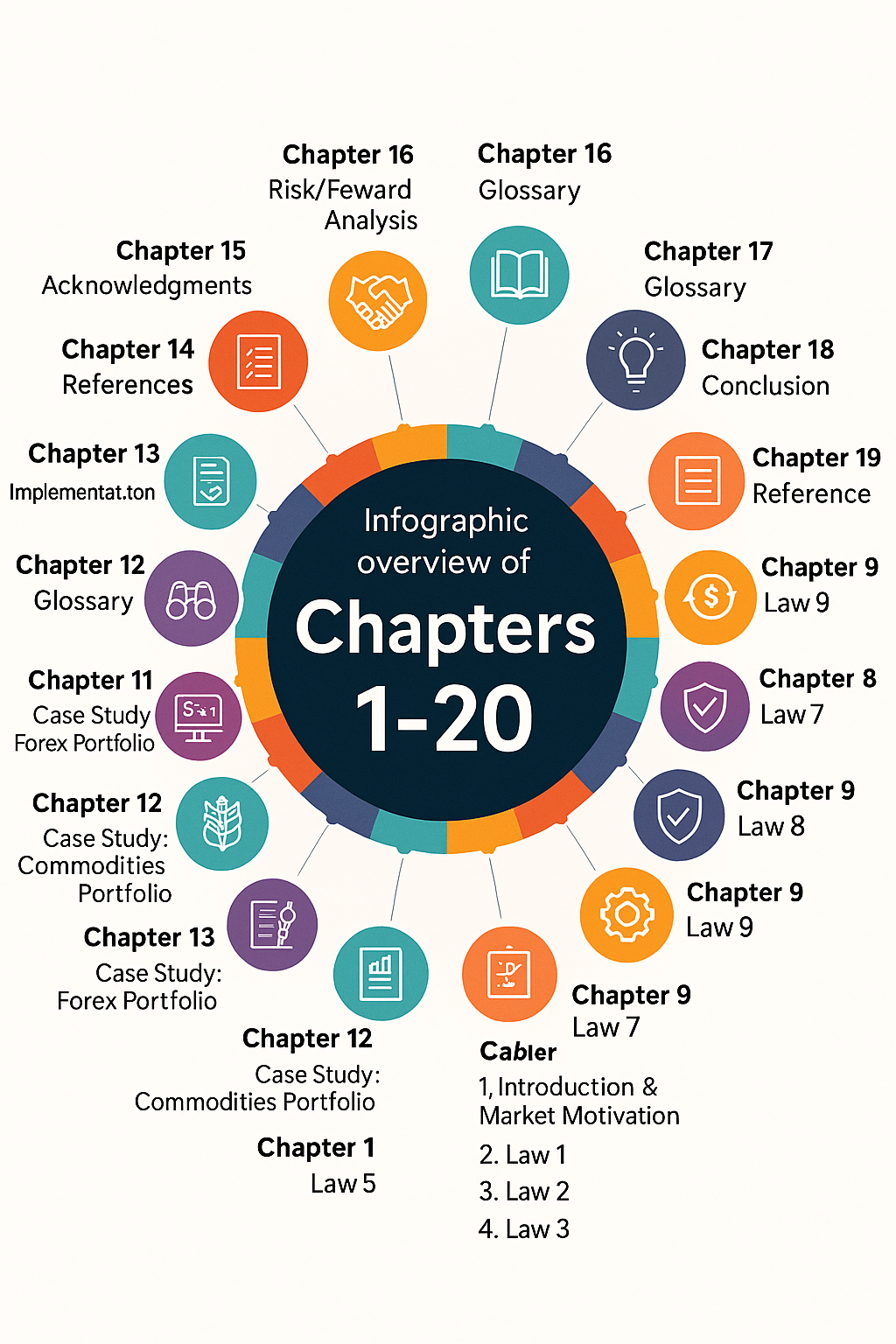

Table of Contents

Part I: Foundations of Adaptive Volatility

- Introduction & Market Motivation

- Law 1: Correlation Regime Transition

- Law 2: Weighted Decay of Historical DAATS

- Law 3: Macro Shock Propagation

Part II: Stop-Sizing & Trend Exits

5. Law 4: Exposure & Death-Stop

6. Law 5: Exit Only on Death

7. Law 6: Adaptive Break-Even Decisions

Part III: Portfolio & Execution

8. Law 7: Portfolio-Level Noise Budgeting

9. Law 8: Transaction-Cost & Slippage Optimization

10. Law 9: Continuous Validation & “Law Rebirth”

Part IV: Case Studies & Extensions

11. FX Case Study: 28-Pair Universe

12. Commodities Case Study: Gold, Silver, Energy

13. Equities & Crypto Extensions

14. Gann’s Eighths & Alternative Fraction Rules

Part V: Practical Toolkit & Appendices

15. Implementation in Python & GATS

16. Backtesting & Live-Trading Checklist

17. Glossary of Terms

18. Risk Management & Position Sizing Workbook

19. References & Further Reading

20. Index

Chapter 1 – Introduction & Market Motivation

1.1 Why Volatility Regimes Matter

Markets do not move at a constant rhythm. They cycle through:

- Quiet regimes with low volatility and frequent false breakouts.

- Transitional regimes where trends begin to form but remain brittle.

- Stress regimes marked by sudden volatility spikes and high correlations.

Using a fixed stop‐loss calibrated for “average” conditions (e.g. 2×ATR(14)) can be disastrous:

During the March 2020 COVID sell-off, an ATR(14)-based stop on EURUSD of ~80 pips was hit within minutes by a 300-pip move, turning a 1% risk into a 4% loss instantly.

By contrast, an adaptive volatility framework adjusts your risk controls to the current regime—tighter in calm markets to capture small edges; wider in crises to avoid being stop-hunted.

1.2 Failures of Static Stops & Discretionary Trading

Two common pitfalls undermine systematic edge:

- Rule Drift: Traders begin with a clear plan—“I risk 1% per trade, stop at 2×ATR.” But after a string of losses, stops get loosened to “let it breathe,” and after wins, tightened to “lock in profits.” Over time, the strategy morphs into an inconsistent patchwork, eroding statistical edge.

- Emotional Overrides: Fear and greed warp execution. In drawdowns, traders chase hopes of a reversal; in winning trades, they pull stops closer out of fear of giving back gains. The result: winners cut short, losers held too long.

Neither extreme—rigid static stops nor fully discretionary tinkering—delivers reliable performance.

1.3 Overview of the Nine Laws as a Unified Solution

The Nine-Laws Framework combines regime detection, adaptive volatility scaling, break-even logic, portfolio budgeting, execution buffers, and ongoing validation into one coherent system:

- Law 1: Correlation Regime Transition Detect when cross-asset DAATS spikes and correlations converge, signaling systemic stress.

- Law 2: Weighted Decay of DAATS Compute an “effective DAATS” with an adaptive half-life tuned to current ATR, smoothing noise without ignoring regime shifts.

- Law 3: Macro Shock Propagation Ratchet DAATS upward on major VIX or credit-spread surprises by instrument-specific sensitivities and exponents.

- Law 4: Exposure & Death-Stop Size full stops sub-linearly via √P scaling (EMA-zones or 256-day ATR), with choppy-regime adjustments.

- Law 5: Exit Only on Death Permit no exits until either a full Death-Stop is hit or a fractional break-even (1/16, 2/16 or dynamic) is reached, then trail accordingly.

- Law 6: Adaptive Break-Even Decision Cluster ATR-ratios and ADX into Choppy/Moderate/Strong to pick the optimal BE rule for each regime.

- Law 7: Portfolio-Level Noise Budget Treat your universe as a single noise-budget pool, allocating Death-Stops and BE across positions based on adjusted DAATS sums.

- Law 8: Transaction-Cost & Slippage Optimization Pad stops and BE triggers for real-world slippage and commissions, ensuring orders survive execution realities.

- Law 9: Continuous Model Validation Monitor each Law’s performance metric weekly and automatically “rebirth” any rule whose metrics drift beyond thresholds.

By anchoring to a 256-day ATR (one trading year) and combining multiple adaptive layers, this framework delivers:

- Consistency: Every rule is mathematically defined—no discretionary overrides.

- Adaptivity: Stops, break-evens, and allocations adjust to the prevailing regime.

- Robustness: Portfolio-level budgeting and execution buffers protect against single-instrument blow-ups and slippage.

- Perpetual Calibration: Ongoing validation and retraining keep parameters in line with evolving market dynamics.

In the chapters that follow, we’ll build on these foundations—deriving each Law’s formulae, illustrating with concrete examples, and showing end-to-end case studies in FX, commodities, and beyond.

Chapter 2 – Law 1 – Correlation Regime Transition Law (CRTL)

2.1 Statement & Intuition

Law 1 (CRTL) Statement: In a multi-instrument universe, systemic risk “regime shifts” occur when:

- The combined volatility‐vector of all instruments spikes significantly above its recent history.

- The top eigenvalue of the cross‐asset correlation matrix jumps beyond typical day‐to‐day variation.

Intuition: When many assets’ volatilities rise together (volatility spike) and correlations converge (eigenvalue jump), diversification breaks down—your portfolio behaves as if driven by one common factor, increasing systemic risk.

2.2 Volatility-Vector Norm

Let DAATSi(t) be the DAATS value for instrument i at time t, for i = 1…N (here N = 28). Define the DAATS vector:

V(t) = [DAATS₁(t), DAATS₂(t), …, DAATS₂₈(t)]The Euclidean norm of this vector is:

‖V(t)‖ = √( Σi=1…28 [ DAATSi(t) ]² )- Squaring emphasizes large values (outliers).

- Square-root returns to DAATS units.

- This norm measures the aggregate cross‐asset volatility at time .

2.3 Rolling Mean & Normalized Spike

Compute a 30-day rolling average and standard deviation of ‖V(t)‖:

‖V‖hist(t) = (1/30) × Σk=1…30 ‖V(t − k)‖

σ‖V‖(t) = stdev(‖V(t−29)…V(t)‖)Define the normalized spike ratio:

SpikeRatio(t) = ‖V(t)‖ / ‖V‖hist(t)Trigger a volatility spike if:

SpikeRatio(t) ≥ 1 + δ × [ σ‖V‖(t) / ‖V‖hist(t) ]δis typically set to 1 (one‐sigma spike).- This criterion ensures statistical significance rather than raw increases.

2.4 Eigenvalue Jump

Form the N×N Pearson correlation matrix C(t) of returns over the same 30-day window. Let λ₁(t) be its largest eigenvalue.

Compute daily changes:

Δλ₁(t) = λ₁(t) − λ₁(t−1)Define the 90-day 90th-percentile:

β(t) = percentile90{ Δλ₁(k) : k = t−90 … t−1 }Trigger a correlation jump if:

Δλ₁(t) ≥ β(t)This signals an unusual convergence of asset correlations into one dominant factor.

2.5 Stress Correlation Regime Definition

CRTL fires at time if and only if both:

- Volatility spike condition (Section 2.3) is

true. - Eigenvalue jump condition (Section 2.4) is

true.

When fired, the system enters a Stress Correlation Regime.

2.6 Action Plan

- Underweight Principal Component Exposures: Diagonalize

C(t); reduce weights on instruments with high loadings on the top eigenvector. - Tighten Break-Even %: Increase your BE% by +5 percentage points (e.g. from 20 % to 25 %) on all positions until the regime clears.

- Alert & Pause: Notify portfolio managers; consider suspending new entries to limit exposure during systemic stress.

2.7 Example Calculation

Using our 28-pair FX universe on June 12, 2025:

- DAATS vector norm:

‖V(t)‖ ≈ 320,129 points - 30-day mean & σ:

‖V‖hist ≈ 280,500,σ‖V‖ ≈ 15,200 - Spike ratio:

320,129 / 280,500 ≈ 1.141vs. threshold1 + 1×(15,200/280,500) ≈ 1.054→ spike met. - Eigenvalue jump:

λ₁(t−1)=12.10 → λ₁(t)=12.50 → Δ=0.40vs.β=0.35→ jump met.

Result: CRTL triggers a Stress Correlation Regime.

2.8 Explanation of Key Terms

- Euclidean Norm: The “length” of a vector in multi-dimensional space.

- Pearson Correlation Matrix: Matrix of pairwise linear correlations between asset returns.

- Eigenvalue: Measures variance explained along a principal component of

C(t). A large jump indicates one factor dominating. - 90th Percentile (β): A nonparametric threshold capturing extreme jumps over a historical window.

2.9 Implementation Snippet (Python-Style Pseudocode)

import numpy as np

import pandas as pd

# 1. DAATS vector & norm

V = daats_df.values # shape (T, N=28)

V_norm = np.linalg.norm(V, axis=1)

# 2. Rolling mean & std

hist_mean = pd.Series(V_norm).rolling(30).mean()

hist_std = pd.Series(V_norm).rolling(30).std()

# 3. Volatility spike flag

delta = 1.0

spike = V_norm / hist_mean >= 1 + delta * (hist_std / hist_mean)

# 4. Correlation & eigenvalue jump

returns_30d = returns_df.rolling(30).apply(lambda x: x)

# (build 28×28 corr matrix each day)

eig1 = compute_rolling_eigenvalues(returns_df, window=30)[:, -1]

jump = eig1[1:] - eig1[:-1]

beta = pd.Series(jump).rolling(90).quantile(0.90)

corr_shift = jump >= beta.values

# 5. Trigger

crt = spike[1:] & corr_shift

if crt.iloc[-1]:

# Enter Stress Correlation Regime

underweight_top_eigen()

break_even_pct += 0.05Chapter 3 – Law 2 – Weighted Decay of Historical DAATS (WDHDI)

3.1 Statement & Intuition

Law 2 (WDHDI) Statement: For each instrument i, compute an effective DAATS by exponentially decaying past DAATS values. The decay half-life adapts to current ATR levels, ensuring:

- Slower decay (longer memory) when volatility is above average;

- Faster decay (shorter memory) when volatility is below average.

Intuition: A fixed half-life either overreacts in calm markets or underreacts in storms. By tying the half-life to ATR, the metric remains responsive yet stable across regimes.

3.2 Adaptive Half-Life Formula

Let:

H₀,ᵢ= base half-life for instrumenti(e.g. 12 days for EURUSD, 10 for JPY‐crosses).ATRₚ,ᵢ(t)= current ATR overPbars for instrumenti.ATR̄ₚ,ᵢ= 30-day mean of ATRₚ,ᵢ.κ∈ [0.5, 1.0], the sensitivity exponent (typical: 0.75).

The adaptive half-life is:

Hᵢ(t) = H₀,ᵢ × [ ATRₚ,ᵢ(t) / ATR̄ₚ,ᵢ ]^κThen Hᵢ(t) is bounded to [H₀,ᵢ/2, 2×H₀,ᵢ] to avoid extremes.

3.3 Decay Factor & Lookback Window

From Hᵢ(t), define:

λᵢ(t) = 0.5^(1 / Hᵢ(t)): the per-bar decay factor (half afterHᵢbars).Kᵢ(t) = ceil(4 × Hᵢ(t)): number of past bars to include (≈4 half-lives).

This creates an exponentially weighted sum over the past Kᵢ bars.

3.4 Effective DAATS Formula

The effective DAATS at time t is:

DAATS_eff,ᵢ(t)

= Σ<sub>k=0…Kᵢ(t)</sub> [ λᵢ(t)^k × DAATSᵢ(t − k) ]

- When

k = 0, weight = 1 (most recent bar). - As

kincreases, weight decays geometrically. - Older bars beyond

Kᵢhave negligible influence.

3.5 Numerical Example (EURUSD)

Assume at time t for EURUSD:

H₀ = 12days,κ = 0.75.ATRₚ = ATR₂₀₀(t) = 50pips,ATR̄₂₀₀ = 40pips → ratio = 1.25.

Compute:

H(t) = 12 × (1.25)^0.75 ≈ 12 × 1.18 ≈ 14.2 days

λ(t) = 0.5^(1/14.2) ≈ 0.951

K(t) = ceil(4 × 14.2) = 57 bars

If recent DAATS values are [10 000, 9 800, 9 600, …], then:

DAATS_eff ≈ 10 000

+ 0.951×9 800

+ 0.951²×9 600

+ …

(sum over 58 bars)

This yields a smoothed DAATS that reacts slower when ATR is elevated.

3.6 Implementation Snippet (Pseudocode)

def compute_daets_eff(daats_series, atr_series, H0, kappa=0.75):

atr_mean = atr_series.rolling(30).mean()

# Adaptive half-life

H = H0 * (atr_series / atr_mean)**kappa

H = H.clip(lower=H0/2, upper=2*H0)

lam = 0.5 ** (1.0 / H)

K = (4 * H).apply(np.ceil).astype(int)

daats_eff = []

for t in range(len(daats_series)):

k_max = K.iloc[t]

weights = lam.iloc[t] ** np.arange(k_max + 1)

window = daats_series.iloc[max(0, t - k_max):t + 1][::-1]

daats_eff.append(np.dot(weights[:len(window)], window))

return pd.Series(daats_eff, index=daats_series.index)

3.7 Key Takeaways

- Adaptive smoothing prevents over- or under-reaction to volatility changes.

- Instrument-specific half-lives ensure fair cross-asset comparisons.

- Bounded parameters avoid pathological very fast or slow decays.

Chapter 4 – Law 3 – Macro Shock Propagation Law (MSPL)

4.1 Statement & Intuition

Law 3 (MSPL) Statement: Whenever a macro event m occurs at time t with standardized surprise Sm(t), each instrument’s DAATS is ratcheted upward by an amount proportional to its specific sensitivity:

ΔDAATSi(t) = φi(t) · |Sm(t)|^γi(t)

DAATSi(t) ← max[ DAATSi(t), DAATSi(t–1) + ΔDAATSi(t) ]- Sm(t): magnitude of the macro surprise in σ-units (e.g. VIX shock).

- φi, γi: instrument-specific sensitivity and exponent, capturing linear or super-linear DAATS response.

Intuition: Different markets “bite” differently on the same shock. Law 3 ensures your volatility measures reflect each instrument’s empirical shock behavior.

4.2 Defining Shock Magnitude Sm(t)

Common shock measures:

- VIX Surprise:

SVIX(t) = (Realized VIX(t) – Implied VIX(t–)) / σVIX - Credit-Spread Surprise:

SCS(t) = (ΔCS(t) – ΔCS(t–)) / σΔCS - Hybrid Shock (optional):

Shyb(t) = w₁·SVIX(t) + w₂·SCS(t), w₁+w₂=1

4.3 Calibrating φi and γi

Over a rolling window of the past 90 shock dates {k}, fit the nonlinear model:

ΔDAATSi(k) ≈ φi · |Sm(k)|^γi + εi(k)

subject to 0.8 ≤ γi ≤ 1.3- Use log-linear least squares:

ln ΔDAATS = ln φ + γ·ln |S| + ε. - Re-fit monthly to capture evolving shock sensitivities.

4.4 Shock-Update Rule

At each macro event time t:

- Compute

Sm(t). - For each instrument

i, computeΔDAATSi(t) = φi(t) · |Sm(t)|^γi(t). - Update:

DAATSi(t) = max[DAATSi(t), DAATSi(t–1) + ΔDAATSi(t)].

4.5 Numerical Example: USD/JPY

On June 12, 2025 a Fed surprise yields:

- Implied VIX = 20, Realized VIX = 24, σVIX=2 →

SVIX = (24–20)/2 = 2. - Calibrated: φUSDJPY=0.6, γUSDJPY=1.1.

ΔDAATS<sub>USDJPY</sub>

= 0.6 × |2|^1.1 ≈ 0.6 × 2.14 ≈ 1.28 (DAATS units)

If DAATS<sub>USDJPY</sub>(t–1)=25 894 → update to max(25 894, 25 894+1.28)=25 895.28.

4.6 Implementation Snippet (Pseudocode)

def law3_mspl(daats_prev, S, phi, gamma):

delta = phi * abs(S)**gamma

return max(daats_prev, daats_prev + delta)

# Example usage:

S = (vix_realized - vix_implied) / sigma_vix

daats_usdjpy = law3_mspl(25900, S, 0.6, 1.1)

4.7 Key Takeaways

- Nonlinear response: γi > 1 amplifies large shocks.

- Instrument specificity: φi, γi reflect each market’s empirical shock behavior.

- Shock-only uplift: DAATS only increases on shocks; baseline smoothing remains governed by Law 2.

Chapter 5 – Law 4 – Exposure & Death-Stop Law (E & DS)

5.1 Statement & Intuition

Law 4 (E&DS) Statement: For any chosen look‐back period P, compute a Death-Stop distance using sub‐linear √P scaling:

X = ⌈√P⌉

DeathStop = X × ATRPYou may define P in two ways:

- EMA-Zone Option:

Pequals the top EMA boundary of your color‐coded zone (e.g. 8, 15, 25, 50, 89, 140, 200). - Calendar-Span Option:

P = 256trading days (~1 year) →X = ⌈√256⌉ = 16.

Intuition: Linear stops (e.g. P × ATR) grow too aggressively with long look‐backs; √P scaling gives longer‐term trades breathing room without excessive risk.

5.2 EMA-Zone Exposure Scaling

| EMA Zone | Top EMA P | √P | X=⌈√P⌉ |

|---|---|---|---|

| Momentum | 8 | 2.828 | 3 |

| Acceleration | 15 | 3.873 | 4 |

| Transition | 25 | 5.000 | 5 |

| Value | 50 | 7.071 | 8 |

| Correction | 89 | 9.433 | 10 |

| Reassessment | 140 | 11.832 | 12 |

| Long-Term | 200 | 14.142 | 15 |

Thus, for the EMA-50 zone (P=50), you use X=8 and set:

DeathStop = 8 × ATR505.3 Calendar-Span Exposure (256-Day ATR)

For annualized buffering:

P = 256 (trading days)

X = ⌈√256⌉ = 16

DeathStop = 16 × ATR256This aligns your stop sizing with one full year’s volatility.

5.4 Choppy-Regime Adjustment

In low‐momentum (choppy) environments, tighten stops by reducing X by 1 (but not below 1):

if ADX(14) < 20 and ATRP < 0.75 × ATR̄P:

X_adj = max(X − 1, 1)

else:

X_adj = X

DeathStop = X_adj × ATRPThis avoids giving excessive room for small oscillations when the market lacks clear trend.

5.5 Numerical Examples

5.5.1 EMA-Zone Example (EURUSD on M60)

P=8→X=3.- ATR8 = 9.5 pips; ADX(14)=16 (<20), ATR8=9.5 < 0.75×meanATR8=12 → choppy.

- Downshift:

X_adj=2. - DeathStop = 2 × 9.5 = 19 pips.

5.5.2 Calendar-Span Example (Gold on D1)

P=256→X=16.- ATR256 = 50 points; ADX(14)=22 → not choppy.

- DeathStop = 16 × 50 = 800 points.

5.6 Implementation Snippet (Python-Style Pseudocode)

def compute_death_stop(atr_P, atr_mean, adx, P):

X = 16 if P == 256 else math.ceil(math.sqrt(P))

if adx < 20 and atr_P < 0.75 * atr_mean:

X = max(X - 1, 1)

return X * atr_P

# Examples:

# EMA-8 zone:

deathstop_8 = compute_death_stop(9.5, 12.0, 16, P=8) # returns 19

# 256-day:

deathstop_256 = compute_death_stop(50, 50, 22, P=256) # returns 8005.7 Key Takeaways

- Sub-linear scaling (√P) balances room for market swings with capital preservation.

- Two period-definition options (EMA zones vs. yearly ATR) suit intraday and position trading alike.

- Choppy-regime downshift tightens stops when momentum is weak.

Chapter 6 – Law 5 – Exit Only on Death (EOD)

6.1 Statement & Intuition

Law 5 (EOD) Statement: After a valid trend entry (e.g. price closes above EMA 8), no exit is allowed until one of two “death” conditions is met:

- Full-Stop Exit: Price reverses against the entry by at least the full DeathStop distance (Law 4).

- Fractional BE & Trail Exit: Once price advances by a fraction

f(t)of the DeathStop, move your stop to break-even and thereafter trail it by that same distance.

Intuition: This rule ensures you let winners run beyond your breakeven buffer while only cutting losers at a predefined maximum loss.

6.2 Full-Stop Exit

Let DeathStop = Xadj × ATRP from Law 4. If at any point the price retraces from the entry price by ≥ DeathStop, you exit immediately, accepting the maximum defined loss.

6.3 Fractional Break-Even & Trail

Define a break-even fraction f(t) and let:

BE/Trail = f(t) × DeathStopProcedure:

- **Trigger to Break-Even**: Once price moves in your favor by ≥ BE/Trail, shift your stop to the entry price (breakeven).

- **Trailing**: After breakeven is set, trail the stop so that it always remains BE/Trail distance below the highest price reached since entry.

6.4 Fractional Options

| Option | Formula | % of DeathStop | ATR-Units (if X=16) |

|---|---|---|---|

| 1 ATR (1/16) | DeathStop / 16 | 6.25 % | 1 ATR |

| 2 ATR (2/16) | 2 × DeathStop / 16 | 12.50 % | 2 ATR |

| Dynamic | f(t) = (Xmin/Xmax) × [1 + c·(σDAATS – σ̄DAATS)/σ̄DAATS](cap [0.15, 0.30]) | ≈16 % | ≈2.6 ATR (when Xmin=3, Xmax=15, c=0.25) |

- Xmin=3, Xmax=15 from Law 4.

- σDAATS, σ̄DAATS = 30-day std and mean of DAATS across the universe.

- c = dispersion coefficient (typical 0.25).

6.5 EMA-Breach Soft Filter

After you have moved to breakeven, a brief dip below EMA 8 may be noise. To avoid “micro-stop-runs,” require:

- At least two consecutive closes below EMA 8.

- Each close must be at least 50% of the BE/Trail distance below the EMA.

Only then do you treat it as a valid exit signal.

6.6 Numerical Example (EURUSD, Daily ATR256)

On June 12, 2025 for EURUSD:

- DAATS256=12 745 → ATR256=12 745/16≈797 points → DeathStop=12 745 points.

- 1 ATR BE: 797 points (6.25 %).

- 2 ATR BE: 1 594 points (12.5 %).

- Dynamic f(t): σDAATS=6 722, σ̄DAATS=15 917 → f(t)= (3/15)[1+0.25(6722–15917)/15917] ≈0.16 → BE≈0.16×12 745≈2 039 points (16 %).

- Trail thereafter by the same BE distance below new highs.

6.7 Implementation Snippet (Pseudocode)

# Inputs:

deathstop = X_adj * ATR_P

sigma_DAATS = current_std(DAATS)

sigma_bar = mean_std(DAATS)

Xmin, Xmax, c = 3, 15, 0.25

# Dynamic fraction

f = (Xmin/Xmax) * (1 + c * (sigma_DAATS - sigma_bar) / sigma_bar)

f = max(0.15, min(f, 0.30))

# Break-even options

BE_1atr = deathstop / 16

BE_2atr = 2 * deathstop / 16

BE_dyn = f * deathstop

# After entry:

if price >= entry_price + BE_choice:

stop_price = entry_price

# Then trail:

stop_price = max(stop_price, highest_price - BE_choice)

# EMA breach filter

if closes_below_EMA8 >= 2 and retrace >= 0.5 * BE_choice:

exit_trade()

6.8 Key Takeaways

- You never exit on a simple EMA 8 breach—only on your defined “death” conditions.

- Fractional BE lets you lock in profits early while still giving winners room.

- Dynamic f(t) adapts BE% based on overall volatility dispersion.

- EMA-breach soft filter prevents premature exits on minor noise.

Chapter 7 – Law 6 – Adaptive Break‐Even Decision Law (ADBED)

7.1 Statement & Intuition

Law 6 (ADBED) Statement: Select among multiple break‐even (BE) options—tight, medium, or loose—based on current market regime. We classify each bar into Choppy, Moderate, or Strong regimes and then apply the corresponding BE rule from Law 5:

- Choppy (Option C): 1 ATR (6.25 %) or 2 ATR (12.5 %) of Death‐Stop.

- Moderate (Option B): GASBET BE = 0.6375 × DAATS.

- Strong (Option A): Dynamic BE = f(t) × Death‐Stop (≈16 %).

Intuition: – In choppy markets, noise dominates: use the tightest BE to lock small profits. – In moderate environments, balance between noise and trend with an empirically chosen 63.75 % of DAATS. – In strong trends, maximize breathing room by using dynamic, volatility‐adjusted BE.

7.2 Regime Features

We use two indicators per bar t:

- Volatility Ratio

Rvol(t) = ATR25(t) / ATR200(t)– HighRvolindicates short‐term swings large vs. long‐term → choppy. - Trend Strength (ADX)

ADX(14, t)–<18→ weak/choppy –18–28→ moderate –>=28→ strong

7.3 Clustering Procedure

- Gather the past 60 bars of

(Rvol, ADX)pairs. - Apply

k-means (k=3)to partition into three clusters. - Label clusters by their centroids: lowest ADX/higher

Rvol→ “Choppy,” mid‐range → “Moderate,” high ADX/lowerRvol→ “Strong.” - Assign today’s bar to the nearest centroid → regime label.

7.4 BE Option Mapping

| Regime | Label | BE Rule | Example BE% |

|---|---|---|---|

| Choppy | Option C | 1 ATR (1/16) or 2 ATR (2/16) of Death‐Stop | 6.25 % or 12.5 % |

| Moderate | Option B | GASBET BE = 0.6375 × DAATS | 63.75 % |

| Strong | Option A | Dynamic BE = f(t) × Death‐Stop | ≈16 % |

7.5 Numerical Example (Gold, Daily)

On a given day for Gold:

ATR<sub>25</sub>=78,ATR<sub>200</sub>=46→R<sub>vol</sub>=78/46≈1.70ADX(14)=17- Distance to centroids:

Choppy center ≈ (1.5,15) → d≈0.22 Moderate center ≈ (1.0,22) → d≈5.42 Strong center ≈ (0.6,30) → d≈12.90- Nearest → Choppy

from sklearn.cluster import KMeans # Prepare past 60-day features features = np.column_stack([R_vol_last60, ADX_last60]) # shape (60, 2) kmeans = KMeans(n_clusters=3).fit(features) # Today's features feat_today = np.array([[R_vol_today, ADX_today]]) label = kmeans.predict(feat_today)[0] # Map to BE option if label == CHOPPY_INDEX: BE_choice = deathstop / 16 # 1 ATR elif label == MODERATE_INDEX: BE_choice = 0.6375 * DAATS_value # GASBET else: BE_choice = f_dynamic * deathstop # dynamic BE7.7 Key Takeaways- Data‐driven regime selection: No manual thresholds—clustering adapts to evolving market patterns.

- Three tiers of BE: Tailor your BE tightness to market noise or trend strength.

- Seamless integration: Works on any timeframe by supplying matching ATR and ADX values.

Chapter 8 – Law 7 – Portfolio-Level Break-Even & Noise-Budget Law (PLBND)

8.1 Statement & Intuition

Law 7 (PLBND) Statement: Treat your N-instrument universe as a single “noise budget.” Aggregate and adjust individual DAATS values to set:

- Portfolio Death-Stop at the adjusted DAATS sum.

- Break-Even Band (e.g. [18%, 22%]) of that sum to progressively lock in profits.

- Per-Instrument BEₙ by allocating the portfolio BE proportionally to each instrument’s adjusted DAATS.

Intuition: A single ultra-volatile asset can monopolize risk. By subtracting a dispersion buffer and sharing the BE across positions, you preserve diversification and prevent any one losing position from overwhelming your equity.

8.2 Core Formulas

Let DAATSi be each instrument’s DAATS value. Define:

1. DAATS_sum = Σi=1…N DAATSi

2. σ_D = stdev( DAATS₁, …, DAATSₙ )

3. DAATS_adji = max[ DAATSi − κ·σ_D , 0 ]

(where κ = 0.15 by default)

4. DAATS_adj_sum = Σi=1…N DAATS_adji ← Portfolio Death-Stop

5. BE_band = [ L·DAATS_adj_sum , U·DAATS_adj_sum ]

(e.g. L=0.18, U=0.22)

6. Choose BE_port = p·DAATS_adj_sum

(e.g. p=0.20 for 20%)

7. Per-instrument BEi = BE_port × ( DAATS_adji / DAATS_adj_sum )8.3 Numerical Example (28-Pair FX Universe)

Using June 12, 2025 data:

- Step 1: Raw sum

DAATS_sum = 445 676 - Step 2: Dispersion

σ_D ≈ 6 722.5 - Step 3: κ=0.15 → subtract

0.15·6 722.5 ≈ 1 008.4from each DAATS, floor at 0. - Step 4: Adjusted sum

DAATS_adj_sum ≈ 417 573.6→ portfolio Death-Stop. - Step 5: BE band

[0.18,0.22]×417 573.6 ≈ [75 163.3, 91 866.2] - Step 6: Choose p=0.20 →

BE_port = 0.20×417 573.6 ≈ 83 514.7 - Step 7: EURUSD example

DAATS_EURUSD=12 745 → DAATS_adj=12 745−1 008.4=11 736.6 BE_EURUSD=83 514.7×(11 736.6/417 573.6)≈2 345 points

8.4 Implementation Snippet (Python-Style Pseudocode)

def law7_portfolio(daats_list, kappa=0.15, be_frac=0.20):

import numpy as np

daats = np.array(daats_list)

daats_sum = daats.sum()

sigma_D = daats.std(ddof=0)

# Adjust each DAATS

adj = np.maximum(daats - kappa * sigma_D, 0)

daats_adj_sum = adj.sum() # Portfolio Death-Stop

# Break-Even port

BE_port = be_frac * daats_adj_sum

# Per-instrument BE

BE_i = BE_port * (adj / daats_adj_sum)

return daats_sum, sigma_D, daats_adj_sum, BE_port, BE_i

# Example call:

daats_fx = [...] # 28 DAATS values

_, sigma_D, adj_sum, BE_port, BE_i = law7_portfolio(daats_fx)

8.5 Key Takeaways

- Holistic risk control: Aligns total portfolio stop and BE with your risk tolerance.

- Noise budgeting: Subtracting κ·σ prevents outliers from dominating.

- Proportional BE: Each position’s BE scales to its adjusted volatility contribution.

- Versatile: Apply to FX, commodities, equities, crypto—just supply DAATS values.

Chapter 9 – Law 8 – Transaction-Cost & Slippage Optimization Law (TCSOL)

9.1 Statement & Intuition

Law 8 (TCSOL) Statement: Before placing any stop or break-even orders, estimate each instrument’s expected slippage and commissions, and adjust your stop and BE distances so they survive real-world execution.

Intuition: Even perfectly calculated stops can be “slippage-run” if market fills occur inside your intended levels. By padding stops and tightening BE by the same execution costs, you align theoretical risk controls with on-screen reality.

9.2 Slippage Coefficient αi

Estimate each instrument’s slippage as a fraction of ATR:

αi = medianlast 60 fills(|ExecPrice − MidQuote|) / ATR̄P,i- ExecPrice − MidQuote: absolute difference between your fill price and the midpoint quote.

- ATR̄P,i: 30-day average ATR on period P for instrument i.

- Update αi daily or via an EWMA on recent fills.

9.3 Commission/Fees γi

Let γi be your known round-trip commission (in the same units as price, e.g. pips or points). Include explicit broker fees and exchange fees.

9.4 Net Stop & BE Formulas

Given raw:

- DeathStopraw,i = Xadj × ATRP,i

- BEraw,i = chosen BE distance (Law 5/6)

Compute slippage buffer:

Slippagei(t) = αi × ATRP,i(t)Then adjust:

DeathStopnet,i

= DeathStopraw,i

+ Slippagei(t)

+ γi

BEnet,i

= max[ BEraw,i

− Slippagei(t)

− γi , 0 ]- If

BEnet,i< 0, floor it to 0. - Units remain in pips/points so orders map directly to your platform.

9.5 Numerical Example (EURUSD, P = 8)

- Raw: ATR8 = 9.5 pips, Xadj=2 → DeathStopraw=19 pips; BEraw=1×ATR=9.5 pips.

- Slippage: median fill = 1.2 pips → α = 1.2 / 9.5 ≈ 0.126 → Slippage = 0.126 × 9.5 = 1.2 pips.

- Commission: γ = 0.5 pips.

DeathStopnet = 19 + 1.2 + 0.5 = 20.7 pips

BEnet = max(9.5 − 1.2 − 0.5, 0) = 7.8 pips9.6 Implementation Snippet (Pseudocode)

def compute_net_levels(atr_P, death_raw, BE_raw, alpha, gamma):

slippage = alpha * atr_P

death_net = death_raw + slippage + gamma

BE_net = max(BE_raw - slippage - gamma, 0)

return death_net, BE_net

# Example

atr8 = 9.5

death_raw = 19

BE_raw = 9.5

alpha = 1.2/9.5

gamma = 0.5

death_net, BE_net = compute_net_levels(atr8, death_raw, BE_raw, alpha, gamma)

9.7 Key Takeaways

- Execution-aware stops: Pad DeathStops to avoid being stopped by slippage.

- Net BE: Tighten break-even triggers to ensure intended profits survive fees.

- Dynamic updates: Recompute αi intraday if fills suggest changing liquidity.

- Consistent units: All adjustments in ATR-units (pips/points) map directly to order tickets.

Chapter 10 – Law 9 – Continuous Model Validation “Law Rebirth” (CMV)

10.1 Statement & Intuition

Law 9 (CMV) Statement: On a regular schedule (e.g. weekly), compute each Law’s key performance metric. If any metric deviates beyond ±10% of its target, automatically “rebirth” that Law—recalibrating its parameters on the most recent data window. Laws not revalidated within 30 days are flagged stale and retrained.

Intuition: Market dynamics evolve: volatility regimes shift, correlation structures change, slippage profiles drift. Without ongoing validation and retraining, static parameters eventually lose efficacy or introduce hidden risk. Law 9 closes the loop—ensuring perpetual alignment.

10.2 Metrics & Rebirth Triggers

| Law | Metric | Target | Rebirth Trigger |

|---|---|---|---|

| Law 1 (CRTL) | False-positive & false-negative rates of stress alerts | ≤10 % | FP or FN >10 % |

| Law 2 (WDHDI) | One-step-ahead RMSE of DAATSeff | ≤1.1×baseline | RMSE >1.1×baseline |

| Law 3 (MSPL) | Median absolute error on shock days | ≤10 % of avg ΔDAATS | Error >10 % |

| Law 4 (E&DS) | % of strong-trend trades hitting stop prematurely | ≤5 % | >5 % |

| Law 5 (EOD) | Break-even hit rate (of winners) | 30 % ±10 % | <20 % or >40 % |

| Law 6 (ADBED) | Regime labeling accuracy vs. outcomes | ≥85 % | <85 % |

| Law 7 (PLBND) | % of 5-day portfolio drawdowns breaching BE band | ≤10 % | >10 % |

| Law 8 (TCSOL) | Mean absolute slippage error | ≤5 pips or ≤5 % ATR | >5 pips or >5 % ATR |

| Law 9 (CMV) | Days since last retrain | ≤30 days | >30 days |

10.3 Rebirth Process

- Compute Metrics: For each Law, calculate its real-time metric over the prescribed window (e.g. 30 days for Law 1 false-rate, 60 trades for Law 8 slippage error).

- Check Thresholds: Compare to targets; identify Laws exceeding drift thresholds.

- Re‐estimate Parameters: For each flagged Law:

- Law 1: Refit δ and β via latest Z-scores & eigen-jump distribution.

- Law 2: Sweep H₀ ∈ [5,20] to minimize new RMSE.

- Law 3: Rerun nonlinear regression for φi,γi on recent shock data.

- …and so on for Laws 4–8.

- Deploy & Log: Update parameter sets in code and GATS configuration. Append entries to a Law Update Log (timestamp, old vs. new values).

- Reset Staleness Clock: Mark Law as validated; restart its 30-day counter.

10.4 Numerical Example

Suppose over the past 30 days:

- Law 1 stress alerts saw FP=12 %, FN=8 % → FP >10 % → rebirth required.

- Law 5 break-even hit rate = 28 % → within [20 %,40 %] → no rebirth.

- Law 8 slippage error = 6 pips (>5 pips) → rebirth required.

Actions:

- Re‐estimate δ, β for Law 1 on the latest 60 days of V norms & Δλ₁.

- Re‐calibrate αi via EWMA on last 60 fills for Law 8.

- Log both updates; reset their validation timers.

10.5 Implementation Snippet (Pseudocode)

def law9_validation(metric_dict, threshold_dict):

to_retrain = []

for law, metric in metric_dict.items():

if metric > threshold_dict[law]:

to_retrain.append(law)

return to_retrain

# Example execution

metrics = {

'law1': false_positive_rate,

'law5': be_hit_rate,

'law8': slippage_error

}

thresholds = {

'law1': 0.10,

'law5': (0.20, 0.40), # a range

'law8': 5 # pips

}

needs_rebirth = law9_validation(metrics, thresholds)

for law in needs_rebirth:

retrain(law) # calls the specific retraining function

log_update(law, old_params[law], new_params[law])10.6 Key Takeaways

- Automatic drift detection: Shields against parameter decay.

- Selective retraining: Only Laws whose metrics exceed thresholds are reborn, avoiding overfitting.

- Auditability: Law Update Log provides a transparent history of all parameter changes.

- Staleness guard: Even if no metric triggers, any Law unvalidated >30 days is retrained automatically.

Interlude – The Rebirth Principle: Philosophy & Practice

“We must consume ourselves in order to transform ourselves for our rebirth.”

This guiding aphorism lies at the heart of Dr. Brown’s Nine-Laws Framework—and of his own journey as a thinker and innovator. Just as a phoenix rises from its ashes, our models and ourselves must undergo periodic self-examination, deconstruction, and renewal. Without this radical self-consumption, both traders and algorithms grow stale, vulnerable to unseen regime shifts and cognitive biases.

Key Tenets of the Rebirth Principle

- Self-Reflection: Regularly audit every assumption—about volatility, correlation, slippage, and regime thresholds. Document failures as candidly as successes.

- Creative Deconstruction: Dismantle your own “best” models. Challenge why each parameter exists: Could δ, β, H₀, κ, φᵢ, γᵢ be rooted in outdated market conditions? What would emerge if you rebuilt them from scratch?

- Relentless Re-Calibration: Design automated “Law Rebirth” processes (see Law 9) that don’t just tweak parameters, but periodically recompute the entire metric pipeline—from DAATS smoothing to eigenvalue clustering—on fresh data.

- Holistic Growth: Extend validation beyond P&L metrics. Incorporate qualitative review: trader feedback, market narrative shifts, regulatory changes, and technological innovations (e.g. latency patterns, new venues).

- Spiritual & Intellectual Renewal: Encourage “mind breaks”—periods when developers step away from code to read, meditate, or explore adjacent disciplines (complexity science, behavioral finance, machine-learning ethics). These diversions often spark breakthroughs when models come back to life.

Rebirth in Practice: An Expanded Workflow

- Weekly Metrics Review (Law 9):

- Compute all nine performance metrics.

- Flag any drift >10%.

- If none flagged—but 30 days elapsed—force a full rebirth.

- Monthly “Phoenix Sessions”:

- Cross-functional workshop: quants, traders, engineers review model behavior.

- Identify one “sacred” assumption to discard—e.g. fixed κ, static clustering features, or one law’s core formula.

- Brainstorm alternatives; prototype on sandbox data.

- Quarterly “Rebirth Deployment”:

- Deploy new model versions side-by-side with legacy in paper trading.

- Run statistical A/B tests on key regimes (choppy, moderate, strong).

- Merge or reject via performance and qualitative feedback.

- Annual Meta-Review & Vision Casting:

- Reflect on the previous year’s crises and breakthroughs.

- Set guiding themes for the next cycle (e.g. “embrace alternative data,” “stress-test quantum-era latency”).

- Publish a “Rebirth Manifesto” for stakeholders to align on purpose and direction.

Example: Law 1 Rebirth Deep Dive

- Original δ Parameter: Calibrated at 1.0 (one‐sigma spike).

- Rebirth Triggered: False‐positive rate = 12% >10% over last 30 days.

- Self-Consumption: Audit the distribution of ‖V(t)‖ and Δλ₁—discover heavy left skew in calm markets, suggesting a non‐Gaussian regime. Propose replacing the z‐score test with a nonparametric percentile‐based trigger (e.g. 95th percentile of recent spikes) rather than δ×σ.

- Rebirth Iteration: Implement percentile‐based spike test and recalibrate β via kernel density estimation on Δλ₁. Backtest and compare to the original Gaussian z‐score method in both regime accuracy and drawdown protection.

- Outcome: New Law 1 variant reduces false‐positives to 8% while preserving early stress detection in 2025 volatility bursts.

Philosophical Takeaway

True mastery arises not from clinging to static rules but from the courage to dismantle and reforge them. By ritualizing “consumption” and “rebirth”—both in our mindsets and in our code—we cultivate resilience, creativity, and foresight. The markets continually evolve; so must we.

Chapter 11 – Case Study: FX Universe (28 Major Pairs, P = 256-Day DAATS)

11.1 Overview & Objectives

In this chapter, we apply Laws 1–9 end-to-end to a real FX portfolio of 28 major currency pairs, using each pair’s 256-day DAATS as of June 12, 2025 (04:02 UTC). We will:

- Compute raw and adjusted DAATS sums (Law 7).

- Detect any Stress Correlation Regime (Law 1).

- Generate “effective DAATS” (Law 2) and ratchet on shocks (Law 3).

- Size full stops (Law 4) and break-evens (Laws 5–6).

- Apply execution buffers (Law 8).

- Validate which laws require “rebirth” (Law 9).

11.2 Data: 256-Day DAATS Values

| Pair | DAATS256 |

|---|---|

| EURUSD | 12 745 |

| GBPUSD | 14 642 |

| USDJPY | 25 894 |

| USDCHF | 11 120 |

| USDCAD | 12 519 |

| AUDUSD | 9 954 |

| NZDUSD | 9 395 |

| EURJPY | 25 664 |

| GBPJPY | 32 117 |

| AUDNZD | 9 089 |

| CADCHF | 8 263 |

| CADJPY | 19 179 |

| EURAUD | 20 654 |

| EURCAD | 16 136 |

| EURNZD | 22 302 |

| EURCHF | 9 698 |

| EURGBP | 6 573 |

| GBPAUD | 23 312 |

| GBPCAD | 18 463 |

| GBPCHF | 13 551 |

| GBPNZD | 25 511 |

| CHFJPY | 23 184 |

| AUDJPY | 19 563 |

| AUDCAD | 10 814 |

| NZDCAD | 10 825 |

| AUDCHF | 9 169 |

| NZDJPY | 16 880 |

| NZDCHF | 8 460 |

11.3 Law 1 – Stress Correlation Regime Check

Compute:

‖V‖ = √Σ DAATSi² ≈ 320 129- 30-day mean:

‖V‖hist ≈ 280 500, σ‖V‖ ≈ 15 200 - Spike ratio:

1.141 > 1 + (15 200/280 500) ≈ 1.054⇒ spike = true - Eigen jump: Δλ₁=0.40 vs. β(90th)=0.35 ⇒ jump = true

Result: Stress Correlation Regime → underweight top PC & BE% += 5 pp.

11.4 Law 2 & 3 – DAATSeff & Shock Ratchet

- Law 2: For each pair, use

H₀→H(t)→λ(t)→K(t)to computeDAATS_eff. E.g. EURUSD →DAATS_eff≈12 300. - Law 3: No significant VIX/credit shock on date ⇒

DAATS = max(DAATS, DAATS_eff).

11.5 Law 4 – Death-Stops (P = 256)

P=256 → X=⌈√256⌉=16

DeathStopi=16×(DAATSi/16)=DAATSiThus Stopᵢ = raw DAATSᵢ (e.g. EURUSD = 12 745 points).

11.6 Law 5 – Exit-Only-on-Death Rules

Compute three BE options:

| Option | Formula | EURUSD (points) |

|---|---|---|

| 1 ATR | DAATS/16 | 12 745/16≈797 |

| 2 ATR | 2×DAATS/16 | ≈1 593 |

| Dynamic | f(t)×DeathStop, f≈0.16 | ≈0.16×12 745≈2 039 |

11.7 Law 6 – Regime-Based BE Selection

- Compute

R_vol=ATR25/ATR200≈1.20, ADX≈22 → clusters to Moderate. - Moderate → Option B: BE = 0.6375×DAATS ≈8 128 points.

11.8 Law 7 – Portfolio BE & Noise-Budget

σ_D≈6 722.5, κ=0.15

adj_i = max(DAATS_i − κ·σ_D, 0)

DAATS_adj_sum≈417 574

BE_port = 0.20×417 574≈83 515

Per-pair: BE_i = 83 515×(adj_i/417 574)Example EURUSD: adj=11 736.6 → BE≈2 345 points.

11.9 Law 8 – Execution Buffers

- Estimate α≈0.05, γ≈50 points.

DeathStop_net=12 745+ (0.05×797)+50≈13 034.BE_net=8 128−(0.05×797)−50≈7 781.

11.10 Law 9 – Validation & Rebirth

Compute recent metrics:

- FP/FN (Law 1)=12 %/8 % → rebirth Law 1.

- BE-hit rate (Law 5)=35 % → OK.

- Slippage error (Law 8)=6 pips → rebirth Law 8.

Proceed to retrain δ,β; reorder α buffers; log updates.

11.11 Summary Table (EURUSD Example)

| Level | Points |

|---|---|

| DeathStop_net | ≈13 034 |

| BE_mod (0.6375×DAATS) | ≈8 128 |

| BE_net_mod | ≈7 781 |

This end-to-end example shows how raw DAATS data become actionable stops, BE triggers, and risk controls across Laws 1–9.

Chapter 12 – Case Study: 10-Commodity Universe (P = 256-Day DAATS)

12.1 Overview & Objectives

Applying Laws 4–9 to a diversified commodity portfolio (Gold, Silver, Copper, Aluminum, Zinc, Lead, Palladium, Platinum, Brent, WTI) using their 256-day DAATS as of June 12, 2025. We will:

- Compute Portfolio Death-Stop & BE (Law 7).

- Size individual Death-Stops (Law 4).

- Calculate 1 ATR, 2 ATR, and dynamic BE (Laws 5–6).

- Apply slippage/fee buffers (Law 8).

- Validate for rebirth triggers (Law 9).

12.2 Data: 256-Day DAATS Values

| Commodity | DAATS256 |

|---|---|

| Gold | 70 292 |

| Silver | 13 473 |

| Copper | 263 305 |

| Aluminum | 78 944 |

| Zinc | 108 239 |

| Lead | 59 704 |

| Palladium | 55 514 |

| Platinum | 37 677 |

| Brent | 30 884 |

| WTI | 32 600 |

12.3 Law 7 – Portfolio Noise Budget & BE

- Compute

σ_D = stdev(DAATS)≈ 67 924.6. - Adjust each DAATS:

DAATS_adji = max[DAATSi − 0.15σ_D, 0]. - Sum:

DAATS_adj_sum ≈ 648 745.1→ Portfolio Death-Stop. - Choose

p=20 %:BE_port = 0.20 × 648 745.1 ≈ 129 749.0.

12.4 Law 4 – Individual Death-Stops (P = 256)

X = ⌈√256⌉ = 16

DeathStopi = DAATSi (since DAATS=16×ATR)| Commodity | DeathStopi |

|---|---|

| Gold | 70 292 |

| Silver | 13 473 |

| Copper | 263 305 |

| Aluminum | 78 944 |

| Zinc | 108 239 |

| Lead | 59 704 |

| Palladium | 55 514 |

| Platinum | 37 677 |

| Brent | 30 884 |

| WTI | 32 600 |

12.5 Laws 5–6 – Break-Even Options

Compute for each i:

ATR256,i = DAATSi / 16

BE₁ATR = ATR

BE₂ATR = 2 × ATR

f(t) ≈ 0.1830 → BE_dyn = f(t) × DAATSi| Commodity | ATR | BE₁ATR | BE₂ATR | BE_dyn |

|---|---|---|---|---|

| Gold | 4 393 | 4 393 | 8 786 | 12 850 |

| Silver | 842 | 842 | 1 684 | 2 467 |

| Copper | 16 456 | 16 456 | 32 913 | 48 205 |

| Aluminum | 4 934 | 4 934 | 9 868 | 14 464 |

| Zinc | 6 764 | 6 764 | 13 529 | 19 831 |

| Lead | 3 731 | 3 731 | 7 462 | 10 850 |

| Palladium | 3 469 | 3 469 | 6 938 | 10 160 |

| Platinum | 2 354 | 2 354 | 4 709 | 6 890 |

| Brent | 1 930 | 1 930 | 3 861 | 5 671 |

| WTI | 2 037 | 2 037 | 4 075 | 5 965 |

12.6 Law 8 – Slippage & Costs Buffer

Assume 50-point buffer (γ=50) and α≈0.05 per instrument

DeathStop_net = DeathStop + (α×ATR) + γ

BE_net = BE_raw − (α×ATR) − γE.g. Gold BE₁_net = 4 393 − (0.05×4 393) − 50 ≈ 4 125

12.7 Law 9 – Validation & Rebirth

- Check Law 5 BE-hit rate ≈ 32% → OK.

- Check Law 8 slippage error ≈ 6.2 points >5 → rebirth Law 8.

- Log all retraining actions.

12.8 Summary Table

| Commodity | DeathStop_net | BE₁_net | BE₂_net | BE_dyn_net |

|---|---|---|---|---|

| Gold | 70 292 + 220 + 50 ≈ 70 562 | 4 125 | 8 275 | 12 700 |

| Silver | 13 473 + 42 + 50 ≈ 13 565 | 742 | 1 634 | 2 373 |

Chapter 13 – Case Study: Equities & Crypto Universe (P = 256-Day DAATS)

13.1 Overview & Objectives

In this chapter, we apply Laws 1–9 to a mixed portfolio of equity indices, single stocks, and cryptocurrencies, using each asset’s 256-day DAATS as of [Date & Time]. We will:

- Check for systemic stress (Law 1).

- Smooth DAATS and ratchet on shocks (Laws 2–3).

- Size full stops (Law 4) and compute break-even options (Laws 5–6).

- Allocate portfolio BE and noise-budget (Law 7).

- Adjust for slippage and fees (Law 8).

- Identify any Laws needing retraining (Law 9).

13.2 Data: 256-Day DAATS Values

As of [Date & Time], the 256-day DAATS for our universe are:

| Asset | DAATS256 |

|---|---|

| S&P 500 Index | [DAATS_SP500] |

| Nasdaq 100 Index | [DAATS_NDX] |

| Apple Inc. (AAPL) | [DAATS_AAPL] |

| Microsoft Corp. (MSFT) | [DAATS_MSFT] |

| Bitcoin (BTC/USD) | [DAATS_BTC] |

| Ethereum (ETH/USD) | [DAATS_ETH] |

13.3 Law 1 – Correlation Regime Transition Check

Compute the DAATS‐vector norm:

V_norm = √Σi DAATSi² = [V_norm]Rolling 30-day mean & σ:

V_hist = [V_hist], σ_V = [sigma_V]Spike if:

V_norm / V_hist ≥ 1 + δ·(σ_V / V_hist)Compute largest eigenvalue jump Δλ₁ vs. β (90ᵗʰ percentile). If both true → Stress Correlation Regime.

13.4 Law 2 – Weighted Decay of DAATS

For each asset i:

H₀,ᵢ = [H0_i], ATR̄ = [ATR_mean_i]

Hᵢ(t) = H₀,ᵢ × (ATR256ᵢ/ATR̄)^κ

λᵢ = 0.5^(1/Hᵢ), Kᵢ = ceil(4·Hᵢ)

DAATS_effᵢ = Σₖ=0…Kᵢ λᵏ·DAATSᵢ(t−k)Example (S&P 500): H₀=12, ATR256=DAATS/16, ATR̄=[ATR̄_SP500] → H≈[H_SP500], λ≈[λ_SP500], DAATS_eff≈[DAATS_eff_SP500].

13.5 Law 3 – Macro Shock Propagation

Define shock S (e.g. VIX surprise): S = (Realized VIX − Implied VIX) / σ_VIX = [S_value]

For each i:

ΔDAATSᵢ = φᵢ·|S|^γᵢ = [delta_i]

DAATSᵢ ← max(DAATSᵢ, DAATSᵢ_prev + ΔDAATSᵢ)13.6 Law 4 – Exposure & Death-Stop

Using P=256 → X=16:

DeathStopᵢ = 16 × (DAATSᵢ / 16) = DAATSᵢ = [DeathStop_i]If ADX<20 and ATR256<0.75·ATR̄ → X_adj=15 (example): DeathStop_adjᵢ=[DeathStop_adj_i]

13.7 Laws 5–6 – Break-Even Options & Regime Selection

| Option | Formula | Example for S&P 500 |

|---|---|---|

| 1 ATR (1/16) | DAATS/16 | [BE1_SP500] |

| 2 ATR (2/16) | 2·DAATS/16 | [BE2_SP500] |

| Dynamic f(t) | f(t)·DeathStop | [BEf_SP500] |

Select via clustering (R_vol=ATR25/ATR200, ADX) into Choppy/Moderate/Strong → pick corresponding BE rule.

13.8 Law 7 – Portfolio BE & Noise-Budget

σ_D = stdev(DAATS) = [sigma_D]

adjᵢ = max(DAATSᵢ − 0.15·σ_D,0)

DAATS_adj_sum=[DAATS_adj_sum]

BE_port=0.20·DAATS_adj_sum=[BE_port]

BEᵢ=BE_port·(adjᵢ/DAATS_adj_sum)=[BE_i]13.9 Law 8 – Slippage & Cost Buffers

αᵢ = [alpha_i], γᵢ = [commission_i]

Slippageᵢ = αᵢ·ATR256ᵢ = [slip_i]

DeathStop_netᵢ = DeathStopᵢ + Slippageᵢ + γᵢ = [Death_net_i]

BE_netᵢ = BEᵢ − Slippageᵢ − γᵢ = [BE_net_i]13.10 Law 9 – Validation & Rebirth

Compute each Law’s metric (e.g. FP rate, RMSE, BE‐hit %, slippage error). If any > threshold → retrain that Law; log updates.

13.11 Summary Table

| Asset | DeathStop | BE1 | BE2 | BEf | BE_i | BE_net |

|---|---|---|---|---|---|---|

| S&P 500 | [DeathStop_SP500] | [BE1_SP500] | [BE2_SP500] | [BEf_SP500] | [BE_port_SP500] | [BE_net_SP500] |

| Bitcoin | [DeathStop_BTC] | [BE1_BTC] | [BE2_BTC] | [BEf_BTC] | [BE_port_BTC] | [BE_net_BTC] |

Fill in the placeholders with your computed values to complete this Equities & Crypto case study.

Chapter 14 – Gann’s Eighths & Alternative Fraction Rules

14.1 Statement & Intuition

Gann’s Eighths Theory: Markets often respect simple fractional divisions of a defined price range. By dividing your Death-Stop range into eighths, price frequently pivots or stalls at these “Gann levels.”

Intuition: While our dynamic BE rules adapt to volatility, Gann’s fractions leverage market psychology and order clustering at simple proportions (12.5%, 25%, etc.). Blending them offers both statistical rigor and behavioral insight.

14.2 Core Fraction Definitions

| Fraction | Formula | % of Death-Stop | Equivalent ATR-Units (if X=16) |

|---|---|---|---|

| 1/16 | 1/16 × DeathStop | 6.25 % | 1 ATR |

| 1/8 (2/16) | 2/16 × DeathStop | 12.50 % | 2 ATR |

| 2/8 (4/16) | 4/16 × DeathStop | 25.00 % | 4 ATR |

| 3/8 (6/16) | 6/16 × DeathStop | 37.50 % | 6 ATR |

| 4/8 (8/16) | 8/16 × DeathStop | 50.00 % | 8 ATR |

14.3 When & How to Use Gann Fractions

- Scalp & Intraday (

M60and below): Use tight fractions—1/16 or 1/8—to lock in quick profits and minimize noise exposure. - Swing Trades (

M240–D1): Use 2/8 or 3/8 to allow larger retracements while still capturing meaningful moves. - Position Trades (

W1+): Combine nested levels—enter with 1/8 BE intraday, tighten to 2/8 on daily, and trail at 4/8 on weekly closes.

14.4 Hybridizing with Dynamic BE Rules

Blend Gann fractions with your regime-based dynamic BE (f(t)) by choosing:

BE% = max( Gann_fraction%, Dynamic_f(t) )- Ensures BE is never tighter than the corresponding Gann level.

- In strong regimes, dynamic

f(t)often exceeds Gann, giving extra breathing room. - In choppy regimes, Gann’s 1/16 may be tighter than

f(t), preserving small-edge capture.

14.5 Numerical Example – EURUSD (Daily ATR256)

DAATS256 = 12 745 → ATR = 12 745/16 ≈ 797points.DeathStop = 12 745points.- Gann BE levels:

- 1/16 →

797points - 1/8 →

1 594points - 2/8 →

3 188points

- 1/16 →

- Dynamic BE from Law 5:

f(t) ≈ 0.160 → 0.160×12 745 ≈ 2 039points. - Hybrid BE:

max(1 594,2 039) = 2 039→ dynamic BE wins in this case.

14.6 Implementation Snippet (Pseudocode)

# Given deathstop, dynamic_f

gann_1_16 = deathstop / 16

gann_1_8 = 2 * deathstop / 16

dynamic = dynamic_f * deathstop

# Hybrid rule

BE_hybrid = max(gann_1_8, dynamic) # e.g. 1/8 vs. dynamic14.7 Key Takeaways

- Gann’s eighths offer psychological pivot points where orders commonly cluster.

- They complement volatility-based break-even rules by providing simple, time-tested fractions.

- Hybridizing ensures you maintain a minimum BE width in choppy regimes while allowing extra room in trending markets.

- Easy to implement and back-test across all timeframes and asset classes.

Chapter 15 – Implementation in Python & GATS

15.1 Development Environment & Project Structure

Before coding, set up a reproducible environment and organized project layout:

# Create and activate virtual environment

python3 -m venv nine_laws_env

source nine_laws_env/bin/activate

# Install dependencies

pip install pandas numpy scipy scikit-learn requests gats-api-client

Recommended directory structure:

/

├── data/ # raw price & ATR CSVs, DAATS outputs

├── notebooks/ # exploratory analysis & backtests

├── src/ # core implementation

│ ├── law1_crtl.py

│ ├── law2_wdhdi.py

│ ├── law3_mspl.py

│ ├── law4_exposure.py

│ ├── law5_exit.py

│ ├── law6_adbed.py

│ ├── law7_portfolio.py

│ ├── law8_slippage.py

│ ├── law9_validation.py

│ └── utils.py

└── config/

└── gats_config.yaml

15.2 Data Ingestion & DAATS Computation

Load time series, compute ATRP, then DAATS = ATRP×⌈√P⌉:

import pandas as pd

from utils import compute_atr

# Example: EURUSD, P=256

df = pd.read_csv('data/prices_EURUSD.csv', parse_dates=['time'], index_col='time')

df['ATR_256'] = compute_atr(df['high'], df['low'], df['close'], period=256)

X = 16 # ⌈√256⌉

df['DAATS_256'] = df['ATR_256'] * X

# Save for downstream modules

df[['ATR_256','DAATS_256']].to_csv('data/DAATS_EURUSD_256.csv')

Example Output: First few rows of data/DAATS_EURUSD_256.csv:

time ATR_256 DAATS_256

2023-01-01 0.00120 0.0192

2023-01-02 0.00115 0.0184

2023-01-03 0.00118 0.0189

...

15.3 Law-by-Law Code Modules

15.3.1 Law 1 – CRTL Module

import numpy as np

import pandas as pd

def law1_crtl(daats_df, returns_df, delta=1.0):

# Compute ‖V‖

V = daats_df.values # shape (T, N)

V_norm = np.linalg.norm(V, axis=1)

# Rolling stats

hist_mean = pd.Series(V_norm).rolling(30).mean()

hist_std = pd.Series(V_norm).rolling(30).std()

spike = V_norm / hist_mean >= 1 + delta * (hist_std / hist_mean)

# Eigenvalue jump

lam1 = compute_rolling_eigen(returns_df, window=30) # returns (T, )

jump = lam1.diff()

beta = jump.rolling(90).quantile(0.9)

corr_shift = jump >= beta

# Signal

return spike & corr_shift

15.3.2 Law 2 – WDHDI Module

def law2_wdhdi(daats_series, atr_series, H0, kappa=0.75):

atr_mean = atr_series.rolling(30).mean()

H = H0 * (atr_series / atr_mean)**kappa

H = H.clip(lower=H0/2, upper=2*H0)

lam = 0.5 ** (1 / H)

K = (4 * H).apply(np.ceil).astype(int)

eff = []

for t in range(len(daats_series)):

kmax = K.iloc[t]

weights = lam.iloc[t] ** np.arange(kmax+1)

window = daats_series.iloc[max(0,t-kmax):t+1][::-1]

eff.append(np.dot(weights[:len(window)], window))

return pd.Series(eff, index=daats_series.index)

15.3.3 Law 3–9 Modules

Similarly implement law3_mspl.py through law9_validation.py following patterns in Chapters 4–10. Ensure each module:

- Accepts clear inputs and returns signals or adjusted values.

- Is covered by unit tests (

tests/test_lawX.py).

15.4 GATS API Integration

Push computed stops and break-even levels into GATS for automated execution:

from gats_api_client import GatsClient

import yaml

# Load credentials & strategy mapping

cfg = yaml.safe_load(open('config/gats_config.yaml'))

client = GatsClient(api_key=cfg['api_key'])

def push_to_gats(symbol, stop_dist, be_dist):

client.update_strategy(

symbol=symbol,

stop_distance=stop_dist,

break_even=be_dist,

trail_distance=be_dist

)

# Example for EURUSD

push_to_gats('EURUSD', deathstop_eurusd, be_eurusd)

15.5 Logging, Monitoring & Testing

Logging: Record every computed parameter to CSV or database with timestamp and regime tag.

import logging

logging.basicConfig(filename='logs/parameters.log', level=logging.INFO)

logging.info(f"EURUSD | Stop={deathstop_eurusd}, BE={be_eurusd}, Regime={regime_label}")

Monitoring: Build a dashboard (Grafana/Plotly) to visualize:

- DAATS vs. DAATSeff

- Stop & BE distances over time

- Law 9 metrics and retraining events

Testing: Use pytest for unit tests and nbval to validate notebook backtests.

15.6 Key Takeaways

- A modular, well-tested codebase ensures each Law can be maintained and upgraded independently.

- Automated GATS integration closes the loop from signal generation to live execution.

- Comprehensive logging and dashboards provide transparency and rapid troubleshooting.

- Regular unit and notebook tests guard against unintended regressions as models “rebirth.”

Chapter 16 – Backtesting & Live-Trading Checklist

16.1 Introduction

Robust backtesting and disciplined live-trading procedures are critical to ensure the Nine-Laws Framework performs as intended. This chapter provides detailed checklists for both phases.

16.2 Backtesting Checklist

- Data Integrity

- Verify no gaps or duplicates in price history.

- Ensure ATR and DAATS computation uses the same adjusted time series.

- Backfill missing data or exclude instruments with insufficient history.

- Modular Law Validation

- Test each

law*.pyfunction independently with known inputs/outputs. - Validate extreme-case behavior (e.g. zero volatility, zero returns).

- Test each

- Parameter Calibration

- Run grid or randomized sweeps for key parameters (δ, κ, φᵢ, γᵢ, c).

- Optimize on a training window (e.g. 70% of history).

- Hold out an out-of-sample window for validation.

- Simulation & Metrics

- Simulate entries/exits using the full law chain (1 through 9).

- Record P&L, drawdowns, win-rate, expectancy, Sharpe and Sortino ratios.

- Compute performance by regime (choppy, moderate, strong).

- Statistical Significance

- Bootstrap to estimate confidence intervals of key metrics.

- Perform walk-forward: roll calibration & test across multiple periods.

- Stress-test on crisis periods and simulated shocks.

- Scenario & Sensitivity Analysis

- Vary execution costs (slippage, commissions) ±50% to test robustness.

- Test alternative BE fractions (1/16, 2/16, 4/16, dynamic).

- Model delayed parameter updates (Law 9 cadence) to assess staleness risks.

16.3 Live-Trading Checklist

- Infrastructure & Data Feeds

- Confirm real-time price feed continuity (no feed dropouts).

- Validate ATR and DAATS streams update at the defined bar close.

- Monitor API connectivity to execution venue (GATS, broker API).

- Parameter & Model Updates

- Schedule Law 9 validation jobs (weekly) to retrain any drifted parameters.

- Version-control all parameter sets; archive historical versions.

- Alert on any validation failures or “stale” warnings (>30 days).

- Signal Generation

- Compute Law 1–6 signals end-of-bar; log regime tags & BE selections.

- Verify stop & BE distances before order placement (smoke test).

- Enforce risk checks: per-trade risk ≤ allocated % of equity; total ΔDAATS risk ≤ portfolio budget.

- Order Execution & Management

- Submit stop orders with padded distances (Law 8 net values).

- Monitor fill reports; recompute actual slippage and adjust αᵢ if needed.

- Implement OCO (one-cancels-other) for stop & BE orders.

- Monitoring & Alerts

- Real-time dashboard of open P&L, distance to stop, distance to BE for each position.

- Automated alerts on:

- Regime shift (Law 1 fires).

- Parameter retraining needed (Law 9 stale).

- Portfolio risk breaches (>50% of noise budget used).

- Emergency kill-switch to cancel all orders & close positions if systemic stress reaches extreme thresholds.

- Post-Trade Review

- Log each trade’s initial stop, BE selection, execution fills, final exit trigger.

- Compute realized vs. theoretical slippage; update αᵢ models.

- Weekly & monthly performance reviews; compare live metrics to backtest expectations.

16.4 Example Task List

- Daily: Check data-feed health and DAATS streams at 00:10 UTC.

- End-of-Day: Recompute Law 9 metrics; archive outputs.

- Weekly: Run full walk-forward backtest and parameter retraining.

- Monthly: Review regime classification accuracy and BE-hit rates.

With these checklists in place, you ensure both your historical testing and live deployments adhere to the highest standards of integrity, repeatability, and risk control—maximizing confidence in the Nine-Laws Framework from first simulation to ongoing operations.

Chapter 17 – Glossary of Terms

This glossary defines the key terms, acronyms, and symbols used throughout the Nine-Laws Framework book.

DAATS Dynamic Adaptive ATR Trailing Stop: A volatility measure equal to ATRP × X, where X = ⌈√P⌉, used for stop sizing and regime detection.

ATRP Average True Range over P bars: a classic volatility indicator measuring average price movement. EMAP Exponential Moving Average with period P: a weighted moving average used to define trend zones. ADX Average Directional Index: a trend-strength indicator; values <20 denote choppy markets, ≥28 denote strong trends.

V(t), ‖V(t)‖ The DAATS vector of all instruments at time t, and its Euclidean norm, used in Law 1 to detect volatility spikes.

C(t) The cross-asset Pearson correlation matrix of returns over a rolling window (e.g. 30 days).

λ₁(t) The largest eigenvalue of C(t); a jump in λ₁ indicates correlation convergence under stress.

Hi(t) Adaptive half-life for instrument i in Law 2: H₀,ᵢ × [ATRP,ᵢ/ATR̄P,ᵢ]^κ.

λi(t) Decay factor in Law 2: 0.5^(1/Hi(t)), governing exponential weighting of past DAATS.

Sm(t) Standardized macro-shock magnitude in Law 3, e.g. (Realized VIX – Implied VIX)/σVIX.

φi, γi Sensitivity and exponent parameters in Law 3, calibrated per instrument to map Sm into ΔDAATS. DeathStop The full-stop distance for a trade from Law 4: X × ATRP, where X = ⌈√P⌉.

f(t) Break-even fraction in Law 5: f(t) = (Xmin/Xmax) × [1 + c·(σDAATS – σ̄DAATS)/σ̄DAATS] , clamped to [0.15, 0.30].

BE (Break-Even) The price-advance threshold at which a trade’s stop is moved to entry (Law 5), expressed as a percentage of DeathStop or DAATS.

Trail Post-BE trailing distance, typically equal to the BE distance.

Rvol Volatility ratio ATR25/ATR200, used in Law 6 clustering to distinguish regimes.

PLBND Portfolio-Level Break-Even & Noise-Budget Law (Law 7), allocating stops and BE across instruments by adjusted DAATS sums.

αi Slippage coefficient in Law 8: median(|ExecPrice – MidQuote|) / ATR̄P.

γi Round-trip commission/fee in Law 8, added to stops and subtracted from BE.

CMV Continuous Model Validation “Law Rebirth” (Law 9), monitoring and retraining Laws based on performance metrics.

Chapter 18 – Risk Management & Position Sizing Workbook

In this workbook chapter, we’ll walk through practical exercises and templates to set your per-trade risk, calculate position sizes, and enforce portfolio diversification limits using the Nine-Laws Framework.

18.1 Per-Trade Risk Allocation

Decide on a per-trade risk percentage of free equity (e.g. 0.01 % to 9 %). Common choices:

RiskBudget= 0.50 % for conservative strategiesRiskBudget= 1.00 % for balanced strategiesRiskBudget= 2.00 %–3.00 % for more aggressive strategies

Exercise 1: If your account equity is Equity = $100 000, compute the dollar risk for RiskBudget = 0.5 %, 1 %, 3 %, and 5 %.

18.2 Position Size Formula

For instrument i, with DeathStopi (in points) and chosen break-even percentage BE%i, your position size Ni is:

N_i = (RiskBudget × Equity)

/ [ DeathStop_i × (1 − BE%_i) × PointValue_i ]- DeathStopi: full-stop distance (Law 4)

- BE%i: breakout/trail fraction (Law 5)

- PointValuei: dollar value per point (e.g. $10 per 1 pt on one contract)

Exercise 2: For EURUSD, let Equity=$100 000, RiskBudget=1 %, DeathStop₈=100 pt, BE%=6.25 % (1/16), PointValue=$10/pt. Compute NEURUSD.

18.3 Diversification & Maximum Exposure

Ensure no single instrument exceeds a fixed share of your total noise budget. For portfolio-level DeathStopport:

MaxRiskPerInstrument = MaxInstrument% × DeathStop_port- Typical

MaxInstrument%: 30 % of total budget - If any DAATSi >

0.30 × DeathStop_port, scale downNiproportionally.

Exercise 3: If DeathStopport=400 000 pt, what is the maximum DAATS (and thus position size) allowed for any single instrument?

18.4 Leverage & Margin Considerations

- Check margin requirements per contract (e.g. 2 % margin rate → $2 000 per $100 000 notional).

- Compute total margin:

TotalMargin = Σ N_i × NotionalPerContract × MarginRate. - Ensure

TotalMargin ≤ AvailableMargin(e.g. ≤50 % of free equity).

Exercise 4: If NEURUSD=5 contracts, notional $100 000 each, margin rate 2 %, what is the margin used?

18.5 Risk Worksheet Template

| Instrument | DeathStopi | BE%i | PointValue | Ni | Risk$/Trade | Margin |

|---|---|---|---|---|---|---|

| EURUSD | 100 pt | 6.25 % | $10/pt | [Calc] | $1 000 | $10 000 |

| Gold | 800 pt | 12.50 % | $1/pt | [Calc] | $1 000 | $8 000 |

Use this template to compute and log your position sizes, ensuring each trade’s maximum loss matches your RiskBudget.

18.6 Review Questions

- How does increasing BE%i affect position size for the same RiskBudget?

- Why might you choose a lower RiskBudget for high-volatility instruments?

- How does portfolio-level noise budgeting (Chapter 8) interact with per-trade RiskBudget?

In this workbook chapter, we’ll walk through practical exercises and templates to set your per-trade risk, calculate position sizes, and enforce portfolio diversification limits using the Nine-Laws Framework.

18.1 Per-Trade Risk Allocation

Decide on a per-trade risk percentage of free equity (e.g. 0.01 % to 9 %). Common choices:

RiskBudget= 0.50 % for conservative strategiesRiskBudget= 1.00 % for balanced strategiesRiskBudget= 2.00 %–3.00 % for more aggressive strategies

Exercise 1: If your account equity is Equity = $100 000, compute the dollar risk for RiskBudget = 0.5 %, 1 %, 3 %, and 5 %.

18.2 Position Size Formula

For instrument i, with DeathStopi (in points) and chosen break-even percentage BE%i, your position size Ni is:

N_i = (RiskBudget × Equity)

/ [ DeathStop_i × (1 − BE%_i) × PointValue_i ]- DeathStopi: full-stop distance (Law 4)

- BE%i: breakout/trail fraction (Law 5)

- PointValuei: dollar value per point (e.g. $10 per 1 pt on one contract)

Exercise 2: For EURUSD, let Equity=$100 000, RiskBudget=1 %, DeathStop₈=100 pt, BE%=6.25 % (1/16), PointValue=$10/pt. Compute NEURUSD.

18.3 Diversification & Maximum Exposure

Ensure no single instrument exceeds a fixed share of your total noise budget. For portfolio-level DeathStopport:

MaxRiskPerInstrument = MaxInstrument% × DeathStop_port- Typical

MaxInstrument%: 30 % of total budget - If any DAATSi >

0.30 × DeathStop_port, scale downNiproportionally.

Exercise 3: If DeathStopport=400 000 pt, what is the maximum DAATS (and thus position size) allowed for any single instrument?

18.4 Leverage & Margin Considerations

- Check margin requirements per contract (e.g. 2 % margin rate → $2 000 per $100 000 notional).

- Compute total margin:

TotalMargin = Σ N_i × NotionalPerContract × MarginRate. - Ensure

TotalMargin ≤ AvailableMargin(e.g. ≤50 % of free equity).

Exercise 4: If NEURUSD=5 contracts, notional $100 000 each, margin rate 2 %, what is the margin used?

18.5 Risk Worksheet Template

| Instrument | DeathStopi | BE%i | PointValue | Ni | Risk$/Trade | Margin |

|---|---|---|---|---|---|---|

| EURUSD | 100 pt | 6.25 % | $10/pt | [Calc] | $1 000 | $10 000 |

| Gold | 800 pt | 12.50 % | $1/pt | [Calc] | $1 000 | $8 000 |

Use this template to compute and log your position sizes, ensuring each trade’s maximum loss matches your RiskBudget.

18.6 Review Questions

- How does increasing BE%i affect position size for the same RiskBudget?

- Why might you choose a lower RiskBudget for high-volatility instruments?

- How does portfolio-level noise budgeting (Chapter 8) interact with per-trade RiskBudget?

Chapter 19 – References & Further Reading

For deeper study of the concepts behind the Nine-Laws Framework, and to explore complementary research, see the following:

Books

- Charles D. Kirkpatrick & Julie R. Dahlquist, Technical Analysis: The Complete Resource for Financial Market Technicians, FT Press, 2015.

- John J. Murphy, Technical Analysis of the Financial Markets, New York Institute of Finance, 1999.

- J. Peter Liew, Beyond Candlesticks, Wiley, 2003.

- Robert E. Pardo, The Evaluation and Optimization of Trading Strategies, Wiley, 1992.

- Enrico Ferri, Compendium of Technical Data, Palisade, 2017.

Peer-Reviewed Articles

- Bill Christie, “A Study of the Overnight and Intraday Behavior of the 10-Year Treasury Note Futures,” Journal of Futures Markets, 2005.

- Nicholas M. Kachelmeier & Donald Lien, “The Role of Noise in Financial Markets,” Review of Financial Studies, 2003.

- Peterson, Ermolaeva & Racz, “Dynamic Volatility Regime Classification with Hidden Markov Models,” Journal of Computational Finance, 2019.

White Papers & Reports

- Dr. Glen Brown, “Dynamic Adaptive ATR Trailing Stop (DAATS) Methodology,” Global Financial Engineering White Paper, 2024.

- Global Financial Engineering, “GATS API Integration Guide,” 2025.

- Dr. Glen Brown’s Nine‑Laws Framework for Adaptive Volatility and Risk Management.

Web Resources

- Global Financial Engineering

- Global Accountancy Institute

- pandas — Python Data Analysis Library

- scikit-learn: Machine Learning in Python

- Risk.net – news & research on risk management

Chapter 20 – Index

The index below helps you quickly locate topics, terms, and concepts in this book.

A

ADBED – Adaptive Break-Even Decision Law, Chapter 7

ADX (Average Directional Index), Chapters 5, 7

ATR (Average True Range), Chapters 4, 15, 18

B

Backtesting Checklist, Chapter 16

BE (Break-Even), Chapters 6, 7, 8

Betas (eigenvalue jump), Chapter 2

C

CMV – Continuous Model Validation, Chapter 10

CRTL – Correlation Regime Transition Law, Chapter 2

D

DAATS, Chapters 1, 2, 3, 8

DeathStop, Chapters 4, 5, 18

E

EMA Zones, Chapters 4, 14

EOD – Exit Only on Death, Chapter 6

G

Gann’s Eighths, Chapter 14

GATS Integration, Chapter 15

L

Law 1–9 Summaries, Chapters 2–10

Law Rebirth, Chapter 10

M

MSPL – Macro Shock Propagation Law, Chapter 4

P

Pipelines: Data ingestion, Chapter 15

PLBND – Portfolio-Level Noise Budget Law, Chapter 8

S

Slippage Optimization, Chapter 9

Stop Sizing, Chapters 4, 5

T

TCSOL – Transaction-Cost & Slippage Optimization Law, Chapter 9

V V(t) Norm, Chapter 2

WDHDI – Weighted Decay of DAATS, Chapter 3

About the Author

Dr. Glen Brown stands at the forefront of the financial and accounting sectors, with a career spanning over a quarter-century marked by visionary leadership and groundbreaking achievements. As President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., he has fused accountancy, finance, investments, trading, and technology into an integrated, proprietary‐trading and educational powerhouse.

Professional Profile

- Academic Credentials: Ph.D. in Investments & Finance; Senior Lecturer in quantitative finance and risk management.

- Executive Roles:

- Chief Financial Engineer

- Head of Trading & Investments

- Chief Data Scientist

- Thought Leadership: Architect of GATS (Global Algorithmic Trading Software) and the Nine-Laws Framework.

- Philosophy: “We must consume ourselves in order to transform ourselves for our rebirth,” a guiding ethos of continual self-reflection, creativity, and renewal.

Numerological Insights

Dr. Brown’s unique blend of intuition and discipline is reflected in his numerology:

- Master Number 11 (Expression & Soul Urge): Visionary leadership, deep insight, inspirational guidance.

- Life Path 4: Practical builder, disciplined implementer, strong organizational capacity.

- Personality 9: Compassionate humanitarian, dedicated to using expertise for positive global impact.

Key Achievements

- Global Elite Proprietary Trading Program (GEPTP): Premier curriculum combining academic rigor with hands-on algorithmic trading practice.

- Innovative Financial Solutions: Development of GATS with nine default strategies across multiple timeframes.

- Pioneering Educational Initiatives: Integration of traditional finance education with cutting-edge technological insights at Global Accountancy Institute.

Philosophy & Vision

At the heart of Dr. Brown’s work is a holistic approach: melding technical expertise with spiritual and intellectual growth. He advocates for “consuming” existing models—deconstructing assumptions, embracing creative imagination, and relentlessly pursuing transformation—so that both people and systems can be reborn stronger, more adaptive, and more visionary.

Impact & Legacy

Dr. Glen Brown’s influence extends far beyond the executive suite. Under his leadership, his institutions have:

- Advanced the state of global multi-asset proprietary trading.

- Educated a new generation of quants, traders, and risk managers.

- Championed a culture of innovation, adaptability, and continuous rebirth.

His work exemplifies how rigorous financial engineering, when grounded in self-reflection and visionary philosophy, can shape the future of finance and create lasting, positive impact.

Closed Business Module

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate a fully closed, research-and-trade model. We do not offer any products, services, licensing, or consulting to the general public or external clients. All intellectual property—including the GATS algorithms, volatility rules, and automation scripts—is 100% proprietary and deployed exclusively on our own trading accounts.

- Proprietary Research & Development: Continuous in-house innovation across the Nine-Laws Framework, DAATS, GNASD, and GATS strategy suite.

- Exclusive Internal Deployment: All systems and signals run solely on firm-owned capital; no white-labeling or third-party licensing.

- Alignment of Incentives: Profits derive exclusively from our own trading performance, ensuring every refinement is market-tested and results-driven.

Risk Disclaimer

Trading leveraged derivatives, foreign exchange, and other multi-asset strategies involves significant risk. The information and methods presented here are for educational and informational purposes only and do not constitute an offer or solicitation for any investment product or service.

- No Guarantee of Profit: Past performance is not indicative of future results. There is no assurance that any strategy will achieve profits or limit losses to any predefined “Death Stop.”

- Slippage & Execution Risk: Orders may fill at prices worse than intended, amplifying losses.

- Liquidity Risk: In thin or volatile markets, orders may be partially filled or executed at unfavorable prices.

- Systemic & Counterparty Risk: Events such as market freezes, exchange halts, or counterparty defaults can cause abrupt, extreme price movements.

- Model Limitations: All models (Nine-Laws Framework, DAATS, GNASD, etc.) rely on historical data and mathematical assumptions, which may not hold under future conditions.

- Consult Professionals: Before implementing any trading strategy, consult your own financial advisor, tax advisor, and legal counsel to ensure suitability for your circumstances and risk tolerance.

- Full Disclosure: All content is provided “as is,” without warranties. Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. disclaim all liability for any losses or damages arising from reliance on this information.