Gold M60 Trade Review (May 22 & 23 Entries)

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

Applying Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss, with clear law references at each step.

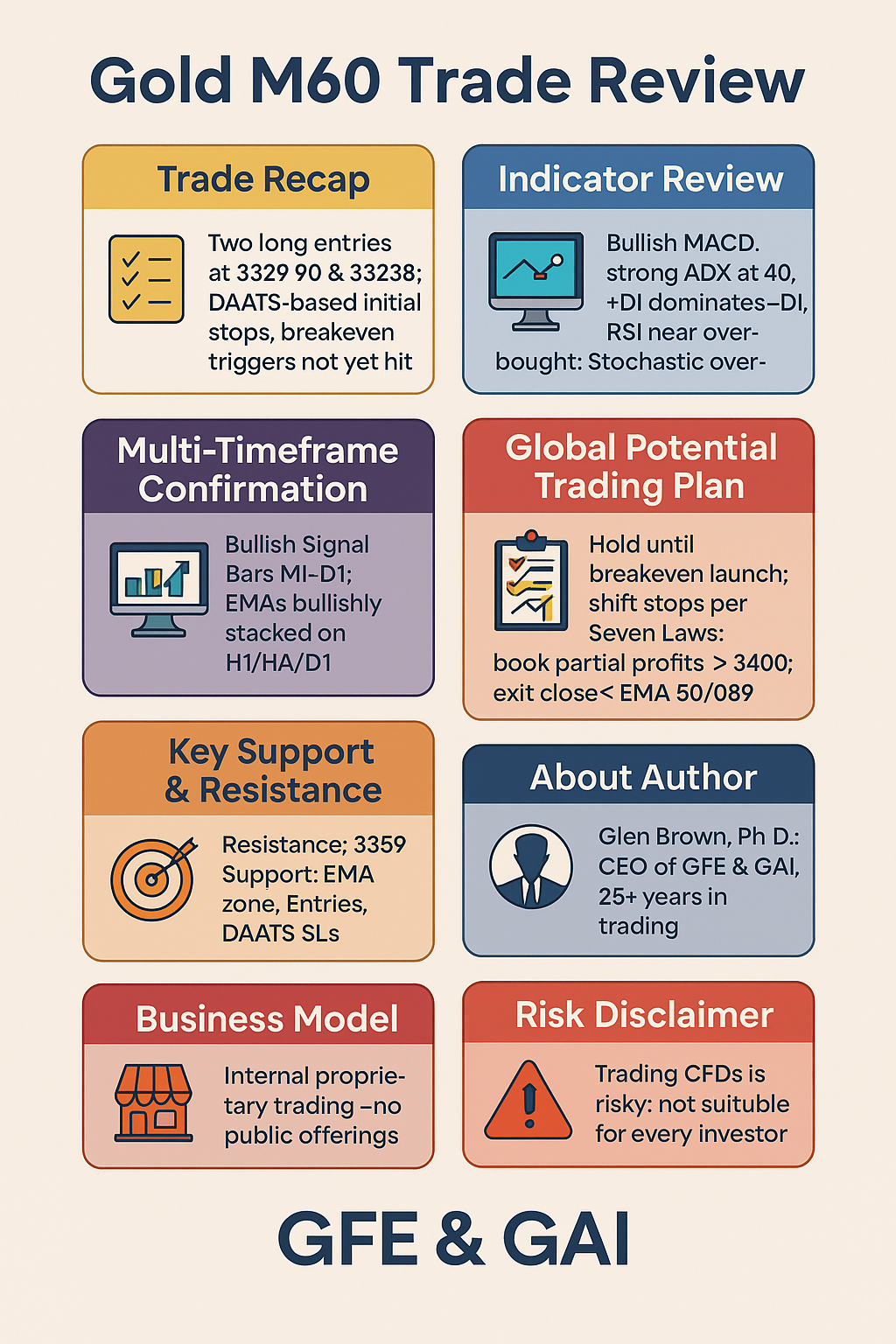

1. Trade Recap

- Entry 1: Long @ 3 329.90 (May 22)

- Law 3 Initial Stop (DAATS): 15 × ATR(200)=15 × 13.24 ≈ 198.6 pts → SL @ 3 131.30

- Law 4 Breakeven Trigger: L = 6 exposures → 6 × ATR(200)=6 × 13.24 ≈ 79.4 pts → BE @ 3 409.30 (not yet hit)

- Entry 2: Long @ 3 323.89 (May 23)

- Law 3 Initial Stop (DAATS): 15 × ATR(200)=198.6 pts → SL @ 3 125.29

- Law 4 Breakeven Trigger: +79.4 pts → BE @ 3 403.29 (not yet hit)

- Current Price: ~ 3 355.75

2. Detailed Indicator Review

| Indicator | Value | Interpretation |

|---|---|---|

| MACD (8,17,5) | Line 12.64 / Sig 10.86 / Hist +1.78 | Strong bullish momentum (Law 1 exposure). |

| ADX (14) | 40.7 ↑ | Trend strength well above 25 (Law 2 scaling). |

| +DI/–DI | +DI 26.3 / –DI 9.9 | Clear directional bias up (EMA structure). |

| RSI (10) | 69.9 | Approaching overbought—watch for pullbacks. |

| Stoch (9,3,3) | %K 82.8 / %D 95.3 | Deep overbought—potential consolidation. |

| ATR (14/25/200) | 11.11 / 12.56 / 13.24 | Full-zone volatility defines our stop (Law 1). |

3. Multi-Timeframe Confirmation

- Signal Bars MT5: All green M1–D1 → bullish alignment (Law 7 universe confirmation).

- EMA Stack (H1/H4/D1): EMAs 50 & 89 bullishly stacked and rising.

4. Global Potential Trading Plan (Next Session)

| Scenario | Trigger | Action |

|---|---|---|

| Hold (no BE yet) | Price < Breakeven triggers (3 409/3 403) | Maintain DAATS stops (Law 3). No trailing until BE. |

| Breakeven Achieved | Price ≥ Entry + 6×ATR(200) | Shift SL to entry (zero-risk) per Law 4; then trail by 6×ATR(200) per Law 5. |

| Partial Profit | Price ≥ 3 400 | Book 30%–50% gains; let remainder run under trailing stop. |

| Reversal Exit | M60 close < EMA 50/89 (~ 3 340) | Exit all longs—structure break. |

| Re-Entry on Pullback | M60 close > EMA 25 (~ 3 350) | New long with L=6 exposures stop; reset DAATS. |

5. Key Support & Resistance

- Resistance: 3 359.42 (recent high)

- Support: EMA 50/89 zone (~ 3 340), Entry levels (3 329.90 / 3 323.89), DAATS SLs (3 131.30 / 3 125.29)

About the Author

Dr. Glen Brown—President & CEO of Global Accountancy Institute, Inc. (GAI) and Global Financial Engineering, Inc. (GFE)—has 25+ years in proprietary trading, quantitative research, and financial education. With a Ph.D. in Investments & Finance, he created the GATS framework and GEPTP, blending hands-on innovation with academic rigor.

Business Model Clarification

GAI & GFE operate as internal proprietary trading firms only. We do not offer public courses or advisories; this content is for in-house research and trading desk development.

Risk Disclaimer

Trading derivatives and CFDs carries significant risk and is not suitable for every investor. This article is educational only and does not constitute financial advice. Always conduct due diligence and consult a licensed professional. Past performance is no guarantee of future results; you assume full responsibility.

Hashtags: #Gold #M60 #ATR #GATS #StopLoss #RiskManagement #TradingAnalysis #DrGlenBrown

Sponsored Content