Integrating Skewness & Kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

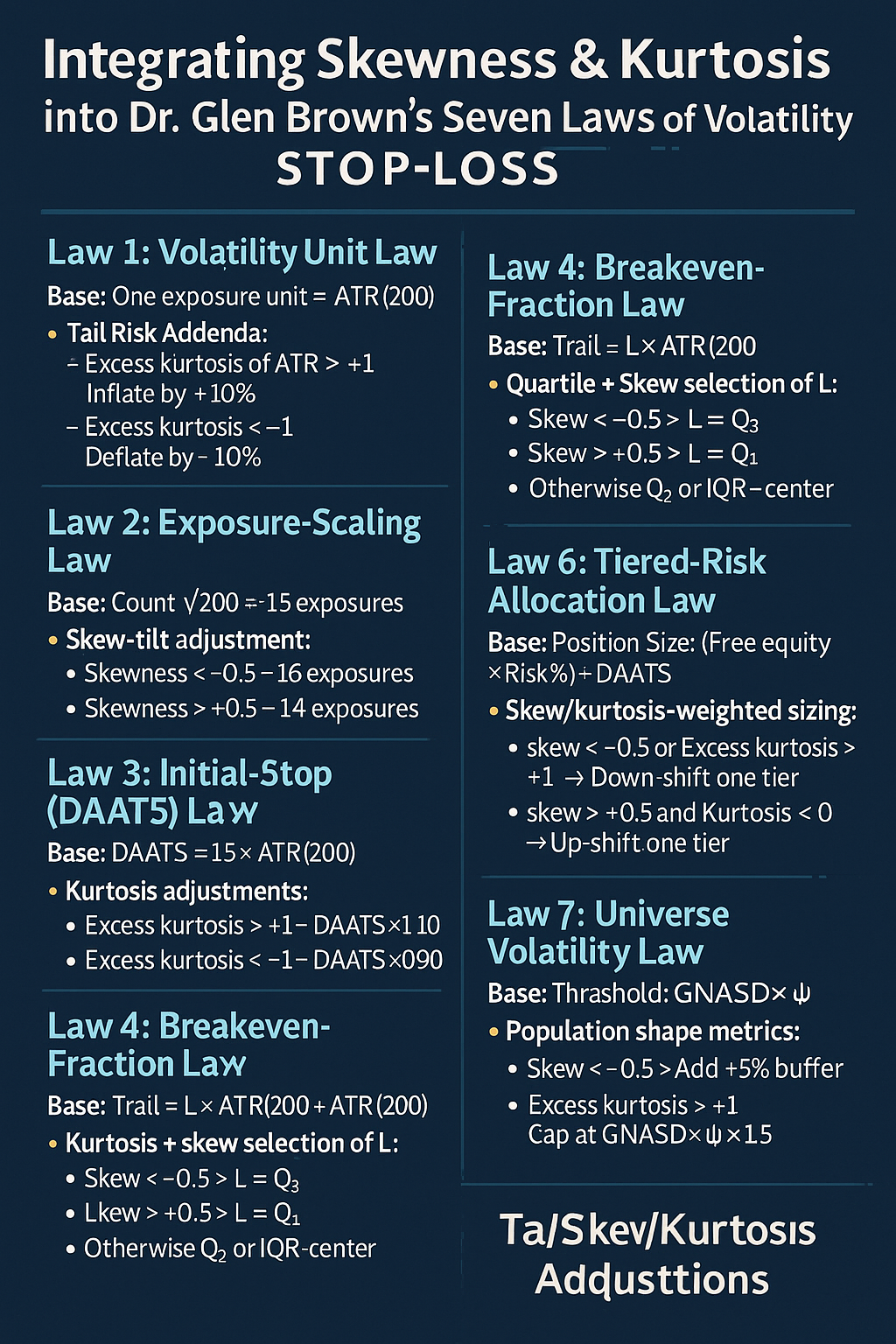

Building on our foundational seven-law stop-loss architecture, we now add skewness and kurtosis to make our stops and breakeven triggers tail-aware and asymmetry-sensitive—while remaining fully compliant with the GATS framework.

Law 1: Volatility Unit Law

Base: One Volatility Exposure = ATR(200).

Tail-Risk Addendum:

• If rolling excess kurtosis of ATR(200) > +1 → inflate exposure unit by +10% (use 1.1×ATR(200)).

• If excess kurtosis < –1 → deflate by –10% (use 0.9×ATR(200)).

Law 2: Exposure-Scaling Law

Base: Initial buffer count = √200 ≈ 14.14 → 15 exposures.

Skew-Tilt:

• If return-series skewness < –0.5 (fat left tail) → bump to 16 exposures.

• If skewness > +0.5 (fat right tail) → tighten to 14 exposures.

Law 3: Initial-Stop (DAATS) Law

Base: DAATS = 15×ATR(200).

Kurtosis Adjustment:

• Leptokurtic regimes (Excess Kurtosis > +1): DAATS ← DAATS × 1.10.

• Platykurtic regimes (Excess Kurtosis < –1): DAATS ← DAATS × 0.90.

Law 4: Breakeven-Fraction Law

Base: Breakeven Trigger = Entry + L×ATR(200).

Quartile + Skew Selection of L:

1. Q₁≈7, Q₂≈10, Q₃≈12 exposures.

2. If skew < –0.5 → L = Q₃ (deeper buffer).

3. If skew > +0.5 → L = Q₁ (early lock-in).

4. Otherwise use Q₂ or IQR-centered L.

Law 5: Trailing-Exposure Law

Base: Trail = L×ATR(200) behind price.

Kurtosis-Responsive Trailing:

• High-kurtosis → trail distance ← L×(1.10×ATR(200)).

• Low-kurtosis → trail distance ← L×(0.90×ATR(200)).

Law 6: Tiered-Risk Allocation Law

Base: Position Size = (Free Equity × Risk%) ÷ DAATS.

Skew/Kurtosis-Weighted Sizing:

• If skew < –0.5 or excess kurtosis > +1 → down-shift one risk tier.

• If skew > +0.5 and kurtosis < 0 → up-shift one tier.

Law 7: Universe Volatility Law

Base: GNASD = σₚₒₚ ÷ N (population SD of DAATS).

Population Shape Metrics:

• If population skew < –0.5 → add 5% buffer to cross-asset breakeven triggers.

• If population excess kurtosis > +1 → cap BE threshold at GNASD×Ψ×1.5.

Implementation Checklist

- Compute ATR(200) and rolling skewness/kurtosis of ATR(200) bars.

- Adjust ATR exposure unit per Law 1.

- Set exposure count per Law 2 using skew rules.

- Calculate DAATS with kurtosis tweaks (Law 3).

- Select L for breakeven per Law 4 using quartiles + skew.

- Apply trailing per Law 5 with kurtosis scaling.

- Size trade per Law 6, shifting tiers on shape extremes.

- Enforce portfolio-level breakeven overlays via Law 7.

Conclusion

By integrating skewness and kurtosis into each of Dr. Brown’s Seven Laws, your stop-loss and breakeven logic become fully tail-aware and asymmetry-sensitive—transforming stop management into a precise science that adapts to distribution shape, not just average volatility.

About the Author

Dr. Glen Brown, Ph.D. in Investments & Finance, is President & CEO of Global Accountancy Institute and Global Financial Engineering. With 25+ years in proprietary trading and quant research, he created the GATS framework and this tail-aware stop-loss architecture.

Business Model Clarification

Global Accountancy Institute and Global Financial Engineering are internal proprietary trading firms. We do not offer public courses or advisory services; all content supports in-house research and trading desk development.

Risk Disclaimer

Trading derivatives and CFDs carries substantial risk. This article is educational only and not financial advice. Always conduct your own due diligence and consult a licensed professional. Past performance is not indicative of future results; trade at your own risk.

Hashtags: #Volatility #ATR #Skewness #Kurtosis #StopLoss #RiskManagement #GATS #DrGlenBrown

Sponsored Content