Laws 4–5: Lock in Zero-Risk & Let Winners Run

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Summary:

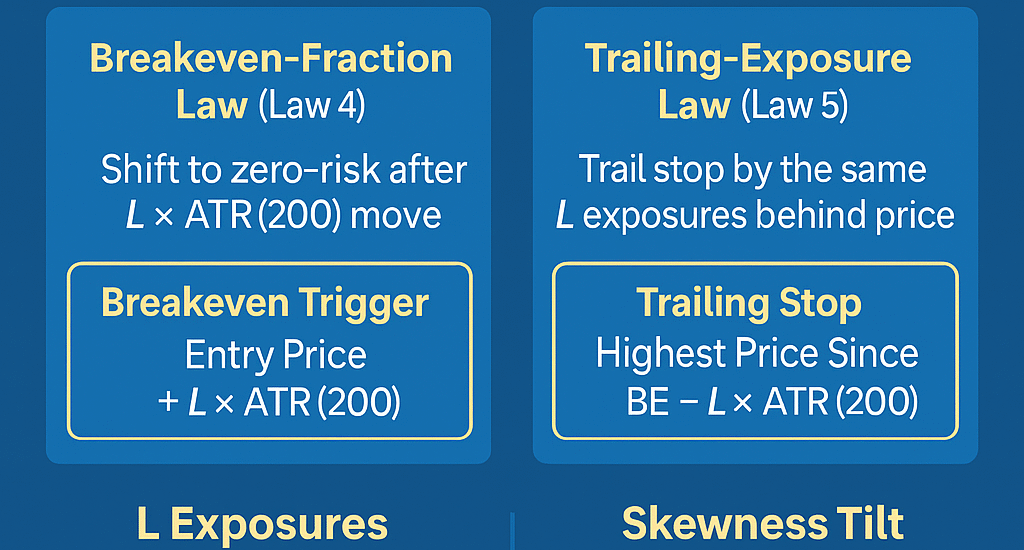

- Breakeven-Fraction Law: shift to zero-risk after L×ATR(200) move

- Trailing-Exposure Law: trail by the same L exposures behind price

- How to choose L via Quartiles (Q₁/Q₂/Q₃), IQR and skewness-tilt

Breakeven-Fraction Law (Law 4)

Once price has moved in your favor by L × ATR(200), you shift your stop to breakeven:

Breakeven Trigger = Entry Price + L × ATR(200)This ensures your trade carries zero downside risk only after it has fully covered its initial DAATS buffer.

Trailing-Exposure Law (Law 5)

After breakeven, trail your stop by the same L×ATR(200) distance behind price—never loosening:

Trailing Stop = Highest Price Since BE – L × ATR(200)This keeps your winners running under proven local volatility conditions.

Choosing L: Quartiles & IQR

Rather than a single default, select L from your √200 exposures (≈15) using distribution quartiles:

- Q₁ (25 %): √50 ≈ 7 exposures (~47 % of DAATS) – for tight, low-noise regimes

- Q₂ (50 %): √100 = 10 exposures (~67 % of DAATS) – balanced buffer

- Q₃ (75 %): √150 ≈ 12 exposures (~82 % of DAATS) – deep‐pullback tolerance

The IQR = Q₃ – Q₁ ≈ 5.18 exposures. Use it to interpolate L smoothly (e.g. ~9.6) or detect regime shifts.

Skewness-Tilt of L

Adjust L based on return-distribution skewness:

- If skew < –0.5 (fat left tail), choose L = Q₃ for extra buffer

- If skew > +0.5 (fat right tail), choose L = Q₁ to lock in profits early

- Otherwise default to L = Q₂ or IQR-centered value

Live Example: Platinum M60 (May 9 Entry)

• Entry @ 989.83 (M60)

• ATR(200) ≈ 4.75 → DAATS = 15×4.75 ≈ 71.25 pts

• Quartile exposures: Q₁≈7, Q₂≈10, Q₃≈12

• Skewness (ATR-bars) ≈ –0.3 → use L = Q₂ = 10

• Breakeven Trigger: 989.83 + 10×4.75 ≈ 1 037.33

• After BE, trail stop at High – 10×4.75 = High – 47.5 pts

About the Author

Dr. Glen Brown, Ph.D. in Investments & Finance, leads Global Accountancy Institute (GAI) and Global Financial Engineering (GFE). For 25+ years he’s pioneered quant-driven proprietary trading and education, crafting the GATS framework and these seven laws.

Business Model Clarification

GAI & GFE are internal proprietary trading firms only. We do not offer public courses or advisory services; all content serves in-house research and desk development.

Risk Disclaimer

Trading derivatives and CFDs involves substantial risk. This article is educational only and not financial advice. Always conduct your own due diligence and consult a licensed professional. Past performance is no guarantee of future results; trade at your own risk.

Hashtags: #BreakevenStop #TrailingStop #ATR #Quartiles #IQR #Skewness #Volatility #GATS #RiskManagement #DrGlenBrown

Sponsored Content