Platinum M60 Trade Review (May 9 Entry) Applying Dr. Glen Brown’s Seven Laws + Technical Indicator Deep-Dive

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

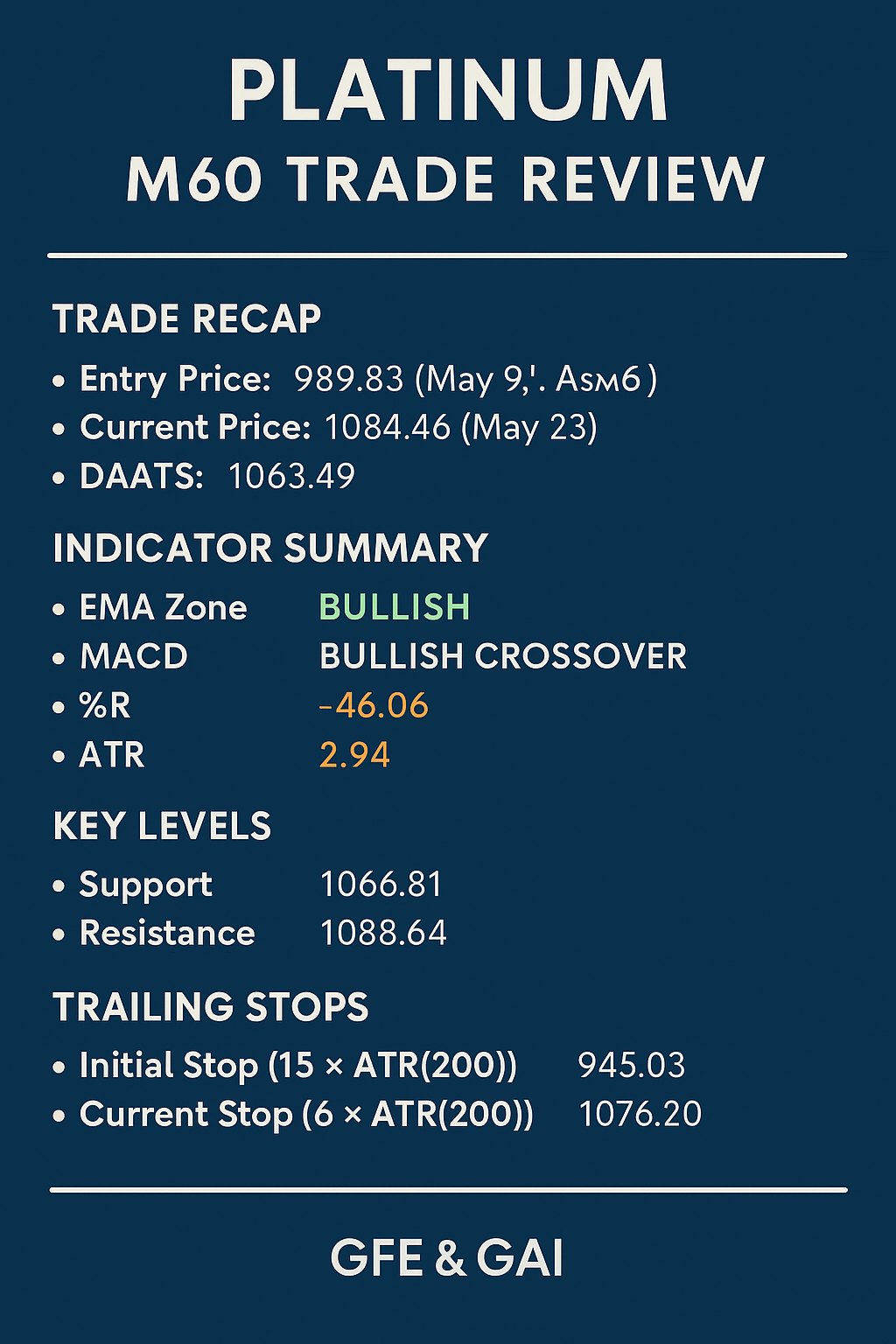

1. Trade Recap

- Entry: Long at 989.83 (May 9, 2025 13:43 GMT)

- Current Price: 1 084.46 (May 23, 2025 11:00 GMT)

- DAATS (Law 3): 15 × ATR(200) = 15 × 4.75 pts ≈ 71.25 pts → Initial SL at 918.58

- Breakeven Trigger (Law 4): 6 × ATR(200) = 6 × 4.75 = 28.5 pts → Breakeven at 1 018.33

- Current Trailing Stop (Law 5): 6 × ATR(200) behind high of 1 092.16 → 1 063.49

2. Detailed Indicator Review

| Indicator | Reading | Interpretation |

|---|---|---|

| MACD (8,17,5) | Line 2.14 / Signal 2.75 / Hist –0.61 | Bearish crossover, momentum waning after late‐May high. |

| ADX (14) & DMI | ADX 32.3 ↑ / +DI 15.6 / –DI 20.3 | Trend still strong (>25) but sellers (+DI vs –DI) entering. |

| Bulls Power (10) | –0.10 | Buyers’ strength has eased below zero. |

| Bears Power (10) | –2.30 | Moderate selling pressure present. |

| Force Index (8) | –12 509 | Negative volume spike on May 21—caution. |

| RSI (10) | 51.7 | Neutral midpoint; room for directional move. |

| Stochastic (9,3,3) | %K 32.5 / %D 53.9 | Exited oversold; weakening bullish attempt. |

| CCI (14) | +4.5 | Momentum balanced, no extremes. |

| ATRs | ATR(14)=5.46 < ATR(25)=6.77 > ATR(200)=4.75 | Short‐term churn above full‐zone volatility; stop valid but expect chop. |

3. Multi-Timeframe Confirmation

- Signal Bars MT5: All green M1→D1—up-trend intact despite M60 pullback.

- EMA Stack: EMAs 1–200 stacked bullishly on H1/H4, confirming larger-frame trend.

4. Global Potential Trading Plan (Next Session)

| Scenario | Trigger | Action |

|---|---|---|

| Hold & Trail | Price > Trailing SL at 1 063.49 | Continue holding; trail by 6×ATR(200)=28.5 pts |

| Partial Profit | Price ≥ Swing High 1 092.16 | Book 30% at ~1 042; let remainder ride trend |

| Trend Reversal Exit | M60 close < EMA 50/89 (~1 070) or MACD hist < 0 | Exit all longs—structure shift |

| Re-Entry on Pullback | M60 close > EMA 25 (~1 082) | Enter long with L=6 exposures stop; reset DAATS |

| Portfolio Check (Law 7) | Price hits GNASD BE trigger if applied | Optionally tighten/remap stops across metals per GNASD |

5. Key Support & Resistance

- Resistance: 1 092.16 (May 21 high)

- Support: EMA 50/89 zone (~1 070), Trailing SL 1 063.49, EMA 25 (~1 082)

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., with 25+ years in proprietary trading and quantitative finance. He holds a Ph.D. in Investments and Finance, and has pioneered multi-asset algorithmic strategies (GATS) and the Global Elite Proprietary Trading Program (GEPTP). As Chief Financial Engineer, Head of Trading & Investments, Chief Data Scientist, and Senior Lecturer, Dr. Brown merges academic rigor with hands-on innovation. His guiding maxim—“We must consume ourselves in order to transform ourselves for our rebirth”—drives his holistic approach to market analysis, technological integration, and professional development.

Business Model Clarification

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate exclusively as internal proprietary trading firms. We do not offer courses, advisory services, or products to the general public. All frameworks, laws, and methodologies shared here are for in-house research, education, and development of our professional trading desks.

Risk Disclaimer

Trading derivatives and CFDs involves substantial risk and may not be suitable for every investor. This article is for educational purposes only and does not constitute financial advice. Always perform your own due diligence and consult a licensed professional before making any trading decisions. Past performance does not guarantee future results; you assume full responsibility for any trades you execute.

Hashtags: #Platinum #GATS #ATR #StopLoss #RiskManagement #TradingAnalysis #DrGlenBrown