Quantum Narratives in EZIM — Mapping EMA Zones to Market States

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Quantum Narratives in EZIM

Quantum Narratives in EZIM — Mapping EMA Zones to Market States

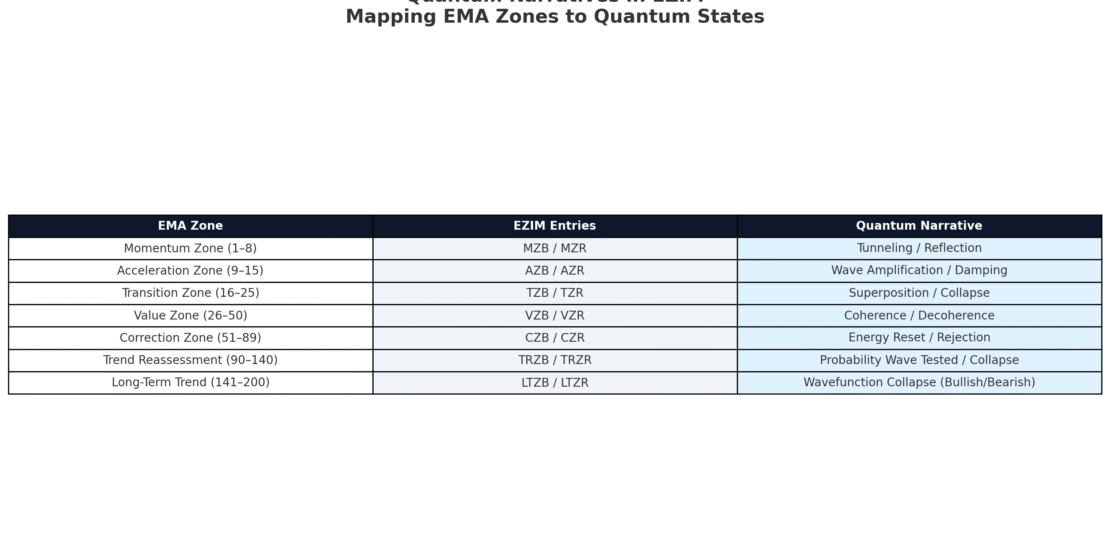

Markets are probability systems. Price is never fixed; it oscillates between acceptance and rejection until commitment is forced. The EMA Zone Interaction Model (EZIM) gives us a taxonomy of Bounces and Rejections, while the quantum narrative layer maps these events to the language of physics: tunneling, superposition, coherence, decoherence, and collapse.

1. Why Quantum Narratives?

Traders often struggle with uncertainty. Quantum mechanics provides metaphors for probability and decision-making under indeterminacy. By linking EZIM entries to quantum states, we anchor trading psychology in universal laws:

- Tunneling: Markets leap barriers like particles crossing forbidden zones.

- Superposition: Until resolved, price holds multiple potential outcomes.

- Coherence: Trend energy aligns into one dominant wave.

- Decoherence: Energy fragments, dispersing momentum.

- Collapse: Market commits — bullish or bearish — finalizing the wavefunction.

2. Bounce States (Bullish Narratives)

Each Bounce is a metaphor for quantum acceptance — energy absorbed, momentum preserved.

MZB (Momentum Zone Bounce) — Particle tunneling: bullish energy penetrates resistance instantly.

AZB (Acceleration Zone Bounce) — Wave amplification: momentum reinforced by coherence.

TZB (Transition Zone Bounce) — Superposition: probabilities collapse upward, trend resumes.

VZB (Value Zone Bounce) — Coherence restoration: scattered waves align in bullish unison.

CZB (Correction Zone Bounce) — Energy reset: system stabilizes, bullish charge renewed.

TRZB (Trend Reassessment Bounce) — Probability wave tested: resilience confirmed at deeper levels.

LTZB (Long-Term Trend Bounce) — Wavefunction collapse: market commits to long-term bullish identity.

3. Rejection States (Bearish Narratives)

Each Rejection is a metaphor for quantum denial — energy expelled, reversal enforced.

MZR (Momentum Zone Rejection) — Particle reflection: bullish attempts deflected instantly.

AZR (Acceleration Zone Rejection) — Wave damping: energy dissipates into bearish continuation.

TZR (Transition Zone Rejection) — Superposition collapse: probabilities resolve downward.

VZR (Value Zone Rejection) — Decoherence: bullish waves scatter, coherence lost.

CZR (Correction Zone Rejection) — Energy rejection: bullish charge expelled violently.

TRZR (Trend Reassessment Rejection) — Probability collapse: long-term bullish attempts denied.

LTZR (Long-Term Trend Rejection) — Wavefunction collapse: market commits to long-term bearish identity.

4. The Mirror of Duality

In physics, wave-particle duality shows that reality manifests as both particle and wave. In EZIM, this becomes Bounce-Rejection duality. Every bullish acceptance has a bearish denial, every upward coherence a downward decoherence. Recognizing this symmetry equips traders to accept both possibilities with equanimity.

5. Integrating Quantum Narratives into GATS

- Execution: Algorithms treat Bounce/Rejection as probabilistic states, confirming with MACD and DAATS.

- Risk: Stops align with collapse points — beyond boundaries where probability resolves.

- Psychology: Traders embrace uncertainty, recognizing indecision as superposition, not error.

Thus, EZIM becomes not just technical — but philosophical, aligning financial engineering with universal law.

About the Author

Dr. Glen Brown — President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. Visionary financial engineer advancing multi-asset proprietary trading frameworks.

Business Model Clarification

Global Accountancy Institute, Inc. & Global Financial Engineering, Inc. are closed-loop proprietary trading firms. We do not offer external services or products. Materials are for internal professional development only.

General Risk Disclaimer

Trading financial instruments involves high risk and may not be suitable for all investors. Losses can exceed deposits. This material is provided for educational purposes within our internal framework and does not constitute financial advice.

Published: September 14, 2025 · Framework: GATS / EZIM · Series: Part 3 of 7