-

Lecture 7: The Law of Drawdown in Time — Quantum Implications for Trade Longevity

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, GATS Methodology

No Comments

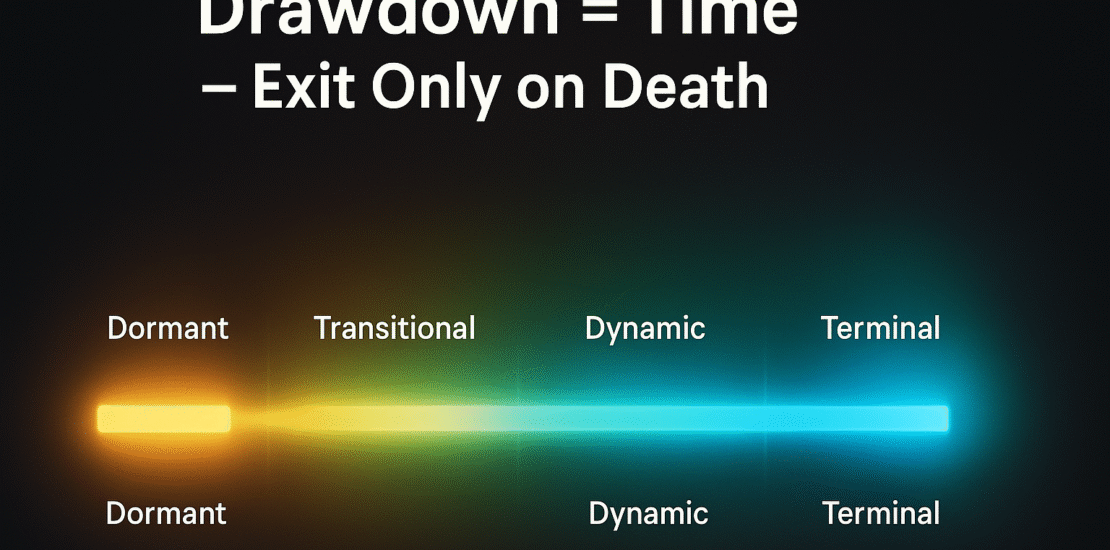

This lecture formalizes the GATS axiom that drawdown should cost time, not capital. We map equity drawdown to a temporal budget via ATR-regime geometry and codify how DS (Death-Stop), DAATS (Dynamic Adaptive ATR Trailing Stop), and the 18.75% Law synchronize to convert equity risk into structured time expenditure. We then extend this to portfolio heat, shock handling, and “Exit Only on Death” discipline, with quantitative tables and MT5/GATS implementation blocks.

-

Lecture 4: The 18.75% Law of Adaptive Transition — Symmetry Between Breakeven and Trail

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading

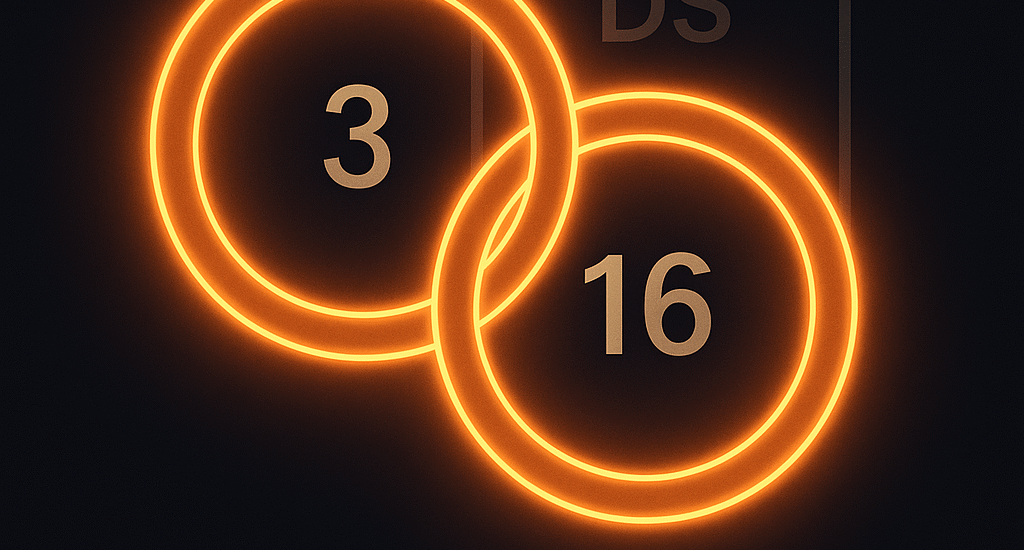

This lecture formalizes the 18.75% Law of Adaptive Transition within the Global Algorithmic Trading Software (GATS). The law defines the universal threshold at which a trade shifts from survival to expansion: the breakeven activation and the ongoing trail amplitude are both set to 3/16 of the Death-Stop (DS). By unifying these thresholds, GATS encodes a structural symmetry that converts drawdown into time and momentum into measured respiration. We provide derivations, tables, and MT5/GATS implementation logic for multi-asset deployment