-

The Adaptive Quantum Doctrine of Breakevens & DAATS in GATS

- November 22, 2025

- Posted by: Drglenbrown1

- Categories: Financial Engineering & Algorithmic Trading, Quantitative Risk Management

No Comments

Discover how GATS integrates Fractional Breakevens, Post-BE Dissipation, and DAATS into a quantum-adaptive risk system that minimizes drawdown and maximizes trend survival.

-

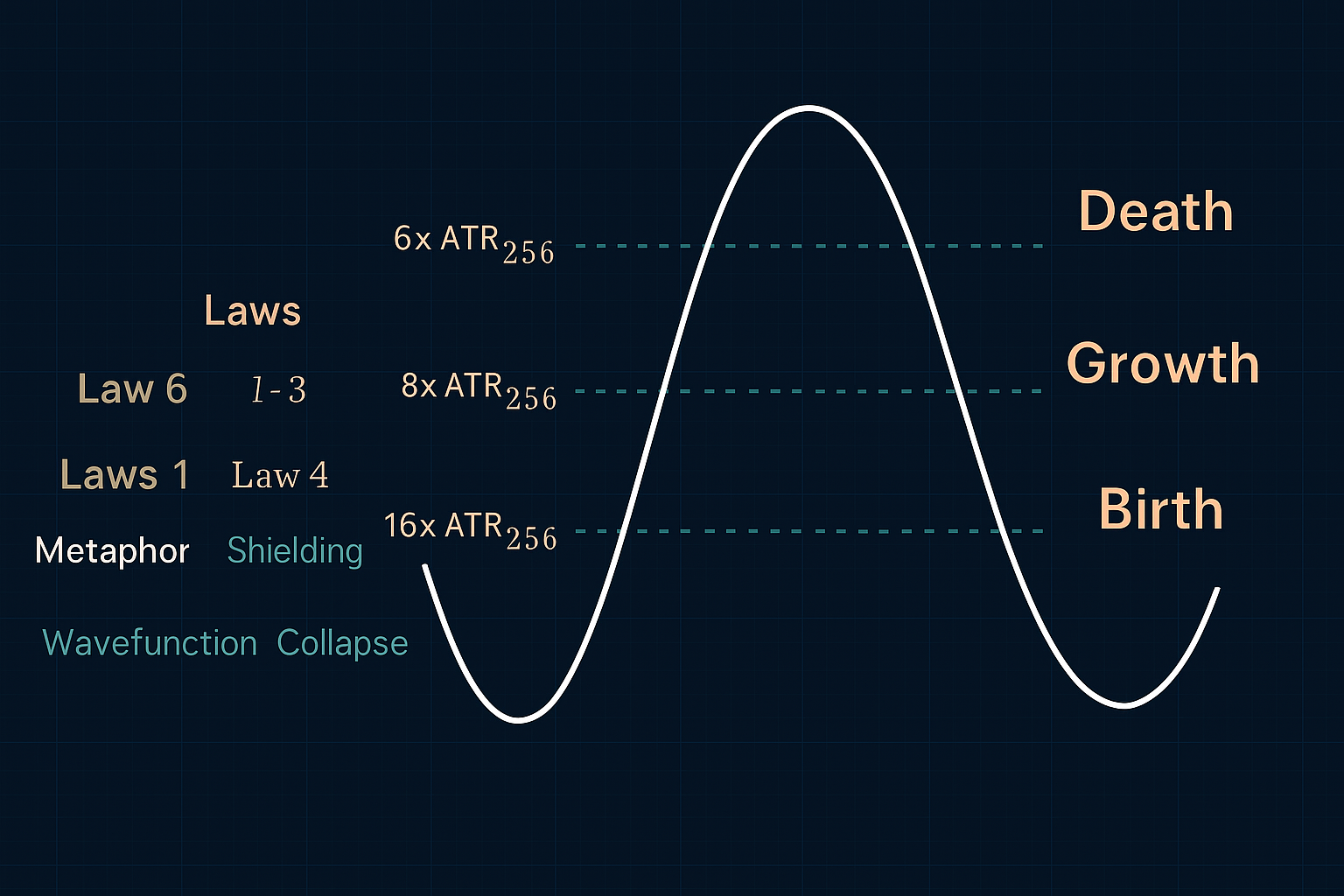

The Volatility Root Law – Part II: From Fractal Breakeven to Volatility-Defined Death

- July 20, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading, Risk Engineering

Part II of Dr. Glen Brown’s Volatility Root Law reveals a quantum volatility lifecycle framework that governs trade entry, breakeven, trailing stops, and exit using fractal amplitude theory and temporal anchoring—structured through the Nine Laws of Adaptive Risk.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum principles to market exits, volatility, and time. Part 2 of the Quantum Mindset series.

-

Adaptive Volatility Scaling in Financial Engineering: Integrating Technical Market Phases with the GATS Framework

- April 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore our cutting-edge methodology that combines the square root of time rule with GATS Color-Coded EMA Zones to create adaptive risk controls in financial engineering. This article delves into the theory and practical applications of dynamic volatility scaling for systematic trading.

-

Global Adaptive Statistical Break-Even Trigger (GASBET) Model

- April 4, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the GASBET Model—a dynamic break-even trigger that integrates statistical measures with our GATS Framework. Learn how leveraging the mean and standard deviation of DAATS values optimizes exit strategies and enhances risk management.

-

Building the Future of Systematic Trading: A Comprehensive Blueprint for Global Financial Engineering

- April 2, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the full organizational blueprint of Global Financial Engineering & Proprietary Trading Institute, where advanced financial engineering, adaptive risk management, and a dynamic units-of-allocation system combine to create an “ATM-like” proprietary trading fund.

-

Adaptive Risk Management in Action: Unlocking the Power of DAATS

- April 2, 2025

- Posted by: Drglenbrown1

- Categories:

Learn how adaptive risk management through the DAATS mechanism in the GATS Framework enhances trading performance by dynamically adjusting stop-loss levels to market volatility.

-

Case Study: Navigating EURUSD with the GATS Framework – A Comprehensive Analysis of a Bullish Trade on March 12, 2025

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore a comprehensive journey through trading strategies spanning from M1 to M43200. Discover how the GATS framework integrates adaptive, multi-timeframe approaches to capture market dynamics and optimize risk management.

-

Building a Competitive Edge: The Power of a Closed Business Model in Finance

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the transformative power of a closed business model in finance, where exclusive innovation and proprietary trading systems create a competitive edge for enduring success.

-

Blueprint for Enduring Excellence: Transformative Strategies in Global Financial Engineering

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the blueprint for enduring excellence in financial engineering. Learn how multi-timeframe strategies, adaptive risk management, and exclusive proprietary innovation are shaping the future of trading.

-

Visionary Leadership in Financial Engineering: The Legacy of Dr. Glen Brown

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the visionary leadership of Dr. Glen Brown and how his pioneering work in financial engineering is revolutionizing trading through advanced, adaptive systems and exclusive innovation.

-

The Art of Dynamic Trailing Stops: A Deep Dive into DAATS

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the dynamic world of trailing stops with DAATS, a cutting-edge risk management tool that adapts to market volatility and time scaling, enhancing trade performance and capital protection.

-

Exclusive Innovation: How GAI and GFE Are Shaping the Future of Trading

- March 11, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore how Global Accountancy Institute, Inc. (GAI) and Global Financial Engineering, Inc. (GFE) are pioneering exclusive innovations in trading, transforming risk management and setting new standards for the future of financial engineering.

-

Bridging Theory and Reality: Practical Applications of Financial Engineering

- March 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the journey from academic financial theories to real-world trading applications with the GATS framework, a revolutionary system that adapts dynamic strategies and risk controls for optimal market performance.

-

Volatility Averaging Across Asset Classes: A New Era in Unified Risk Management

- March 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the revolutionary approach of volatility averaging, which standardizes risk management across asset classes to create a unified, adaptive framework for modern trading.

-

Adaptive Risk Management Unleashed: The Dynamic ATR Trailing Stop (DAATS) Advantage

- March 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Learn how the Dynamic ATR Trailing Stop (DAATS) offers a groundbreaking, adaptive approach to risk management, seamlessly integrating volatility and time scaling for enhanced trading outcomes.

-

Multi-Timeframe Mastery: Harnessing Dynamic Trading Strategies for Maximum Impact

- March 9, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Learn how the GATS framework harnesses multi-timeframe analysis and adaptive risk management to create dynamic trading strategies that capture market opportunities with precision and resilience.

-

From Theory to Practice: How GATS is Redefining Algorithmic Trading

- March 9, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover how the GATS framework bridges the gap between financial theory and practical application, revolutionizing algorithmic trading with adaptive risk management and multi-timeframe strategies.

- 1

- 2