-

Temporal Liquidity Fields: The Geometry of Volatility Flow — Dr. Glen Brown

- October 27, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

No Comments

Dr. Glen Brown maps liquidity currents across timeframes in GATS, offering equations, metrics, and protocols to trade volatility flow safely and effectively.

-

Fractal Temporal Synchronization: The Law of Time-State Alignment — Dr. Glen Brown

- October 26, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

A detailed paper by Dr. Glen Brown revealing how multi-timeframe phase alignment generates exponential coherence through the GATS Framework.

-

Compression within Containment: Transforming Drawdown into Time — Dr. Glen Brown

- October 25, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

A detailed paper by Dr. Glen Brown showing how GATS turns drawdown into time through the M1440-anchored Death Stop and temporal elasticity during volatility compression

-

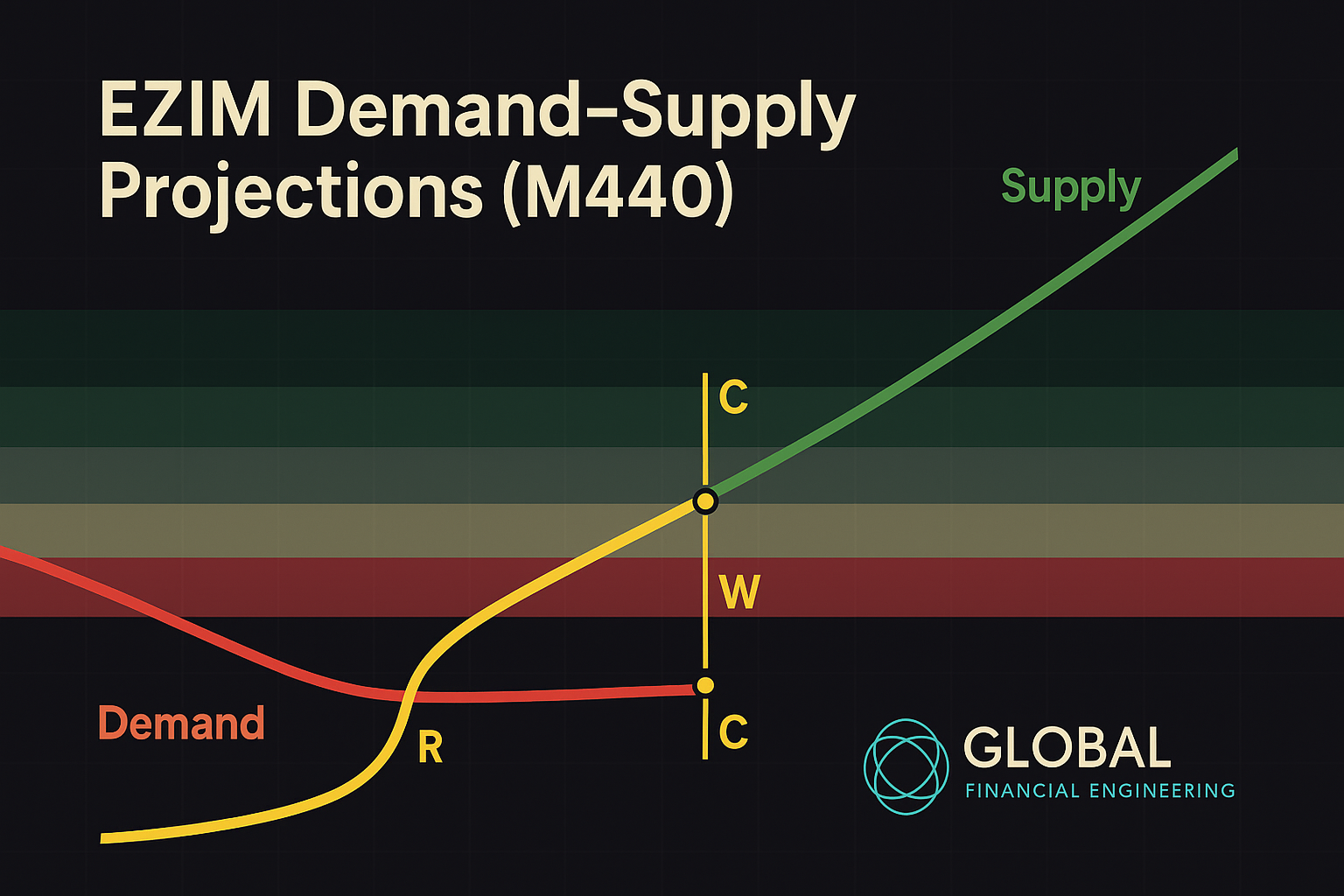

EZIM Demand–Supply Projections (M1440)

- September 28, 2025

- Posted by: Drglenbrown1

- Category: GATS / EZIM

EZIM interactions with downward-sloping demand and upward-sloping supply lines on M1440. Includes readable formulas, compression/energy metrics, MACD governance, signals, and coding hooks for GATS.

-

The Quantum Narrative of EMA Zones and MACD(15,25,8) – Part II

- August 31, 2025

- Posted by: Drglenbrown1

- Category: Quantum Trading Philosophy

Explore Bitcoin and EURUSD case studies, fractal uncertainty geometry, and the metaphysical laws of trading. A sacred quantum philosophy emerges, uniting financial engineering with the Nine Laws.

-

The Quantum Narrative of EMA Zones and MACD(15,25,8)

- August 31, 2025

- Posted by: Drglenbrown1

- Category: Quantum Trading Philosophy

A deep exploration of EMA Zones, MACD, and the Nine Laws reimagined as quantum mechanics operators and wavefunctions. A transformative trading philosophy.

-

Quantum Risk Mastery: Dr. Glen Brown’s Nine Laws Framework for Adaptive Volatility Stop-Loss and Risk Management

- August 3, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering & Trading Strategies

Discover how Dr. Glen Brown fuses quantum mechanics narratives with nine principled laws to create an adaptive volatility stop-loss and risk management framework—reinventing portfolio protection in today’s markets.

-

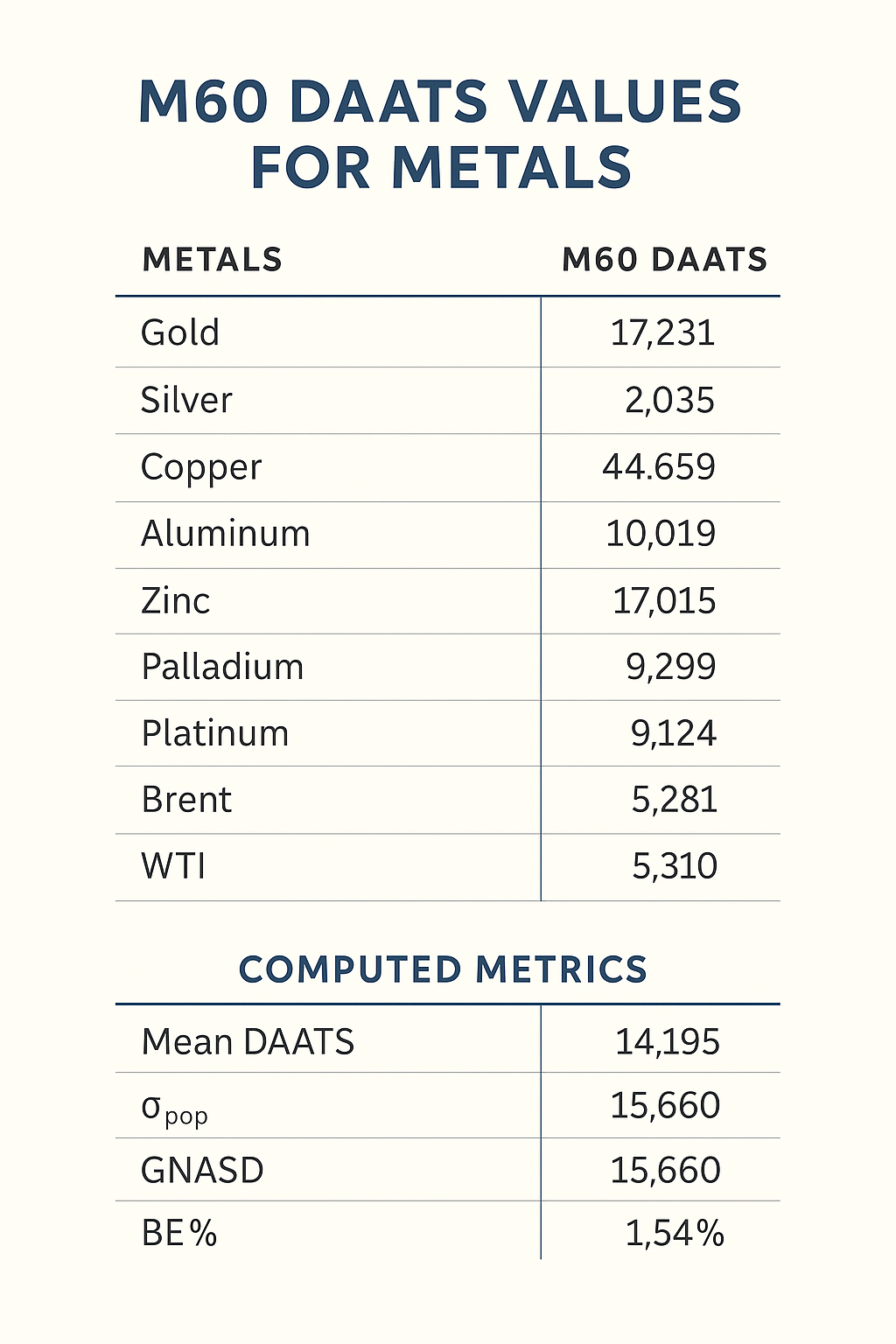

Calculating GNASD & BE% for M60 Metals Portfolio

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how to compute portfolio σpop, GNASD (one-sigma noise unit), and BE% for 10 metals (Gold, Silver, Copper, Aluminum, Zinc, Lead, Palladium, Platinum, Brent, WTI) using updated M60 DAATS values.

-

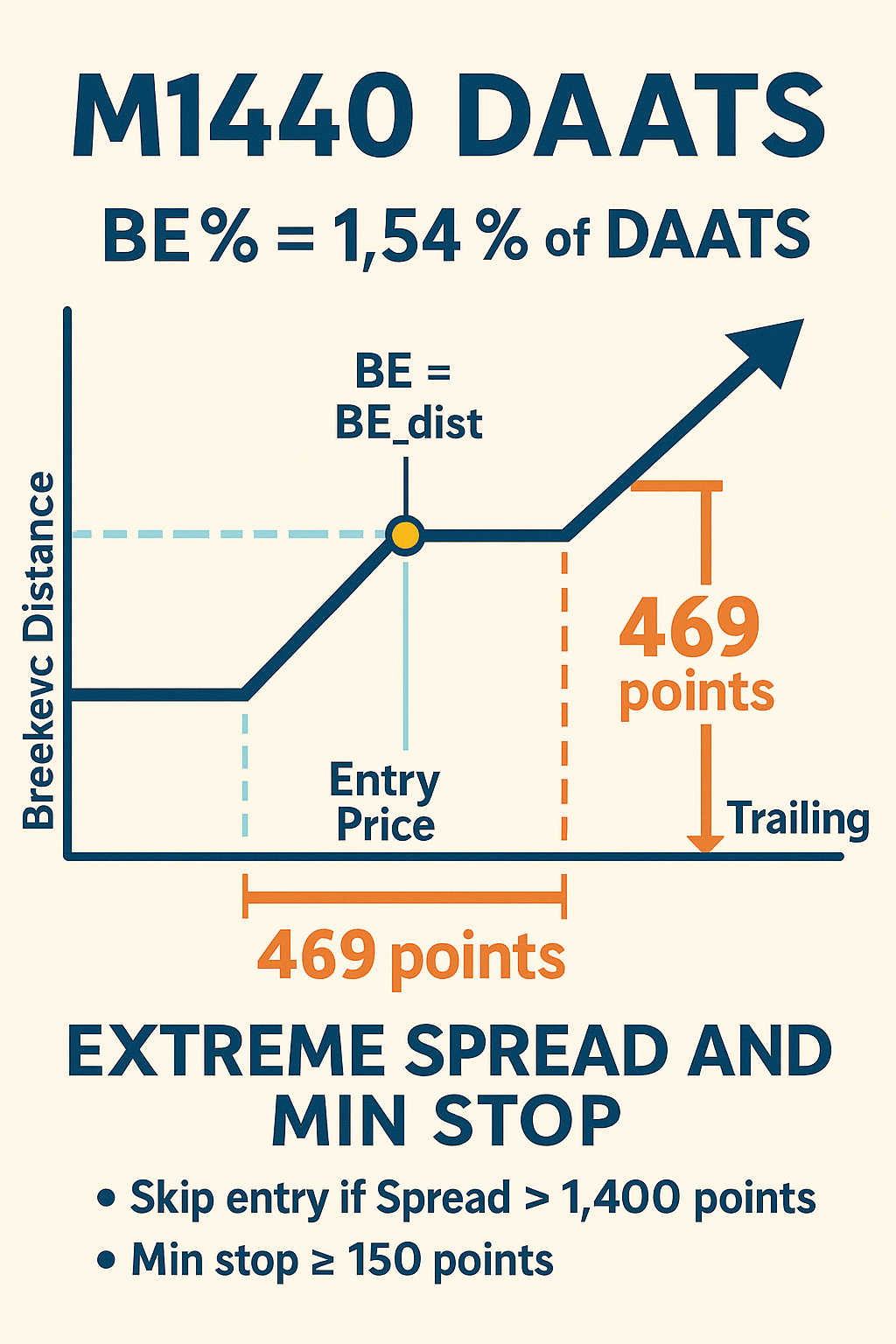

Final M1440 DAATS Lecture: Breakeven & Trailing Stops with Extreme Spread Handling

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn our final M1440 DAATS framework for 28 forex pairs: BE % = 1.54 % of DAATS, post‐BE trailing = 469 points, and skip entries if spread > 1 400 points, all aligned with Dr. Brown’s Seven Laws.

-

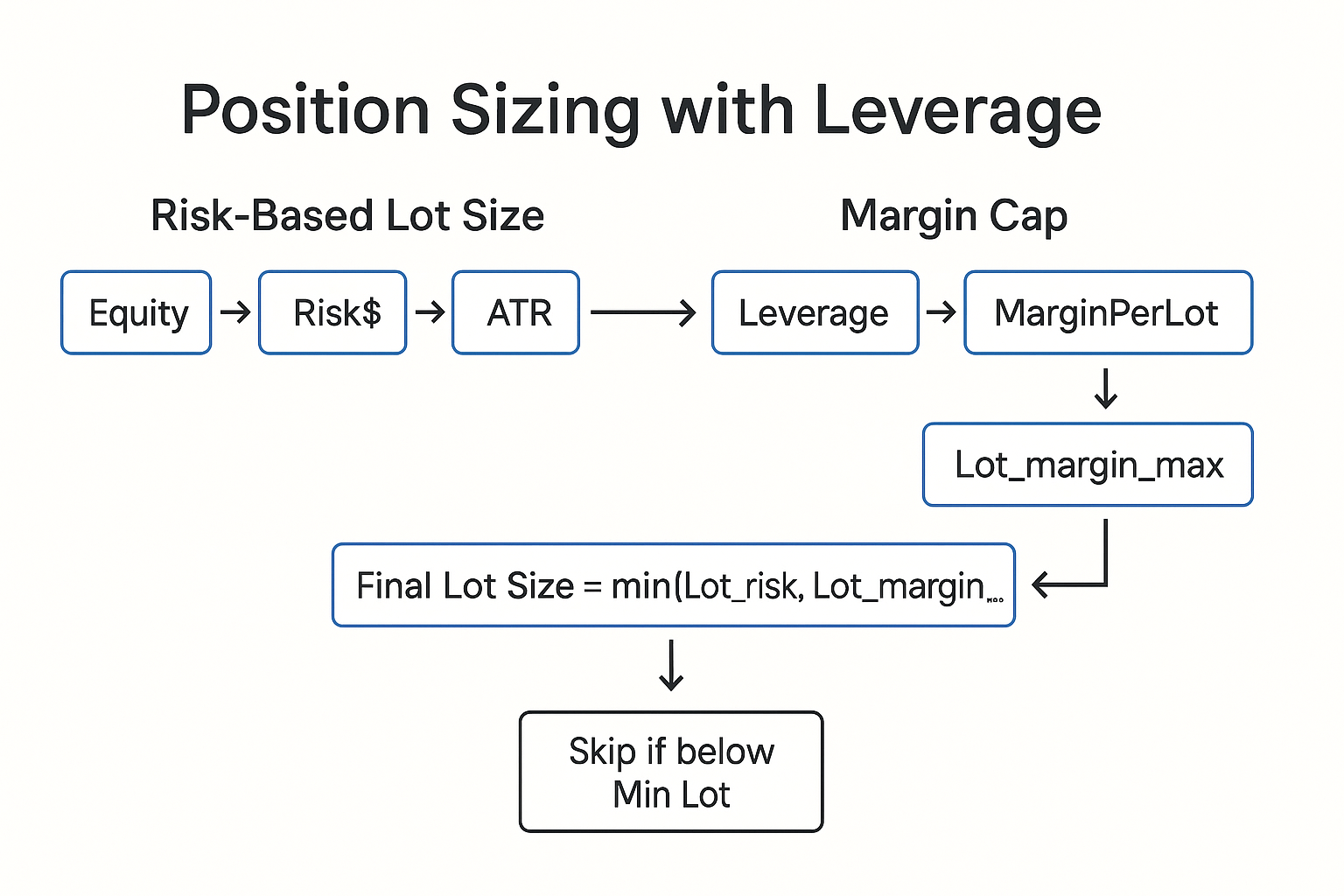

Position Sizing Under Extreme Leverage in Dr. Glen Brown’s Seven-Law Framework

- May 29, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Learn how to incorporate extreme leverage into Dr. Glen Brown’s Seven-Law volatility stop-loss framework for disciplined position sizing

-

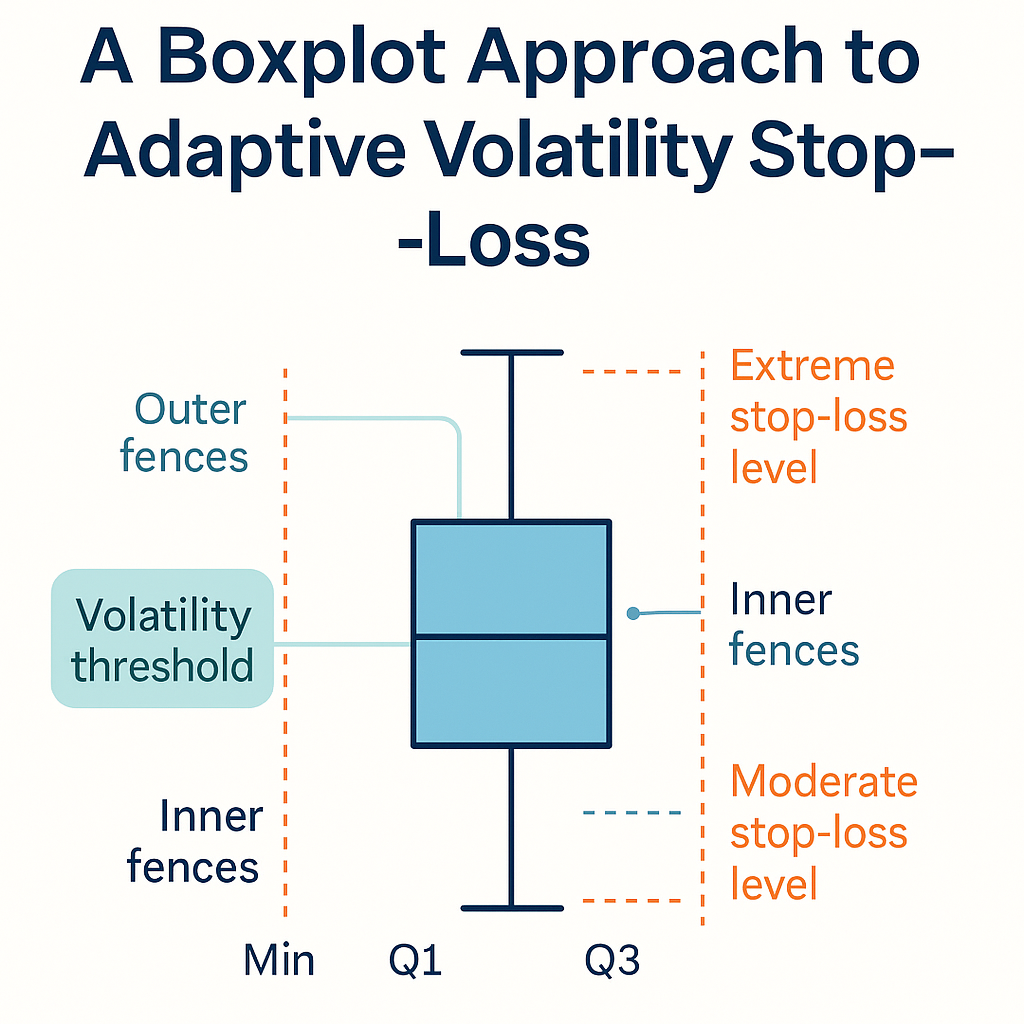

Whiskers & Fences: A Boxplot Approach to Adaptive Volatility Stop-Loss

- May 26, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to apply boxplot hinges, whiskers and fences to Dr. Glen Brown’s Seven Laws to detect regime shifts and dynamically adjust stop-loss buffers using ATR(200) exposures.

-

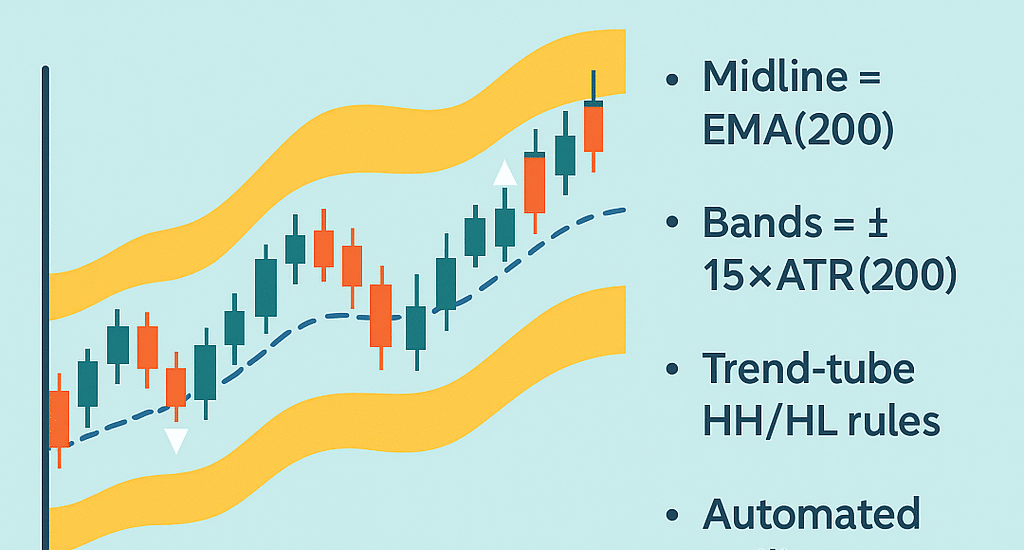

Keltner Reinvented: Embedding k = 15 into Your Trend Envelope

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to implement an adaptive Keltner Channel with EMA(200) midline and ±15×ATR(200) bands, including Pine/MT4 code, trend-tube rules, and automated trailing.

-

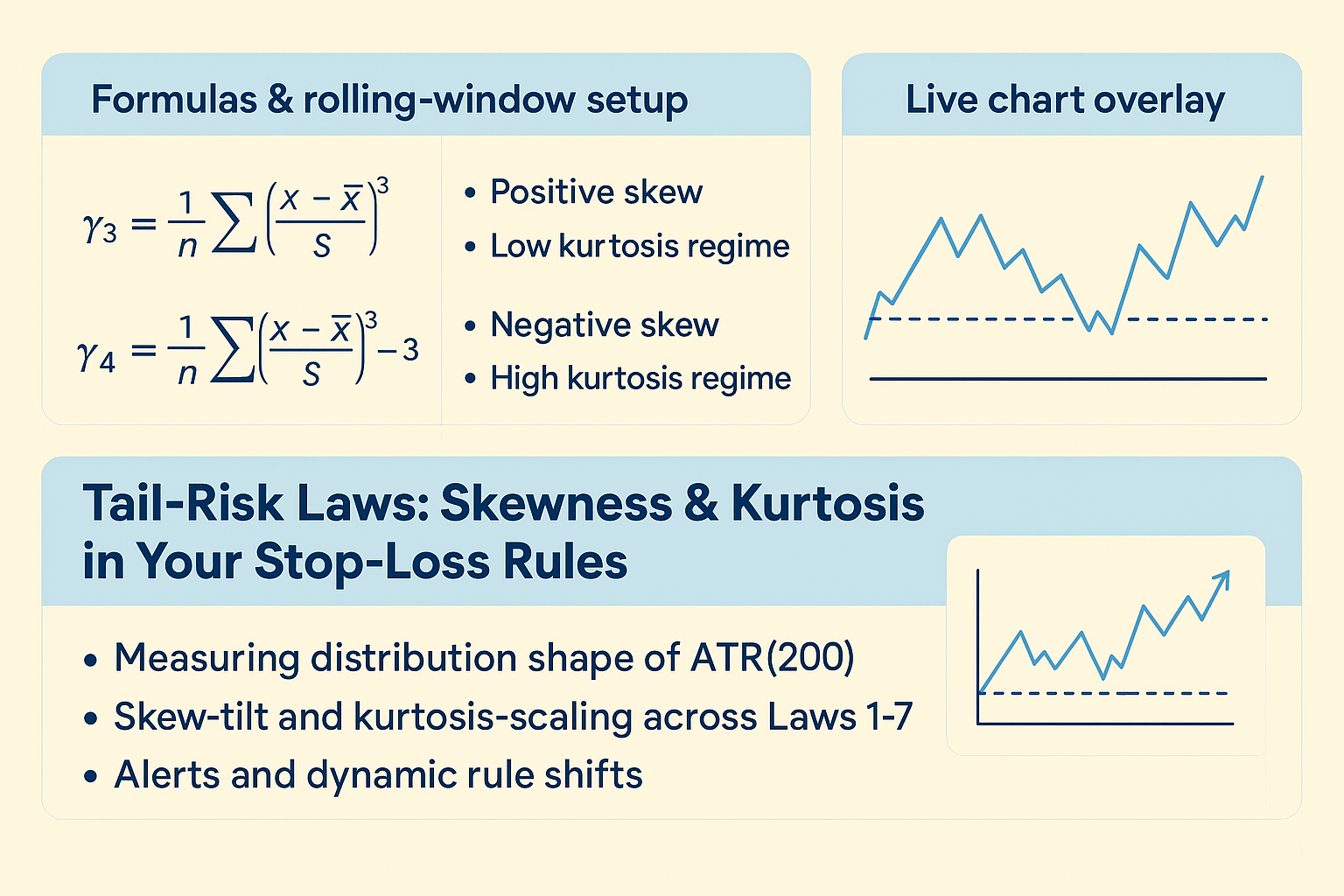

Tail-Risk Laws: Skewness & Kurtosis in Your Stop-Loss Rules

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to measure ATR(200) skewness and kurtosis, apply skew-tilt & kurtosis-scaling to Dr. Glen Brown’s Seven Laws, and view live chart overlays for dynamic stop adjustments.

-

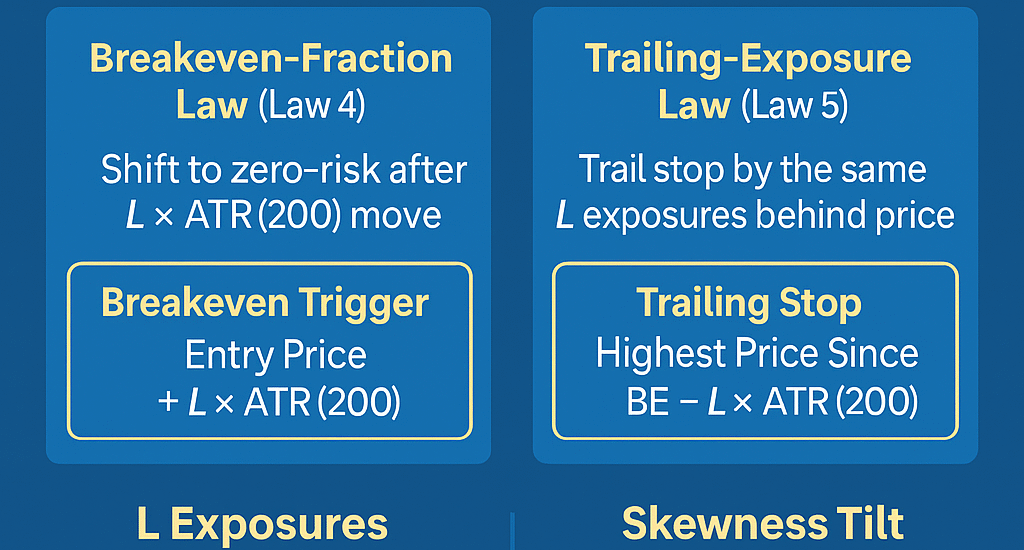

Laws 4–5: Lock in Zero-Risk & Let Winners Run

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Master Laws 4–5 of Dr. Glen Brown’s framework—adaptive breakeven triggers and trailing stops using quartile/IQR and skewness—to lock in zero risk and let winners run.

-

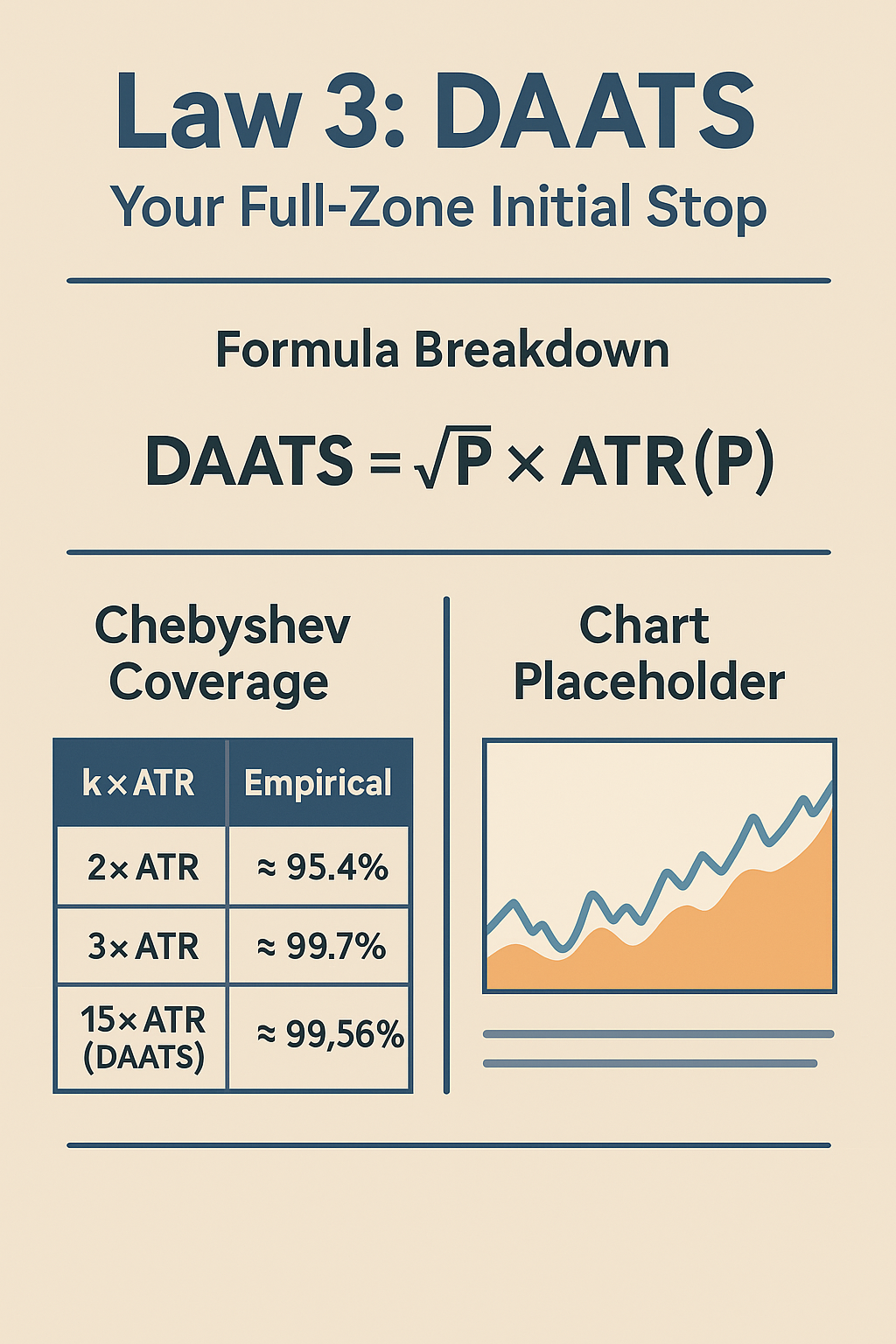

Law 3: DAATS—Your Full-Zone Initial Stop

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Law 3 of Dr. Glen Brown’s Seven Laws: DAATS = √P×ATR(P). Learn the formula, Chebyshev’s worst-case guarantee, and see an example trade with DAATS plotted.

-

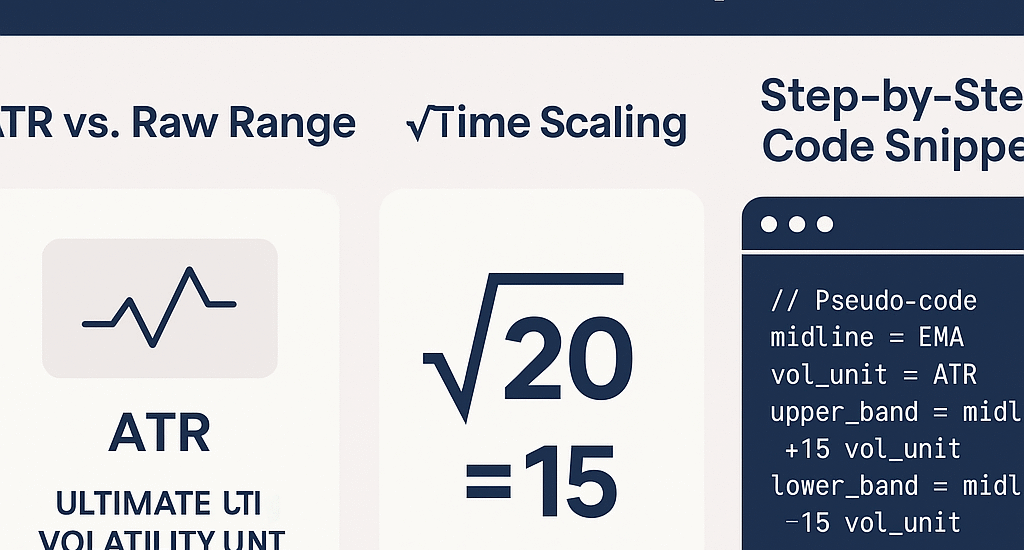

Law 1–2: Anchor Your Stops to ATR(200) & √Time Exposures

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn why ATR(200) is the ultimate volatility unit and how √time scaling (√200≈15 exposures) underpins adaptive stop-loss management, with step-by-step chart implementation.

-

Beyond ATR: Introducing Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover why static ATR-based stops fail and explore Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—anchored by √time scaling, DAATS and GNASD—for a truly adaptive risk framework.

-

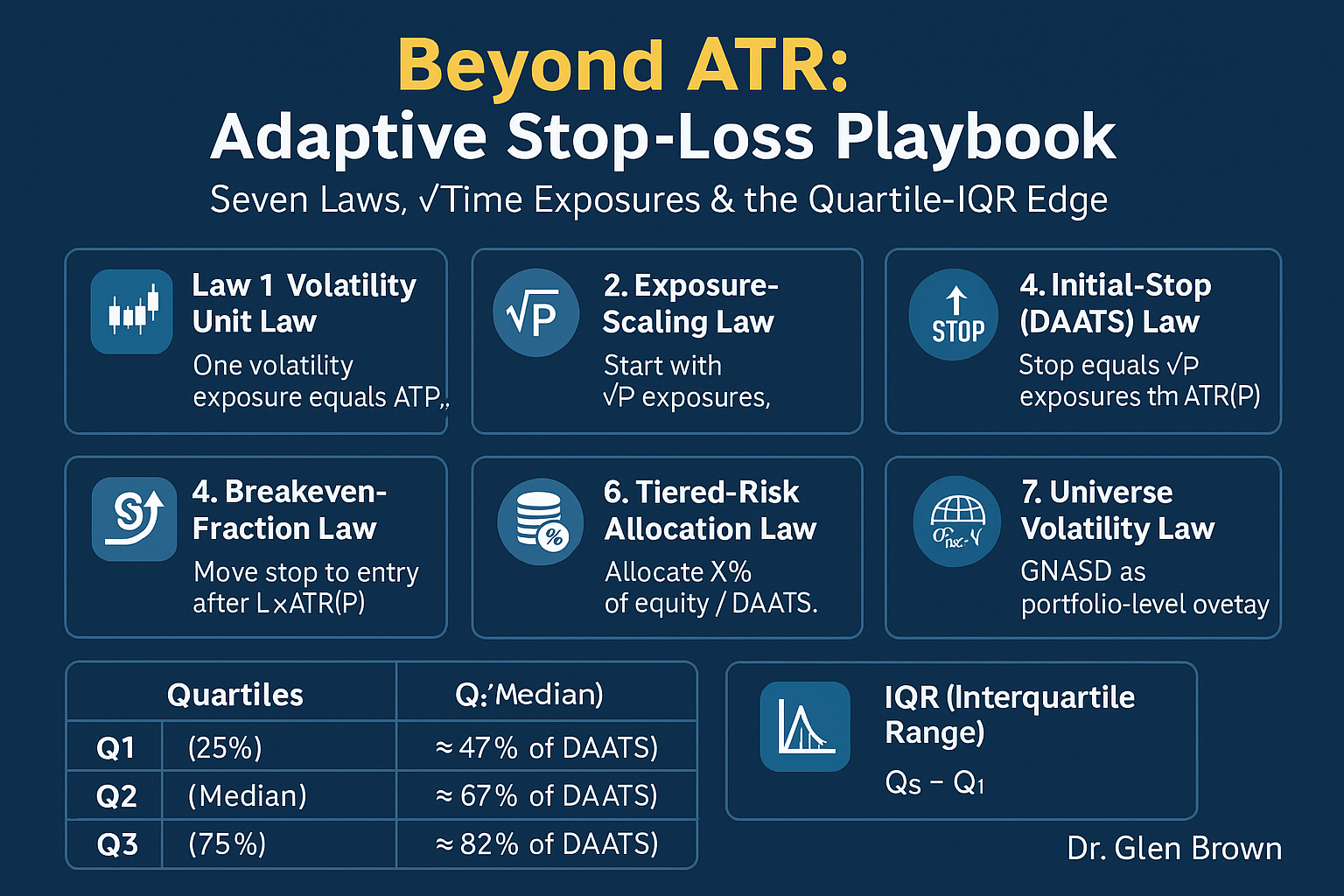

Beyond ATR: Dr. Glen Brown’s Adaptive Stop-Loss Playbook—Seven Laws, √Time Exposures & the Quartile-IQR Edge

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Dr. Glen Brown’s next-level stop-loss framework: seven universal laws, √time volatility exposures, and quartile/IQR techniques for adaptive breakeven and trailing stops.

- 1

- 2