-

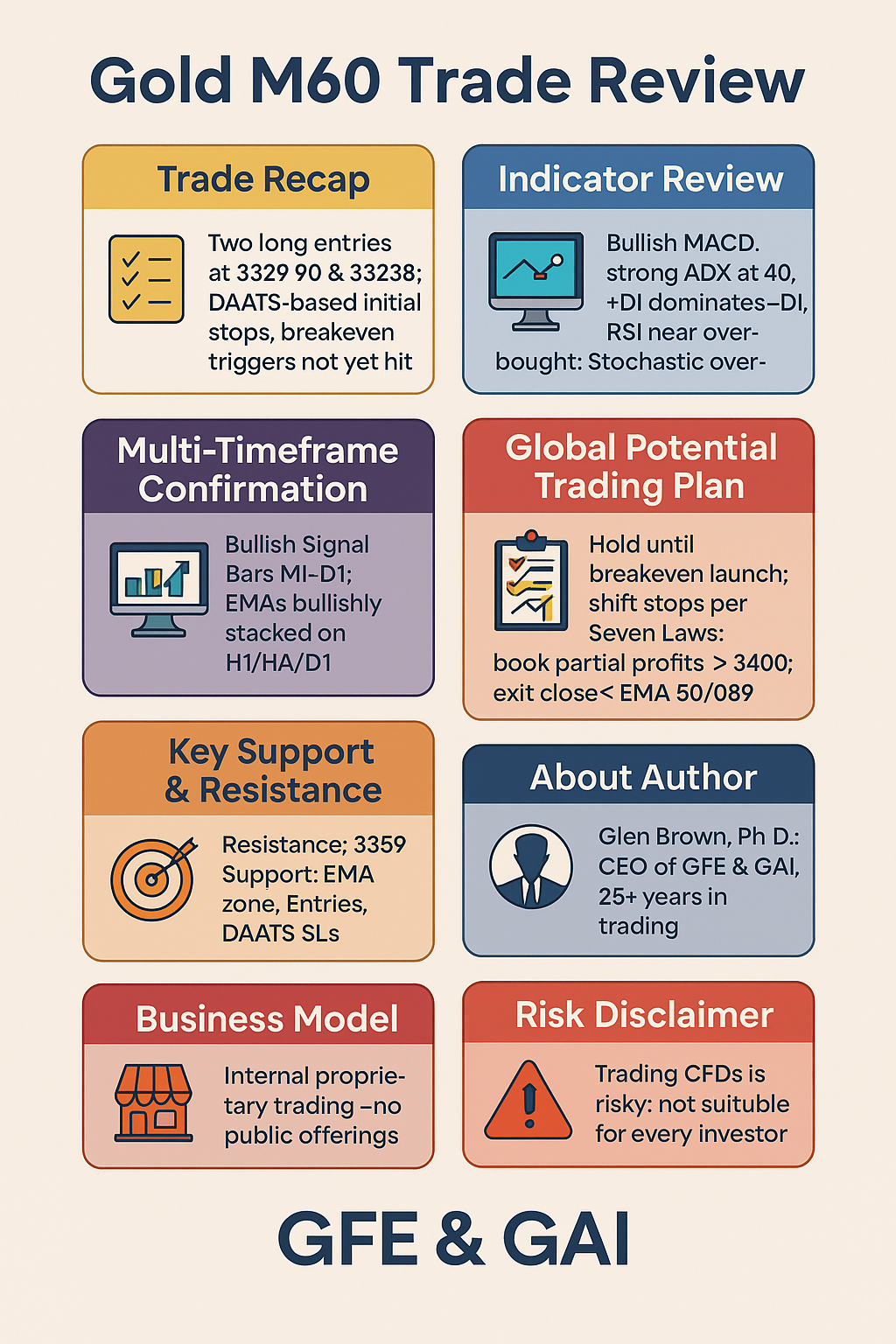

Gold M60 Trade Review (May 22 & 23 Entries)

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

No Comments

Detailed Gold M60 trade review using Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—entry, stops, breakeven triggers, indicator deep-dive and next-session plan.

-

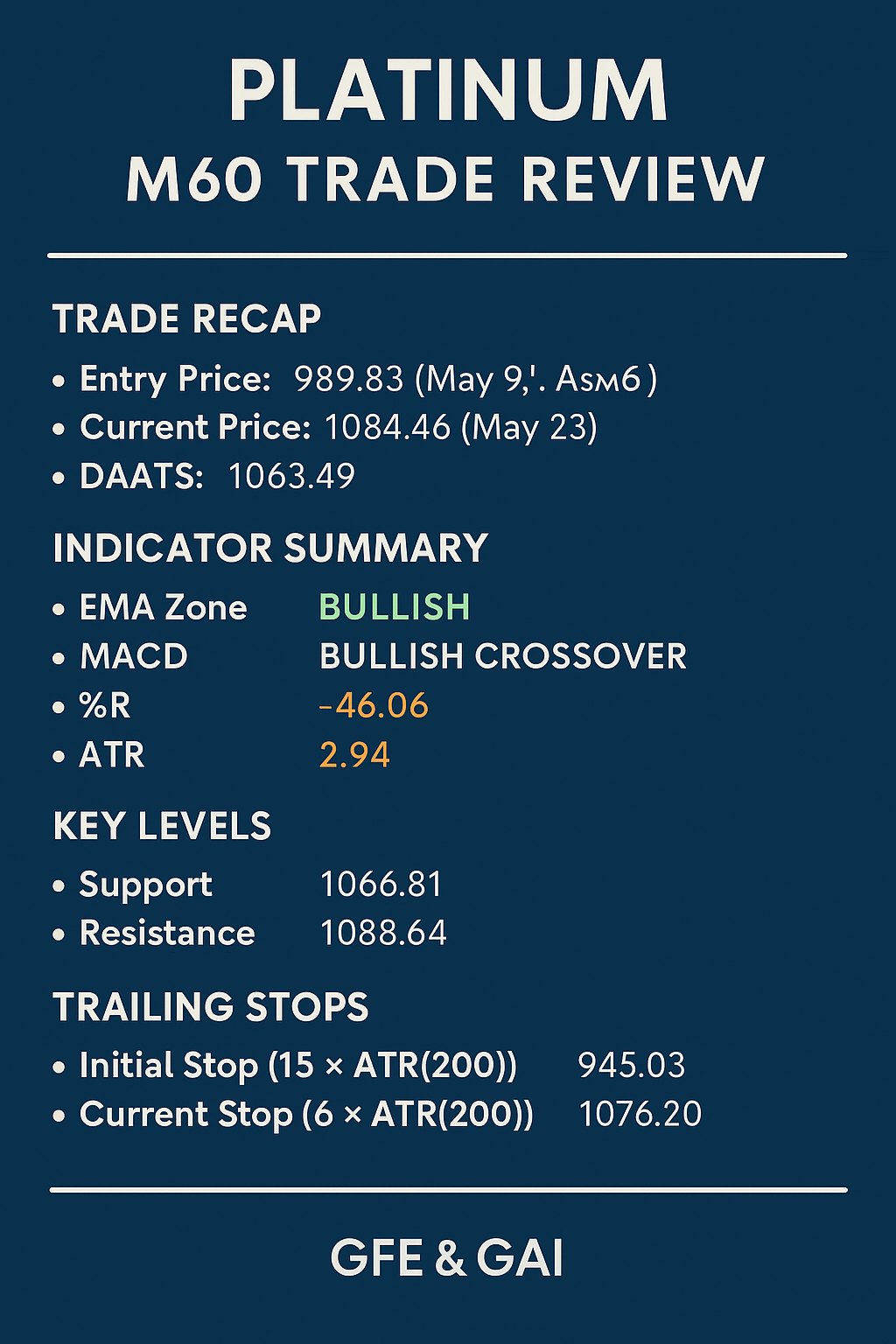

Platinum M60 Trade Review (May 9 Entry) Applying Dr. Glen Brown’s Seven Laws + Technical Indicator Deep-Dive

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

In-depth review of the May 9 Platinum M60 trade using Dr. Glen Brown’s seven Laws of Volatility Stop-Loss, plus multi-indicator analysis and next-session plan.

-

Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Dr. Glen Brown’s seven universal laws of volatility stop-loss—a zone-aligned, ATR(200)-based framework for adaptive stops, breakeven rules, and tiered risk management across all markets and timeframes.

-

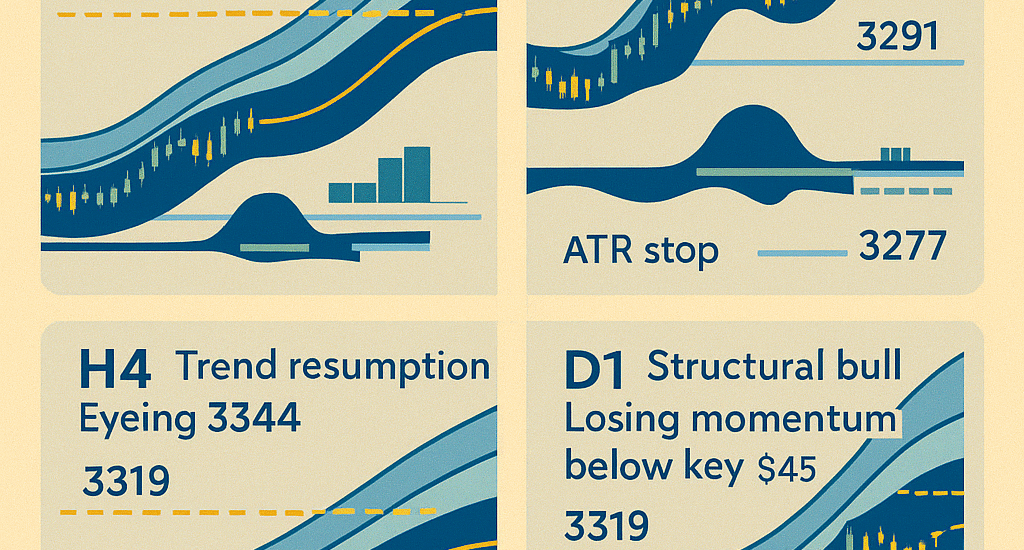

Gold (XAU/USD) Multi-Timeframe End-of-Day Analysis & GPTP

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Market Analysis

Discover the end-of-day multi-timeframe analysis for Gold across M30, H1, H4, and D1 using GATS WaveSafe ATR & EMA-Zone frameworks with actionable GPTP.

-

WaveSafe ATR Keltner Channel

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Integrate the WaveSafe ATR Exit Model with Keltner Channels—EMA(25), ATR(25), √25-based multipliers—for volatility-adaptive bands across all timeframes.

-

GATS “WaveSafe ATR” Universal Exit Model

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the WaveSafe ATR Exit Model—a universal, volatility-adaptive trailing stop framework using ATR(25) & √time for any timeframe, delivered with a 5:1 reward-to-risk structure.

-

Adaptive Risk Management in Action: Unlocking the Power of DAATS

- April 2, 2025

- Posted by: Drglenbrown1

- Categories:

Learn how adaptive risk management through the DAATS mechanism in the GATS Framework enhances trading performance by dynamically adjusting stop-loss levels to market volatility.

-

The Art of Dynamic Trailing Stops: A Deep Dive into DAATS

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the dynamic world of trailing stops with DAATS, a cutting-edge risk management tool that adapts to market volatility and time scaling, enhancing trade performance and capital protection.

-

Pyramidization within Global Algorithmic Trading Software (GATS): Enhancing Trading Performance

- July 23, 2024

- Posted by: Drglenbrown1

- Category: Trading Strategies

Learn how pyramidization within Global Algorithmic Trading Software (GATS) can enhance your trading performance by combining multiple strategies. Insights by Dr. Glen Brown.

-

Mastering Trade Management with Trailing Stops: A Guide by Dr. Glen Brown

- July 23, 2024

- Posted by: Drglenbrown1

- Category: Trading Strategies

Learn how to effectively manage trades using trailing stops with Dr. Glen Brown’s comprehensive guide. Discover strategies within the Global Algorithmic Trading Software (GATS).

-

Model for End-of-Day Analysis Using GATS Color-coded EMA Zones, Directional and Momentum Bias, and Fibonacci Extensions

- July 10, 2024

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover a structured approach to trading by combining GATS Color-coded EMA Zones with Fibonacci extensions. Enhance your strategy with this detailed guide by Dr. Glen Brown.

-

Strategy Guide for Global Traders Using GATS Color-coded EMA Zones with Fibonacci Extensions

- July 10, 2024

- Posted by: Drglenbrown1

- Category: Forex Trading Strategies

Discover a structured approach to forex trading by combining GATS Color-coded EMA Zones with Fibonacci extensions. Enhance your strategy with this detailed guide by Dr. Glen Brown.

-

Integrating GATS Color-coded EMA Zones with Fibonacci Extensions for Effective Trading

- July 10, 2024

- Posted by: Drglenbrown1

- Category: Forex Trading Strategies

Discover a structured approach to forex trading by combining GATS Color-coded EMA Zones with Fibonacci extensions. Enhance your strategy with this detailed guide by Dr. Glen Brown.

-

Performance Review for Global Algorithmic Trading Software (GATS30) Strategy 4: Global Intraday Swing Trader (June 24, 2024)

- June 24, 2024

- Posted by: Drglenbrown1

- Category: Trading Strategies

Learn how to master the markets with the Global Intraday Swing Trader Strategy, designed by Dr. Glen Brown. This powerful strategy is tailored for Forex, Stocks, Futures, and Cryptos, providing clear rules for trend identification, entry, and exit points.

-

Mastering the Markets: A Simple and Effective Trading Strategy for Forex, Stocks, Futures, and Cryptos Part 2

- June 23, 2024

- Posted by: Drglenbrown1

- Category: Trading Strategies

Learn a powerful yet simple trading strategy for Forex, Stocks, Futures, and Cryptos, featuring key indicators and robust risk management techniques.

-

“Mastering the Markets: A Simple and Effective Trading Strategy for Forex, Stocks, Futures, and Cryptos”

- June 23, 2024

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover a powerful yet simple trading strategy designed for average traders. Learn how to set it up and implement it across various asset classes with our daily and weekly market analysis videos.

-

Leveraging GANN’s Concepts within Global Algorithmic Trading Software (GATS)

- June 13, 2024

- Posted by: Drglenbrown1

- Category: Financial Trading, Algorithmic Trading, Trading Strategies

Discover how Global Algorithmic Trading Software (GATS) integrates W.D. Gann’s 1/8th theory to enhance trading strategies with dynamic trailing stops, disciplined risk management, and ambitious profit targets, providing traders with a robust framework for consistent success.

-

An Integrated Approach for Market Predictions: Expanding Dr. Glen Brown’s Market Expected Moves Hypothesis (MEMH), Dynamic Adaptive ATR Trailing Stops (DAATS) with Fibonacci Scaling Factors and Break-Even Point Analysis

- February 17, 2024

- Posted by: Drglenbrown1

- Category: Quantitative Finance Techniques

This research presents a comprehensive and sophisticated integrated approach that expands upon Dr. Glen Brown’s esteemed Market Expected Moves Hypothesis (MEMH). By incorporating Fibonacci factors and break-even point analysis, along with the utilization of Dynamic Adaptive ATR Trailing Stops (DAATS), the enhanced MEMH offers an advanced predictive model for estimating price movements in the financial market. This novel framework provides traders and investors with an enhanced level of precision, detail, and confidence in making informed decisions.

- 1

- 2