-

Global Weekly Forex Portfolio Risk Management Guide For Global Traders

- July 3, 2025

- Posted by: Drglenbrown1

- Category: Forex Portfolio Analysis, Quantum Risk Management

No Comments

This weekly guide leverages Dr. Glen Brown’s quantum-inspired Nine-Laws Framework and GATS methodology to deliver adaptive, self-calibrating risk controls—stops, break-evens, and position sizing—across a global portfolio of 28 major FX pairs.

-

The Quantum Edge – Synthesizing the Nine Laws

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Quantum-Inspired Trading Systems, Holistic Strategy Synthesis

Trading is a quantum dance of uncertainty and precision, mastered through a unified framework. Dr. Glen Brown’s Nine-Laws Framework synthesizes the nine GATS strategies with quantum principles, from entanglement to state tomography, to navigate markets across timeframes. This article unifies the series, showcasing how GATS1 to GATS43200 deliver a quantum edge from minutes to months, optimizing returns and risks.

-

Comparing GATS Strategies – A Quantum Spectrum of Performance

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Strategy Evaluation, Quantum-Inspired Trading Systems

Trading strategies span a quantum spectrum, each measuring market states at different scales. Dr. Glen Brown’s Nine-Laws Framework powers the nine GATS strategies, from GATS1’s rapid scalping to GATS9’s long-term trends, offering a range of performance profiles. This article compares their effectiveness across timeframes, leveraging quantum multi-scale principles to optimize returns from minutes to months.

-

Exit Only on Death – Quantum Measurement for Trade Closure

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Trade Execution, Quantum-Inspired Trading Systems

Closing a trade is like collapsing a quantum state—timing is everything. Dr. Glen Brown’s Law 5 of the Nine-Laws Framework enforces exit only on death, using death-stops and fractional break-evens, inspired by quantum measurement. This article explores how GATS1 to GATS43200 apply this law, ensuring disciplined exits across timeframes from minutes to months, maximizing profits in volatile markets.

-

Exposure & Death-Stop – Sub-Linear Scaling with √P

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Risk Control, Quantum-Inspired Trading Systems

Trading is like navigating a quantum path where past moves shape future risks. Dr. Glen Brown’s Law 4 of the Nine-Laws Framework introduces sub-linear √P scaling and death-stops to manage exposure, inspired by path-dependent memory. This article explores how GATS1 to GATS43200 apply this law, adjusting stops and exits across timeframes from minutes to months, ensuring disciplined risk management in volatile markets.

-

The Nine GATS Strategies: A Quantum-Inspired Trading Spectrum

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Algorithmic Trading, Quantum-Inspired Trading Systems

Financial markets, like quantum systems, are probabilistic and dynamic, oscillating between bullish, bearish, and choppy states. Dr. Glen Brown’s Nine-Laws Framework, powered by the Global Algorithmic Trading Software (GATS), harnesses this complexity through nine strategies, from the rapid Global Momentum Scalper (GATS1) to the enduring Global Monthly Trend Rider (GATS9). This article introduces these strategies, spanning timeframes from 1-minute to monthly, and their quantum-inspired design, rooted in the √Time Principle (√256 ≈ 16 exposures). By blending financial engineering with concepts like entanglement and path-dependent memory, GATS strategies offer a rigorous approach to trend-following and risk management, setting the stage for a series exploring the Nine Laws.

-

Dr. Glen Brown’s Nine‑Laws Framework for Adaptive Volatility and Risk Management

- June 12, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Finance / Risk Management

Discover a nine‑law adaptive risk framework and a 0.01 %–9 % equity risk grid for modern FX trading.

-

Introduction to Dr. Glen Brown’s Nine‑Laws Framework for Adaptive Volatility and Risk Management

- June 9, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Finance / Risk Management

-

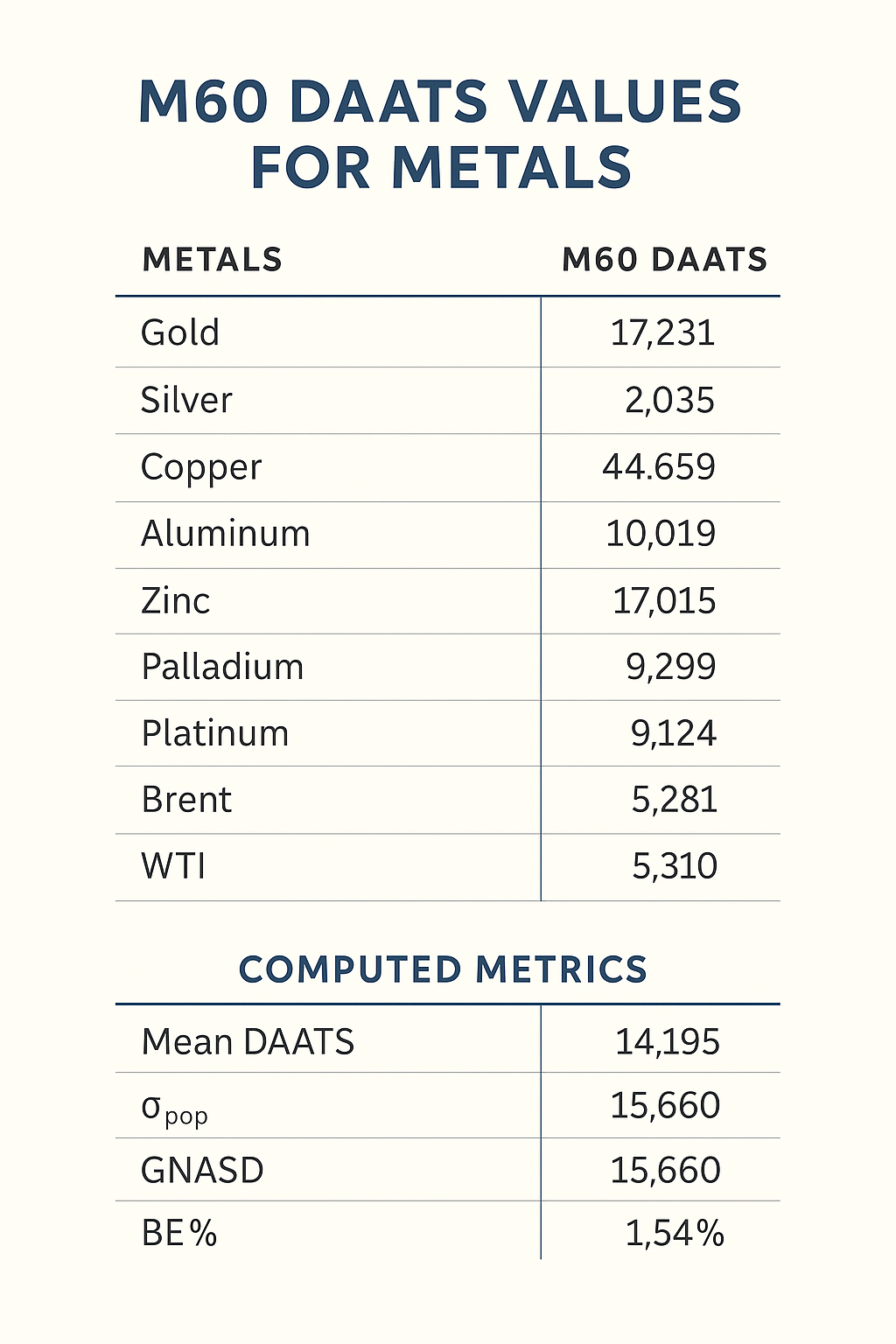

Calculating GNASD & BE% for M60 Metals Portfolio

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how to compute portfolio σpop, GNASD (one-sigma noise unit), and BE% for 10 metals (Gold, Silver, Copper, Aluminum, Zinc, Lead, Palladium, Platinum, Brent, WTI) using updated M60 DAATS values.

-

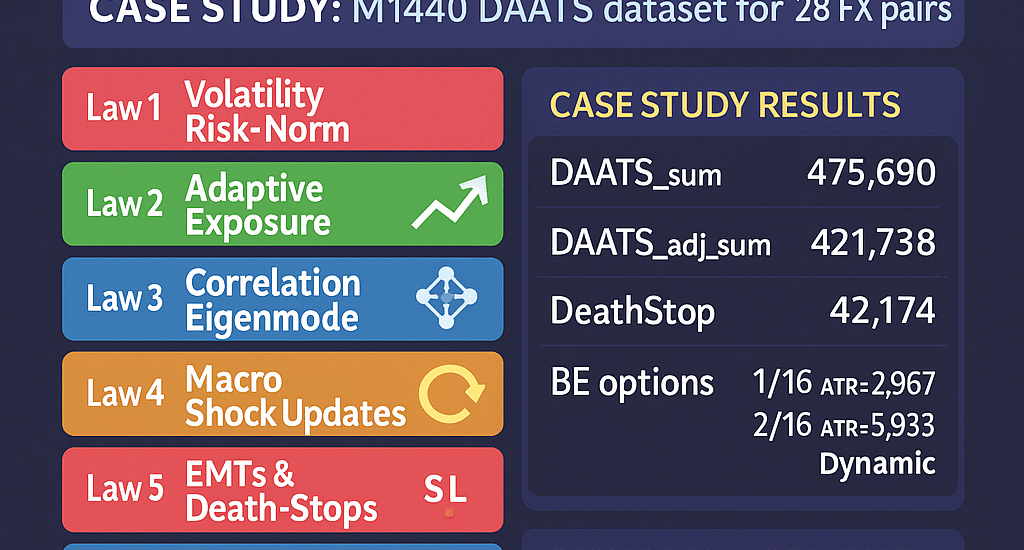

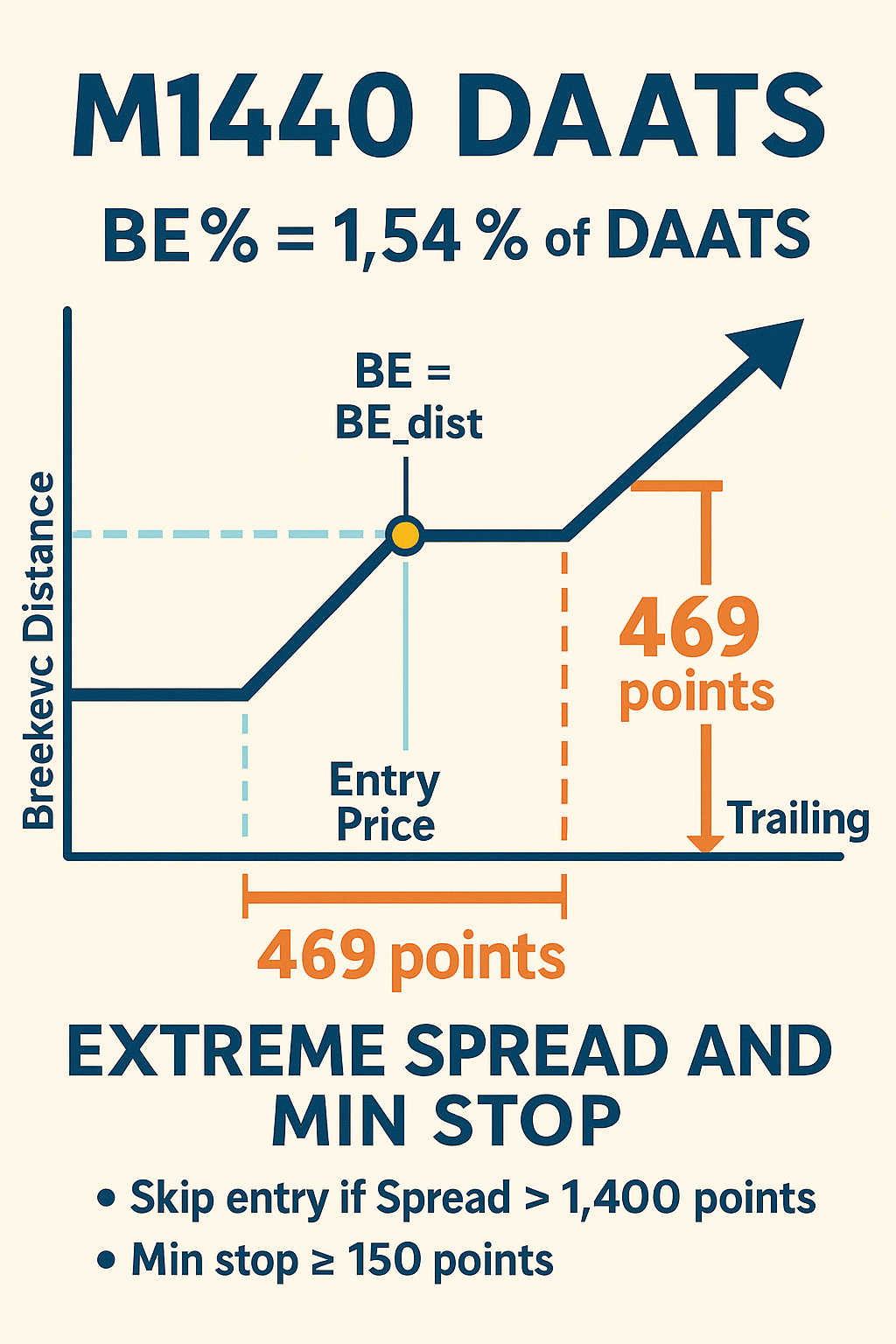

Final M1440 DAATS Lecture: Breakeven & Trailing Stops with Extreme Spread Handling

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn our final M1440 DAATS framework for 28 forex pairs: BE % = 1.54 % of DAATS, post‐BE trailing = 469 points, and skip entries if spread > 1 400 points, all aligned with Dr. Brown’s Seven Laws.

-

Recalculating BE% & GNASD for GEMF – USA Sub‐Fund (June 1, 2025)

- June 1, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how to recalculate portfolio BE% and GNASD (one-sigma noise unit) for GEMF – USA Sub-Fund using updated M60 DAATS values on June 1, 2025. Includes formulae, examples, and implementation linked to Dr. Brown’s Seven Laws.

-

Applying M60 DAATS & GNASD Logic to Equities: GEMF – USA Sub‐Fund

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how GEMF – USA Sub-Fund uses M60 DAATS and GNASD to set stop floors, breakeven triggers, and trailing stops on micro-timeframes (M30, M15, M5, M1) under the Daily MACD bias and M60 EMA regime.

-

Micro‐Timeframe Stop Floors & Breakeven Logic Using M60 DAATS & GNASD

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

In this lecture, we demonstrate how GATS leverages M60 DAATS and the portfolio’s one‐sigma noise unit (GNASD) to establish robust stop‐loss floors, breakeven triggers, and trailing stops on M30, M15, M5, and M1. By anchoring micro‐timeframe stops to hourly volatility and applying a 1.39% breakeven rule per pair, traders can avoid routine hourly whipsaw while still capturing high‐probability moves under the Daily MACD bias and M60 EMA regime filters.

-

Law 7: GNASD—Managing Cross-Asset Noise Budgets

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Law 7 of Dr. Glen Brown’s Seven Laws—GNASD for portfolio-level stops. Learn how to compute population σ, normalize by N, and apply global breakeven triggers with hybrid caps and cost floors.

-

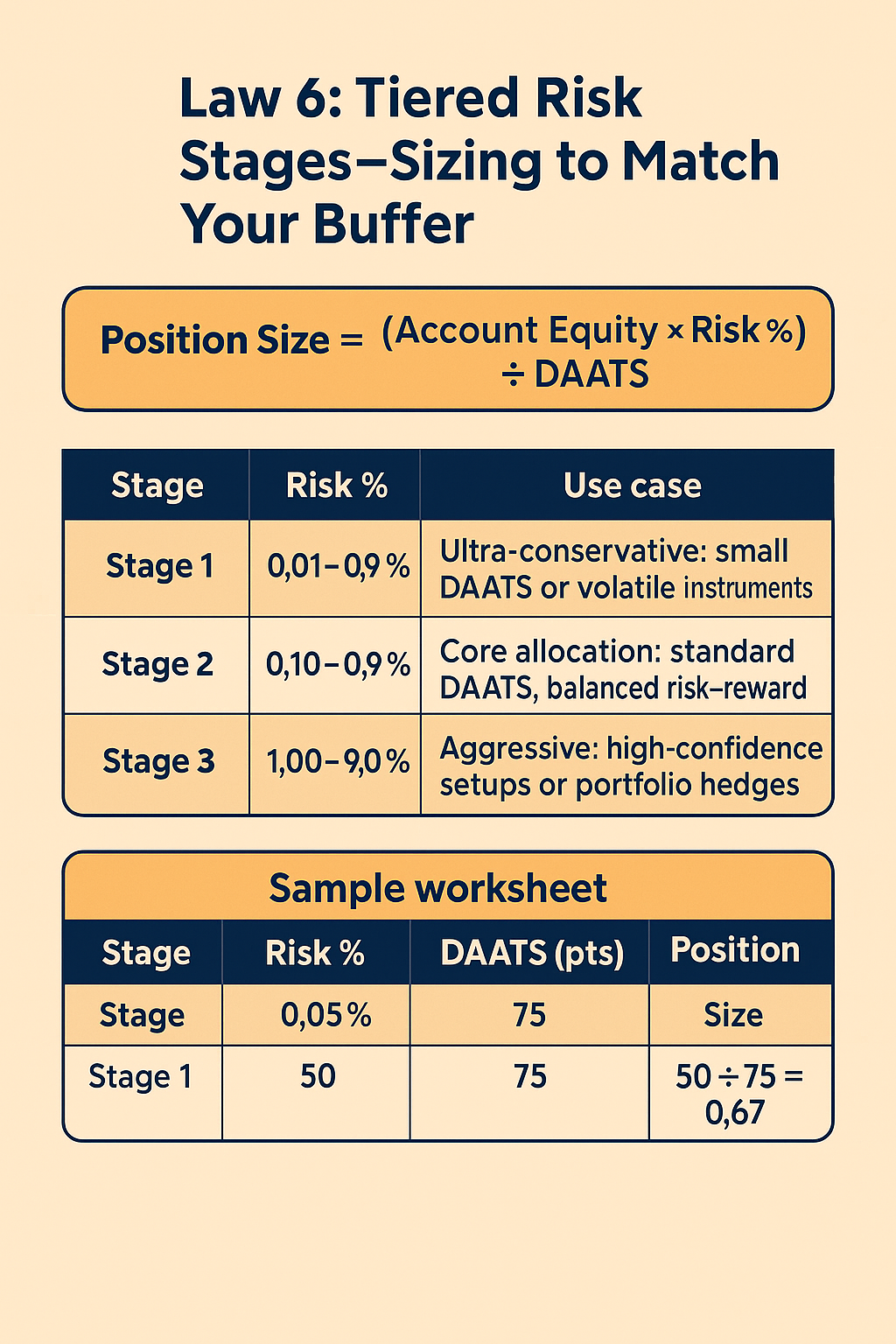

Law 6: Tiered Risk Stages—Sizing to Match Your Buffer

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn Law 6 of Dr. Glen Brown’s Seven Laws: position sizing via (Equity×Risk %) ÷ DAATS, explore Stage 1/2/3 risk tiers, and see case studies on dollar-at-risk levels.

-

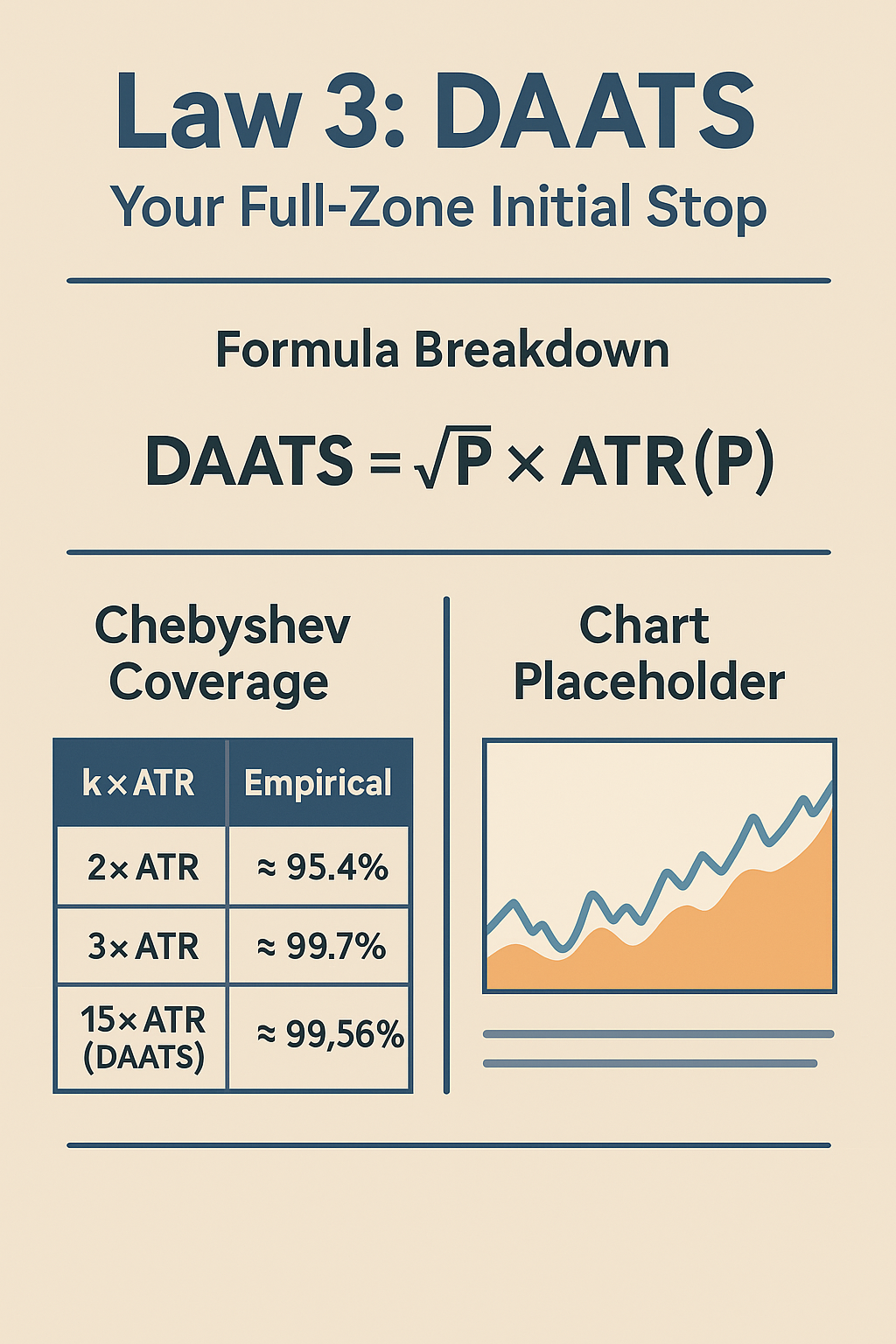

Law 3: DAATS—Your Full-Zone Initial Stop

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Law 3 of Dr. Glen Brown’s Seven Laws: DAATS = √P×ATR(P). Learn the formula, Chebyshev’s worst-case guarantee, and see an example trade with DAATS plotted.

-

Beyond ATR: Introducing Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover why static ATR-based stops fail and explore Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—anchored by √time scaling, DAATS and GNASD—for a truly adaptive risk framework.

-

GASBET: The Global Adaptive Statistical Break-Even Trigger

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading / Risk Management

Explore the DAATS distance distribution, the GASBET

𝜅

𝜎

κσ trigger formula, visualization techniques, and trade-offs between manual and automated exits.