-

Lecture 3: Death-Stop (DS) and DAATS — Converting Drawdown into Time

- November 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Lecture Series

No Comments

GATS Lecture 3 codifies DS=DAATS initialization and the 18.75% Break-Even law, showing how to convert drawdown into time with constant trail amplitude and MT5-ready logic.

-

Lecture 2: The Quad-Confirmation Principle — Structural Resonance in Multi-Timeframe Trading

- November 1, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading, Global Financial Markets Analysis, Global Financial Markets Insights

Explore how GATS achieves structural coherence through multi-timeframe resonance and the Quad-Confirmation Principle, with RI gating and MT5 implementation logic.

-

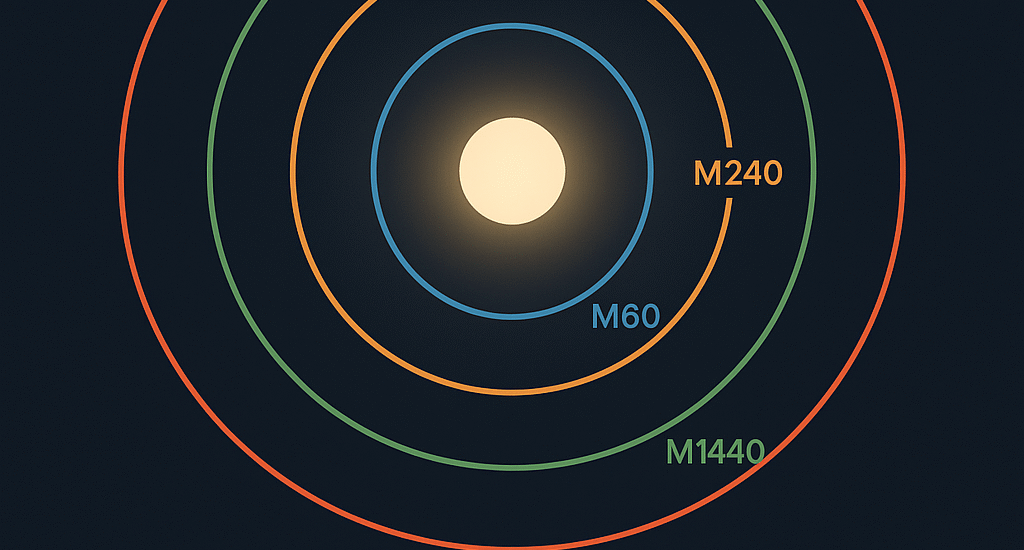

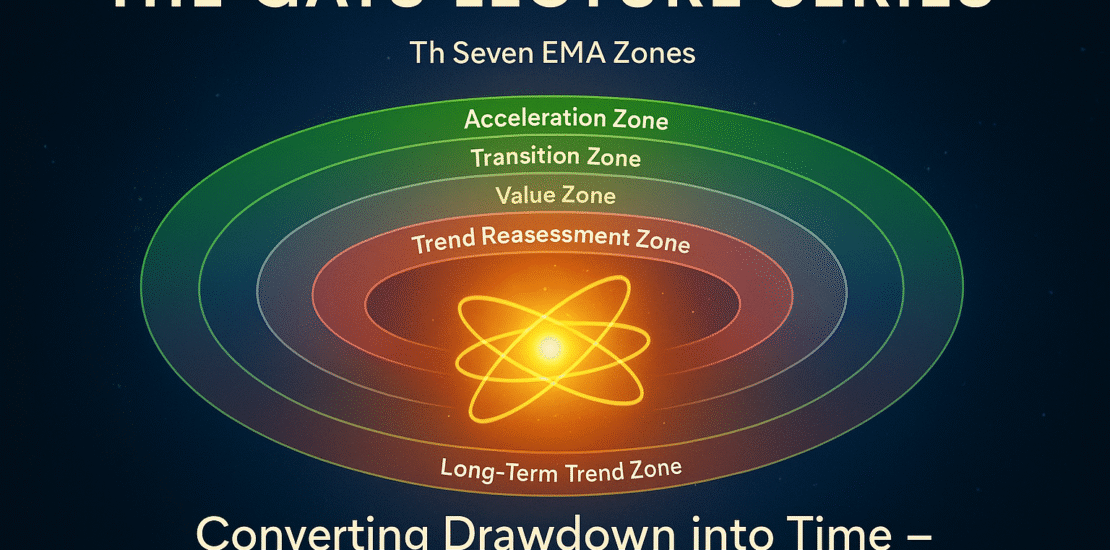

The Foundations of GATS: From EMA Zones to Quantum Risk Dynamics

- October 31, 2025

- Posted by: Drglenbrown1

- Categories:

Discover the foundational principles of GATS — Dr. Glen Brown’s advanced algorithmic trading framework that fuses EMA Zones, ATR-based risk logic, and quantum-inspired volatility management.

-

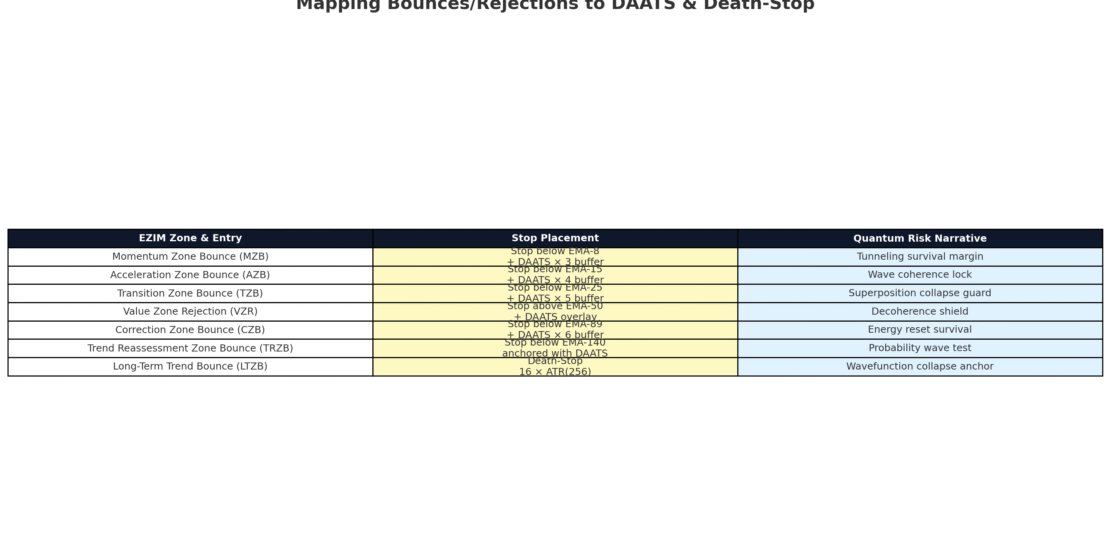

Risk & EZIM — Anchoring Stops, DAATS, and Death-Stop

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Risk & EZIM

Risk is the backbone of EZIM. This article shows how DAATS and Death-Stop anchor the Bounce & Rejection Paradigm into disciplined survival rules.

-

🌌 GATS Profit-Banking Overlay (PBO) Protocol — Quantum Narrative Edition

- September 7, 2025

- Posted by: Drglenbrown1

- Category: GATS Handbook

A desk-ready GATS protocol: DS=DAATS=16×ATR-256 (M1440), BE% at 7.8125%, and staged Profit-Banking at GSC wells (×6, ×9, ×12) to recycle capital while letting the final 25% ride into deep wells (×15–×21).

-

Exit Only on Death – Quantum Measurement for Trade Closure

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Trade Execution, Quantum-Inspired Trading Systems

Closing a trade is like collapsing a quantum state—timing is everything. Dr. Glen Brown’s Law 5 of the Nine-Laws Framework enforces exit only on death, using death-stops and fractional break-evens, inspired by quantum measurement. This article explores how GATS1 to GATS43200 apply this law, ensuring disciplined exits across timeframes from minutes to months, maximizing profits in volatile markets.

-

Exposure & Death-Stop – Sub-Linear Scaling with √P

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Risk Control, Quantum-Inspired Trading Systems

Trading is like navigating a quantum path where past moves shape future risks. Dr. Glen Brown’s Law 4 of the Nine-Laws Framework introduces sub-linear √P scaling and death-stops to manage exposure, inspired by path-dependent memory. This article explores how GATS1 to GATS43200 apply this law, adjusting stops and exits across timeframes from minutes to months, ensuring disciplined risk management in volatile markets.