-

Guidex Theory: Reframing Digital Currencies as a Global Kinetic Energy Matrix

- November 24, 2025

- Posted by: Drglenbrown1

- Category: Digital Currencies / Macro-Theory / Crypto Valuation Models

No Comments

Guidex Theory redefines Bitcoin and digital assets as nodes in a global kinetic energy matrix—transforming computational work and electrical power into digital reserves. Dr. Glen Brown introduces a new valuation and trading framework grounded in thermodynamics, entropy, and adaptive market regimes.

-

Part 6: Automation, Alerts & Portfolio Integration

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Part 6 shows you how to build dashboards, alert systems, and portfolio-level risk allocation for a live, systematic implementation of the Enhanced Equity Valuation Model.

-

Part 5: Advanced Overlays — Multi-Factor, Monte Carlo, Capital & Event Modules

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Part 5 shows you how to layer DCF, relative P/E, Monte Carlo, capital structure, and event modules for a truly next-generation valuation model.

-

Part 4: Probability Weighting & Margin-of-Safety

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Part 4 shows you step-by-step how to compute a probability-weighted forecast and apply a margin-of-safety, using Tesla as the example.

-

Part 3: Defining Regimes via Fibonacci Splits & Scenario Forecasts

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Part 3 shows you step-by-step how to apply 38.2%, 50%, or 61.8% Fibonacci splits to your EVDF, derive EVGF, and forecast prices for each regime using Tesla as an example.

-

Part 2: Calibrating EVDF ↔ EVGF to Today’s Price — A Quantum Measurement Approach

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

In Part 2, we collapse fundamental value into observed price—deriving EVDF & EVGF via a quantum measurement analogy—complete with a Tesla example.

-

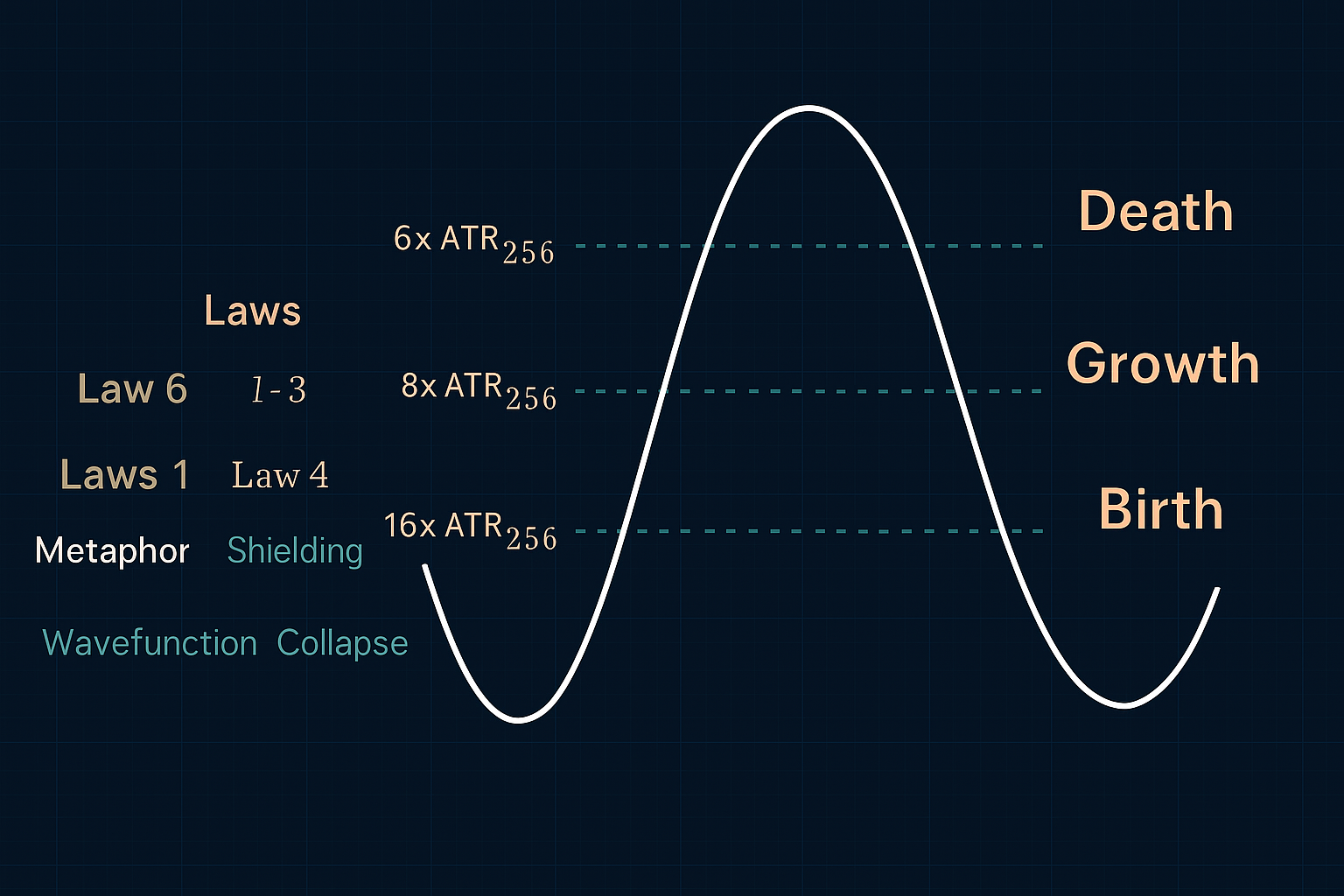

Quantum Risk Mastery: Dr. Glen Brown’s Nine Laws Framework for Adaptive Volatility Stop-Loss and Risk Management

- August 3, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering & Trading Strategies

Discover how Dr. Glen Brown fuses quantum mechanics narratives with nine principled laws to create an adaptive volatility stop-loss and risk management framework—reinventing portfolio protection in today’s markets.

-

The Volatility Root Law – Part II: From Fractal Breakeven to Volatility-Defined Death

- July 20, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading, Risk Engineering

Part II of Dr. Glen Brown’s Volatility Root Law reveals a quantum volatility lifecycle framework that governs trade entry, breakeven, trailing stops, and exit using fractal amplitude theory and temporal anchoring—structured through the Nine Laws of Adaptive Risk.

-

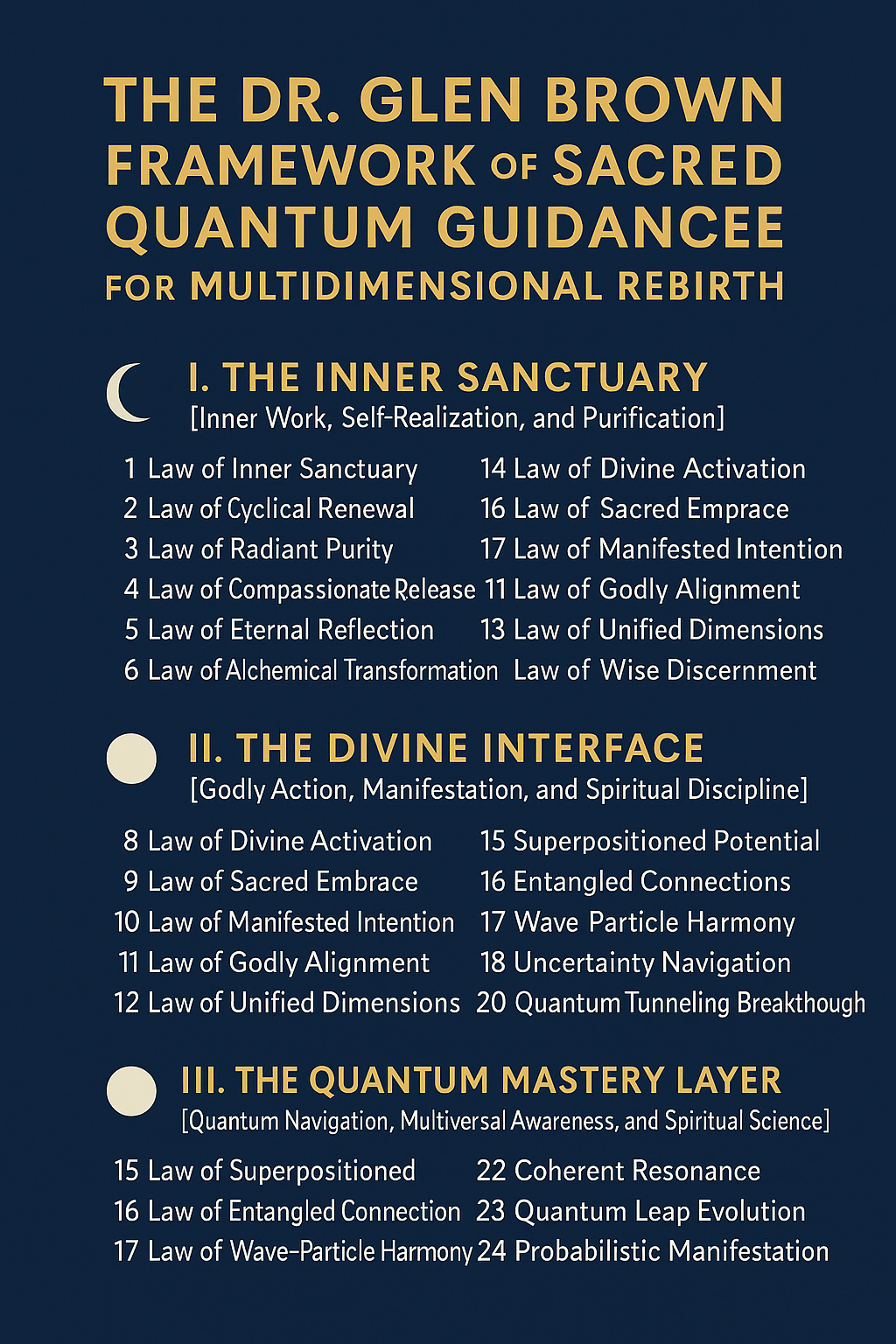

The Dr. Glen Brown Framework of Sacred Quantum Guidance for Multidimensional Rebirth

- July 18, 2025

- Posted by: Drglenbrown1

- Categories: Quantum Philosophy, Spiritual Frameworks

The Dr. Glen Brown Framework of Sacred Quantum Guidance for Multidimensional Rebirth is a doctrine of 24 universal laws designed to awaken higher consciousness. Fusing quantum physics, divine philosophy, and personal transformation, this framework offers a timeless path for self-mastery, spiritual alignment, and intentional manifestation.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Finance, Thought Leadership, GATS Series

Discover the foundation of Dr. Glen Brown’s Nine-Laws Framework as he applies quantum principles to market chaos. Learn how to trade with coherence, resilience, and engineered discipline.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

In Part 3 of his Quantum Intricacies series, Dr. Glen Brown explains Laws 7–9 for maintaining portfolio coherence through noise budgeting, slippage buffers, and adaptive model rebirth.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum principles to market exits, volatility, and time. Part 2 of the Quantum Mindset series.

-

Dr. Glen Brown’s Perspectives: The Empire of Death in 2025

- July 12, 2025

- Posted by: Drglenbrown1

- Category: Global Economic Outlook

Dr. Glen Brown exposes the Empire of Death dominating 2025—fueled by conflict, hunger, climate shocks, and high interest rates. A transformative call to action.

-

Adaptive Volatility in FX: Applying Dr. Glen Brown’s Nine-Laws Framework to EUR/USD (1-Hour) – June 30, 2025

- June 30, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading, Financial Engineering, Risk Management

This analysis demonstrates how Dr. Glen Brown’s Nine-Laws Framework, combined with GATS60 methodology, delivers a rigorously adaptive, quantum-inspired risk engine—optimizing entries, stops, and position sizing for EUR/USD in volatile FX markets.

-

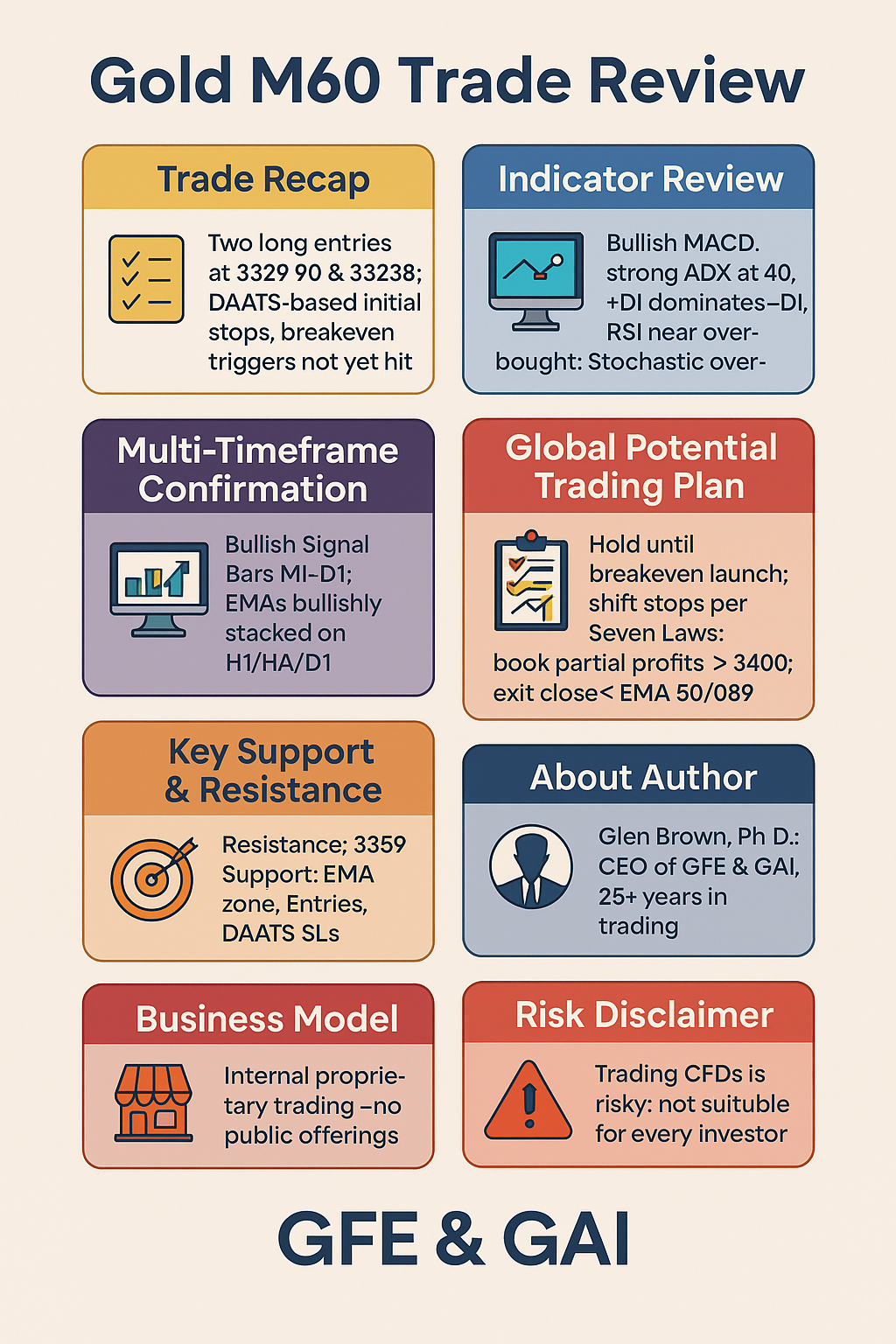

Gold M60 Trade Review (May 22 & 23 Entries)

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

Detailed Gold M60 trade review using Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—entry, stops, breakeven triggers, indicator deep-dive and next-session plan.

-

Markets on the Edge: Anatomy of the Most Volatile Week Since WWII

- April 13, 2025

- Posted by: Drglenbrown1

- Category: Market Volatility and Risk

In April 2025, global markets witnessed historic volatility. Dr. Glen Brown unpacks the macro signals, behavioral responses, and GATS strategies that defined the most volatile week since WWII.

-

Currency Wars and the End of Dollar Dominance: What Comes Next?

- April 13, 2025

- Posted by: Drglenbrown1

- Categories: Geopolitical Finance, Global Currency Dynamics

Explore the rise of currency wars, the fading dominance of the U.S. dollar, and how GATS macro signals reveal the shift to a multipolar monetary system. Dr. Glen Brown dissects the future of global finance.

-

From Free Trade to Fortress Economies: Charting the Collapse of Global Integration

- April 13, 2025

- Posted by: Drglenbrown1

- Category: Global Economic Analysis

The era of globalization is giving way to protectionism and economic fragmentation. In this insightful analysis, Dr. Glen Brown unpacks the death of globalism, the rise of fortress economies, and the macro signals pointing to a new world order.