-

Lecture 2: The Quad-Confirmation Principle — Structural Resonance in Multi-Timeframe Trading

- November 1, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading, Global Financial Markets Analysis, Global Financial Markets Insights

No Comments

Explore how GATS achieves structural coherence through multi-timeframe resonance and the Quad-Confirmation Principle, with RI gating and MT5 implementation logic.

-

The Foundations of GATS: From EMA Zones to Quantum Risk Dynamics

- October 31, 2025

- Posted by: Drglenbrown1

- Categories:

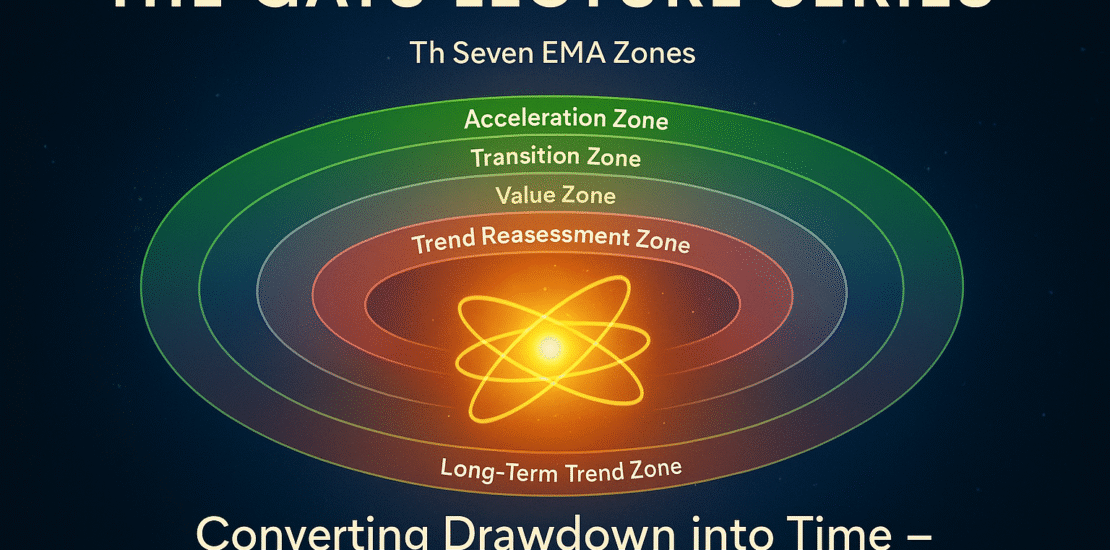

Discover the foundational principles of GATS — Dr. Glen Brown’s advanced algorithmic trading framework that fuses EMA Zones, ATR-based risk logic, and quantum-inspired volatility management.

-

Fractal Temporal Synchronization: The Law of Time-State Alignment — Dr. Glen Brown

- October 26, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

A detailed paper by Dr. Glen Brown revealing how multi-timeframe phase alignment generates exponential coherence through the GATS Framework.

-

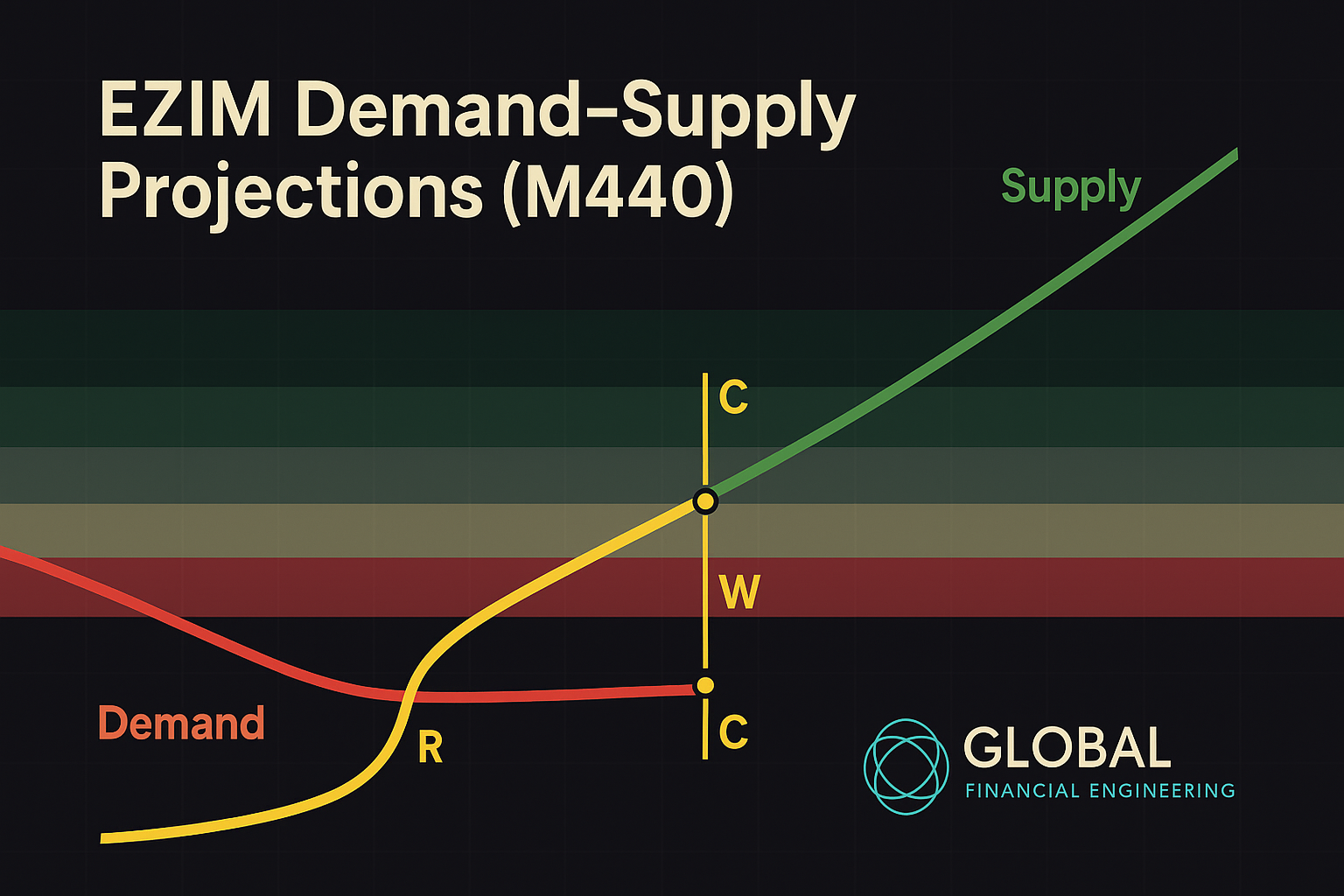

EZIM Demand–Supply Projections (M1440)

- September 28, 2025

- Posted by: Drglenbrown1

- Category: GATS / EZIM

EZIM interactions with downward-sloping demand and upward-sloping supply lines on M1440. Includes readable formulas, compression/energy metrics, MACD governance, signals, and coding hooks for GATS.

-

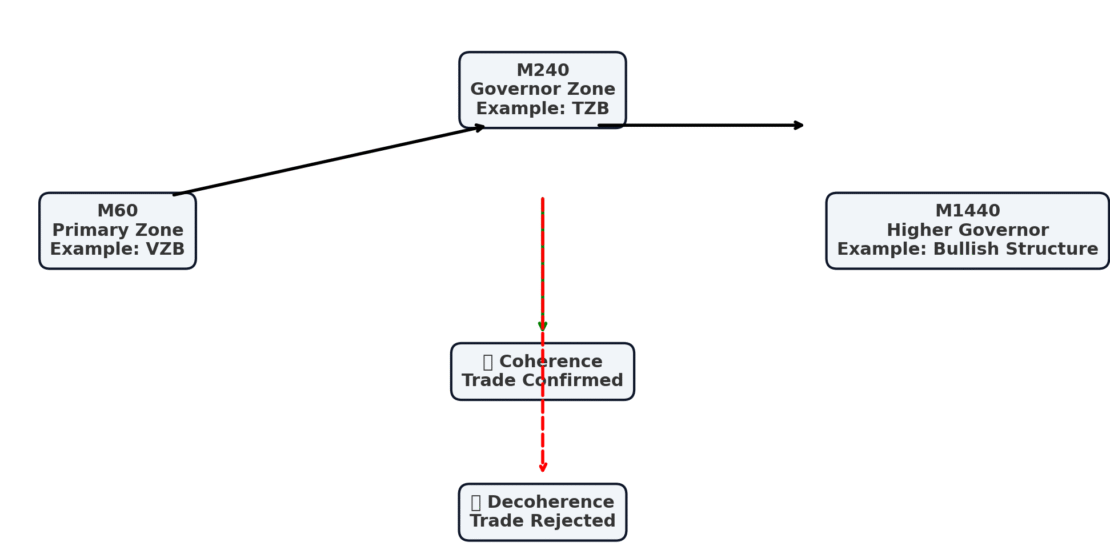

Multi-Timeframe Synergy in EZIM — Coherence Across Market Structures

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Multi-Timeframe Synergy in EZIM

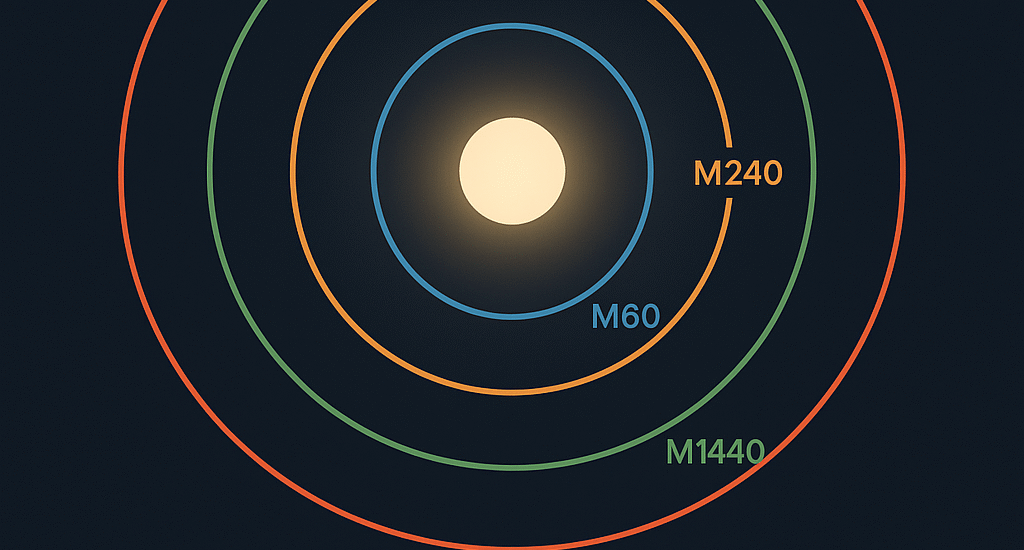

Multi-Timeframe Synergy in EZIM explains how Bounces and Rejections across M60, M240, and M1440 align to create coherence and filter noise.

-

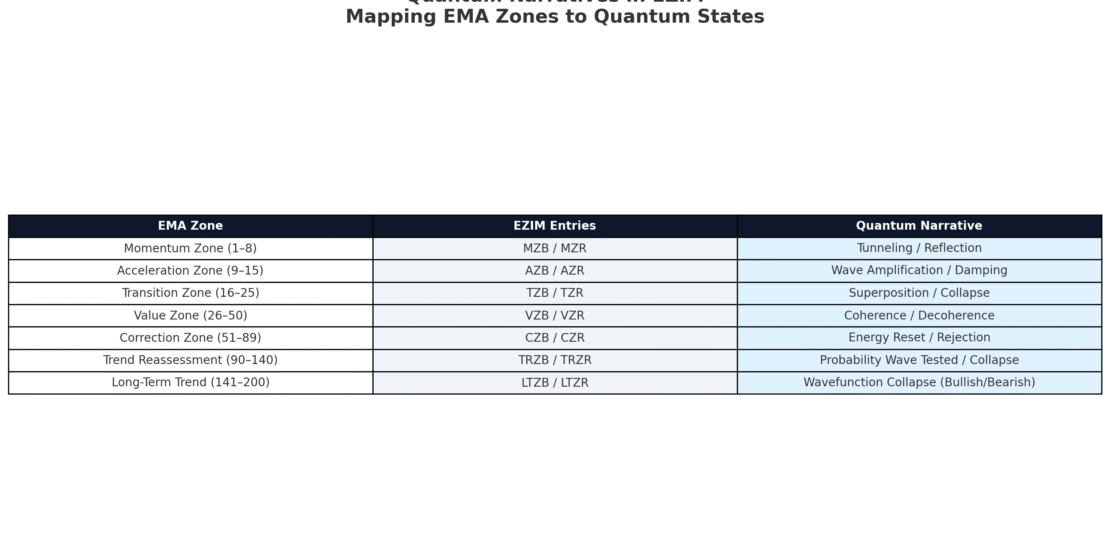

Quantum Narratives in EZIM — Mapping EMA Zones to Market States

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Quantum Narratives in EZIM

-

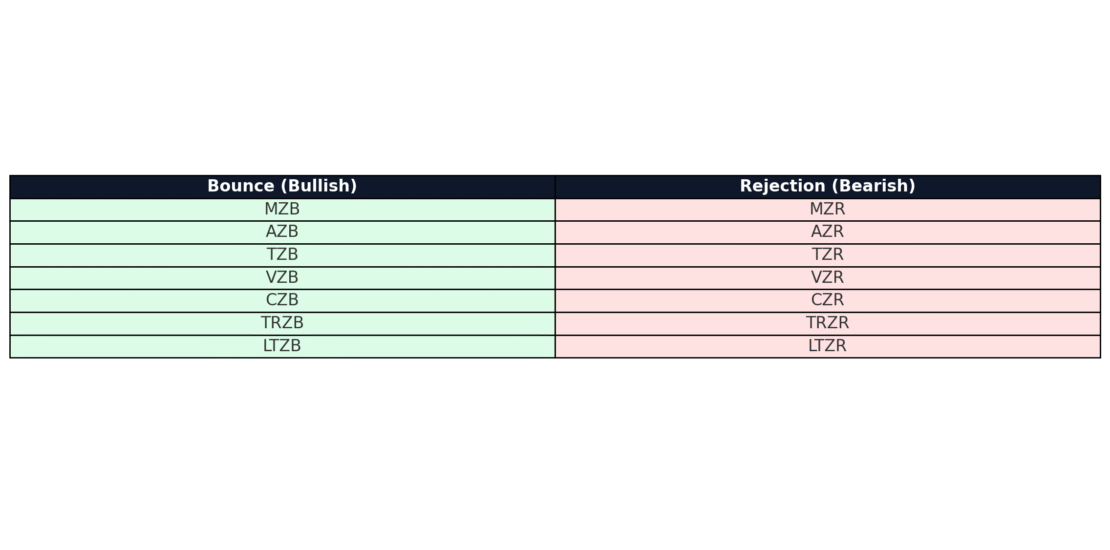

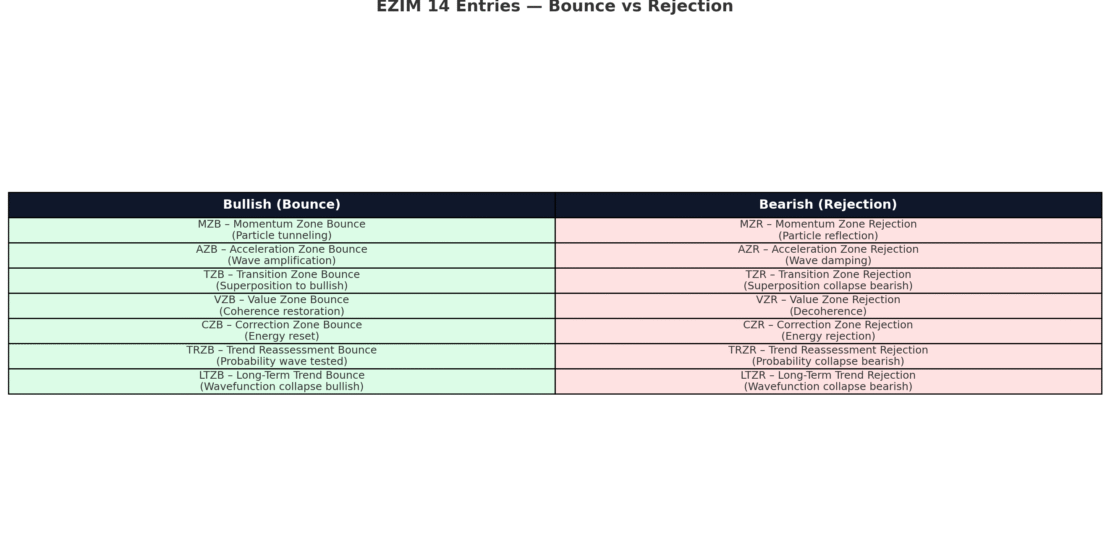

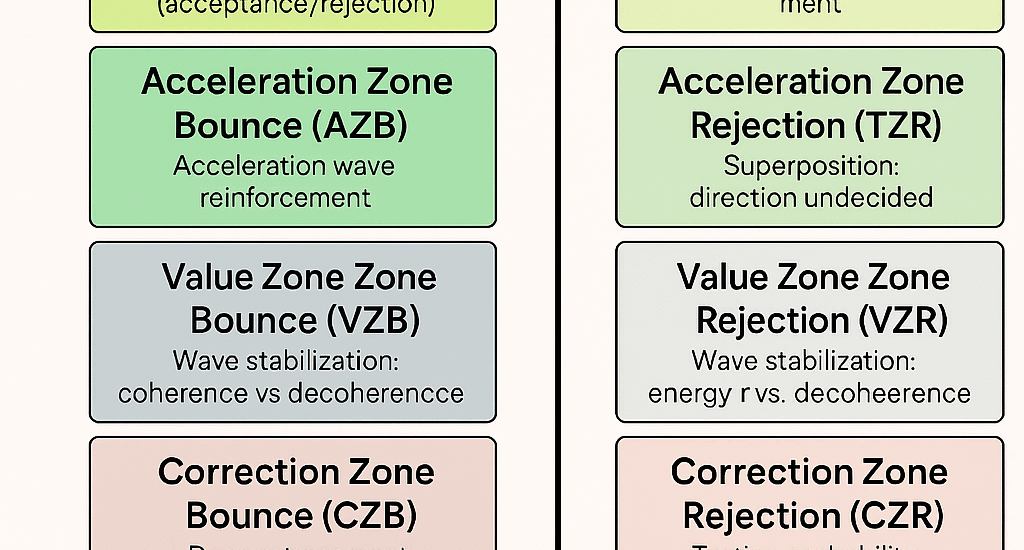

The 14 EZIM Entries — Bounce & Rejection Taxonomy

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM 14-entry taxonomy provides traders with a structured field manual of entries across bullish and bearish market structures, linked with quantum metaphors.

-

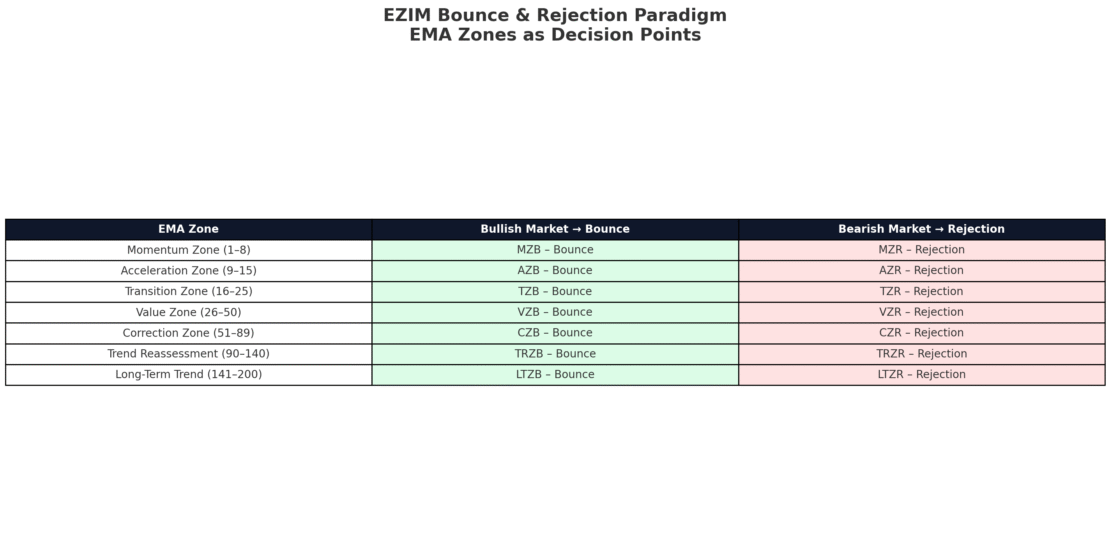

Introduction to EZIM — The Bounce & Rejection Paradigm

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM Bounce & Rejection Paradigm classifies EMA zone interactions into bullish Bounces and bearish Rejections, creating a powerful taxonomy enriched with quantum metaphors.

-

The 14 EZIM Entries: Quantum Narratives of Bounces and Rejections

- September 14, 2025

- Posted by: Drglenbrown1

- Category: Trading Frameworks / Quantum Narratives

The EZIM 14-entry taxonomy provides traders with precise entry definitions across bullish and bearish structures, enriched with quantum metaphors to enhance execution and psychology.

-

EMA Zone Interaction Model (EZIM) — GATS Bounce & Rejection Framework

- September 12, 2025

- Posted by: Drglenbrown1

- Category: Trading Frameworks / GATS Methodology

The EMA Zone Interaction Model (EZIM) defines price interactions at EMA boundaries as Bounces in bullish markets and Rejections in bearish markets, providing clarity for traders with quantum-inspired narratives.

-

The Quantum Narrative of EMA Zones and MACD(15,25,8) – Part II

- August 31, 2025

- Posted by: Drglenbrown1

- Category: Quantum Trading Philosophy

Explore Bitcoin and EURUSD case studies, fractal uncertainty geometry, and the metaphysical laws of trading. A sacred quantum philosophy emerges, uniting financial engineering with the Nine Laws.

-

The Quantum Narrative of EMA Zones and MACD(15,25,8)

- August 31, 2025

- Posted by: Drglenbrown1

- Category: Quantum Trading Philosophy

A deep exploration of EMA Zones, MACD, and the Nine Laws reimagined as quantum mechanics operators and wavefunctions. A transformative trading philosophy.

-

Exposure & Death-Stop – Sub-Linear Scaling with √P

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Risk Control, Quantum-Inspired Trading Systems

Trading is like navigating a quantum path where past moves shape future risks. Dr. Glen Brown’s Law 4 of the Nine-Laws Framework introduces sub-linear √P scaling and death-stops to manage exposure, inspired by path-dependent memory. This article explores how GATS1 to GATS43200 apply this law, adjusting stops and exits across timeframes from minutes to months, ensuring disciplined risk management in volatile markets.

-

Weighted Decay of DAATS – Smoothing Noise with Lindblad Dynamics

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Volatility Management, Quantum-Inspired Trading Systems

Market noise, like the random fluctuations of quantum particles, can disrupt trading precision. Dr. Glen Brown’s Law 2 of the Nine-Laws Framework refines the Dynamic Adaptive ATR Trailing Stop (DAATS) with a weighted decay mechanism, inspired by quantum decoherence, to smooth volatility. This article explores how GATS1 to GATS43200 apply this law, adjusting DAATS across timeframes from minutes to months, ensuring stability and adaptability in the face of market chaos.

-

Correlation Regime Transition – Detecting Systemic Stress with Entanglement

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Risk Management, Quantum-Inspired Trading Systems

Markets, like entangled quantum particles, can suddenly synchronize during systemic stress, amplifying volatility across assets. Dr. Glen Brown’s Law 1 of the Nine-Laws Framework, paired with the Global Algorithmic Trading Software (GATS), detects these correlation regime transitions using DAATS spikes and multi-timeframe alignments. This article explores how GATS1 to GATS43200 identify and respond to such stress, leveraging quantum entanglement principles to pause trades and hedge risks, ensuring resilience from minute-to-month timeframes.

-

The Nine GATS Strategies: A Quantum-Inspired Trading Spectrum

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Algorithmic Trading, Quantum-Inspired Trading Systems

Financial markets, like quantum systems, are probabilistic and dynamic, oscillating between bullish, bearish, and choppy states. Dr. Glen Brown’s Nine-Laws Framework, powered by the Global Algorithmic Trading Software (GATS), harnesses this complexity through nine strategies, from the rapid Global Momentum Scalper (GATS1) to the enduring Global Monthly Trend Rider (GATS9). This article introduces these strategies, spanning timeframes from 1-minute to monthly, and their quantum-inspired design, rooted in the √Time Principle (√256 ≈ 16 exposures). By blending financial engineering with concepts like entanglement and path-dependent memory, GATS strategies offer a rigorous approach to trend-following and risk management, setting the stage for a series exploring the Nine Laws.

-

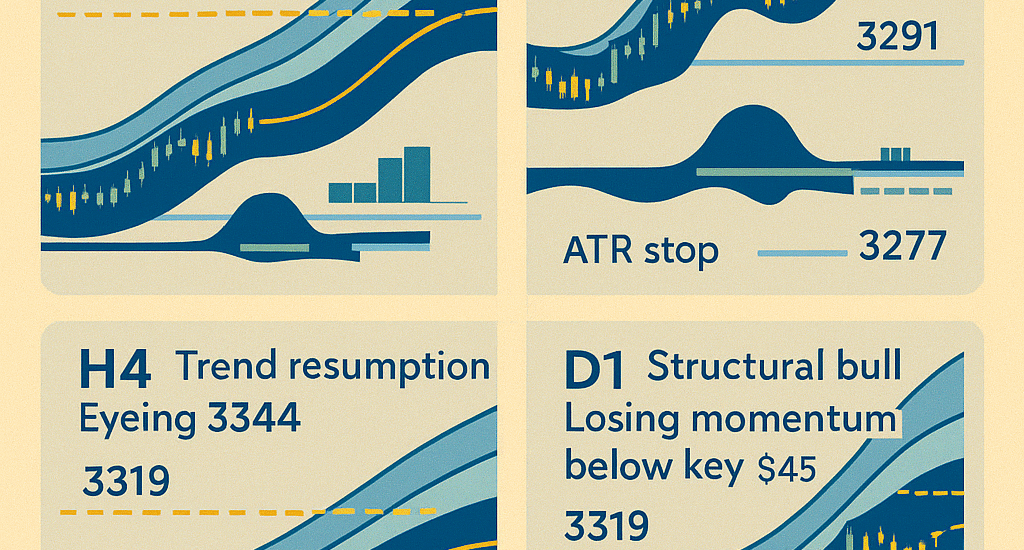

Gold (XAU/USD) Multi-Timeframe End-of-Day Analysis & GPTP

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Market Analysis

Discover the end-of-day multi-timeframe analysis for Gold across M30, H1, H4, and D1 using GATS WaveSafe ATR & EMA-Zone frameworks with actionable GPTP.

-

Platinum Daily “High-Conviction Bullish Blueprint”

- May 20, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the Platinum Daily “High-Conviction Bullish Blueprint” using the GATS framework—EMA zones, MACD, oscillators & tactical trade plan.