-

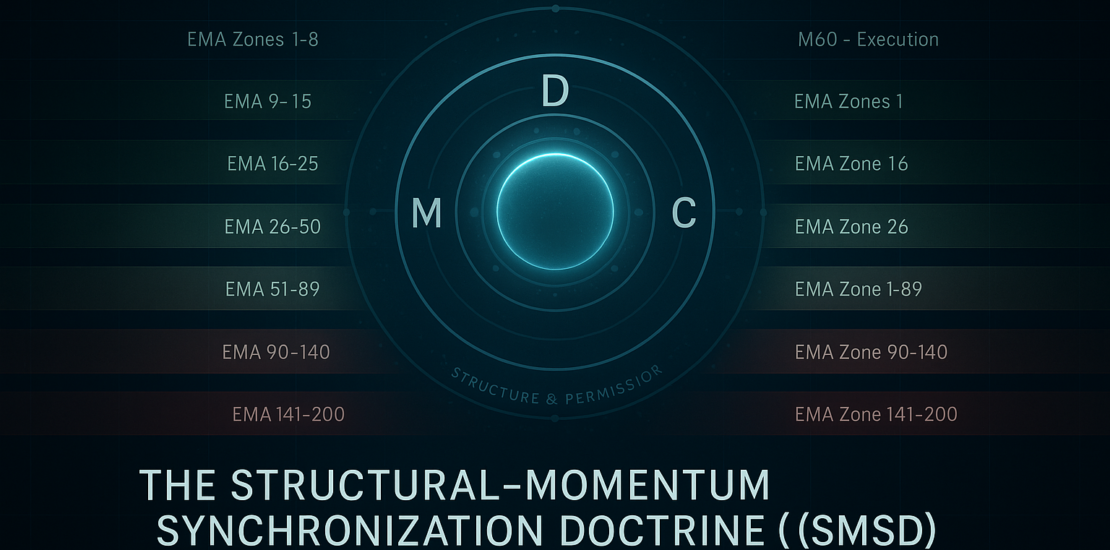

Structural–Momentum Synchronization Doctrine (SMSD) — Master Document

- December 7, 2025

- Posted by: Drglenbrown1

- Categories: Global Algorithmic Trading Software (GATS), Institutional Frameworks, Volatility & Risk Doctrine

1 Comment

This master document compiles Sections 1–15 of the Structural–Momentum Synchronization Doctrine (SMSD), detailing how Dr. Glen Brown unifies momentum, structural drift, EMA zones, market identity, and the Nine-Laws Framework into a complete, volatility-aware execution architecture for GATS and G9TTS.

-

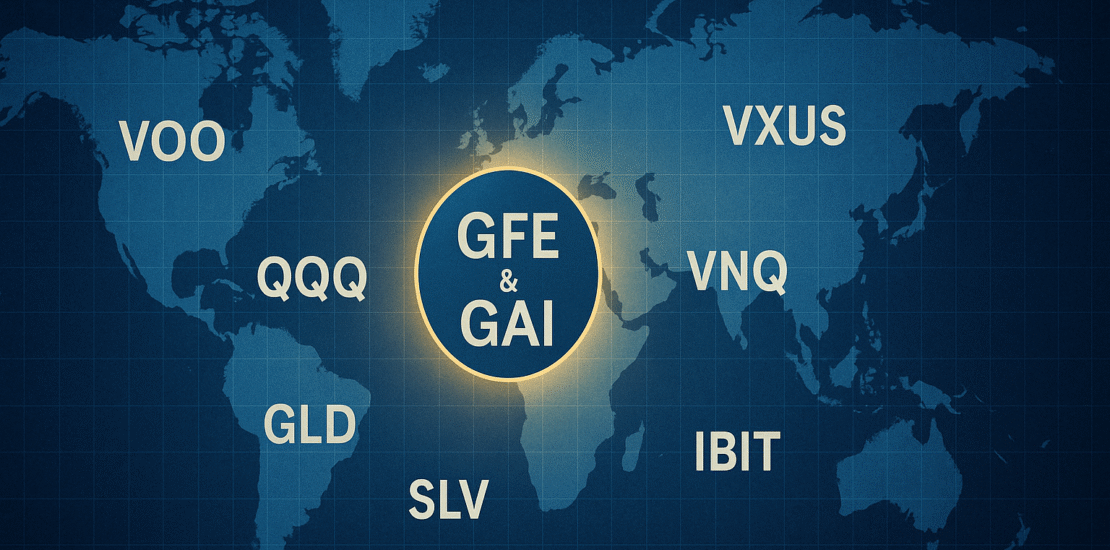

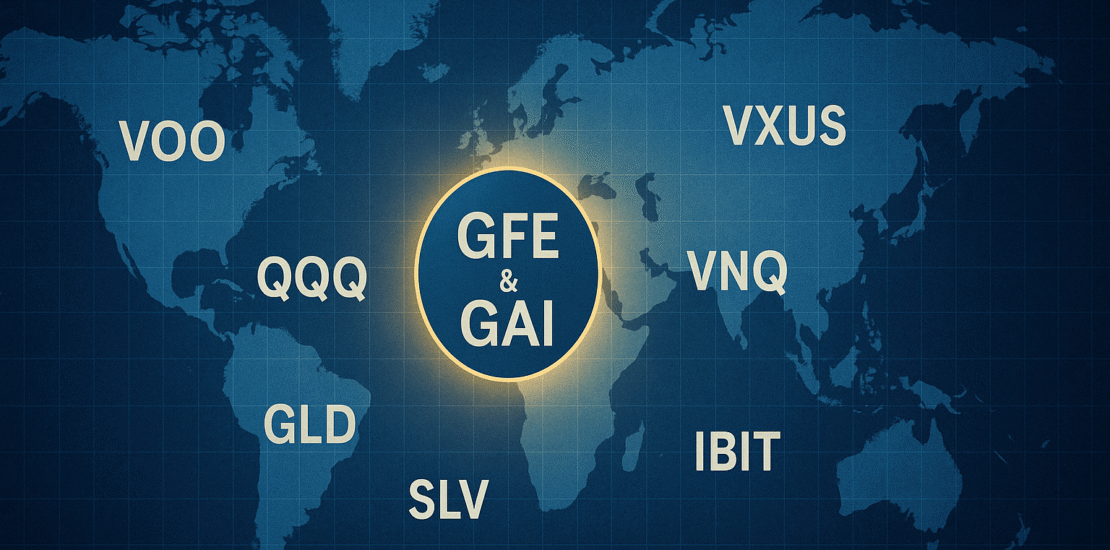

Global Multi-Asset ETF Portfolio White Paper v1.0 – GAI & GFE

- November 28, 2025

- Posted by: Drglenbrown1

- Categories: Global Proprietary Trading Research, Research & White Papers

This white paper presents the Global Multi-Asset 50-ETF Portfolio engineered for Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. It unifies GATS, the Universal Risk Doctrine (DS = 16 × ATR256), the 1–9% timeframe-indexed risk model, and the Nine-Laws Framework into a single proprietary trading doctrine for cross-asset, multi-timeframe execution.

-

Global Multi-Asset ETF Master Portfolio for GFE & GAI

- November 28, 2025

- Posted by: Drglenbrown1

- Category: Global Multi-Asset Portfolios

Discover the Global Multi-Asset ETF Master Portfolio designed by Dr. Glen Brown for GFE & GAI, integrating GATS, DAATS, and the Nine-Laws Framework into a unified, institution-grade ETF universe.

-

Guidex Theory – Reframing Digital Currencies as a Global Kinetic Energy Matrix

- November 25, 2025

- Posted by: Drglenbrown1

- Categories: Digital Asset Research, Quantitative Research, Research & White Papers

Guidex Theory – White Paper v1.0, authored by Dr. Glen Brown, reframes digital currencies as nodes in a global kinetic energy matrix. The paper introduces the Kinetic Index Score (KIS), a four-dimensional Guidex Matrix, entropy regimes, and a complete integration with GATS, DAATS, and the Nine-Laws Framework to build structurally robust, energy-aware crypto portfolios.

-

Goldman Sachs Valuation Masterclass: Applying Dr. Glen Brown’s Nine-Laws Framework

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

A comprehensive, Nine-Laws-anchored valuation of Goldman Sachs: from smoothed fundamentals to regime-based, probability-weighted, and safety-adjusted price targets.

-

Part 5: Advanced Overlays — Multi-Factor, Monte Carlo, Capital & Event Modules

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Part 5 shows you how to layer DCF, relative P/E, Monte Carlo, capital structure, and event modules for a truly next-generation valuation model.

-

Part 4: Probability Weighting & Margin-of-Safety

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Part 4 shows you step-by-step how to compute a probability-weighted forecast and apply a margin-of-safety, using Tesla as the example.

-

Part 3: Defining Regimes via Fibonacci Splits & Scenario Forecasts

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Part 3 shows you step-by-step how to apply 38.2%, 50%, or 61.8% Fibonacci splits to your EVDF, derive EVGF, and forecast prices for each regime using Tesla as an example.

-

Part 2: Calibrating EVDF ↔ EVGF to Today’s Price — A Quantum Measurement Approach

- August 5, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

In Part 2, we collapse fundamental value into observed price—deriving EVDF & EVGF via a quantum measurement analogy—complete with a Tesla example.

-

Dr. Glen Brown’s Enhanced Equity Valuation Model: Integrating the Nine-Laws for Dynamic, Risk-Adjusted Valuation

- August 4, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Discover Dr. Glen Brown’s next-generation Equity Valuation Model—fully adaptive, regime-based, and risk-adjusted via a proprietary Nine-Laws framework.

-

Dr. Glen Brown’s Nine-Laws Framework: A Quantum Revolution in Volatility Risk Management

- July 31, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum mechanics concepts—superposition, density matrices, and Lindblad dynamics—to adaptively manage volatility and risk in forex, equities, commodities, and crypto strategies.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Finance, Thought Leadership, GATS Series

Discover the foundation of Dr. Glen Brown’s Nine-Laws Framework as he applies quantum principles to market chaos. Learn how to trade with coherence, resilience, and engineered discipline.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum principles to market exits, volatility, and time. Part 2 of the Quantum Mindset series.

-

Global Weekly Forex Portfolio Risk Management Guide For Global Traders

- July 3, 2025

- Posted by: Drglenbrown1

- Category: Forex Portfolio Analysis, Quantum Risk Management

This weekly guide leverages Dr. Glen Brown’s quantum-inspired Nine-Laws Framework and GATS methodology to deliver adaptive, self-calibrating risk controls—stops, break-evens, and position sizing—across a global portfolio of 28 major FX pairs.

-

Adaptive Volatility in Crypto: Applying Dr. Glen Brown’s Nine-Laws Framework to BTC/USD (1-Hour) – A GATS60 Case Study

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Quantum Finance, Risk Management

Explore how Dr. Glen Brown’s Nine-Laws Framework transforms crypto trading risk management into a self-calibrating, quantum-inspired system—anchoring volatility, regime detection, and execution buffers in rigorous mathematical operators.

-

The Quantum Edge – Synthesizing the Nine Laws

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Quantum-Inspired Trading Systems, Holistic Strategy Synthesis

Trading is a quantum dance of uncertainty and precision, mastered through a unified framework. Dr. Glen Brown’s Nine-Laws Framework synthesizes the nine GATS strategies with quantum principles, from entanglement to state tomography, to navigate markets across timeframes. This article unifies the series, showcasing how GATS1 to GATS43200 deliver a quantum edge from minutes to months, optimizing returns and risks.

-

Comparing GATS Strategies – A Quantum Spectrum of Performance

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Strategy Evaluation, Quantum-Inspired Trading Systems

Trading strategies span a quantum spectrum, each measuring market states at different scales. Dr. Glen Brown’s Nine-Laws Framework powers the nine GATS strategies, from GATS1’s rapid scalping to GATS9’s long-term trends, offering a range of performance profiles. This article compares their effectiveness across timeframes, leveraging quantum multi-scale principles to optimize returns from minutes to months.

-

Continuous Model Validation – Quantum State Tomography

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Model Validation, Quantum-Inspired Trading Systems

A trading model is like a quantum system needing constant recalibration to stay accurate. Dr. Glen Brown’s Law 9 of the Nine-Laws Framework uses continuous validation, inspired by quantum state tomography, to refine GATS strategies. This article explores how GATS1 to GATS43200 adapt through weekly reviews, ensuring robustness across timeframes from minutes to months in evolving markets.

- 1

- 2