-

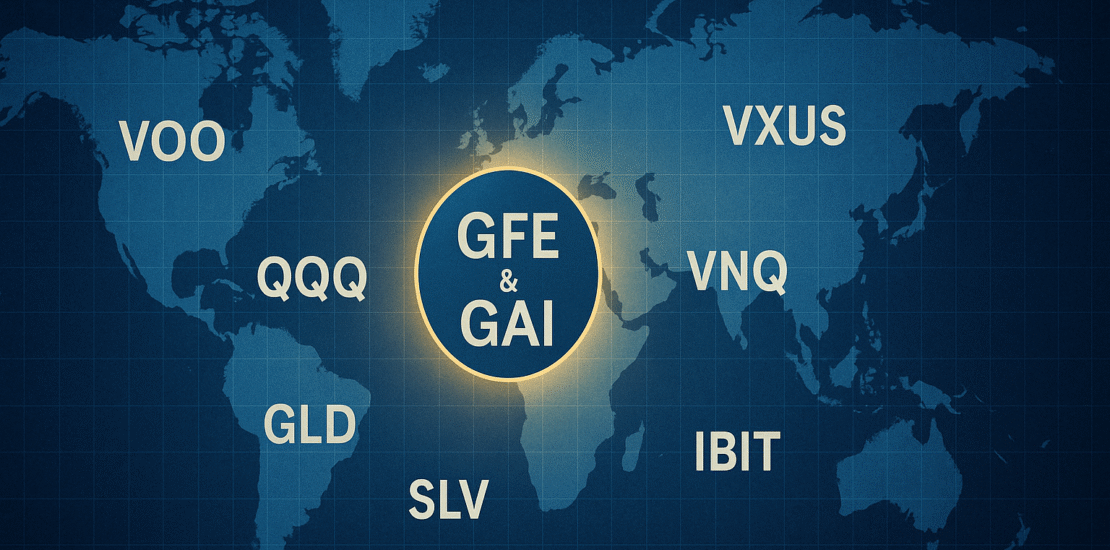

Global Multi-Asset ETF Portfolio White Paper v1.0 – GAI & GFE

- November 28, 2025

- Posted by: Drglenbrown1

- Categories: Global Proprietary Trading Research, Research & White Papers

No Comments

This white paper presents the Global Multi-Asset 50-ETF Portfolio engineered for Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. It unifies GATS, the Universal Risk Doctrine (DS = 16 × ATR256), the 1–9% timeframe-indexed risk model, and the Nine-Laws Framework into a single proprietary trading doctrine for cross-asset, multi-timeframe execution.

-

Global Multi-Asset ETF Master Portfolio for GFE & GAI

- November 28, 2025

- Posted by: Drglenbrown1

- Category: Global Multi-Asset Portfolios

Discover the Global Multi-Asset ETF Master Portfolio designed by Dr. Glen Brown for GFE & GAI, integrating GATS, DAATS, and the Nine-Laws Framework into a unified, institution-grade ETF universe.

-

Negentropic Pulse Dynamics: Rebirth within Macro Entropy — Dr. Glen Brown

- October 25, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

Dr. Glen Brown unveils Negentropic Pulse Dynamics within the GATS Framework—how order forms inside macro entropy through multi-timeframe energy realignment and volatility geometry.

-

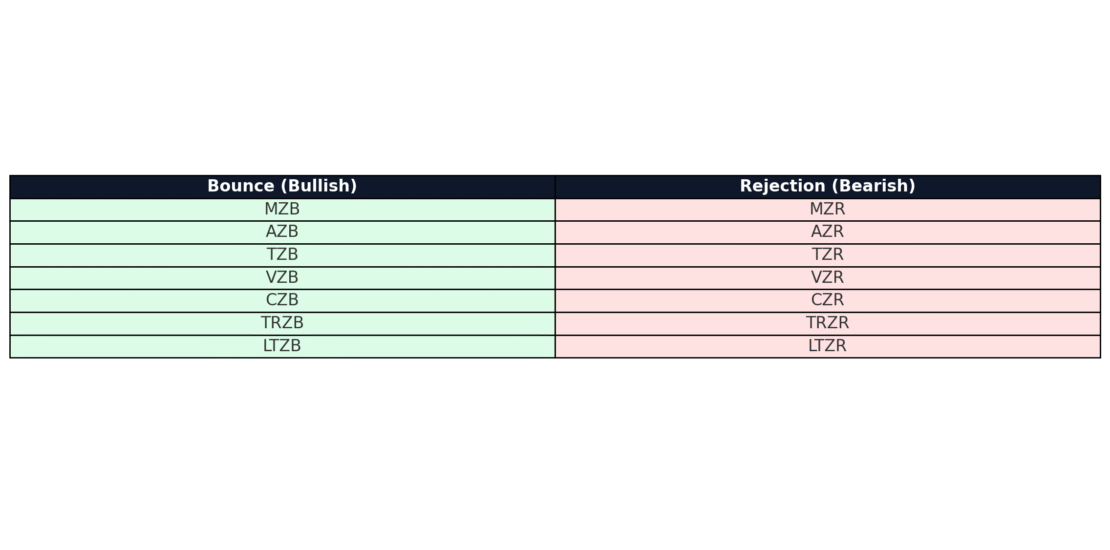

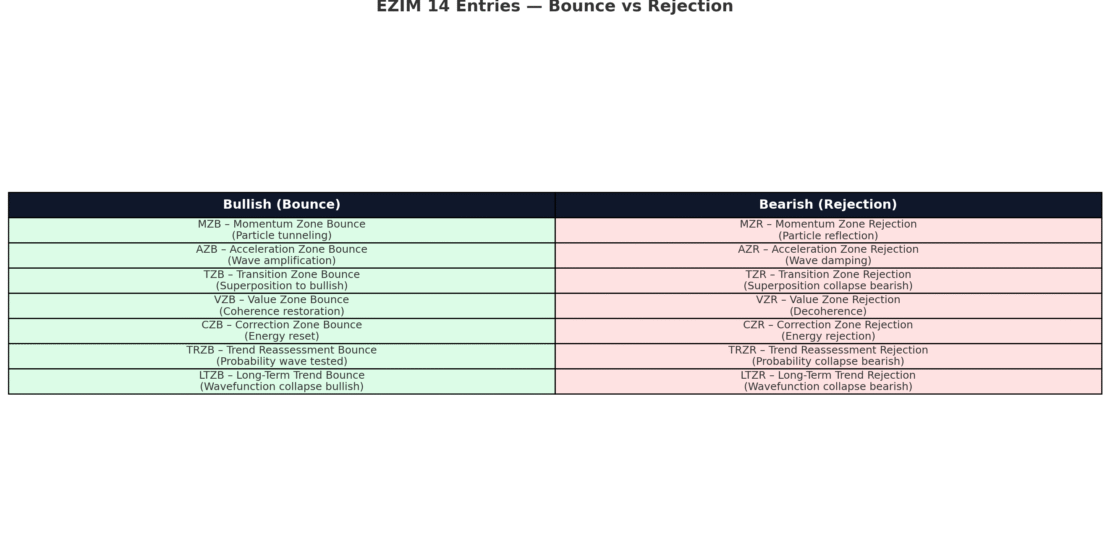

The 14 EZIM Entries — Bounce & Rejection Taxonomy

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM 14-entry taxonomy provides traders with a structured field manual of entries across bullish and bearish market structures, linked with quantum metaphors.

-

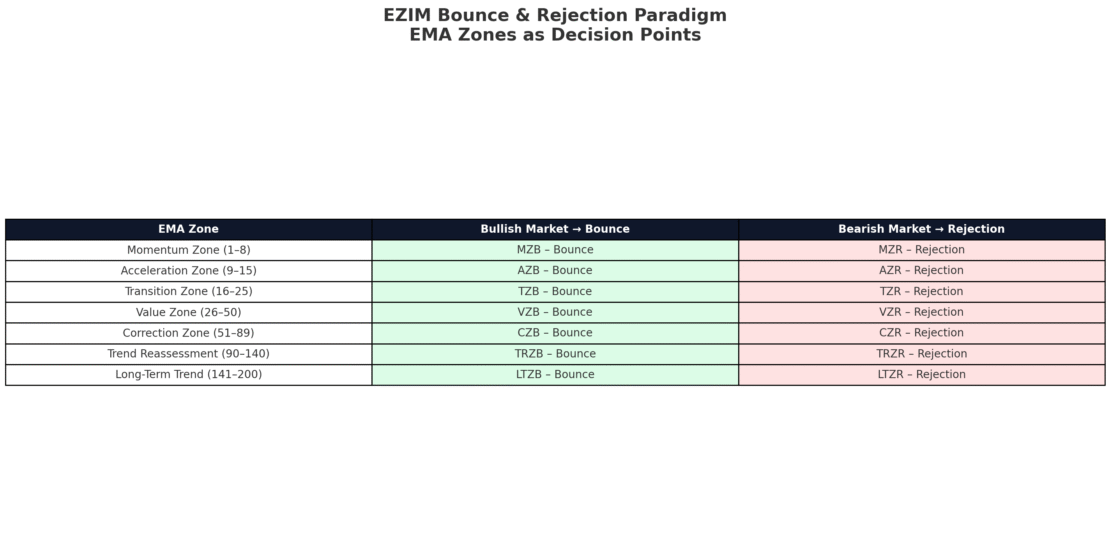

Introduction to EZIM — The Bounce & Rejection Paradigm

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM Bounce & Rejection Paradigm classifies EMA zone interactions into bullish Bounces and bearish Rejections, creating a powerful taxonomy enriched with quantum metaphors.

-

The 14 EZIM Entries: Quantum Narratives of Bounces and Rejections

- September 14, 2025

- Posted by: Drglenbrown1

- Category: Trading Frameworks / Quantum Narratives

The EZIM 14-entry taxonomy provides traders with precise entry definitions across bullish and bearish structures, enriched with quantum metaphors to enhance execution and psychology.

-

Building Your First GUQFXP Trade: From Signal to Death-Stop

- July 5, 2025

- Posted by: Drglenbrown1

- Category: Global Universal Quantum FX Portfolio (GUQFXP)

In this walkthrough, we step through a single GUQFXP trade from initial signal generation through to Death-Stop placement, adaptive break-even, and profit-target execution.

-

Adaptive Volatility in FX: Applying Dr. Glen Brown’s Nine-Laws Framework to EUR/USD (1-Hour) – June 30, 2025

- June 30, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading, Financial Engineering, Risk Management

This analysis demonstrates how Dr. Glen Brown’s Nine-Laws Framework, combined with GATS60 methodology, delivers a rigorously adaptive, quantum-inspired risk engine—optimizing entries, stops, and position sizing for EUR/USD in volatile FX markets.

-

Introducing the Global Tokenized Leverage Framework (GTLF): A New Paradigm for Internal Capital, Margin, and Risk Management

- May 13, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Introducing GTLF – an off-chain, tokenized model for capital unitization, programmable margin, and leveraged exposure within a closed-loop trading ecosystem.

-

The Closed-Loop Proprietary Model: Why GFE Keeps Innovation In-House

- April 25, 2025

- Posted by: Drglenbrown1

- Category: Proprietary Trading

Explore why GFE’s fully integrated research-to-execution cycle delivers a sustained competitive edge in global markets through its in-house GATS platform and collaborative feedback loops

-

Global Adaptive Statistical Break-Even Trigger (GASBET) Model

- April 4, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the GASBET Model—a dynamic break-even trigger that integrates statistical measures with our GATS Framework. Learn how leveraging the mean and standard deviation of DAATS values optimizes exit strategies and enhances risk management.

-

Building the Future of Systematic Trading: A Comprehensive Blueprint for Global Financial Engineering

- April 2, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the full organizational blueprint of Global Financial Engineering & Proprietary Trading Institute, where advanced financial engineering, adaptive risk management, and a dynamic units-of-allocation system combine to create an “ATM-like” proprietary trading fund.

-

Building a Competitive Edge: The Power of a Closed Business Model in Finance

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the transformative power of a closed business model in finance, where exclusive innovation and proprietary trading systems create a competitive edge for enduring success.

-

Blueprint for Enduring Excellence: Transformative Strategies in Global Financial Engineering

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the blueprint for enduring excellence in financial engineering. Learn how multi-timeframe strategies, adaptive risk management, and exclusive proprietary innovation are shaping the future of trading.

-

Visionary Leadership in Financial Engineering: The Legacy of Dr. Glen Brown

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the visionary leadership of Dr. Glen Brown and how his pioneering work in financial engineering is revolutionizing trading through advanced, adaptive systems and exclusive innovation.

-

Exclusive Innovation: How GAI and GFE Are Shaping the Future of Trading

- March 11, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore how Global Accountancy Institute, Inc. (GAI) and Global Financial Engineering, Inc. (GFE) are pioneering exclusive innovations in trading, transforming risk management and setting new standards for the future of financial engineering.

-

Global Traders Guide: Mastering the Global Nasdaq Elite 30 Portfolio (GNE30)

- January 24, 2025

- Posted by: Drglenbrown1

- Category: Global Nasdaq Elite 30 Portfolio

The Global Nasdaq Elite 30 Portfolio (GNE30) combines innovation, growth, and performance by featuring the top 30 companies from the Nasdaq-100 Index. Paired with the Global Hourly Trend Follower (M60) strategy, this guide provides traders with a structured approach to capitalize on hourly trends, robust risk management, and medium-duration trading opportunities. Perfect for proprietary trading professionals, the GNE30 portfolio reflects a disciplined approach to navigating dynamic financial markets.

-

Introduction to the Global Algorithmic Trading Software (GATS)

- November 3, 2024

- Posted by: Drglenbrown1

- Category: Algorithmic Trading and Financial Engineering

Discover the transformative power of GATS – a cutting-edge software for algorithmic trading, designed for precision, risk management, and multi-timeframe analysis.