-

Lecture 4: The 18.75% Law of Adaptive Transition — Symmetry Between Breakeven and Trail

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading

No Comments

This lecture formalizes the 18.75% Law of Adaptive Transition within the Global Algorithmic Trading Software (GATS). The law defines the universal threshold at which a trade shifts from survival to expansion: the breakeven activation and the ongoing trail amplitude are both set to 3/16 of the Death-Stop (DS). By unifying these thresholds, GATS encodes a structural symmetry that converts drawdown into time and momentum into measured respiration. We provide derivations, tables, and MT5/GATS implementation logic for multi-asset deployment

-

Lecture 3: Death-Stop (DS) and DAATS — Converting Drawdown into Time

- November 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Lecture Series

GATS Lecture 3 codifies DS=DAATS initialization and the 18.75% Break-Even law, showing how to convert drawdown into time with constant trail amplitude and MT5-ready logic.

-

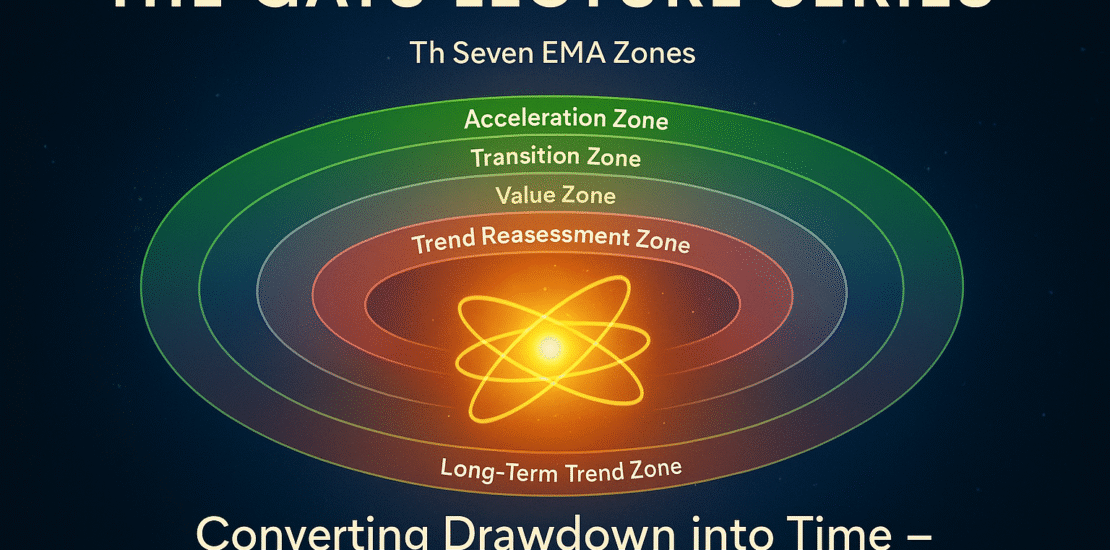

The Foundations of GATS: From EMA Zones to Quantum Risk Dynamics

- October 31, 2025

- Posted by: Drglenbrown1

- Categories:

Discover the foundational principles of GATS — Dr. Glen Brown’s advanced algorithmic trading framework that fuses EMA Zones, ATR-based risk logic, and quantum-inspired volatility management.

-

Negentropic Pulse Dynamics: Rebirth within Macro Entropy — Dr. Glen Brown

- October 25, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

Dr. Glen Brown unveils Negentropic Pulse Dynamics within the GATS Framework—how order forms inside macro entropy through multi-timeframe energy realignment and volatility geometry.

-

Compression within Containment: Transforming Drawdown into Time — Dr. Glen Brown

- October 25, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

A detailed paper by Dr. Glen Brown showing how GATS turns drawdown into time through the M1440-anchored Death Stop and temporal elasticity during volatility compression

-

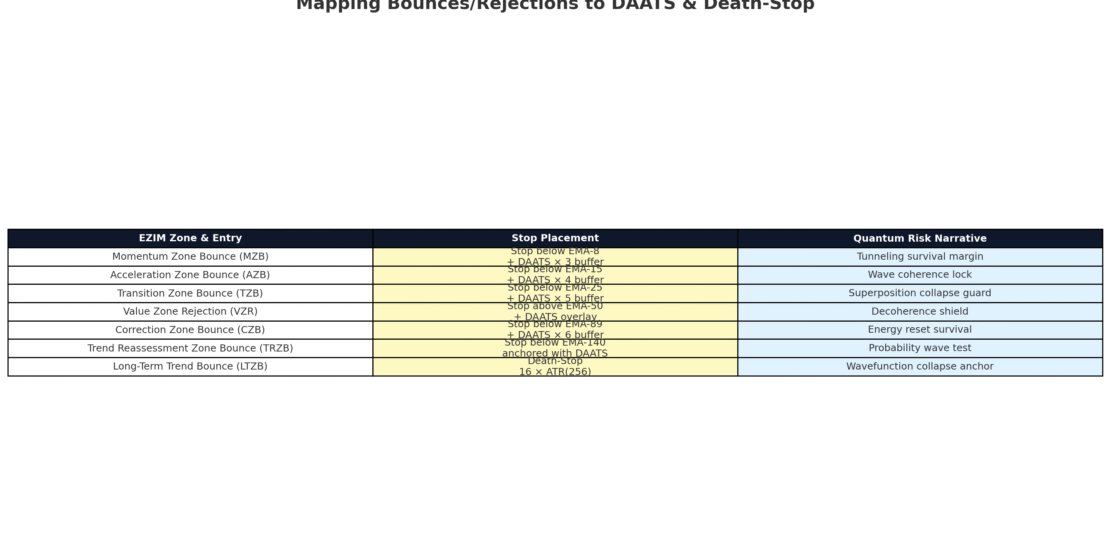

Risk & EZIM — Anchoring Stops, DAATS, and Death-Stop

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Risk & EZIM

Risk is the backbone of EZIM. This article shows how DAATS and Death-Stop anchor the Bounce & Rejection Paradigm into disciplined survival rules.

-

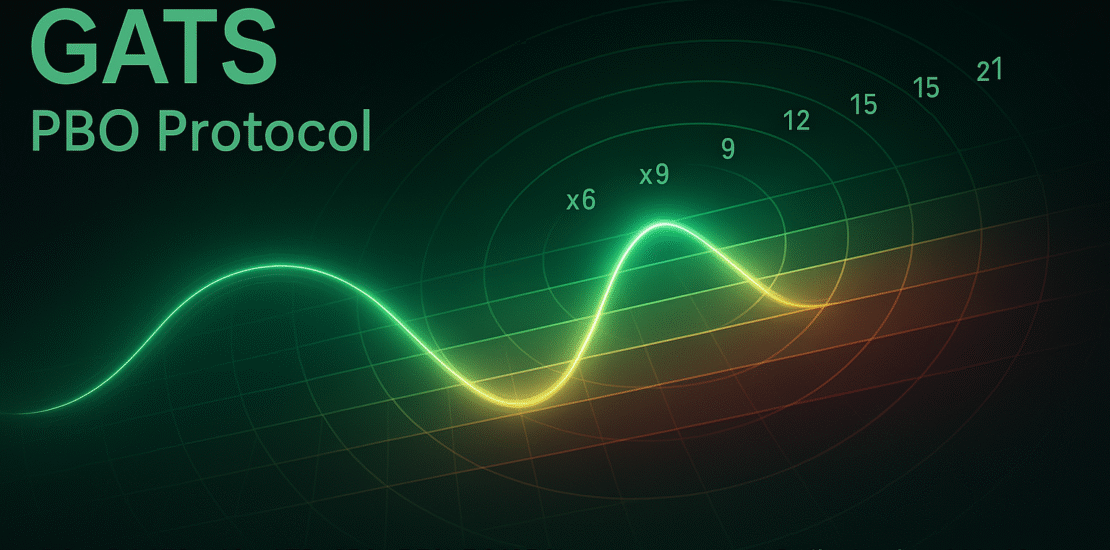

🌌 GATS Profit-Banking Overlay (PBO) Protocol — Quantum Narrative Edition

- September 7, 2025

- Posted by: Drglenbrown1

- Category: GATS Handbook

A desk-ready GATS protocol: DS=DAATS=16×ATR-256 (M1440), BE% at 7.8125%, and staged Profit-Banking at GSC wells (×6, ×9, ×12) to recycle capital while letting the final 25% ride into deep wells (×15–×21).

-

The Dr. Glen Brown Forex Valuation Model (DGB-FVM): A Unified Macro-Tactical Framework for Currency Fair Value

- August 12, 2025

- Posted by: Drglenbrown1

- Category: Global Research & Models

Introducing DGB-FVM—the missing valuation anchor for FX. A unified macro-tactical framework with PPP/REER/IRP, risk premia, GATS integration, and a EURUSD example.

-

Gold Strategy Update — August 8, 2025: Applying Dr. Glen Brown’s Nine Laws with GATS

- August 8, 2025

- Posted by: Drglenbrown1

- Category: Global Daily Insights

A disciplined, bullish-only Gold plan for August 8, 2025—aligning GATS with Dr. Glen Brown’s Nine Laws to filter noise, trail with DAATS, and exit only on death points.

-

Dr. Glen Brown’s Enhanced Equity Valuation Model: Integrating the Nine-Laws for Dynamic, Risk-Adjusted Valuation

- August 4, 2025

- Posted by: Drglenbrown1

- Category: Equity Valuation / Financial Engineering

Discover Dr. Glen Brown’s next-generation Equity Valuation Model—fully adaptive, regime-based, and risk-adjusted via a proprietary Nine-Laws framework.

-

Quantum Risk Mastery: Dr. Glen Brown’s Nine Laws Framework for Adaptive Volatility Stop-Loss and Risk Management

- August 3, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering & Trading Strategies

Discover how Dr. Glen Brown fuses quantum mechanics narratives with nine principled laws to create an adaptive volatility stop-loss and risk management framework—reinventing portfolio protection in today’s markets.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Finance, Thought Leadership, GATS Series

Discover the foundation of Dr. Glen Brown’s Nine-Laws Framework as he applies quantum principles to market chaos. Learn how to trade with coherence, resilience, and engineered discipline.

-

Building Your First GUQFXP Trade: From Signal to Death-Stop

- July 5, 2025

- Posted by: Drglenbrown1

- Category: Global Universal Quantum FX Portfolio (GUQFXP)

In this walkthrough, we step through a single GUQFXP trade from initial signal generation through to Death-Stop placement, adaptive break-even, and profit-target execution.

-

Global Weekly Forex Portfolio Risk Management Guide For Global Traders

- July 3, 2025

- Posted by: Drglenbrown1

- Category: Forex Portfolio Analysis, Quantum Risk Management

This weekly guide leverages Dr. Glen Brown’s quantum-inspired Nine-Laws Framework and GATS methodology to deliver adaptive, self-calibrating risk controls—stops, break-evens, and position sizing—across a global portfolio of 28 major FX pairs.

-

Adaptive Volatility in FX: Applying Dr. Glen Brown’s Nine-Laws Framework to EUR/USD (1-Hour) – June 30, 2025

- June 30, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading, Financial Engineering, Risk Management

This analysis demonstrates how Dr. Glen Brown’s Nine-Laws Framework, combined with GATS60 methodology, delivers a rigorously adaptive, quantum-inspired risk engine—optimizing entries, stops, and position sizing for EUR/USD in volatile FX markets.

-

The Quantum Edge – Synthesizing the Nine Laws

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Quantum-Inspired Trading Systems, Holistic Strategy Synthesis

Trading is a quantum dance of uncertainty and precision, mastered through a unified framework. Dr. Glen Brown’s Nine-Laws Framework synthesizes the nine GATS strategies with quantum principles, from entanglement to state tomography, to navigate markets across timeframes. This article unifies the series, showcasing how GATS1 to GATS43200 deliver a quantum edge from minutes to months, optimizing returns and risks.

-

Continuous Model Validation – Quantum State Tomography

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Model Validation, Quantum-Inspired Trading Systems

A trading model is like a quantum system needing constant recalibration to stay accurate. Dr. Glen Brown’s Law 9 of the Nine-Laws Framework uses continuous validation, inspired by quantum state tomography, to refine GATS strategies. This article explores how GATS1 to GATS43200 adapt through weekly reviews, ensuring robustness across timeframes from minutes to months in evolving markets.

-

Transaction-Cost & Slippage Optimization – Mitigating Measurement Noise

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Trade Execution Optimization, Quantum-Inspired Trading Systems

Trading execution is like a quantum measurement—small errors can skew results. Dr. Glen Brown’s Law 8 of the Nine-Laws Framework optimizes transaction costs and slippage, inspired by quantum error correction, to enhance precision. This article explores how GATS1 to GATS43200 apply this law, padding stops and using limit orders across timeframes from minutes to months, ensuring efficient trade execution.