-

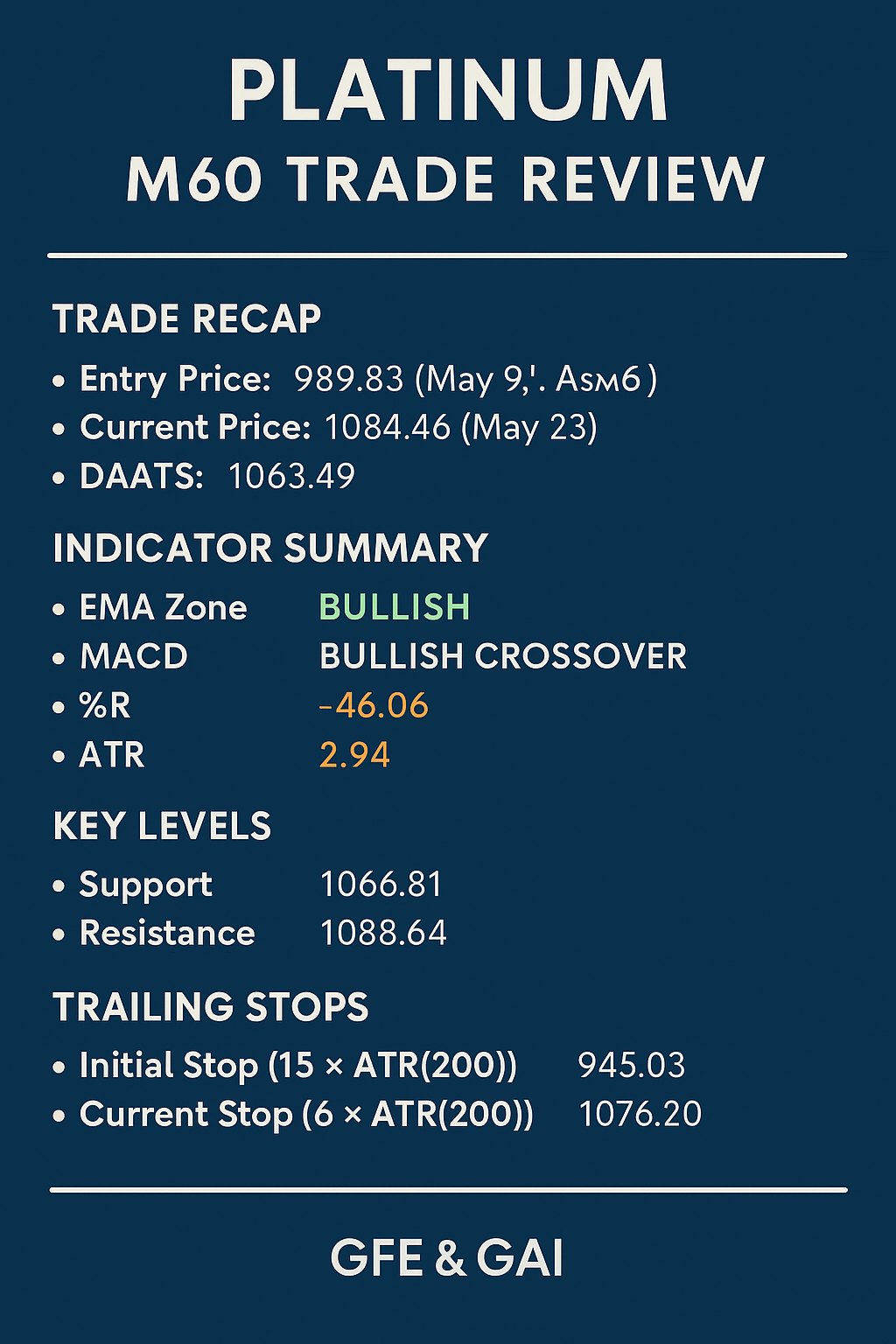

Platinum M60 Trade Review (May 9 Entry) Applying Dr. Glen Brown’s Seven Laws + Technical Indicator Deep-Dive

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

No Comments

In-depth review of the May 9 Platinum M60 trade using Dr. Glen Brown’s seven Laws of Volatility Stop-Loss, plus multi-indicator analysis and next-session plan.

-

Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Dr. Glen Brown’s seven universal laws of volatility stop-loss—a zone-aligned, ATR(200)-based framework for adaptive stops, breakeven rules, and tiered risk management across all markets and timeframes.

-

Integrating Cryptocurrency into Corporate Treasury Management

- May 4, 2025

- Posted by: Drglenbrown1

- Category: Corporate Finance / Cryptocurrency

Discover a comprehensive framework for integrating cryptocurrencies into corporate treasury operations—covering stablecoin pools, DeFi yield strategies, risk controls, and accounting best practices.

-

The Closed-Loop Proprietary Model: Why GFE Keeps Innovation In-House

- April 25, 2025

- Posted by: Drglenbrown1

- Category: Proprietary Trading

Explore why GFE’s fully integrated research-to-execution cycle delivers a sustained competitive edge in global markets through its in-house GATS platform and collaborative feedback loops

-

Building the Future of Systematic Trading: A Comprehensive Blueprint for Global Financial Engineering

- April 2, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the full organizational blueprint of Global Financial Engineering & Proprietary Trading Institute, where advanced financial engineering, adaptive risk management, and a dynamic units-of-allocation system combine to create an “ATM-like” proprietary trading fund.

-

The Evolution of Financial Engineering: From Theory to Systematic Trading

- April 2, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore our innovative adaptive break-even mechanism for the GATS Framework, which combines dynamic percentages and fixed points to create a market-responsive exit strategy across multiple timeframes.

-

A Hybrid Adaptive Break-Even Mechanism for the GATS Framework: Integrating Dynamic Percentages and Fixed Point Thresholds

- March 27, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore our innovative adaptive break-even mechanism for the GATS Framework, which combines dynamic percentages and fixed points to create a market-responsive exit strategy across multiple timeframes.

-

GATS Framework Performance Measurement Model

- March 16, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Delve into our complete performance measurement model for the GATS Framework, showcasing key metrics, demo data analysis, and a data-driven approach to algorithmic trading performance, developed by Dr. Glen Brown.

-

Heiken Ashi and Color-Coded EMA Zones: Visualizing Market Structure in Real Time

- March 11, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover how Heiken Ashi candles and color-coded EMA zones work together to visualize market structure in real time, providing clear insights for trend identification and risk management in modern trading systems.

-

The Daily MACD as a Trend Governor: Filtering Noise in a Fast-Paced Market

- March 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover how the Daily MACD (6, 9, 3) acts as a trend governor to filter noise in fast-paced markets, enhancing multi-timeframe trading strategies for improved risk management and trade consistency.

-

Layered Signal Confirmation: The Future of Multi-Indicator Trading Systems

- March 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the future of multi-indicator trading with layered signal confirmation—a dynamic approach that integrates multiple technical indicators to improve trade accuracy and risk management.

-

Global Adaptive Time Scaling: Transforming Market Analysis with GTSF

- March 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the revolutionary concept of Global Adaptive Time Scaling (GTSF), a dynamic tool that aligns risk management and signal generation with the true rhythm of the market for enhanced trading performance.

-

Global Trade Turbulence: A Comprehensive Trading Guide for Global Traders

- March 6, 2025

- Posted by: Drglenbrown1

- Category: Global Trading / Financial Engineering

A comprehensive trading guide for Global Traders, combining macroeconomic insights with our advanced GATS and DAATS framework to capitalize on market volatility and transform trade turbulence into opportunity.

-

Global Traders Guide: Mastering the Global Nasdaq Elite 30 Portfolio (GNE30)

- January 24, 2025

- Posted by: Drglenbrown1

- Category: Global Nasdaq Elite 30 Portfolio

The Global Nasdaq Elite 30 Portfolio (GNE30) combines innovation, growth, and performance by featuring the top 30 companies from the Nasdaq-100 Index. Paired with the Global Hourly Trend Follower (M60) strategy, this guide provides traders with a structured approach to capitalize on hourly trends, robust risk management, and medium-duration trading opportunities. Perfect for proprietary trading professionals, the GNE30 portfolio reflects a disciplined approach to navigating dynamic financial markets.

-

Transforming for Rebirth: The Evolution of a Closed Proprietary Trading Model

- January 12, 2025

- Posted by: Drglenbrown1

- Category: Proprietary Trading Strategies

At GAI and GFE, internal growth forms the foundation of sustainable success, empowering teams with advanced skills and technologies for proprietary trading excellence.

-

Transforming for Rebirth: Inside Our Closed Proprietary Trading Model

- January 12, 2025

- Posted by: Drglenbrown1

- Category: Proprietary Trading Strategies

Guided by the philosophy, “We must consume ourselves in order to transform ourselves for our rebirth,” GAI and GFE redefine proprietary trading with a unique closed business model.

-

The 9 Default Trading Strategies in Global Algorithmic Trading Software (GATS)

- December 7, 2024

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Financial Technology, Risk Management, Trading Strategies

The Global Algorithmic Trading Software (GATS) offers nine powerful default trading strategies, catering to traders across multiple timeframes. Learn how these strategies use cutting-edge tools like DAATS and MEMH to navigate diverse markets effectively.

-

Algorithmic Trading with GATS: Building a Strong Foundation

- November 3, 2024

- Posted by: Drglenbrown1

- Category: Algorithmic Trading and Financial Engineering

Discover how the Global Algorithmic Trading Software (GATS) builds a strong foundation in algorithmic trading, empowering traders to navigate financial markets with precision.