-

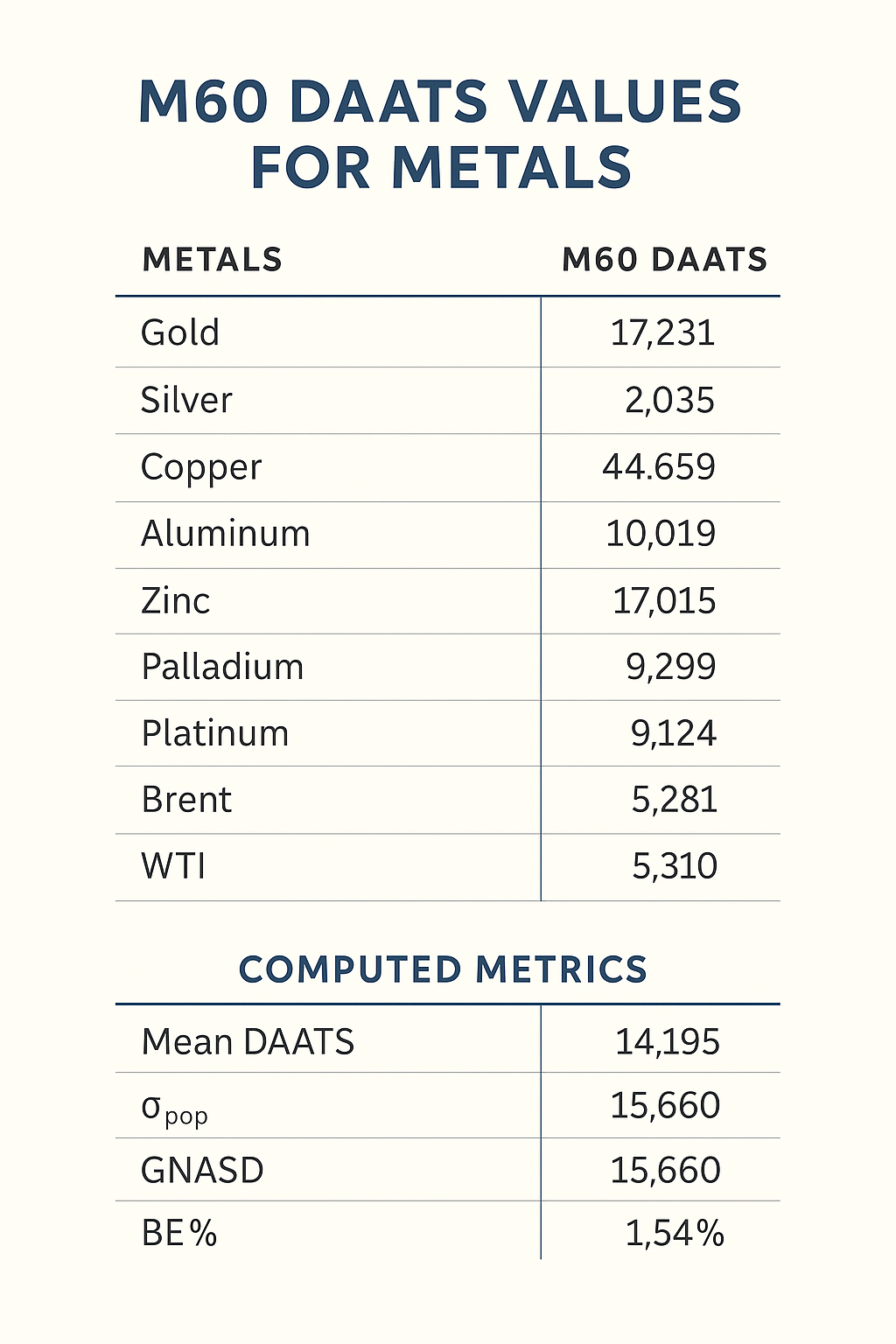

Calculating GNASD & BE% for M60 Metals Portfolio

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

No Comments

Learn how to compute portfolio σpop, GNASD (one-sigma noise unit), and BE% for 10 metals (Gold, Silver, Copper, Aluminum, Zinc, Lead, Palladium, Platinum, Brent, WTI) using updated M60 DAATS values.

-

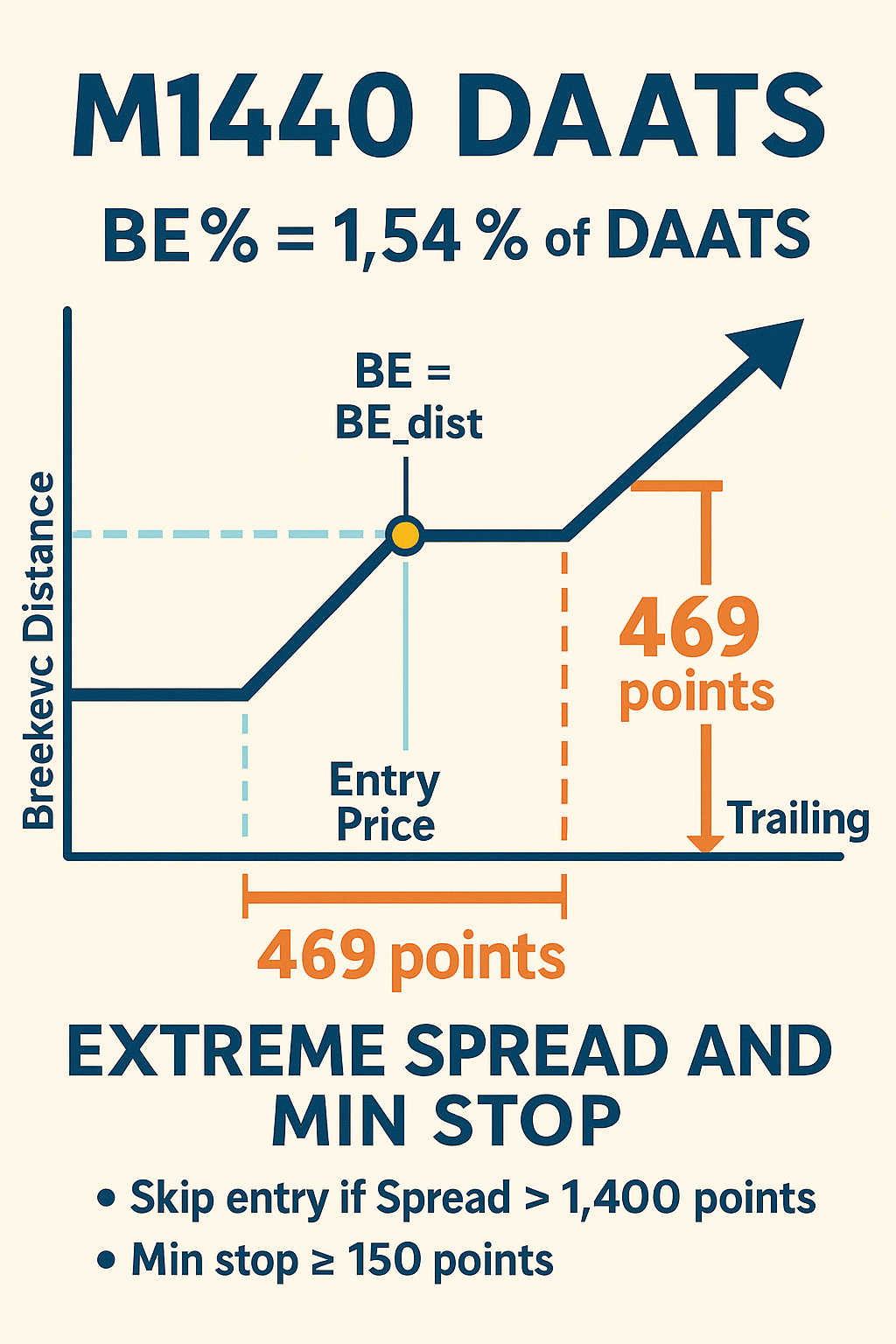

Final M1440 DAATS Lecture: Breakeven & Trailing Stops with Extreme Spread Handling

- June 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn our final M1440 DAATS framework for 28 forex pairs: BE % = 1.54 % of DAATS, post‐BE trailing = 469 points, and skip entries if spread > 1 400 points, all aligned with Dr. Brown’s Seven Laws.

-

Recalculating BE% & GNASD for GEMF – USA Sub‐Fund (June 1, 2025)

- June 1, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how to recalculate portfolio BE% and GNASD (one-sigma noise unit) for GEMF – USA Sub-Fund using updated M60 DAATS values on June 1, 2025. Includes formulae, examples, and implementation linked to Dr. Brown’s Seven Laws.

-

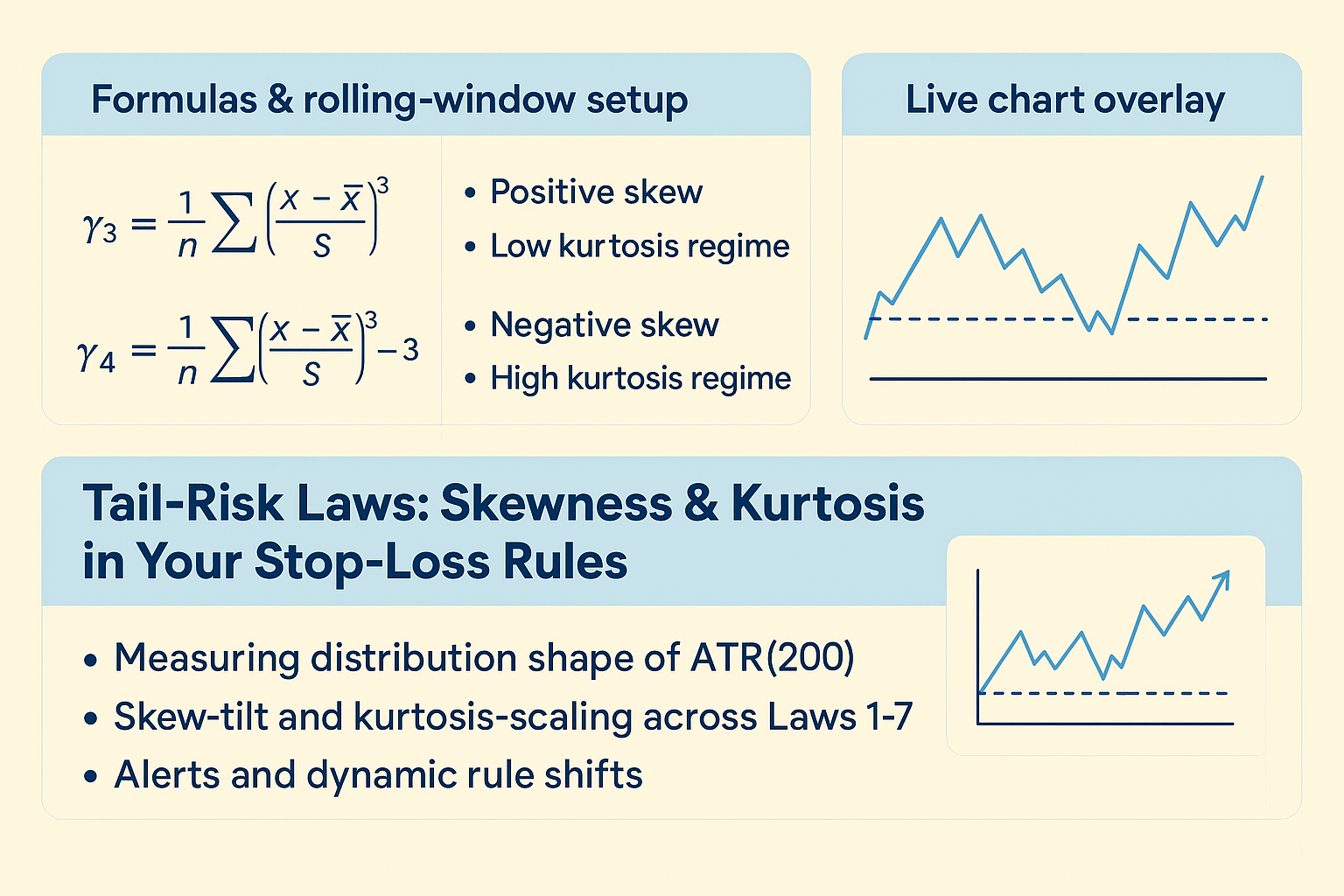

Tail-Risk Laws: Skewness & Kurtosis in Your Stop-Loss Rules

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to measure ATR(200) skewness and kurtosis, apply skew-tilt & kurtosis-scaling to Dr. Glen Brown’s Seven Laws, and view live chart overlays for dynamic stop adjustments.

-

An Integrated Approach for Market Predictions: Expanding Dr. Glen Brown’s Market Expected Moves Hypothesis (MEMH), Dynamic Adaptive ATR Trailing Stops (DAATS) with Fibonacci Scaling Factors and Break-Even Point Analysis

- February 17, 2024

- Posted by: Drglenbrown1

- Category: Quantitative Finance Techniques

This research presents a comprehensive and sophisticated integrated approach that expands upon Dr. Glen Brown’s esteemed Market Expected Moves Hypothesis (MEMH). By incorporating Fibonacci factors and break-even point analysis, along with the utilization of Dynamic Adaptive ATR Trailing Stops (DAATS), the enhanced MEMH offers an advanced predictive model for estimating price movements in the financial market. This novel framework provides traders and investors with an enhanced level of precision, detail, and confidence in making informed decisions.