-

Applying M60 DAATS & GNASD Logic to Equities: GEMF – USA Sub‐Fund

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

No Comments

Learn how GEMF – USA Sub-Fund uses M60 DAATS and GNASD to set stop floors, breakeven triggers, and trailing stops on micro-timeframes (M30, M15, M5, M1) under the Daily MACD bias and M60 EMA regime.

-

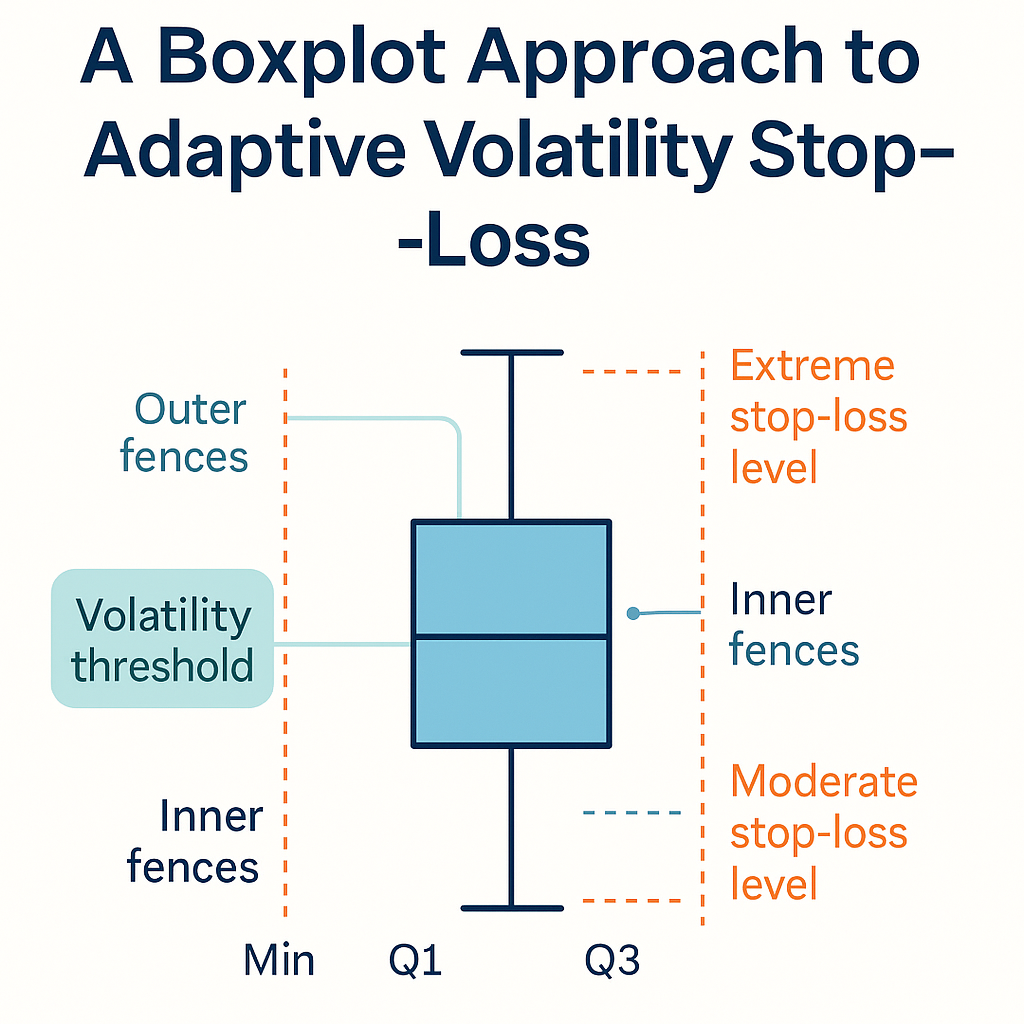

Whiskers & Fences: A Boxplot Approach to Adaptive Volatility Stop-Loss

- May 26, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to apply boxplot hinges, whiskers and fences to Dr. Glen Brown’s Seven Laws to detect regime shifts and dynamically adjust stop-loss buffers using ATR(200) exposures.

-

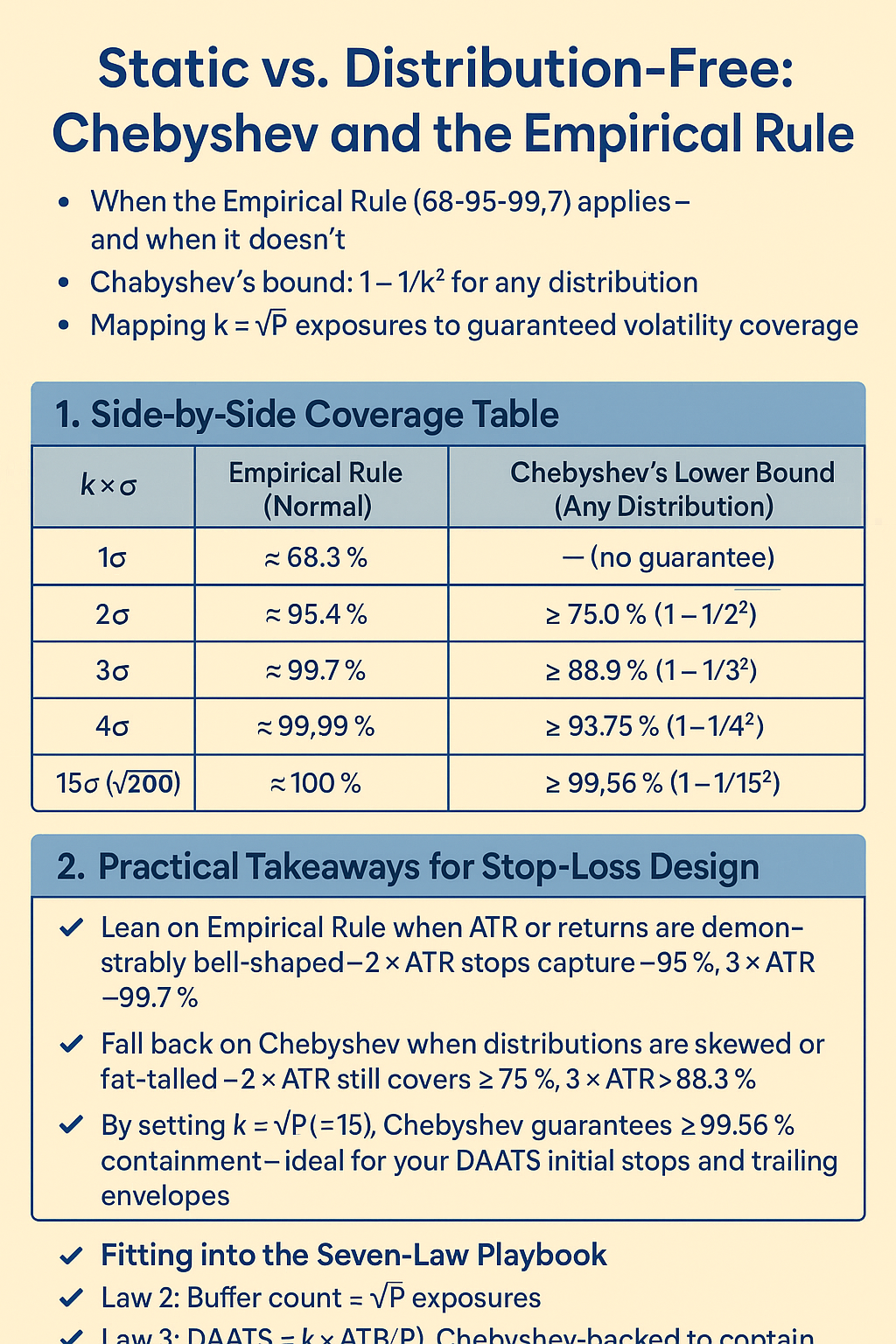

Static vs. Distribution-Free: Chebyshev and the Empirical Rule

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Compare the Empirical Rule for normal distributions with Chebyshev’s inequality for any distribution. Learn how k=√P exposures maps to guaranteed volatility coverage within Dr. Glen Brown’s Seven-Law framework.

-

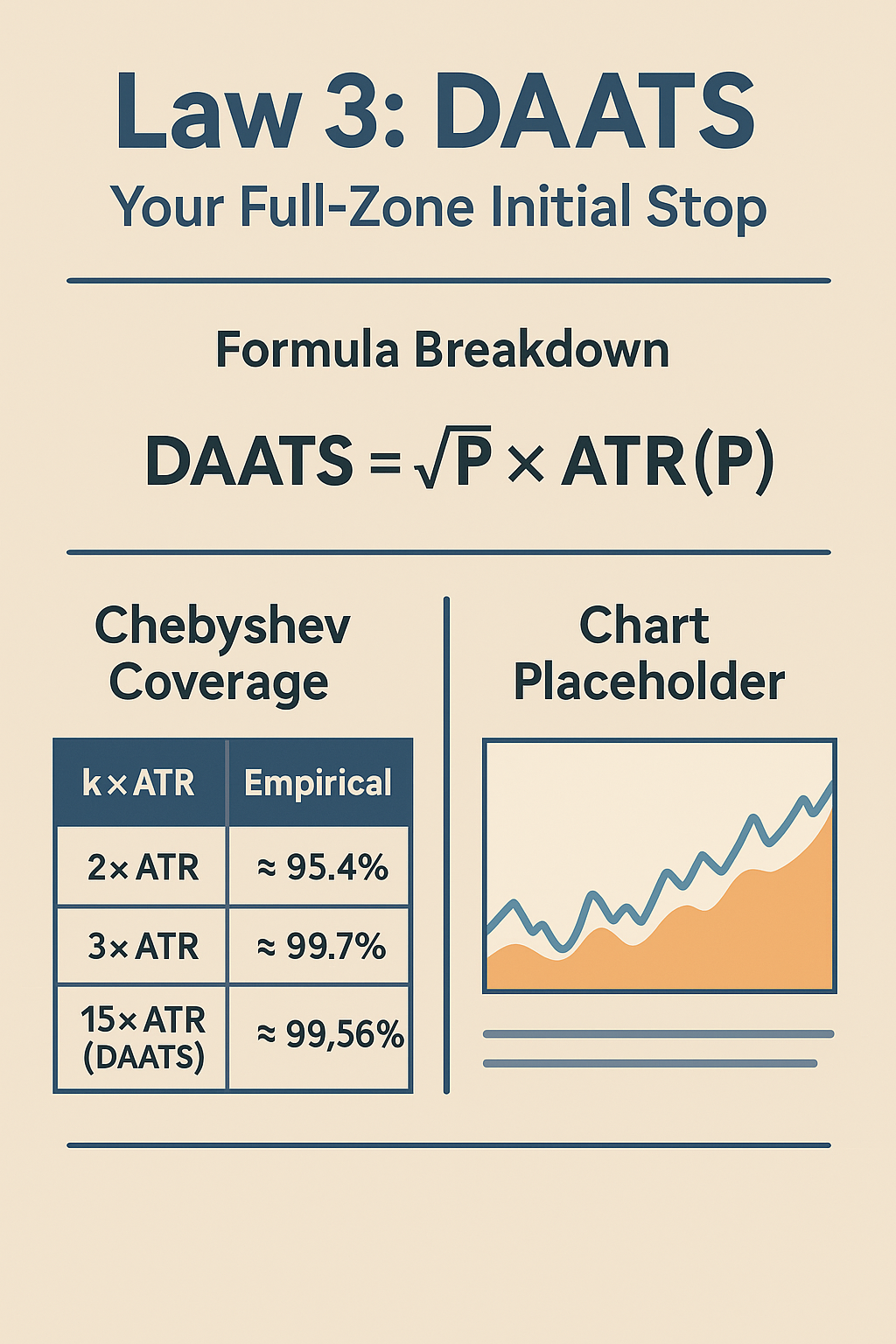

Law 3: DAATS—Your Full-Zone Initial Stop

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Law 3 of Dr. Glen Brown’s Seven Laws: DAATS = √P×ATR(P). Learn the formula, Chebyshev’s worst-case guarantee, and see an example trade with DAATS plotted.

-

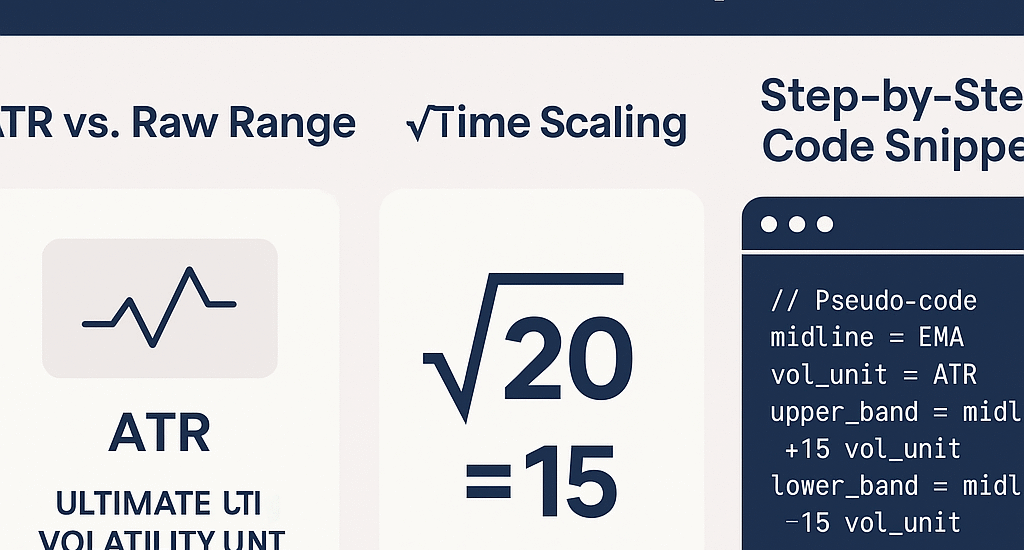

Law 1–2: Anchor Your Stops to ATR(200) & √Time Exposures

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn why ATR(200) is the ultimate volatility unit and how √time scaling (√200≈15 exposures) underpins adaptive stop-loss management, with step-by-step chart implementation.

-

Beyond ATR: Introducing Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover why static ATR-based stops fail and explore Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—anchored by √time scaling, DAATS and GNASD—for a truly adaptive risk framework.

-

Integrating Skewness & Kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to integrate skewness and kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss within the GATS framework for truly adaptive, tail-aware stops and breakeven rules.

-

Beyond ATR: Dr. Glen Brown’s Adaptive Stop-Loss Playbook—Seven Laws, √Time Exposures & the Quartile-IQR Edge

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Dr. Glen Brown’s next-level stop-loss framework: seven universal laws, √time volatility exposures, and quartile/IQR techniques for adaptive breakeven and trailing stops.

-

Gold M60 Trade Review (May 22 & 23 Entries)

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

Detailed Gold M60 trade review using Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss—entry, stops, breakeven triggers, indicator deep-dive and next-session plan.

-

Platinum M60 Trade Review (May 9 Entry) Applying Dr. Glen Brown’s Seven Laws + Technical Indicator Deep-Dive

- May 23, 2025

- Posted by: Drglenbrown1

- Category: Trading Analysis

In-depth review of the May 9 Platinum M60 trade using Dr. Glen Brown’s seven Laws of Volatility Stop-Loss, plus multi-indicator analysis and next-session plan.

-

Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 22, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Explore Dr. Glen Brown’s seven universal laws of volatility stop-loss—a zone-aligned, ATR(200)-based framework for adaptive stops, breakeven rules, and tiered risk management across all markets and timeframes.

-

Adaptive Risk Management in Action: Unlocking the Power of DAATS

- April 2, 2025

- Posted by: Drglenbrown1

- Categories:

Learn how adaptive risk management through the DAATS mechanism in the GATS Framework enhances trading performance by dynamically adjusting stop-loss levels to market volatility.

-

Fibonacci Meets Financial Engineering: Setting Realistic Risk Thresholds

- March 11, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the powerful fusion of Fibonacci retracement and financial engineering, where adaptive risk models set realistic thresholds for optimal trade management and enhanced market forecasting.