-

Applying M60 DAATS & GNASD Logic to Equities: GEMF – USA Sub‐Fund

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

No Comments

Learn how GEMF – USA Sub-Fund uses M60 DAATS and GNASD to set stop floors, breakeven triggers, and trailing stops on micro-timeframes (M30, M15, M5, M1) under the Daily MACD bias and M60 EMA regime.

-

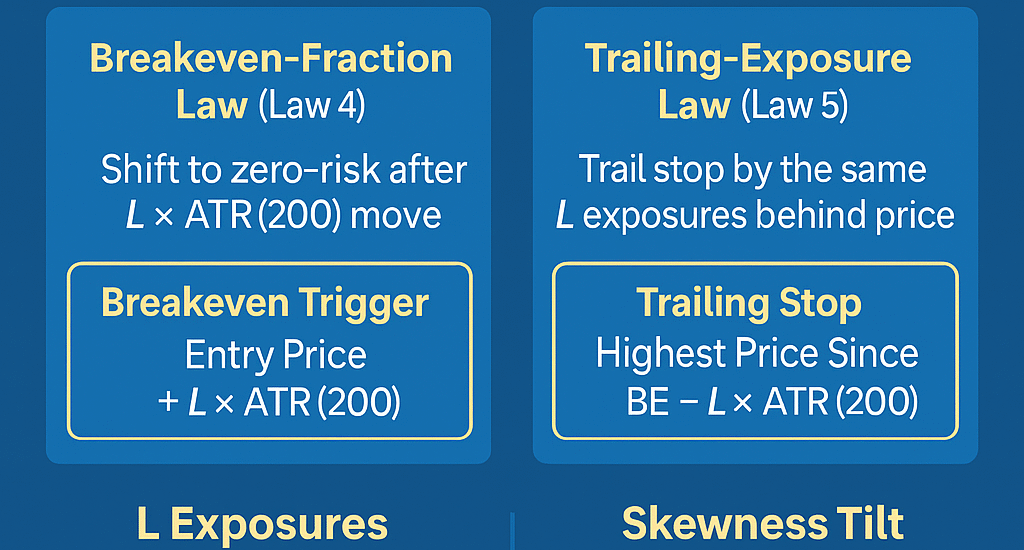

Laws 4–5: Lock in Zero-Risk & Let Winners Run

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Master Laws 4–5 of Dr. Glen Brown’s framework—adaptive breakeven triggers and trailing stops using quartile/IQR and skewness—to lock in zero risk and let winners run.

-

WaveSafe ATR Keltner Channel

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Integrate the WaveSafe ATR Exit Model with Keltner Channels—EMA(25), ATR(25), √25-based multipliers—for volatility-adaptive bands across all timeframes.

-

GATS “WaveSafe ATR” Universal Exit Model

- May 21, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the WaveSafe ATR Exit Model—a universal, volatility-adaptive trailing stop framework using ATR(25) & √time for any timeframe, delivered with a 5:1 reward-to-risk structure.

-

Mastering Risk Management in Global Markets: A Deep Dive into the GATS Methodology

- October 16, 2024

- Posted by: Drglenbrown1

- Category: Trading Strategies, Financial Markets

Explore the key elements of the GATS methodology for managing risk effectively in global financial markets. Understand the Dynamic ATR Trailing Stop and how to maximize trend following.

-

An Integrated Approach for Market Predictions: Expanding Dr. Glen Brown’s Market Expected Moves Hypothesis (MEMH), Dynamic Adaptive ATR Trailing Stops (DAATS) with Fibonacci Scaling Factors and Break-Even Point Analysis

- February 17, 2024

- Posted by: Drglenbrown1

- Category: Quantitative Finance Techniques

This research presents a comprehensive and sophisticated integrated approach that expands upon Dr. Glen Brown’s esteemed Market Expected Moves Hypothesis (MEMH). By incorporating Fibonacci factors and break-even point analysis, along with the utilization of Dynamic Adaptive ATR Trailing Stops (DAATS), the enhanced MEMH offers an advanced predictive model for estimating price movements in the financial market. This novel framework provides traders and investors with an enhanced level of precision, detail, and confidence in making informed decisions.