Tail-Risk Laws: Skewness & Kurtosis in Your Stop-Loss Rules

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

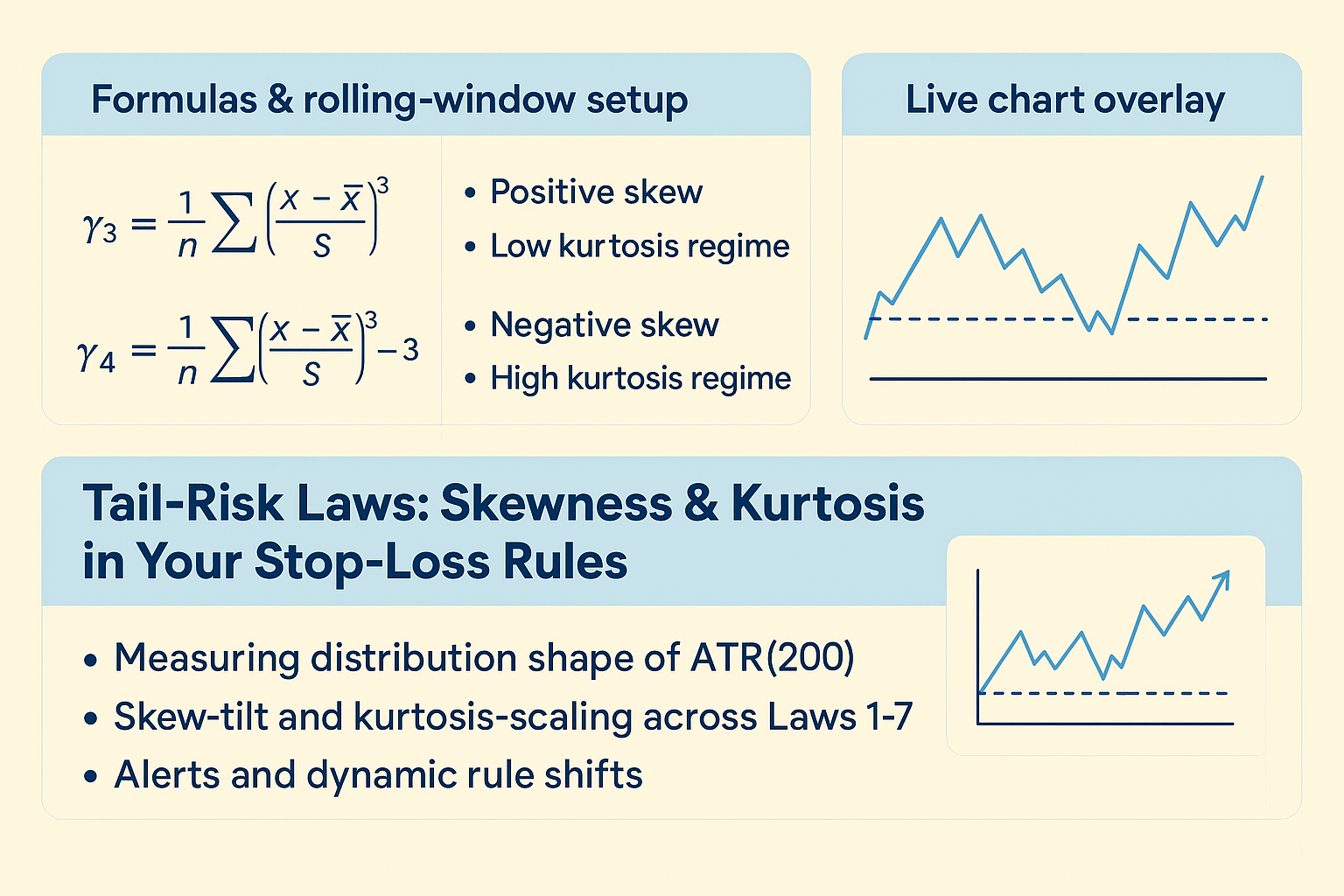

Volatility isn’t just about magnitude—it’s also about shape. Introducing Tail-Risk Laws (an extension of Laws 1–7): we integrate skewness and kurtosis of ATR(200) into your stop-loss rules to adapt for asymmetry and fat tails.

Summary

- How to measure the distribution shape of ATR(200)

- Applying skew-tilt & kurtosis-scaling across Laws 1–7

- Setting up alerts and dynamic rule shifts based on regime

Key Sections

- Formulas & Rolling-Window Setup

- Regime Classification Examples

- Live Chart with Shape-Based Buffers

1. Formulas & Rolling-Window Setup

Compute rolling skewness (γ₃) and excess kurtosis (γ₄) over your ATR(200) series using an n-bar window (e.g., n=50):

γ₃ = (1/n) Σ ((x–μ)/σ)³

γ₄ = (1/n) Σ ((x–μ)/σ)⁴ – 3Where μ and σ are the mean and standard deviation of ATR(200) over the last n bars.

2. Regime Classification Examples

Use skewness and kurtosis to define three regimes:

- Positive Skew, Low Kurtosis: Smaller downside tails—tighten L & reduce buffer

- Negative Skew, High Kurtosis: Fat left tail—widen L & buffer

- Neutral Skew/Kurtosis: Default buffer and exposure settings

3. Live Chart with Shape-Based Buffers

Overlay dynamic bands on price:

buffer = base_exposures × ATR(200)

if skew < –0.5: buffer += buffer×0.10

if kurtosis > +1: buffer += buffer×0.10

plot(EMA(200) ± buffer)Figure 1 below shows how a high-kurtosis regime expands the buffer (red dashed), while positive skew compresses it (green dashed).

About the Author

Dr. Glen Brown, Ph.D. in Investments & Finance, is President & CEO of Global Accountancy Institute and Global Financial Engineering. With over 25 years in quant research and proprietary trading, he crafted the GATS framework and these Tail-Risk Laws to make stop-loss rules truly adaptive.

Business Model Clarification

GAI & GFE operate solely as internal proprietary trading firms. We do not offer public courses or advisory services; all methodologies serve in-house research.

Risk Disclaimer

Trading derivatives and CFDs carries substantial risk. This article is educational only and is not financial advice. Always conduct your own due diligence and consult a licensed professional. Past performance does not guarantee future results; trade at your own risk.

Hashtags: #Skewness #Kurtosis #TailRisk #ATR #StopLoss #Volatility #GATS #RiskManagement #DrGlenBrown

Sponsored Content