Whiskers & Fences: A Boxplot Approach to Adaptive Volatility Stop-Loss

- May 26, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

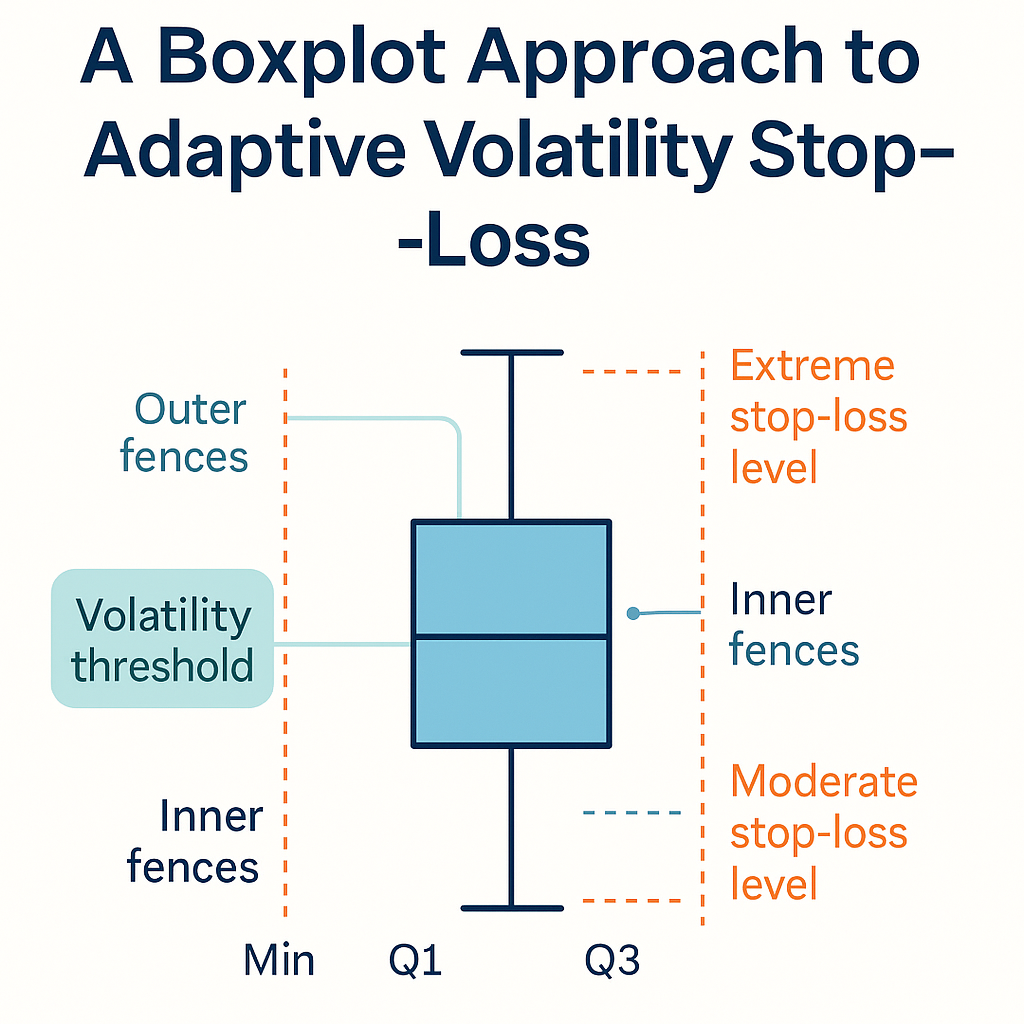

Beyond simple ATR-multiples, we can borrow from Tukey’s boxplot to build statistical “fences” around our ATR(200) exposures—hinges (Q₁, Q₃), inner fences (±1.5 × IQR), and outer fences (±3 × IQR)—to detect volatility regime shifts and adapt our Breakeven & Trailing rules within Dr. Glen Brown’s Seven-Law framework.

Why Boxplot Fences?

Standard stops assume a fixed multiplier. By contrast, boxplot fences let us:

- Detect regime shifts: exposures crossing inner fences flag noise extremes.

- Scale buffers: lean or deepen your L exposures based on Q₁/Q₃ and IQR.

- Cap runaway stops: outer fences impose a maximum DAATS limit.

Key Concepts & Definitions

| Boxplot Element | Statistical Definition | GATS Mapping |

|---|---|---|

| Lower Hinge (Q₁) | 25th percentile | Conservative Breakeven L = Q₁ |

| Upper Hinge (Q₃) | 75th percentile | Deep-buffer Breakeven L = Q₃ |

| IQR | Q₃–Q₁ | Exposure spread for interpolation |

| Inner Fences | Q₁–1.5×IQR, Q₃+1.5×IQR | “Routine” noise extremes—adjust L |

| Outer Fences | Q₁–3×IQR, Q₃+3×IQR | True outliers—cap stops / pause entries |

Computing Hinges & Fences

// Calculate rolling ATR(200) exposures

exposures = rolling_atr200_exposures

Q1 = percentile(exposures, 25)

Q3 = percentile(exposures, 75)

IQR = Q3 – Q1

inner_lower = Q1 – 1.5 * IQR

inner_upper = Q3 + 1.5 * IQR

outer_lower = Q1 – 3 * IQR

outer_upper = Q3 + 3 * IQR

Applying Fences to Your Stop-Loss Laws

- Dynamic L Selection (Laws 4–5):

- If exposures ≤ inner_upper → use L between Q₁ and median (Q₂).

- If inner_upper< exposures ≤ outer_upper → use L = Q₃.

- If exposures > outer_upper → enter “extreme volatility” mode: widen stops to full DAATS or halt new entries.

- Regime Alerts:

- Whisker-Cross Alert when exposures cross inner fences.

- Outlier Alarm when exposures exceed outer fences—tighten all stops immediately.

- Adaptive Stop Caps: Limit your DAATS envelope so it never grows beyond

outer_upper × ATR(200), even if ATR spikes.

Example Workflow

- Compute rolling exposures and boxplot statistics over a 200-bar window.

- Calculate inner/outer fences.

- On each new bar, pick L based on current exposure vs. fences.

- Apply L in Breakeven & Trailing formulas:

BE = Entry + L×ATR(200); Trail = HighSinceBE – L×ATR(200) - Cap maximum stop distance at

outer_upper×ATR(200).

About the Author

Dr. Glen Brown, Ph.D. in Investments & Finance, leads Global Accountancy Institute (GAI) and Global Financial Engineering (GFE). With over 25 years in quant research and proprietary trading, he pioneered the GATS framework and these statistical-fence stop-loss enhancements.

Business Model Clarification

GAI & GFE are strictly internal proprietary trading firms. We do not offer public courses or advisory services; all methodologies serve in-house desk development.

Risk Disclaimer

Trading CFDs and derivatives involves significant risk. This article is educational only and not financial advice. Always conduct your own due diligence and consult a licensed professional. Past performance does not guarantee future results; trade responsibly.

Hashtags: #Boxplot #Whiskers #Fences #ATR #StopLoss #Volatility #GATS #RiskManagement #DrGlenBrown

Sponsored Content