-

Law X: The Dual-Magnet Regime Commitment Engine

- December 23, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading & Market Doctrine

No Comments

Excerpt: A universal market law: constraint resolves before commitment. Law X combines Pin Basins, Commitment Basins, and the RC1–RC3 hierarchy to compute timeframe authority, permission commitment, and formalize non-participation as a correct decision state.

-

Why Most Traders Die by Their Own Stops

- December 17, 2025

- Posted by: Drglenbrown1

- Category: Trading Psychology & Risk Doctrine

Most traders do not fail because their strategies are wrong—they fail because their stops are structurally incompatible with volatility. This article challenges the myth of “tight risk,” reframes stop-losses as survival boundaries rather than safety devices, and introduces the critical distinction between drawdown and time. It lays the foundation for understanding why true risk management begins with how long a trade must be allowed to live.

-

The Square Root of Time Law (SRTL)

- December 17, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading & Financial Engineering

The Square Root of Time Law (SRTL) introduces a law-based framework for constructing Death Stops that scale correctly with volatility diffusion and trade lifecycle. By anchoring risk to time rather than execution timeframe, SRTL eliminates arbitrary stop placement, rejects heuristic ATR conventions, and establishes a universal survival doctrine integrated with the Nine-Laws Framework, DAATS, and TWVF.

-

The Global 365 Thought Leadership Series — Index

- December 10, 2025

- Posted by: Drglenbrown1

- Categories:

-

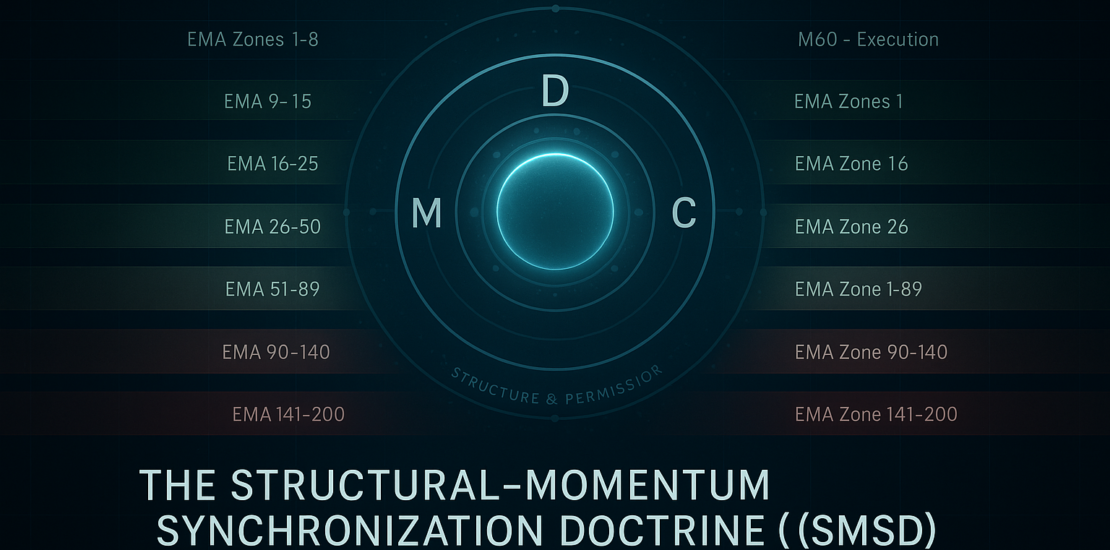

Structural–Momentum Synchronization Doctrine (SMSD) — Master Document

- December 7, 2025

- Posted by: Drglenbrown1

- Categories: Global Algorithmic Trading Software (GATS), Institutional Frameworks, Volatility & Risk Doctrine

This master document compiles Sections 1–15 of the Structural–Momentum Synchronization Doctrine (SMSD), detailing how Dr. Glen Brown unifies momentum, structural drift, EMA zones, market identity, and the Nine-Laws Framework into a complete, volatility-aware execution architecture for GATS and G9TTS.

-

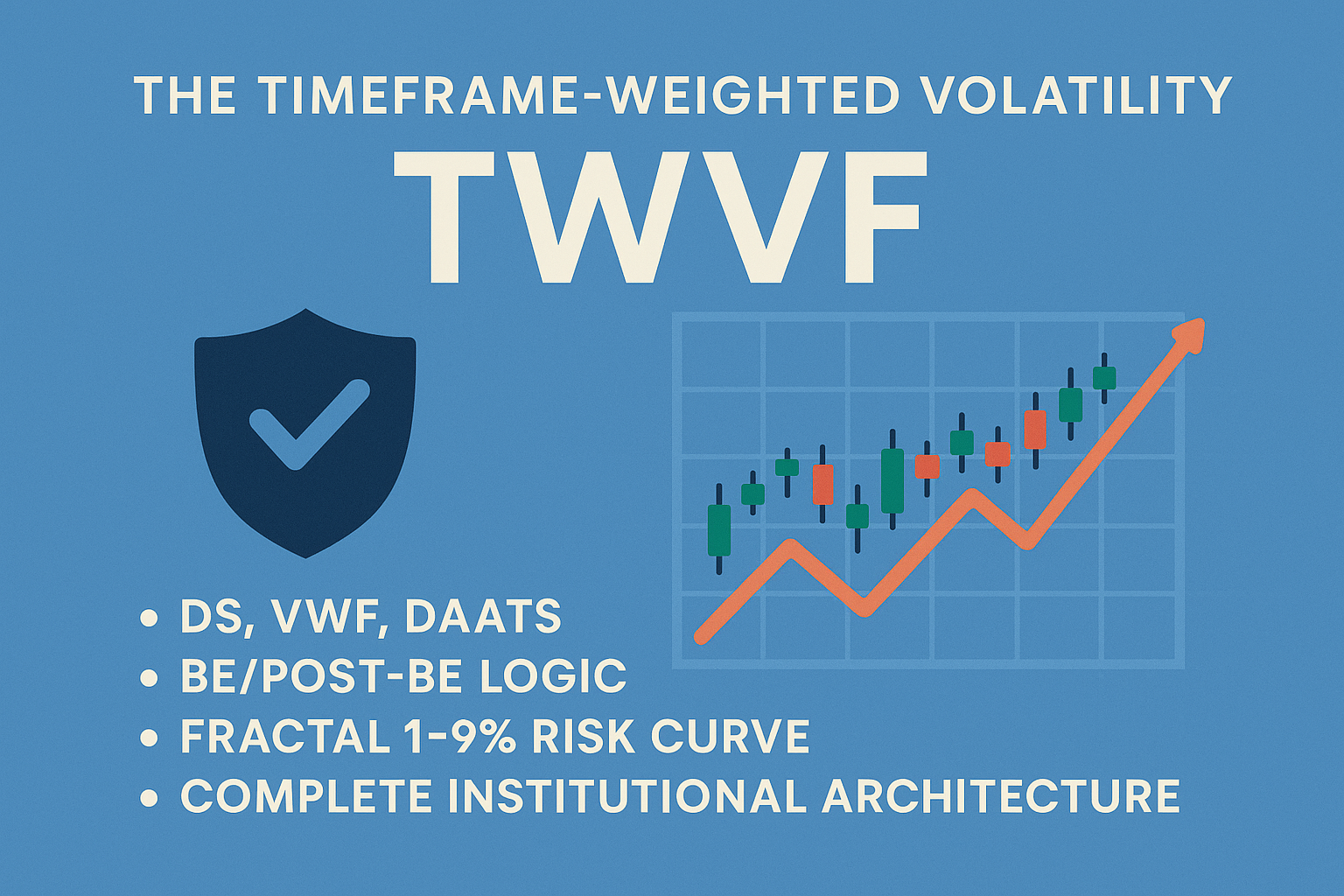

The Dr. Glen Brown Timeframe-Weighted Volatility Framework (TWVF): A Unified Institutional Doctrine for Multi-Timeframe Trading

- November 29, 2025

- Posted by: Drglenbrown1

- Categories:

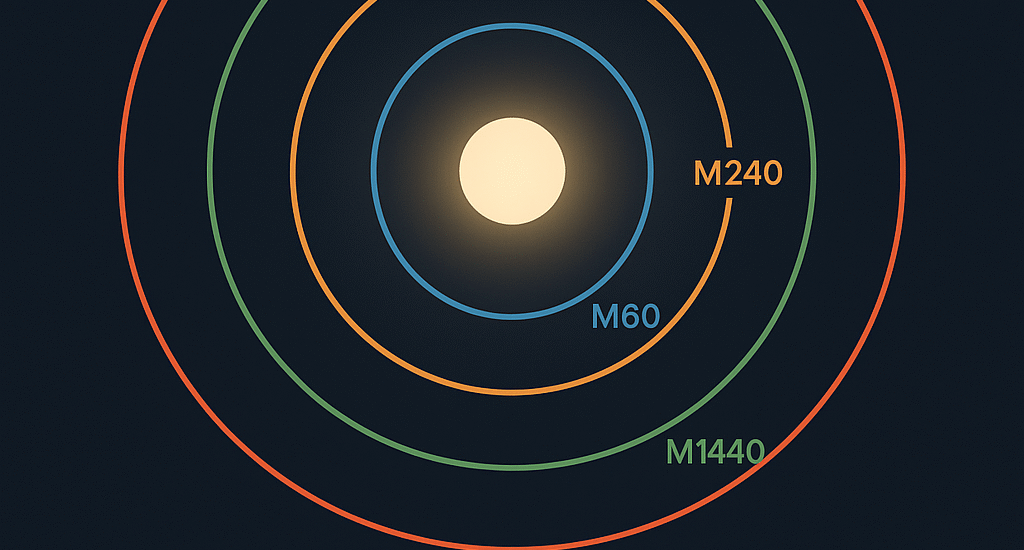

The Timeframe-Weighted Volatility Framework (TWVF) is Dr. Glen Brown’s signature institutional doctrine, unifying volatility truth, trend structure, risk identity, and multi-timeframe execution across all nine GATS strategies. This white paper introduces the full model, including DS, VWF, DAATS, BE/Post-BE logic, the fractal 1–9% risk curve, and the complete institutional architecture behind TWVF.

-

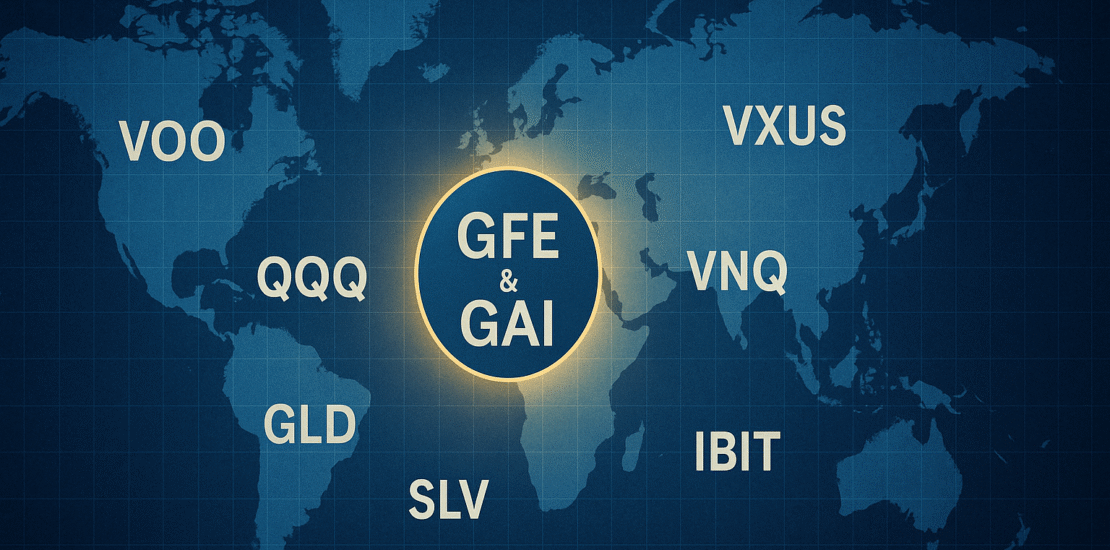

Global Multi-Asset ETF Portfolio White Paper v1.0 – GAI & GFE

- November 28, 2025

- Posted by: Drglenbrown1

- Categories: Global Proprietary Trading Research, Research & White Papers

This white paper presents the Global Multi-Asset 50-ETF Portfolio engineered for Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. It unifies GATS, the Universal Risk Doctrine (DS = 16 × ATR256), the 1–9% timeframe-indexed risk model, and the Nine-Laws Framework into a single proprietary trading doctrine for cross-asset, multi-timeframe execution.

-

Global Multi-Asset ETF Master Portfolio for GFE & GAI

- November 28, 2025

- Posted by: Drglenbrown1

- Category: Global Multi-Asset Portfolios

Discover the Global Multi-Asset ETF Master Portfolio designed by Dr. Glen Brown for GFE & GAI, integrating GATS, DAATS, and the Nine-Laws Framework into a unified, institution-grade ETF universe.

-

Guidex Theory – Reframing Digital Currencies as a Global Kinetic Energy Matrix

- November 25, 2025

- Posted by: Drglenbrown1

- Categories: Digital Asset Research, Quantitative Research, Research & White Papers

Guidex Theory – White Paper v1.0, authored by Dr. Glen Brown, reframes digital currencies as nodes in a global kinetic energy matrix. The paper introduces the Kinetic Index Score (KIS), a four-dimensional Guidex Matrix, entropy regimes, and a complete integration with GATS, DAATS, and the Nine-Laws Framework to build structurally robust, energy-aware crypto portfolios.

-

Guidex Theory: Reframing Digital Currencies as a Global Kinetic Energy Matrix

- November 24, 2025

- Posted by: Drglenbrown1

- Category: Digital Currencies / Macro-Theory / Crypto Valuation Models

Guidex Theory redefines Bitcoin and digital assets as nodes in a global kinetic energy matrix—transforming computational work and electrical power into digital reserves. Dr. Glen Brown introduces a new valuation and trading framework grounded in thermodynamics, entropy, and adaptive market regimes.

-

The Adaptive Quantum Doctrine of Breakevens & DAATS in GATS

- November 22, 2025

- Posted by: Drglenbrown1

- Categories: Financial Engineering & Algorithmic Trading, Quantitative Risk Management

Discover how GATS integrates Fractional Breakevens, Post-BE Dissipation, and DAATS into a quantum-adaptive risk system that minimizes drawdown and maximizes trend survival.

-

Global Lottery Structural Analysis Model (GLSAM) v1.1

- November 18, 2025

- Posted by: Drglenbrown1

- Categories: Global Lottery Structural Analysis Model (GLSAM) v1.1, Structural Models, White Papers, GLSAM, Quantitative Research

The Global Lottery Structural Analysis Model (GLSAM) v1.1 is the world’s first fully formalized, non-predictive structural entropy framework for high-randomness lottery systems such as Powerball. In this white paper, Dr. Glen Brown introduces GLSAM’s regime architecture, entropy envelopes, Powerball Entropy Index (P-Index), AntiCrowd logic, and the Research Note Series/Long-Term Structural Matrix ecosystem under the Global Entropy & Game Theory Research Division.

-

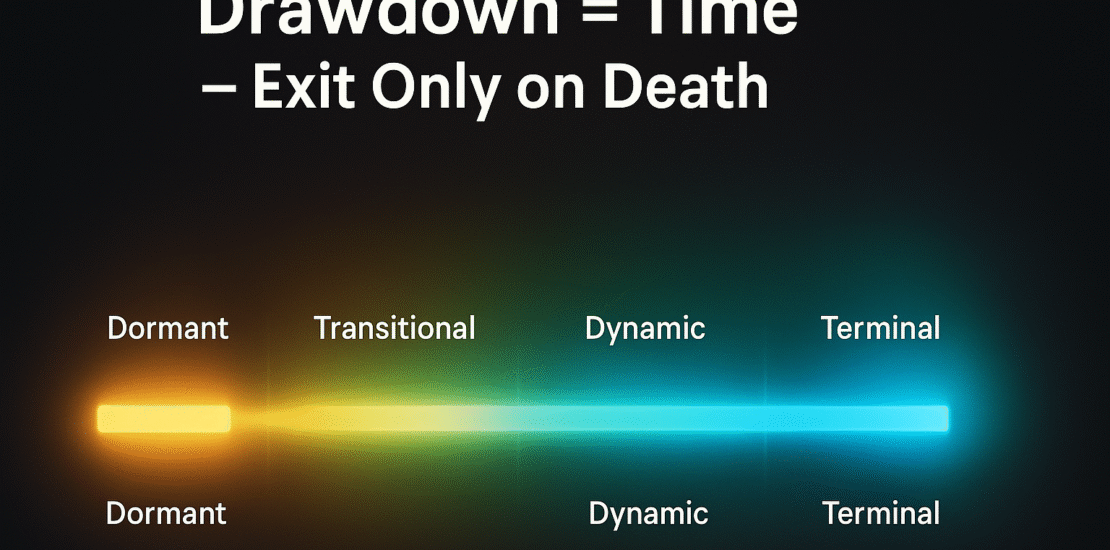

Lecture 7: The Law of Drawdown in Time — Quantum Implications for Trade Longevity

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, GATS Methodology

This lecture formalizes the GATS axiom that drawdown should cost time, not capital. We map equity drawdown to a temporal budget via ATR-regime geometry and codify how DS (Death-Stop), DAATS (Dynamic Adaptive ATR Trailing Stop), and the 18.75% Law synchronize to convert equity risk into structured time expenditure. We then extend this to portfolio heat, shock handling, and “Exit Only on Death” discipline, with quantitative tables and MT5/GATS implementation blocks.

-

Lecture 6: The Geometry of Time — Trade Lifecycles, Resonant Durations, and Temporal Compression within GATS

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, GATS Methodology

This lecture develops the Temporal Geometry Model within the Global Algorithmic Trading Software (GATS). Each trade is treated as a temporal organism whose lifespan expands or contracts with volatility, multi-timeframe alignment, and the 18.75% adaptive law. We formalize Temporal Compression (TC), Resonant Duration (Tres), and Chrono-Risk Scaling, and provide MT5/GATS execution patterns that convert volatility into measurable time.

-

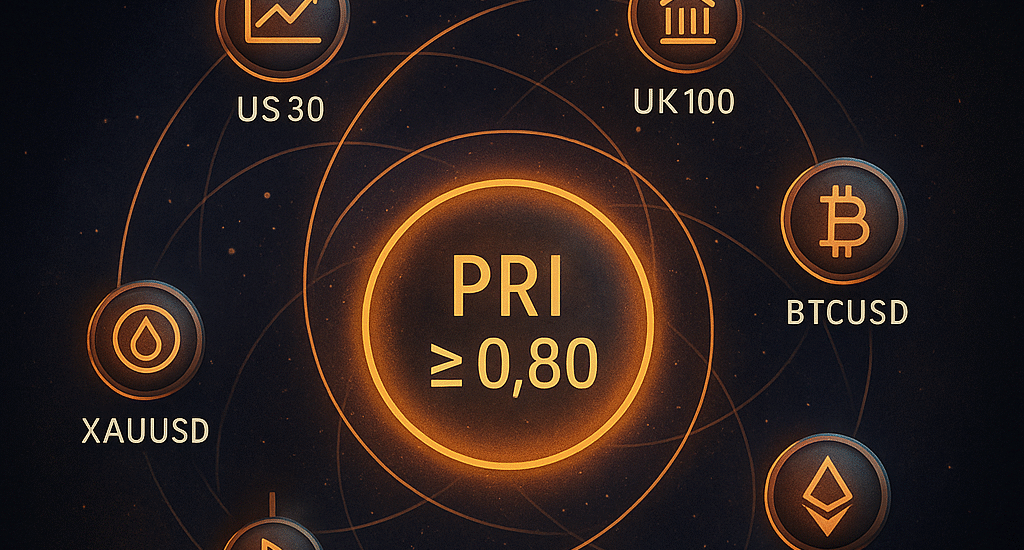

Lecture 5: Portfolio-Level Calibration — From FX to Indices and Beyond

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Global Daily Insights, Global Financial Engineers, Global Financial Insights, Trading Psychology, Algorithmic Trading

This lecture extends the foundational GATS risk geometry from individual trade logic to full portfolio orchestration. Through Portfolio-Level Resonance Calibration (PLRC), the system harmonizes volatility, risk, and trail parameters across multiple asset classes—FX, indices, metals, energies, and crypto. Using normalized ATR ratios, DS=DAATS initialization, and the 18.75% Law, GATS achieves coherent risk expression across diverse markets. The result is a unified field of temporal risk symmetry where each instrument breathes proportionally within a portfolio’s collective rhythm.

-

Lecture 4: The 18.75% Law of Adaptive Transition — Symmetry Between Breakeven and Trail

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading

This lecture formalizes the 18.75% Law of Adaptive Transition within the Global Algorithmic Trading Software (GATS). The law defines the universal threshold at which a trade shifts from survival to expansion: the breakeven activation and the ongoing trail amplitude are both set to 3/16 of the Death-Stop (DS). By unifying these thresholds, GATS encodes a structural symmetry that converts drawdown into time and momentum into measured respiration. We provide derivations, tables, and MT5/GATS implementation logic for multi-asset deployment

-

Lecture 3: Death-Stop (DS) and DAATS — Converting Drawdown into Time

- November 2, 2025

- Posted by: Drglenbrown1

- Category: GATS Lecture Series

GATS Lecture 3 codifies DS=DAATS initialization and the 18.75% Break-Even law, showing how to convert drawdown into time with constant trail amplitude and MT5-ready logic.

-

Lecture 2: The Quad-Confirmation Principle — Structural Resonance in Multi-Timeframe Trading

- November 1, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading, Global Financial Markets Analysis, Global Financial Markets Insights

Explore how GATS achieves structural coherence through multi-timeframe resonance and the Quad-Confirmation Principle, with RI gating and MT5 implementation logic.