Law 6: Tiered Risk Stages—Sizing to Match Your Buffer

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Law 6 of Dr. Glen Brown’s Seven Laws translates your full-zone stop buffer (DAATS) into properly scaled position sizes via a simple equity-at-risk formula. By allocating risk in three distinct stages, you maintain consistent drawdown control while allowing for flexibility in stop magnitude.

Summary

- Formula: Position Size = (Equity × Risk %) ÷ DAATS

- Stage 1/2/3 Risk Tiers: 0.01–0.09 %, 0.10–0.90 %, 1.00–9.00 %

- Case Studies: Examples of dollar-at-risk across different account sizes and DAATS values

Key Sections

- Sizing Worksheet

- Equity Curves by Stage

- Best Practices & Common Pitfalls

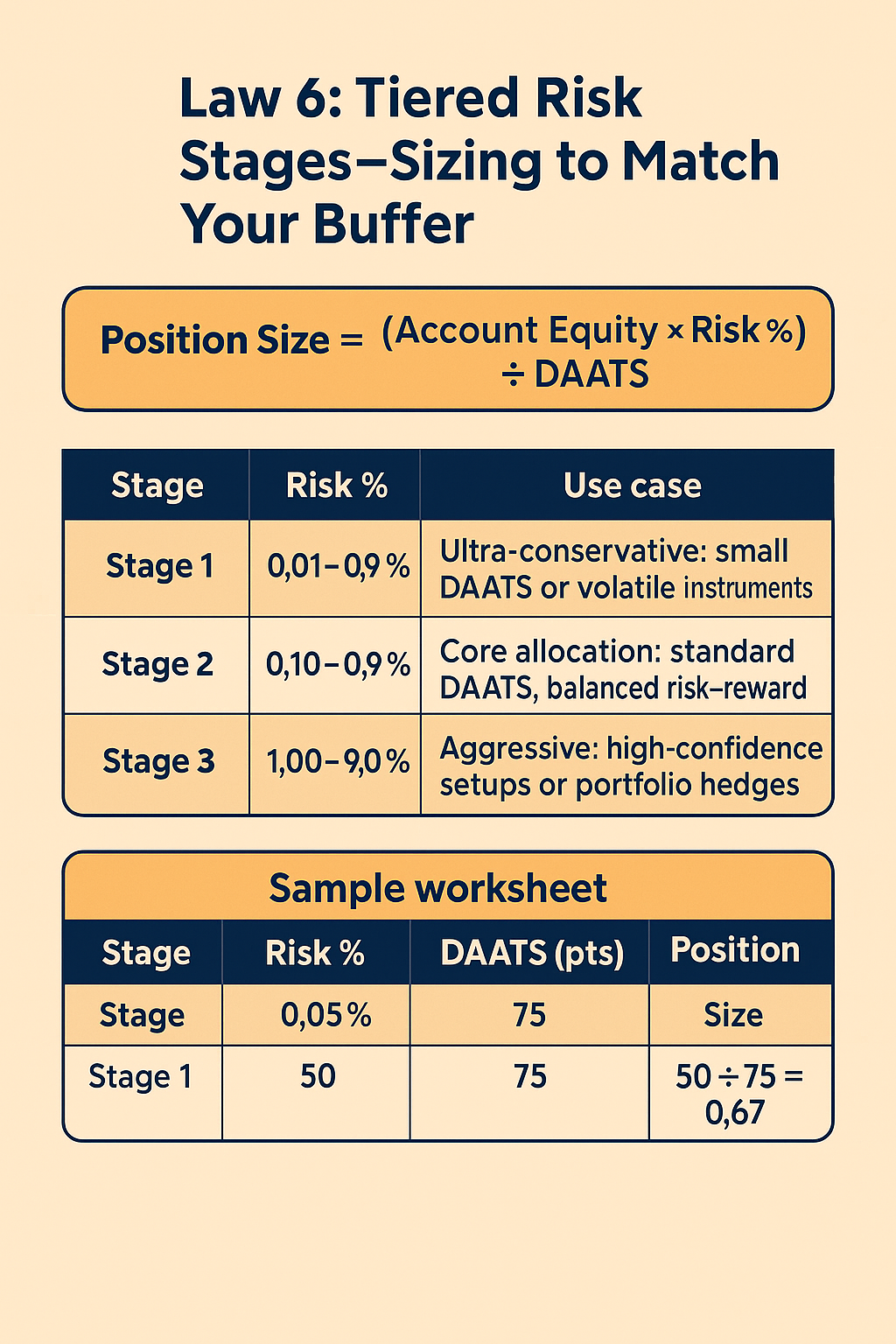

Position Sizing Formula

To ensure your trade’s dollar-risk never exceeds your tolerance, use:

Position Size = (Account Equity × Risk %) ÷ DAATSWhere:

- Account Equity is the free equity available.

- Risk % is chosen from one of three stages.

- DAATS is your full-zone stop = √P × ATR(P).

Stage 1/2/3 Risk Tiers

Choose your risk per trade based on how aggressive you wish to be:

| Stage | Risk % | Use Case |

|---|---|---|

| Stage 1 | 0.01 %–0.09 % | Ultra-conservative: small DAATS or volatile instruments |

| Stage 2 | 0.10 %–0.90 % | Core allocation: standard DAATS, balanced risk–reward |

| Stage 3 | 1.00 %–9.00 % | Aggressive: high-confidence setups or portfolio hedges |

Sizing Worksheet

Below is a sample worksheet for a $100,000 account with a DAATS of 75 pts:

| Stage | Risk % | Risk ($) | DAATS (pts) | Position Size (units) |

|---|---|---|---|---|

| 1 | 0.05 % | $50 | 75 | $50 ÷ 75 ≈ 0.67 units |

| 2 | 0.50 % | $500 | 75 | $500 ÷ 75 ≈ 6.67 units |

| 3 | 5.00 % | $5,000 | 75 | $5,000 ÷ 75 ≈ 66.67 units |

Equity Curves by Stage

Allocating risk in tiers allows backtests to reveal how drawdowns and growth trajectories differ when using conservative vs. aggressive sizing. In general:

- Stage 1 yields the smallest drawdowns and slowest equity growth.

- Stage 2 balances growth and volatility for most traders.

- Stage 3 offers the highest returns at the cost of deeper drawdowns.

(Charts omitted for brevity—visualize equity curves rising steeply with Stage 3 but with larger dips during adverse periods.)

Best Practices & Common Pitfalls

- Match Risk to Confidence: High DAATS (wide stops) often warrant lower Stage selections.

- Avoid Over-Leverage: Never push Stage 3 to the absolute 9 % limit on untested setups.

- Reassess on Volatility Changes: If ATR(200) spikes, recalc DAATS and adjust stage accordingly.

- Use Trailing Stops: Combine with Laws 4–5 to lock in profits and reduce effective dollar-risk.

About the Author

Dr. Glen Brown, Ph.D. in Investments & Finance, is President & CEO of Global Accountancy Institute and Global Financial Engineering. With over 25 years in proprietary trading and quantitative research, he created the GATS framework and this seven-law stop-loss architecture.

Business Model Clarification

Global Accountancy Institute and Global Financial Engineering operate as internal proprietary trading firms. We do not offer public courses or advisory services; all methodologies are for in-house research and desk development.

Risk Disclaimer

Trading derivatives and CFDs carries substantial risk. This article is educational only and does not constitute financial advice. Always conduct your own due diligence and consult a licensed professional. Past performance does not guarantee future results; trade at your own risk.

Hashtags: #PositionSizing #RiskManagement #DAATS #TieredRisk #TradingLaws #GATS #DrGlenBrown

Sponsored Content