Risk & EZIM — Anchoring Stops, DAATS, and Death-Stop

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Risk & EZIM

Price action without risk management is noise. In Part 4 of the EZIM Series, we embed the Bounce & Rejection Paradigm into the heart of the GATS risk model: DAATS, Death-Stop, and ATR-based positioning. This fusion ensures that every trade is framed not only by entry logic but also by exit discipline, transforming uncertainty into calculated exposure.

1. Why Risk is the True Backbone

In EZIM, the Bounce or Rejection defines where to engage the market. But risk controls define whether the trade survives volatility. A profitable framework demands both:

- DAATS (Dynamic Adaptive ATR Stop): Expands/contracts stops as volatility compresses or explodes.

- Death-Stop: Anchored at

16 × ATR(256)or deeper, ensuring survival across cycles. - Break-Even Logic: Partial collapse points (1 × ATR, 6.25% DS) to protect equity during trend uncertainty.

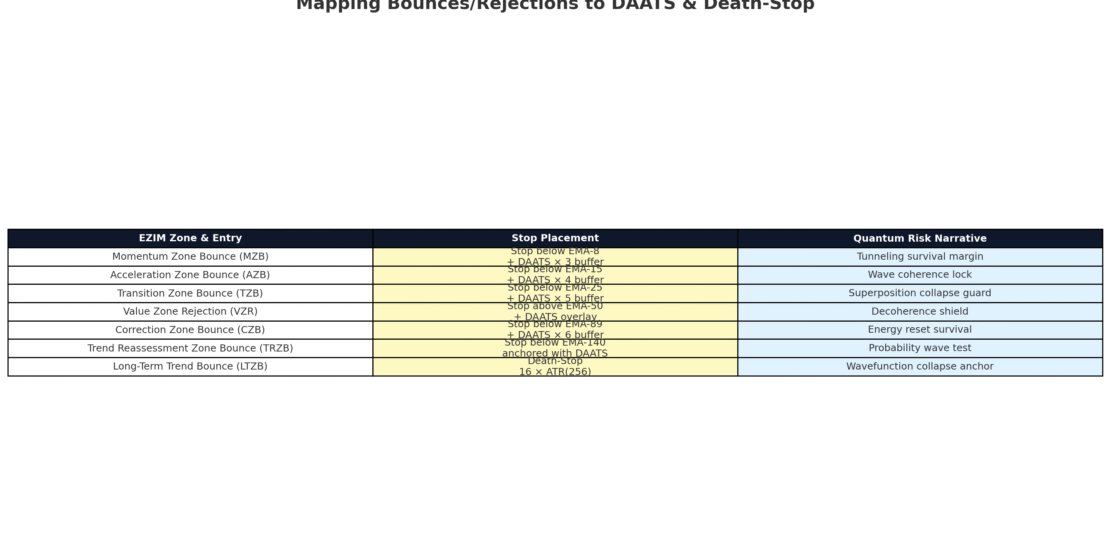

2. Mapping Risk to EZIM Zones

Every Bounce and Rejection offers its own “probability corridor.” Stops and targets must be placed beyond these boundaries, not within them. Example mappings:

Momentum Zone Bounce (MZB): Stop beneath EMA-8 boundary with DAATS × 3 buffer. Equivalent to tunneling survival margin.

Value Zone Rejection (VZR): Stop above EMA-50 with DAATS overlay. Equivalent to decoherence shield.

Long-Term Trend Bounce (LTZB): Anchored to Death-Stop levels, recognizing a “wavefunction collapse” in favor of trend continuation.

3. Quantum Risk Analogies

- Death-Stop: Like an event horizon; once crossed, trend identity is lost.

- DAATS: A quantum field adjustment — breathing with volatility waves.

- Break-Even: The partial collapse of the probability function, reducing risk exposure while retaining potential upside.

These metaphors reinforce trader psychology, transforming stops from “loss markers” into state-definers.

4. Portfolio-Level Implications

When scaled across 28 FX pairs, equities, indices, and commodities:

- Total DAATS Budget becomes a noise-allocation system.

- Death-Stops unify long-term survival across instruments.

- Quantum narratives reduce emotional interference — traders accept stops as natural collapses, not personal errors.

About the Author

Dr. Glen Brown — President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. Visionary financial engineer advancing multi-asset proprietary trading frameworks.

Business Model Clarification

Global Accountancy Institute, Inc. & Global Financial Engineering, Inc. are closed-loop proprietary trading firms. We do not offer external services or products. Materials are for internal professional development only.

General Risk Disclaimer

Trading financial instruments involves high risk and may not be suitable for all investors. Losses can exceed deposits. This material is provided for educational purposes within our internal framework and does not constitute financial advice.

Published: September 15, 2025 · Framework: GATS / EZIM · Series: Part 4 of 7