Lecture 7: The Law of Drawdown in Time — Quantum Implications for Trade Longevity

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, GATS Methodology

From Capital Erosion to Temporal Expenditure in the GATS Continuum

By Dr. Glen Brown

Abstract

This lecture formalizes the GATS axiom that drawdown should cost time, not capital. We map equity drawdown to a temporal budget via ATR-regime geometry and codify how DS (Death-Stop), DAATS (Dynamic Adaptive ATR Trailing Stop), and the 18.75% Law synchronize to convert equity risk into structured time expenditure. We then extend this to portfolio heat, shock handling, and “Exit Only on Death” discipline, with quantitative tables and MT5/GATS implementation blocks.

1) First Axiom — Drawdown as Time

Let equity drawdown be reinterpreted as “time spent waiting for coherence to return.” Define the structural stop as DS = 16 × ATR256(M240), with DAATS initially unified to DS. The position is sized by DS, not by local noise. Thus, capital risk becomes a temporal wager against the higher-timeframe structure.

2) Drawdown–Time Mapping (DTM)

Effective time dilates/compacts with volatility:

T_eff = (ATR_256 / ATR_50) × T_baseAssociate any partial drawdown fraction (δ) of DS with a time fraction (τ) of the expected structural cycle:

δ = DD_points / DS_points, τ = T_spent / T_effUnder DS anchoring, GATS treats δ ≈ τ in expectation: a 25% structural draw (δ=0.25) should approximately consume 25% of the effective time budget before coherence tests are re-evaluated (RI, Quad status, EMA-zone order).

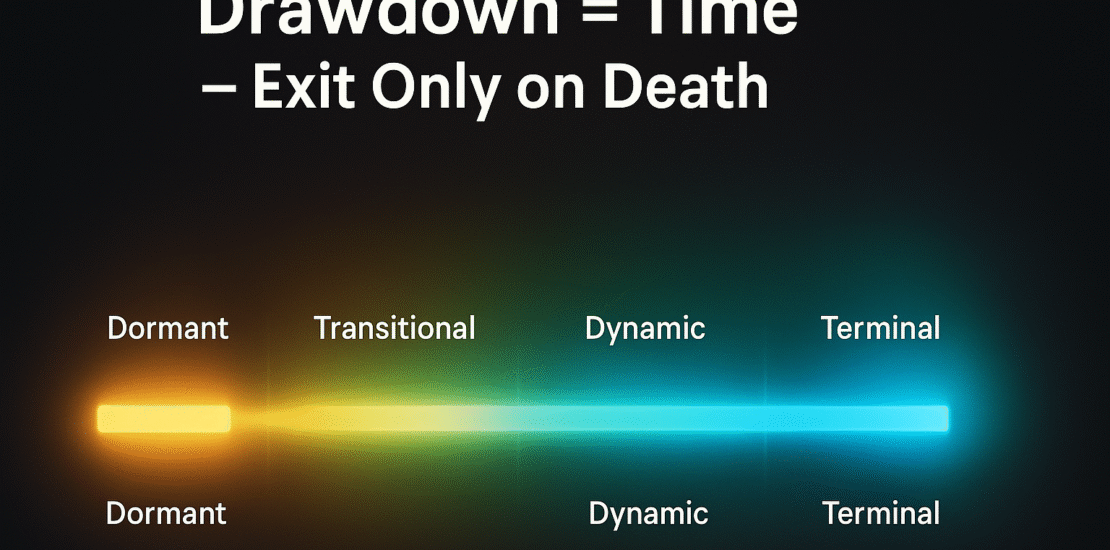

3) Temporal States & Triggers

| State | Definition | Trigger | Stop Logic | Objective |

|---|---|---|---|---|

| Dormant | Post-entry, pre-momentum | Entry under Quad-3/RI≥0.85 | DS=DAATS | Risk in time, not capital |

| Transitional | Momentum proven | +0.1875 × DS in favor | Move to BE; trail = 0.1875×DS | Symmetric respiration |

| Dynamic | Trend breathing | Trail active; RI maintained | Constant trail amplitude | Let profits time-expand |

| Terminal | Structure invalidated | Hit DAATS or DS | Exit only by stops | Discipline over discretion |

4) Portfolio Heat as Time to Exhaustion

Let total open risk (heat) be the time-to-exhaustion of the portfolio’s structural budget:

Heat_total = Σ Risk_i (as % of equity, sized by DS_i)

T_exhaust ≈ (1 − Heat_total / Heat_limit) × T_cycleWith Heat_limit (e.g., 7.5%) and T_cycle as the average T_eff across positions, the portfolio’s remaining “time budget” shrinks as heat rises. Entries pause when Heat_total ≥ Heat_gate (e.g., 6.0%) unless PRI and RI are exceptionally strong.

5) Exit Only on Death (EOD) Discipline

- Hard stop: DS (may widen if macro ATR expands materially, never tightens).

- Protective stop: DAATS (breakeven then constant amplitude = 0.1875×DS).

- No discretionary tightening: exits occur only via DAATS trail or DS breach.

EOD ensures time completes the test; traders don’t capitulate to micro-noise.

6) Shock Handling — Macro Time Warps

| Signal | Condition | Time Effect | System Response |

|---|---|---|---|

| MSPL (Macro Shock) | ATR_256 ↑ ≥ 25% in Δt | Time dilation (structure expands) | Freeze new entries; DS may widen; DAATS locks (no tightening) |

| CRTL (Correlation Regime) | Cross-asset correlation spike | Portfolio time compresses | Reduce add-ons; cap heat; require Quad-4/RI↑ for new signals |

7) Math Pack — Time-Drawdown Operators

Resonant Duration:

T_res = T_base × (ATR_256 / ATR_50) × RITime-to-BE (expected):

T_BE ≈ (0.1875 × DS_points) / V_driftwith V_drift the expected directional velocity conditioned on RI and EMA-zone slope. If T_BE > T_res, entry quality is low → prefer Quad-4 or skip.

8) MT5 / GATS Execution Blocks

8.1 Time-Aware Risk Gate

bool AllowNewEntry(string sym){

double RI = ResonanceIndex(sym);

if(RI < 0.85) return false;

if(PortfolioHeat() >= HeatGate()) return false;

if(MacroShockActive()) return false;

return true;

}8.2 DS=DAATS Initialization & 18.75% Transition

void InitStops(string sym, double entry){

double ds = 16.0 * ATR(sym, PERIOD_H4, 256);

SetHardStop(sym, entry - ds); // long example

SetDAATS(sym, entry - ds); // DAATS0 = DS

StoreMeta(sym, ds, 0.1875*ds);

}8.3 Drawdown→Time Monitoring

void UpdateDTM(string sym, double entry){

double ds = GetDS(sym);

double dd = Max(0.0, entry - Bid(sym)); // long

double delta = dd / ds; // δ

double Teff = (ATR(sym, PERIOD_H4,256)/ATR(sym,PERIOD_H1,50)) * 60; // mins on M60

double Tspent = GetMinutesSinceEntry(sym);

double tau = Tspent / Teff; // τ

if(delta >= 0.5 && tau < 0.5) FlagPatience(); // behind schedule: avoid tightening

if(delta <= 0.25 && tau > 0.75) RecheckRI(); // ahead of schedule: coherence missing?

}8.4 EOD Enforcement

void EnforceEOD(string sym){

// Never tighten DS; DAATS trails at constant amplitude once BE is hit.

if(PriceHitsDAATS(sym) || PriceHitsDS(sym)) ClosePosition(sym);

}9) Worked Micro-Examples

FX (EURUSD, long)

- M240 ATR256=0.0068 → DS=0.1088

- BE/Trail amplitude = 0.0204

- At a 0.0109 adverse move (10% DS), allow time equal to ~10% of

T_effbefore re-testing coherence.

Gold (XAUUSD, long)

- M240 ATR256=8.5 → DS=136

- BE/Trail amplitude=25.5

- If ATR256 spikes +25% (MSPL), freeze new entries and allow DS widening logic; keep DAATS from tightening.

10) Reflection — Quantum Longevity

A GATS trade is a finite lifeline moving through time fields. The law of drawdown in time ensures it is tested by structure, not by noise. Under DS anchoring, DAATS symmetry, and EOD discipline, capital endurance becomes temporal endurance—the quantum of patience measured by coherence rather than hope.

Conclusion

By mapping drawdown to time and enforcing exit only by structural stops, GATS preserves capital while allowing trades to traverse the necessary temporal distance for trends to manifest. This is the essence of drawdown as time: disciplined longevity in a stochastic world.

About the Author

Dr. Glen Brown is the President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., leading institutions at the frontier of financial engineering and proprietary trading. With over 25 years of expertise in finance, accounting, and algorithmic trading, Dr. Brown integrates quantum theory, mathematics, and philosophical insight into the architecture of modern financial systems.

General Disclaimer

The material presented herein is for educational and informational purposes only. Trading and investing in financial markets involve substantial risk. Past performance is not indicative of future results. Always perform your own due diligence before making trading decisions. Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. do not provide investment advice.

Business Model Disclaimer

Global Financial Engineering, Inc. and Global Accountancy Institute, Inc. operate as a Global Multi-Asset Class Closed Professional Proprietary Trading Firm. The firms do not accept external client funds or manage assets on behalf of the public. All trading and research activities are conducted internally through proprietary capital, systems, and strategies under the Global Algorithmic Trading Software (GATS) Framework. Educational and analytical materials are presented solely for knowledge development, technical insight, and institutional transparency of process—not for solicitation or investment advisory purposes.