-

Dr. Glen Brown’s Nine-Laws Framework: A Quantum Revolution in Volatility Risk Management

- July 31, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

No Comments

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum mechanics concepts—superposition, density matrices, and Lindblad dynamics—to adaptively manage volatility and risk in forex, equities, commodities, and crypto strategies.

-

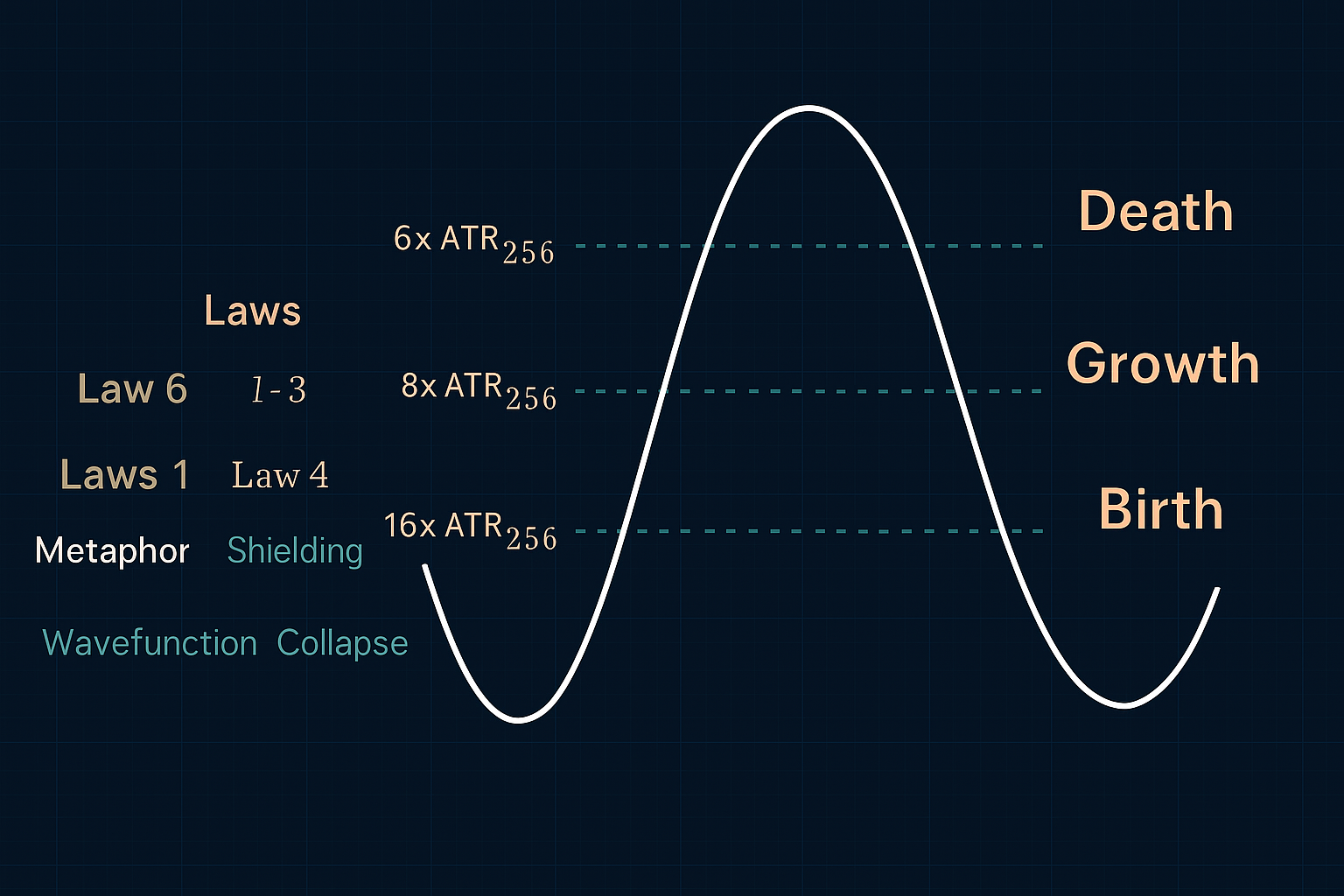

The Volatility Root Law – Part II: From Fractal Breakeven to Volatility-Defined Death

- July 20, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading, Risk Engineering

Part II of Dr. Glen Brown’s Volatility Root Law reveals a quantum volatility lifecycle framework that governs trade entry, breakeven, trailing stops, and exit using fractal amplitude theory and temporal anchoring—structured through the Nine Laws of Adaptive Risk.

-

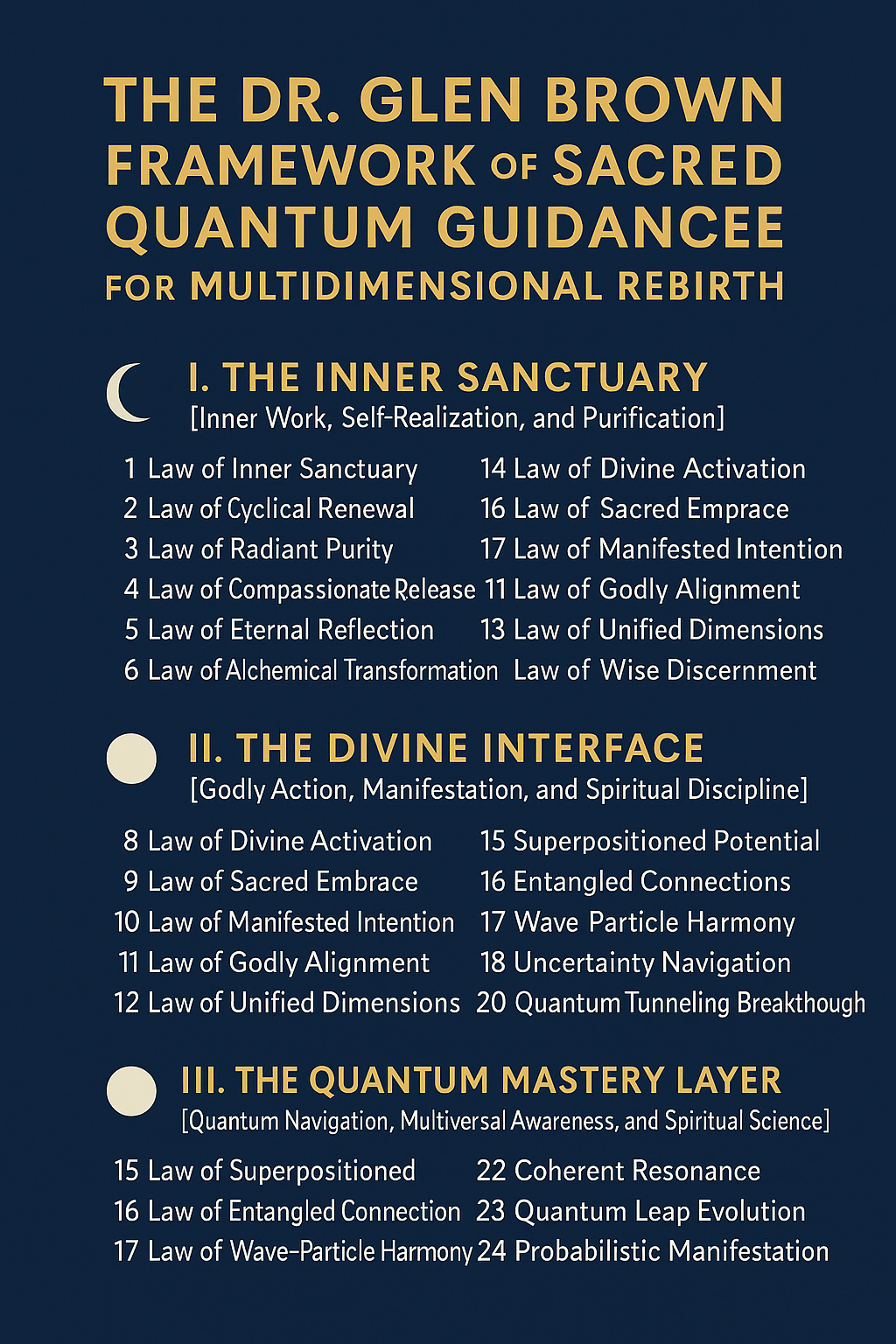

The Dr. Glen Brown Framework of Sacred Quantum Guidance for Multidimensional Rebirth

- July 18, 2025

- Posted by: Drglenbrown1

- Categories: Quantum Philosophy, Spiritual Frameworks

The Dr. Glen Brown Framework of Sacred Quantum Guidance for Multidimensional Rebirth is a doctrine of 24 universal laws designed to awaken higher consciousness. Fusing quantum physics, divine philosophy, and personal transformation, this framework offers a timeless path for self-mastery, spiritual alignment, and intentional manifestation.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Finance, Thought Leadership, GATS Series

Discover the foundation of Dr. Glen Brown’s Nine-Laws Framework as he applies quantum principles to market chaos. Learn how to trade with coherence, resilience, and engineered discipline.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

In Part 3 of his Quantum Intricacies series, Dr. Glen Brown explains Laws 7–9 for maintaining portfolio coherence through noise budgeting, slippage buffers, and adaptive model rebirth.

-

Quantum Intricacies of Markets: Forging a Quantum Mindset with Dr. Glen Brown’s Nine-Laws Framework

- July 18, 2025

- Posted by: Drglenbrown1

- Category: Quantum Mindset with Dr. Glen Brown

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum principles to market exits, volatility, and time. Part 2 of the Quantum Mindset series.

-

Dr. Glen Brown’s Perspectives: The Empire of Death in 2025

- July 12, 2025

- Posted by: Drglenbrown1

- Category: Global Economic Outlook

Dr. Glen Brown exposes the Empire of Death dominating 2025—fueled by conflict, hunger, climate shocks, and high interest rates. A transformative call to action.

-

Building Your First GUQFXP Trade: From Signal to Death-Stop

- July 5, 2025

- Posted by: Drglenbrown1

- Category: Global Universal Quantum FX Portfolio (GUQFXP)

In this walkthrough, we step through a single GUQFXP trade from initial signal generation through to Death-Stop placement, adaptive break-even, and profit-target execution.

-

Global Weekly Forex Portfolio Risk Management Guide For Global Traders

- July 3, 2025

- Posted by: Drglenbrown1

- Category: Forex Portfolio Analysis, Quantum Risk Management

This weekly guide leverages Dr. Glen Brown’s quantum-inspired Nine-Laws Framework and GATS methodology to deliver adaptive, self-calibrating risk controls—stops, break-evens, and position sizing—across a global portfolio of 28 major FX pairs.

-

Portfolio Noise-Budget & Adaptive Risk Controls for Base & Precious Metals Applying Dr. Glen Brown’s Nine-Laws Framework & GATS Strategies

- June 30, 2025

- Posted by: Drglenbrown1

- Categories:

-

Adaptive Volatility in FX: Applying Dr. Glen Brown’s Nine-Laws Framework to EUR/USD (1-Hour) – June 30, 2025

- June 30, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading, Financial Engineering, Risk Management

This analysis demonstrates how Dr. Glen Brown’s Nine-Laws Framework, combined with GATS60 methodology, delivers a rigorously adaptive, quantum-inspired risk engine—optimizing entries, stops, and position sizing for EUR/USD in volatile FX markets.

-

Adaptive Volatility in Crypto: Applying Dr. Glen Brown’s Nine-Laws Framework to BTC/USD (1-Hour) – A GATS60 Case Study

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Quantum Finance, Risk Management

Explore how Dr. Glen Brown’s Nine-Laws Framework transforms crypto trading risk management into a self-calibrating, quantum-inspired system—anchoring volatility, regime detection, and execution buffers in rigorous mathematical operators.

-

The Quantum Edge – Synthesizing the Nine Laws

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Quantum-Inspired Trading Systems, Holistic Strategy Synthesis

Trading is a quantum dance of uncertainty and precision, mastered through a unified framework. Dr. Glen Brown’s Nine-Laws Framework synthesizes the nine GATS strategies with quantum principles, from entanglement to state tomography, to navigate markets across timeframes. This article unifies the series, showcasing how GATS1 to GATS43200 deliver a quantum edge from minutes to months, optimizing returns and risks.

-

Comparing GATS Strategies – A Quantum Spectrum of Performance

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Strategy Evaluation, Quantum-Inspired Trading Systems

Trading strategies span a quantum spectrum, each measuring market states at different scales. Dr. Glen Brown’s Nine-Laws Framework powers the nine GATS strategies, from GATS1’s rapid scalping to GATS9’s long-term trends, offering a range of performance profiles. This article compares their effectiveness across timeframes, leveraging quantum multi-scale principles to optimize returns from minutes to months.

-

Continuous Model Validation – Quantum State Tomography

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Model Validation, Quantum-Inspired Trading Systems

A trading model is like a quantum system needing constant recalibration to stay accurate. Dr. Glen Brown’s Law 9 of the Nine-Laws Framework uses continuous validation, inspired by quantum state tomography, to refine GATS strategies. This article explores how GATS1 to GATS43200 adapt through weekly reviews, ensuring robustness across timeframes from minutes to months in evolving markets.

-

Transaction-Cost & Slippage Optimization – Mitigating Measurement Noise

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Trade Execution Optimization, Quantum-Inspired Trading Systems

Trading execution is like a quantum measurement—small errors can skew results. Dr. Glen Brown’s Law 8 of the Nine-Laws Framework optimizes transaction costs and slippage, inspired by quantum error correction, to enhance precision. This article explores how GATS1 to GATS43200 apply this law, padding stops and using limit orders across timeframes from minutes to months, ensuring efficient trade execution.

-

Portfolio-Level Noise Budget – Managing Entangled Risks

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Portfolio Risk Management, Quantum-Inspired Trading Systems

A portfolio is like a quantum system where entangled assets amplify noise during stress. Dr. Glen Brown’s Law 7 of the Nine-Laws Framework allocates a noise budget using DAATS and GNASD, inspired by quantum entanglement principles. This article explores how GATS1 to GATS43200 manage these risks, balancing exposure across timeframes from minutes to months, ensuring robust portfolio performance.

-

Adaptive Break-Even Decision – Clustering Regimes

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Market Regime Analysis, Quantum-Inspired Trading Systems

Markets shift like quantum states between calm and chaos, requiring smart exit points. Dr. Glen Brown’s Law 6 of the Nine-Laws Framework adapts break-even decisions using regime clustering, inspired by quantum density matrix principles. This article explores how GATS1 to GATS43200 apply this law, adjusting exits across timeframes from minutes to months, ensuring profit protection in dynamic conditions.