GNASD-Enhanced GASBET: A Timeframe-Adaptive Break-Even Framework

- May 8, 2025

- Posted by: Drglenbrown1

- Categories:

Lead

In a world of ever-shifting volatility, knowing exactly when to move your stop to breakeven can make the difference between locked-in profit and a runner that turns into a loser. By combining a per-instrument dispersion metric (GNASD), √time scaling, Fibonacci-ratio multipliers, and hybrid cost/broker constraints, this model delivers mathematically rigorous, timeframe-sensitive break-even triggers—fully integrated into the GATS ecosystem.

Introduction

Dynamic, volatility-driven break-even triggers are a core risk-management pillar in proprietary trading. Traditional fixed-percentage or static pip targets fail to adapt across charts ranging from M1 to monthly. Here, we introduce a novel synthesis—Global Normalized Average Standard Deviation (GNASD) scaled by √time, enhanced with Fibonacci Z-scores, and bounded by both spread/broker rules and a hybrid cap—to generate truly adaptive, practical breakeven levels inside GATS.

1. Defining GNASD: A Per-Instrument Dispersion Metric

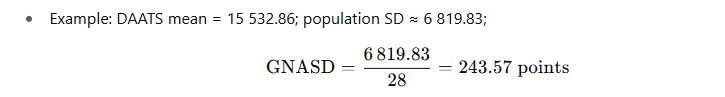

- GNASD = (Population SD of DAATS) ÷ (Number of Instruments)

- Treats your 28-pair universe as a full population, yielding a single, normalized measure of “per-pair noise.”

- Example: DAATS mean = 15 532.86; population SD ≈ 6 819.83; GNASD=6 819.8328=243.57 points

- Benefit: Auto-adjusts as you add/remove instruments—maintains comparability across any universe size.

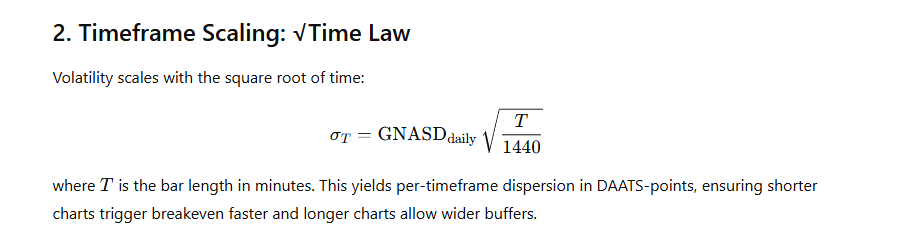

2. Timeframe Scaling: √Time Law

where TTT is the bar length in minutes. This yields per-timeframe dispersion in DAATS-points, ensuring shorter charts trigger breakeven faster and longer charts allow wider buffers.

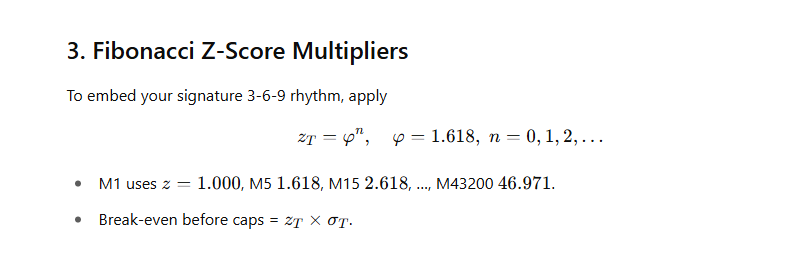

3. Fibonacci Z-Score Multipliers

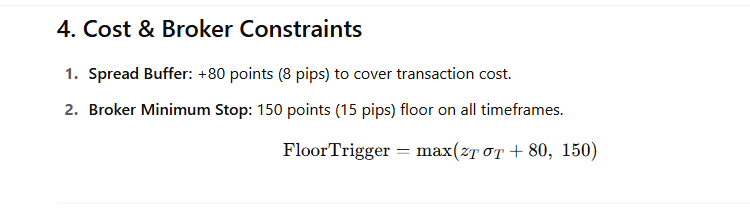

4. Cost & Broker Constraints

- Spread Buffer: +80 points (8 pips) to cover transaction cost.

- Broker Minimum Stop: 150 points (15 pips) floor on all timeframes.

5. Hybrid Cap: Controlling Extreme Triggers

To prevent runaway levels on slow charts, cap all triggers at 1.5 × mean DAATS (~23 299 points):

This keeps monthly thresholds within a practical range.

6. Full Trigger Schedule

| TF | zTz_TzT | σT\sigma_TσT (pts) | +80 pts | FloorTrigger (pts) | Cap (23 299) | Final BE (pts) | (pips) | % of Mean |

|---|---|---|---|---|---|---|---|---|

| M1 | 1.000 | 6.42 | 86.42 | 150 | 23 299 | 150 | 15.0 | 0.97 % |

| M5 | 1.618 | 14.35 | 103.22 | 150 | 23 299 | 150 | 15.0 | 0.97 % |

| M15 | 2.618 | 24.86 | 145.08 | 150 | 23 299 | 150 | 15.0 | 0.97 % |

| M30 | 4.236 | 35.16 | 215.16 | 228.92 | 23 299 | 228.92 | 22.89 | 1.47 % |

| M60 | 6.854 | 49.72 | 129.72 | 420.78 | 23 299 | 420.78 | 42.08 | 2.71 % |

| M240 | 11.089 | 99.44 | 179.44 | 1 182.66 | 23 299 | 1 182.66 | 118.27 | 7.61 % |

| M1440 | 17.942 | 243.57 | 323.57 | 4 450.14 | 23 299 | 4 450.14 | 445.01 | 28.65 % |

| M10080 | 29.030 | 644.43 | 724.43 | 18 787.79 | 23 299 | 18 787.79 | 1 878.78 | 120.99 % |

| M43200 | 46.971 | 1 334.09 | 1 414.09 | 62 743.20 | 23 299 | 23 299 | 2 329.93 | 150.00 % |

7. Integration within GATS

- Stop-Manager Module: Embed these BE thresholds as OCO stop orders, automatically adjusted per timeframe.

- Universe Updates: On instrument add/removal, GNASD recalculates, rescaling all triggers.

- Regime Flags: Tie cap or Z-score shifts to volatility regimes for dynamic tuning.

8. Theoretical Discussion

- Population vs. Sample SD: Dividing by N yields unbiased per-instrument dispersion (GNASD), ideal when your 28 pairs are the full trading universe.

- √Time Law: Grounded in Brownian diffusion, ensures mathematically consistent scaling.

- Fibonacci Multipliers: Provide a harmonized, scalable rhythm across timeframes, yet allow capping for practicality.

- Hybrid Constraints: Balance theoretical optimality with real-world cost and broker requirements.

Conclusion & Call to Action

This GNASD-Enhanced GASBET framework marries rigorous statistical theory with pragmatic cost controls and operational constraints—delivering a universality and adaptability critical for high-frequency, multi-timeframe trading. Ready to see it in action? Back-test this schedule across your GATS strategies or contact us to implement it directly in your trading infrastructure.

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. A Ph.D. in Investments & Finance, he’s the architect of GATS—a multi-tiered, algorithmic trading suite—and has decades of experience pioneering volatility-adaptive risk frameworks and integrating metaphysical insights into financial engineering.

Risk Disclaimer

This article is for educational purposes only and does not constitute investment advice. Trading involves significant risk of loss. Past results are not indicative of future performance. Always perform your own due diligence and consult a qualified professional before trading