Law 3: DAATS—Your Full-Zone Initial Stop

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Law 3 of Dr. Glen Brown’s Seven Laws defines the “DAATS” envelope—the initial stop placed at the full-zone volatility range. This article breaks down the formula, explores Chebyshev’s distribution-free guarantee, and demonstrates a real-trade example with DAATS plotted on the chart.

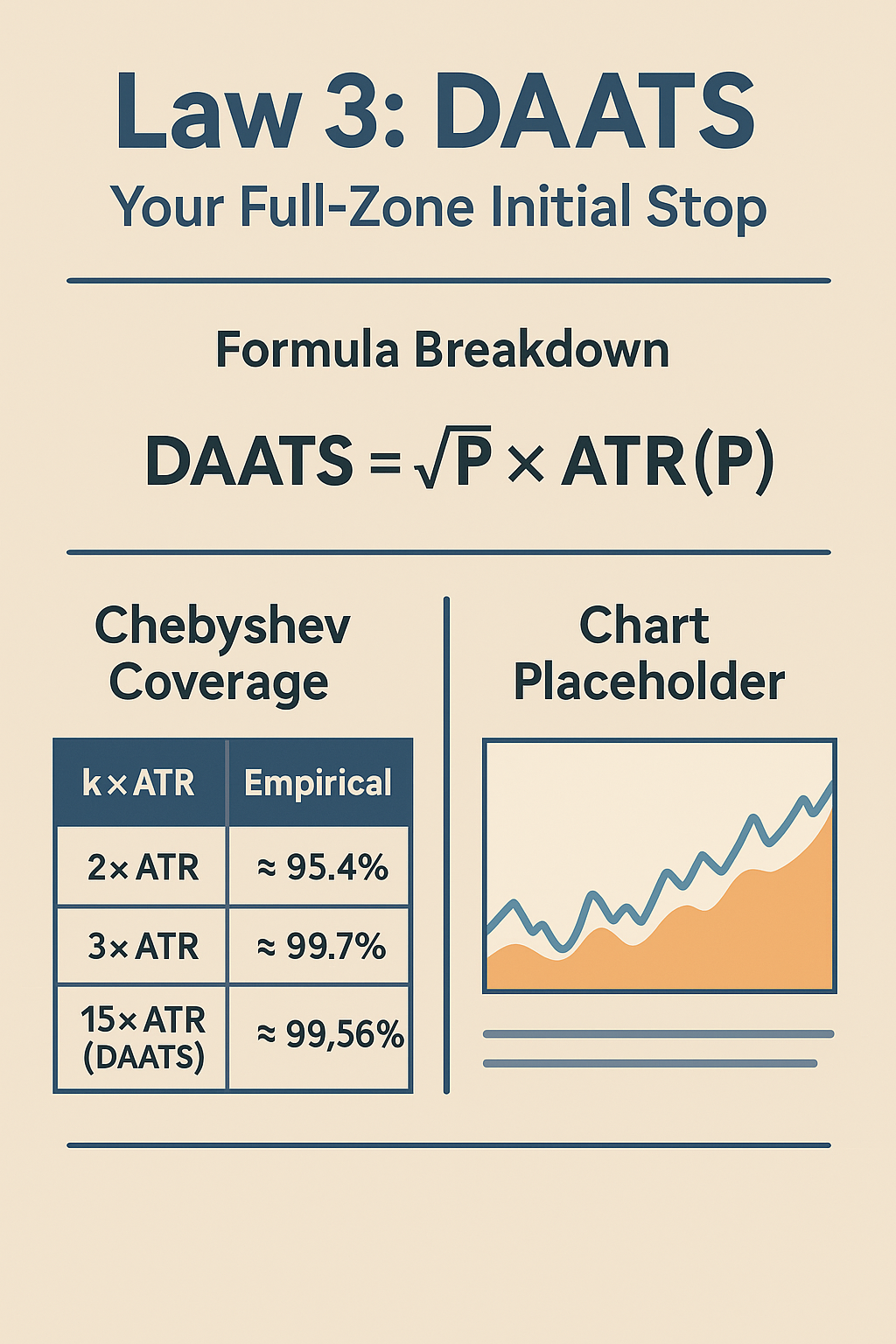

DAATS = √P × ATR(P) Explained

We define DAATS (Dr. Brown’s Adaptive ATR Stop) as:

DAATS = √P × ATR(P)- P: the maximum EMA period for your structural zone (e.g., P = 200).

- ATR(P): the Average True Range over P bars—your volatility unit.

- √P: the exposure count derived from the √time law (√200 ≈ 14.14 → 15 exposures).

This places your stop outside even the deepest single-leg corrective wave, anchored to the same timeframe as your EMA structure.

Chebyshev’s Guarantee & Worst-Case Bounds

Chebyshev’s Inequality states for any distribution, at least 1–1/k² of observations lie within ±kσ of the mean. With k = √200 ≈ 15:

P(|X – μ| < 15σ) ≥ 1 – 1/225 ≈ 99.56%

Thus, DAATS = 15×ATR(200) will contain at least 99.56% of all ATR-bar values—no normality assumption required.

Chebyshev vs. Empirical Coverage

| k × ATR | Empirical (Normal) | Chebyshev (Any Dist.) |

|---|---|---|

| 2× ATR | ≈ 95.4% | ≥ 75% |

| 3× ATR | ≈ 99.7% | ≥ 88.9% |

| 15× ATR (DAATS) | ≈ 100% | ≥ 99.56% |

Example Trade with DAATS Plotted

Below is a real M60 chart of Gold (XAU/USD). The red envelope represents DAATS (±15×ATR(200)) around EMA(200):

Notice how the stop holds above deep corrective legs and only triggers on structurally significant breaks—fully validating Law 3 in live market conditions.

About the Author

Dr. Glen Brown, Ph.D. in Investments & Finance, is President & CEO of Global Accountancy Institute and Global Financial Engineering. With over 25 years in proprietary trading and quantitative research, he developed the GATS framework and this seven-law stop-loss architecture.

Business Model Clarification

Global Accountancy Institute and Global Financial Engineering operate exclusively as internal proprietary trading firms. We do not offer public courses or advisory services; all methodologies are for in-house research and professional desk development.

Risk Disclaimer

Trading derivatives and CFDs carries substantial risk and may not suit every investor. This article is educational only and does not constitute financial advice. Always perform your own due diligence and consult a licensed professional. Past performance does not guarantee future results; trade at your own risk.

Hashtags: #DAATS #ATR #Chebyshev #StopLoss #Volatility #GATS #RiskManagement #TradingLaws #DrGlenBrown

Sponsored Content