Lecture 2: The Quad-Confirmation Principle — Structural Resonance in Multi-Timeframe Trading

- November 1, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading, Global Financial Markets Analysis, Global Financial Markets Insights

From Frequency Locking to Executable Logic in GATS (MT5 Implementation)

By Dr. Glen Brown

Abstract

This lecture formalizes the Quad-Confirmation Principle within the Global Algorithmic Trading Software (GATS), showing how multi-timeframe Heiken-Ashi Smoothed (HAS) alignment produces structural resonance for higher-integrity entries and management. We define Quad-1 through Quad-4, introduce a Resonance Index (RI) for quantitative gating, and provide MT5/MQL5-style pseudocode for production-grade execution. The result is a codified path from frequency alignment to portfolio-ready automation.

1) Law of Hierarchical Resonance

Statement: Lower timeframes respect higher-timeframe structure most of the time. In GATS, this is operationalized by requiring aligned HAS polarity (Blue for bullish, Red for bearish) across stacked timeframes before activation of entry/scale rules.

Formal view: Let HASTF ∈ {+1, −1} denote bullish/ bearish polarity on timeframe TF. Define ordered stack S = {TF0, TF1, TF2, TF3} with TF0 = execution timeframe. Structural resonance exists if a minimum subset of consecutive higher tiers share identical polarity with TF0.

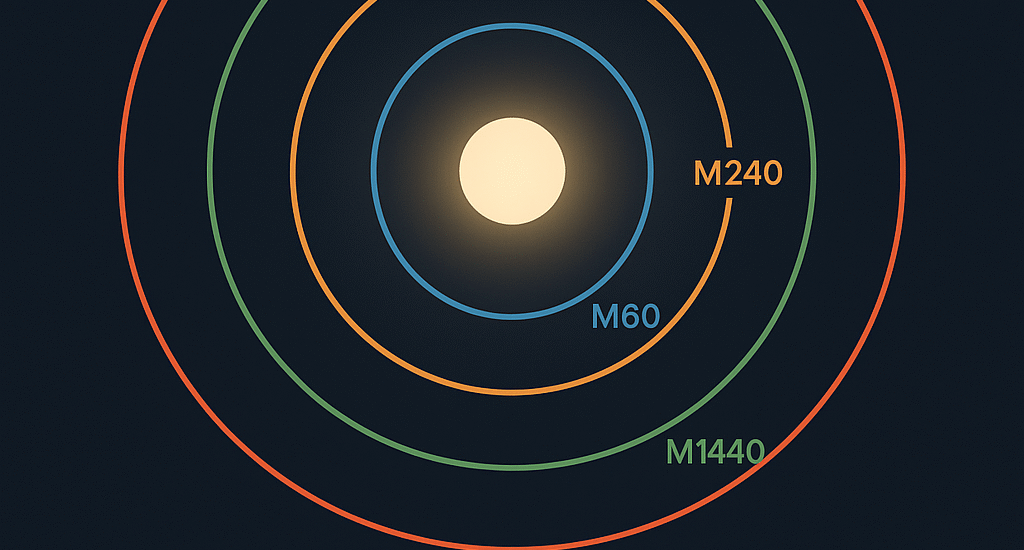

2) Quad-System Architecture

| Quad Level | Composition | Typical Stack (M60 core) | Purpose | Trade Utility |

|---|---|---|---|---|

| Quad-1 | Local only | M60 | Impulse detection | Fast entries; high churn risk |

| Quad-2 | Local + 1 higher | M60 + M240 | Momentum reinforcement | Short-term trend participation |

| Quad-3 | Local + 2 higher | M60 + M240 + M1440 | Structural resonance | Optimal balance (default) |

| Quad-4 | Local + 3 higher | M60 + M240 + M1440 + M10080 | Macro coherence | Institutional timing; lower frequency |

GATS Default: Quad-3 for routine execution; Quad-4 when capital preservation & macro alignment are paramount.

3) Resonance Index (RI) — Quantitative Gating

Assign weights to each confirming timeframe and sum their signed polarity:

RI = Σ ( ωᵢ · HASᵢ ) , HASᵢ ∈ {+1, −1}

Recommended weights for an M60 core:

| Timeframe | Role | Weight (ω) | Anchor |

|---|---|---|---|

| M60 | Execution/Trigger | 0.35 | EMA 16–25 (Transition) + EMA 26–50 (Value) |

| M240 | Structural | 0.25 | EMA 26–50 (Value) |

| M1440 | Macro Bias | 0.25 | EMA 90–140 (Reassessment) |

| M10080 | Super-Macro | 0.15 | EMA 141–200 (Long-Term) |

Activation: Longs if RI ≥ +0.85; Shorts if RI ≤ −0.85. Pause new entries if |RI| < 0.75; manage existing positions with DAATS/DS only.

4) MT5 / GATS Pseudocode (Production-Ready Patterns)

4.1 HAS Polarity Accessor

// Returns +1 for Blue (bullish), -1 for Red (bearish)

int HAS_Polarity(string symbol, ENUM_TIMEFRAMES tf)

{

// Implement your HAS smoothing; return polarity only

// Example: if( hasClose > hasOpen ) return +1; else return -1;

return GetHASColor(symbol, tf) ? +1 : -1;

}

4.2 Quad-Confirmation Check

bool Quad3_Aligned(string sym)

{

int p60 = HAS_Polarity(sym, PERIOD_H1);

int p240 = HAS_Polarity(sym, PERIOD_H4);

int p1440 = HAS_Polarity(sym, PERIOD_D1);

return (p60 == p240 && p240 == p1440);

}

bool Quad4_Aligned(string sym)

{

int p60 = HAS_Polarity(sym, PERIOD_H1);

int p240 = HAS_Polarity(sym, PERIOD_H4);

int p1440 = HAS_Polarity(sym, PERIOD_D1);

int p10080= HAS_Polarity(sym, PERIOD_W1);

return (p60 == p240 && p240 == p1440 && p1440 == p10080);

}

4.3 Resonance Index (weighted)

double ResonanceIndex(string sym)

{

int p60 = HAS_Polarity(sym, PERIOD_H1);

int p240 = HAS_Polarity(sym, PERIOD_H4);

int p1440 = HAS_Polarity(sym, PERIOD_D1);

int p10080= HAS_Polarity(sym, PERIOD_W1);

// Weights for M60 core:

return 0.35*p60 + 0.25*p240 + 0.25*p1440 + 0.15*p10080;

}

4.4 Entry Gate with DS=DAATS Initialization and BE=18.75%

bool EntryGate_LONG(string sym)

{

if(!Quad3_Aligned(sym)) return false; // Quad-3 minimum

double RI = ResonanceIndex(sym);

if(RI < 0.85) return false; // Quantitative gate

// DS sizing on M240; DAATS0 = DS (Unified start)

double atr256_m240 = ATR(sym, PERIOD_H4, 256);

double DS_points = 16.0 * atr256_m240;

double riskPct = 0.75; // default (0.75 - 1.00)

double units = PositionSizeFromDS(sym, riskPct, DS_points);

// Place order & attach stops

PlaceLong(sym, units, DS_points); // DS hard stop

SetDAATS(sym, DS_points); // DAATS0 = DS

return true;

}

4.5 DAATS Activation and Trailing

void ManageDAATS_LONG(string sym, double entryPrice, double DS_points)

{

// Activation at 18.75% of DS (3/16)

double trigger = 0.1875 * DS_points;

if( Bid(sym) - entryPrice >= trigger )

{

// Move to breakeven and trail by same offset

double trailOffset = trigger;

SetBreakEven(sym, entryPrice);

StartTrailing(sym, trailOffset); // keep constant amplitude

}

}

Note: The DAATS regime multiplier (k ∈ {12, 16, 18}) can still be applied to internal analytics (ATR50 on M60) for diagnostics, but the trail amplitude specified here is locked to 0.1875 × DS for universal symmetry.

5) Operational Tables — Timeframe Stacks & Anchors

| Execution TF | Confirmation Stack | DS Anchor | Primary Use |

|---|---|---|---|

| M60 | M60 + M240 + M1440 (Quad-3) | M240 ATR256 × 16 | Default engine |

| M30 | M30 + M60 + M240 (Quad-3) | M1440 ATR256 × 16 | Aggressive add-ons |

| M15 | M15 + M30 + M60 (Quad-3) | M240 ATR256 × 16 | Intraday rotation |

| M240 | M240 + M1440 + M10080 (Quad-3) | M1440 ATR256 × 16 | Strategic swing |

EMA Zones: All seven zones active on each confirming timeframe; enter only when zone order and slopes are coherent.

6) Quantum Analogy — Phase Coherence & Entangled Timeframes

Each timeframe is a frequency band in a probabilistic wavefield. When HAS polarities align (Quad-3/Quad-4), constructive interference amplifies directional probability—this is the Resonant Entry State. When alignment breaks, destructive interference lowers RI, halting new entries while DS/DAATS preserve the living trade until coherence returns.

7) Integration with Risk Engine (Universal Settings)

- DS (sizing & hard stop): 16 × ATR256(M240)

- DAATS (initial): DAATS0 = DS (Unified start)

- BE Trigger: 18.75% of DS (3/16 × DS)

- Trail Offset: 0.1875 × DS (constant amplitude)

- Risk: 0.75% – 1.00% per trade, sized only from DS

- Entry Gate: Quad-3 alignment and RI ≥ 0.85

Conclusion

The Quad-Confirmation Principle turns multi-timeframe uncertainty into a measurable resonance. With RI gating, DS=DAATS initialization, and BE=18.75% trail symmetry, GATS integrates frequency alignment with executable discipline—enabling institutional entries, controlled breathing, and conversion of drawdown into time rather than capital loss.

About the Author

Dr. Glen Brown is the President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., leading institutions at the frontier of financial engineering and proprietary trading. With over 25 years of expertise in finance, accounting, and algorithmic trading, Dr. Brown integrates quantum theory, mathematics, and philosophical insight into the architecture of modern financial systems.

General Disclaimer

The material presented herein is for educational and informational purposes only. Trading and investing in financial markets involve substantial risk. Past performance is not indicative of future results. Always perform your own due diligence before making trading decisions. Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. do not provide investment advice.

Business Model Disclaimer

Global Financial Engineering, Inc. and Global Accountancy Institute, Inc. operate as a Global Multi-Asset Class Closed Professional Proprietary Trading Firm. The firms do not accept external client funds or manage assets on behalf of the public. All trading and research activities are conducted internally through proprietary capital, systems, and strategies under the Global Algorithmic Trading Software (GATS) Framework. Educational and analytical materials are presented solely for knowledge development, technical insight, and institutional transparency of process—not for solicitation or investment advisory purposes.