Lecture 4: The 18.75% Law of Adaptive Transition — Symmetry Between Breakeven and Trail

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading

From Fractal Geometry to Temporal Symmetry in Risk Evolution

By Dr. Glen Brown

Abstract

This lecture formalizes the 18.75% Law of Adaptive Transition within the Global Algorithmic Trading Software (GATS). The law defines the universal threshold at which a trade shifts from survival to expansion: the breakeven activation and the ongoing trail amplitude are both set to 3/16 of the Death-Stop (DS). By unifying these thresholds, GATS encodes a structural symmetry that converts drawdown into time and momentum into measured respiration. We provide derivations, tables, and MT5/GATS implementation logic for multi-asset deployment.

1) Conceptual Foundation

In GATS, the DS is a structural mortality boundary anchored to higher-timeframe volatility: DS = 16 × ATR256(M240). The DAATS (Dynamic Adaptive ATR Trailing Stop) begins unified with DS and later evolves according to an objective transition rule:

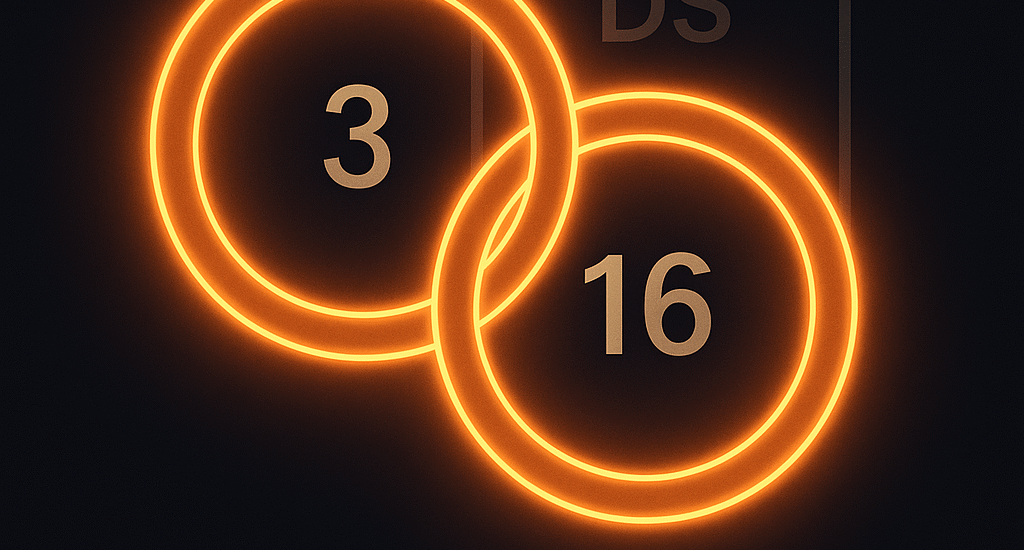

Symmetry Equation: BE_trigger = Trail_amplitude = (3/16) × DS = 0.1875 × DS

This replaces arbitrary “bar counts” with a spatial rule derived directly from the same structure that defines trade life expectancy. The first moment of validation (breakeven) and the ongoing respiration (trailing distance) share a single constant.

2) Adaptive Transition States

| State | Description | Risk Mode | Time Function |

|---|---|---|---|

| Dormant | DS active; no momentum proof | Pure protection | Static time |

| Transitional | Price advances by 0.1875 × DS | Move to BE | Time dilation |

| Dynamic | Trail with amplitude 0.1875 × DS | Profit respiration | Time normalization |

| Terminal | Hit DAATS (trail) or DS (hard stop) | Position expiration | Time collapse |

3) Quantitative Interpretation (Fractal Ratio)

Empirically in GATS calibration, long-horizon volatility (ATR256) and short-horizon volatility (ATR50) often respect a practical scaling. We encode the operational symmetry as:

- Structure:

DS = 16 × ATR256(M240) - Breath/Transition:

BE = Trail = 3/16 × DS

Thus the 3:16 proportion binds validation and respiration to the same structural frame: DS : BE = 16 : 3 ≈ 5.333 : 1. This is the golden operational ratio for risk evolution inside GATS.

4) Implementation Framework (MT5 / GATS)

4.1 Initialization (DS = DAATS)

// Higher-timeframe structure

double atr256_m240 = ATR(symbol, PERIOD_H4, 256);

double DS_points = 16.0 * atr256_m240;

// Unified start

double DAATS0 = DS_points; // DAATS = DS at t=0

// Position sizing (risk from DS only)

double units = PositionSizeFromDS(symbol, Equity, RiskPct, DS_points);4.2 Adaptive Transition — The 18.75% Law

// Constants

double BE_trigger = 0.1875 * DS_points; // 3/16 × DS

double TrailOffset = BE_trigger; // constant amplitude

// Activation logic (long example)

if ((Bid(symbol) - entryPrice) >= BE_trigger) {

SetStop(symbol, entryPrice); // move to breakeven

StartTrailing(symbol, TrailOffset); // keep constant trail amplitude

}

// Exit: hit DAATS (trail) or DS (hard stop). No discretionary tightening.4.3 Gating with Quad-3 / RI (from Lecture 2)

- Minimum entry gate: Quad-3 alignment (M60 + M240 + M1440) and

RI ≥ 0.85. - Pause new entries: if

|RI| < 0.75. Existing trades continue under DS/DAATS.

5) Universal Operations Table

| Element | Specification | Purpose |

|---|---|---|

| Execution TF | M60 | Optimum frequency–structure balance |

| Confirmation | Quad-3 (M60+M240+M1440) | Structural resonance |

| DS (sizing & hard stop) | 16 × ATR256(M240) | Trade life expectancy |

| DAATS (initial) | DAATS0 = DS | Drawdown → time (unified start) |

| BE Trigger | 0.1875 × DS | Objective activation |

| Trail Offset | 0.1875 × DS | Constant respiration amplitude |

| Risk per trade | 0.75% – 1.00% | Derived strictly from DS |

6) Worked Example (XAUUSD)

Suppose on M240, ATR256 = 8.50. Then:

- DS: 16 × 8.50 = 136.00 points

- BE Trigger: 0.1875 × 136.00 = 25.50 points

- Trail Offset: 25.50 points (constant)

With Equity = $100,000 and Risk% = 1.00%, size positions using DS_value and broker point value, then manage with the 18.75% symmetry for breakeven and trailing.

7) Philosophical Reflection — The Law of Temporal Equilibrium

The 18.75% Law is a covenant between structure and time. The same fraction of structural risk that justifies continuation also governs respiration. In this symmetry, uncertainty becomes rhythm; volatility becomes breath; risk evolves through time rather than destroying capital.

Conclusion

By encoding BE_trigger = Trail_amplitude = 0.1875 × DS, GATS compresses complexity into an elegant invariant. The result is a universal transition protocol that protects early, breathes consistently, and aligns micro-movement with macro structure—the hallmark of algorithmic discipline and temporal intelligence.

About the Author

Dr. Glen Brown is the President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., leading institutions at the frontier of financial engineering and proprietary trading. With over 25 years of expertise in finance, accounting, and algorithmic trading, Dr. Brown integrates quantum theory, mathematics, and philosophical insight into the architecture of modern financial systems.

General Disclaimer

The material presented herein is for educational and informational purposes only. Trading and investing in financial markets involve substantial risk. Past performance is not indicative of future results. Always perform your own due diligence before making trading decisions. Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. do not provide investment advice.

Business Model Disclaimer

Global Financial Engineering, Inc. and Global Accountancy Institute, Inc. operate as a Global Multi-Asset Class Closed Professional Proprietary Trading Firm. The firms do not accept external client funds or manage assets on behalf of the public. All trading and research activities are conducted internally through proprietary capital, systems, and strategies under the Global Algorithmic Trading Software (GATS) Framework. Educational and analytical materials are presented solely for knowledge development, technical insight, and institutional transparency of process—not for solicitation or investment advisory purposes.