Lecture 5: Portfolio-Level Calibration — From FX to Indices and Beyond

- November 2, 2025

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Global Daily Insights, Global Financial Engineers, Global Financial Insights, Trading Psychology, Algorithmic Trading

Harmonizing ATR Scaling, DS/DAATS Parameters, and Cross-Asset Volatility Geometry

By Dr. Glen Brown

Abstract

This lecture extends the foundational GATS risk geometry from individual trade logic to full portfolio orchestration. Through Portfolio-Level Resonance Calibration (PLRC), the system harmonizes volatility, risk, and trail parameters across multiple asset classes—FX, indices, metals, energies, and crypto. Using normalized ATR ratios, DS=DAATS initialization, and the 18.75% Law, GATS achieves coherent risk expression across diverse markets. The result is a unified field of temporal risk symmetry where each instrument breathes proportionally within a portfolio’s collective rhythm.

1) The Need for Normalization

Markets differ in nominal price, tick size, and volatility amplitude, yet GATS treats all through the same structural logic. To achieve portfolio coherence, each instrument is rescaled using a Volatility Normalization Coefficient (VNC):

VNCᵢ = ATR₍50,ᵢ₎ / mean(ATR₍50,Universe₎)This ratio expresses how volatile an asset is relative to the portfolio norm. It becomes the cornerstone for adaptive risk and DS/DAATS scaling across instruments.

2) Cross-Asset Calibration Matrix

| Asset Class | Example Symbols | Core TF | DS Anchor | DAATS Anchor | VNC Weight | Risk per Trade |

|---|---|---|---|---|---|---|

| Major FX | EURUSD, GBPUSD, USDJPY | M60 | M240 ATR256 × 16 | M60 ATR50 × k(12–16×) | 1.00 | 0.75% |

| Indices | US30, UK100, GER40 | M60 | M240 ATR256 × 18 | M60 ATR50 × 16× | 1.25 | 0.60% |

| Metals | XAUUSD, XAGUSD | M60 | M240 ATR256 × 20 | M60 ATR50 × 18× | 1.50 | 0.50% |

| Energy | WTI, Brent | M60 | M240 ATR256 × 22 | M60 ATR50 × 20× | 1.75 | 0.50% |

| Crypto | BTCUSD, ETHUSD | M60 | M240 ATR256 × 25 | M60 ATR50 × 22× | 2.00 | 0.40% |

3) Dynamic Risk Allocation Algorithm

To maintain risk parity:

Riskᵢ = BaseRisk / VNCᵢThis inversely scales risk with volatility, ensuring that assets with higher ATR values receive proportionally smaller allocation. Implementation example in MQL5:

double VNC = ATR(sym, PERIOD_H1, 50) / PortfolioMeanATR50();

double adjRisk = BaseRisk / VNC;

double DS_points = DS_Multiplier(sym) * ATR(sym, PERIOD_H4, 256);

double units = PositionSizeFromDS(sym, adjRisk, DS_points);4) DAATS–DS Correlation Matrix

| Condition | ATR Expansion | DAATS Response | System Action |

|---|---|---|---|

| Volatility Compression | ATR ↓ ≥ 10% | DAATS tightens proportionally | Hold trades; no scaling |

| Volatility Expansion | ATR ↑ ≥ 15% | DAATS expands automatically | Allow add-on entries |

| Macro Volatility Shock | ATR ↑ ≥ 25% | DAATS locks (stop only widens) | Freeze new entries |

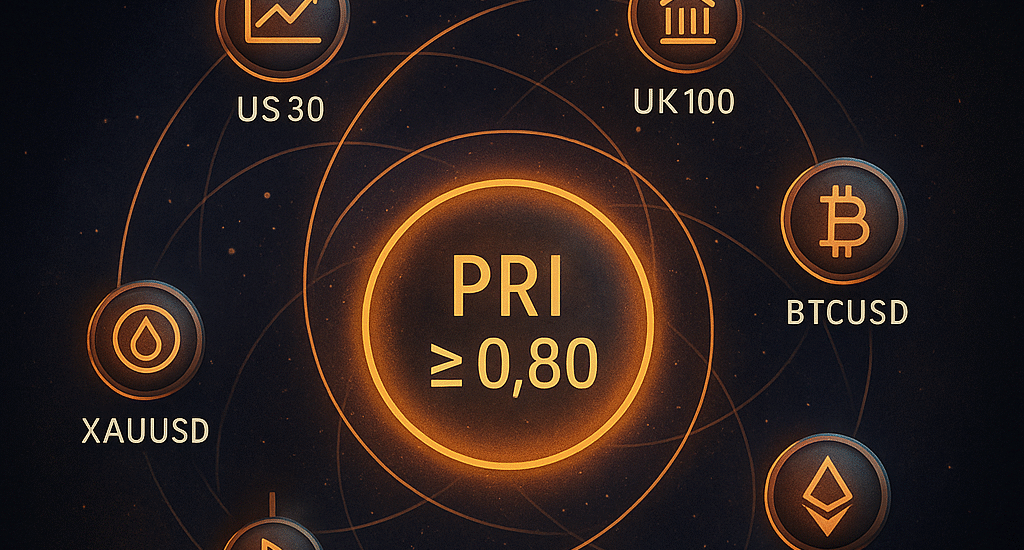

5) Portfolio-Level Resonance Index (PRI)

Extending Lecture 2’s Resonance Index (RI) to the portfolio level:

PRI = (1/N) Σ ( RIᵢ × Wᵢ )A portfolio enters a Global Resonant State when PRI ≥ 0.80. This alignment ensures synchronized momentum across all instruments.

6) GATS Integration Pipeline

- Collect ATR₍50₎ and ATR₍256₎ for all assets.

- Compute VNCᵢ and adjust Risk% accordingly.

- Apply DS = DAATS = 16 × ATR₍256₎; set BE = 0.1875 × DS.

- Monitor PRI ≥ 0.80 for synchronized entries.

- Re-normalize weekly using latest ATR data.

7) Quantum Analogy — The Symphony of Volatility

Each instrument is a frequency; the portfolio is an orchestra. When each is normalized via VNC and conducted under the same 18.75% law, their vibrations merge into a coherent market symphony. The Portfolio Resonance Index acts as the conductor’s baton—signaling coherence when PRI ≥ 0.80.

Conclusion

Portfolio-Level Calibration transforms GATS from a strategy engine into a symphonic system of risk coherence. Volatility normalization (VNC), adaptive risk allocation, and PRI resonance unify multi-asset trading within a single law of temporal symmetry—DS = DAATS with 18.75% adaptive transition. The result is a living, breathing ecosystem where markets of every class pulse in harmony with the same disciplined rhythm.

About the Author

Dr. Glen Brown is the President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., leading institutions at the frontier of financial engineering and proprietary trading. With over 25 years of expertise in finance, accounting, and algorithmic trading, Dr. Brown integrates quantum theory, mathematics, and philosophical insight into the architecture of modern financial systems.

General Disclaimer

The material presented herein is for educational and informational purposes only. Trading and investing in financial markets involve substantial risk. Past performance is not indicative of future results. Always perform your own due diligence before making trading decisions. Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. do not provide investment advice.

Business Model Disclaimer

Global Financial Engineering, Inc. and Global Accountancy Institute, Inc. operate as a Global Multi-Asset Class Closed Professional Proprietary Trading Firm. The firms do not accept external client funds or manage assets on behalf of the public. All trading and research activities are conducted internally through proprietary capital, systems, and strategies under the Global Algorithmic Trading Software (GATS) Framework. Educational and analytical materials are presented solely for knowledge development, technical insight, and institutional transparency of process—not for solicitation or investment advisory purposes.