-

Law X: The Dual-Magnet Regime Commitment Engine

- December 23, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading & Market Doctrine

No Comments

Excerpt: A universal market law: constraint resolves before commitment. Law X combines Pin Basins, Commitment Basins, and the RC1–RC3 hierarchy to compute timeframe authority, permission commitment, and formalize non-participation as a correct decision state.

-

Lecture 2: The Quad-Confirmation Principle — Structural Resonance in Multi-Timeframe Trading

- November 1, 2025

- Posted by: Drglenbrown1

- Categories: GATS Lecture Series, Global Financial Insights, Trading Psychology, Algorithmic Trading, Global Financial Markets Analysis, Global Financial Markets Insights

Explore how GATS achieves structural coherence through multi-timeframe resonance and the Quad-Confirmation Principle, with RI gating and MT5 implementation logic.

-

The Quantum Edge – Synthesizing the Nine Laws

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Quantum-Inspired Trading Systems, Holistic Strategy Synthesis

Trading is a quantum dance of uncertainty and precision, mastered through a unified framework. Dr. Glen Brown’s Nine-Laws Framework synthesizes the nine GATS strategies with quantum principles, from entanglement to state tomography, to navigate markets across timeframes. This article unifies the series, showcasing how GATS1 to GATS43200 deliver a quantum edge from minutes to months, optimizing returns and risks.

-

Comparing GATS Strategies – A Quantum Spectrum of Performance

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Strategy Evaluation, Quantum-Inspired Trading Systems

Trading strategies span a quantum spectrum, each measuring market states at different scales. Dr. Glen Brown’s Nine-Laws Framework powers the nine GATS strategies, from GATS1’s rapid scalping to GATS9’s long-term trends, offering a range of performance profiles. This article compares their effectiveness across timeframes, leveraging quantum multi-scale principles to optimize returns from minutes to months.

-

Continuous Model Validation – Quantum State Tomography

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Model Validation, Quantum-Inspired Trading Systems

A trading model is like a quantum system needing constant recalibration to stay accurate. Dr. Glen Brown’s Law 9 of the Nine-Laws Framework uses continuous validation, inspired by quantum state tomography, to refine GATS strategies. This article explores how GATS1 to GATS43200 adapt through weekly reviews, ensuring robustness across timeframes from minutes to months in evolving markets.

-

Transaction-Cost & Slippage Optimization – Mitigating Measurement Noise

- June 29, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Trade Execution Optimization, Quantum-Inspired Trading Systems

Trading execution is like a quantum measurement—small errors can skew results. Dr. Glen Brown’s Law 8 of the Nine-Laws Framework optimizes transaction costs and slippage, inspired by quantum error correction, to enhance precision. This article explores how GATS1 to GATS43200 apply this law, padding stops and using limit orders across timeframes from minutes to months, ensuring efficient trade execution.

-

Portfolio-Level Noise Budget – Managing Entangled Risks

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Portfolio Risk Management, Quantum-Inspired Trading Systems

A portfolio is like a quantum system where entangled assets amplify noise during stress. Dr. Glen Brown’s Law 7 of the Nine-Laws Framework allocates a noise budget using DAATS and GNASD, inspired by quantum entanglement principles. This article explores how GATS1 to GATS43200 manage these risks, balancing exposure across timeframes from minutes to months, ensuring robust portfolio performance.

-

Adaptive Break-Even Decision – Clustering Regimes

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Market Regime Analysis, Quantum-Inspired Trading Systems

Markets shift like quantum states between calm and chaos, requiring smart exit points. Dr. Glen Brown’s Law 6 of the Nine-Laws Framework adapts break-even decisions using regime clustering, inspired by quantum density matrix principles. This article explores how GATS1 to GATS43200 apply this law, adjusting exits across timeframes from minutes to months, ensuring profit protection in dynamic conditions.

-

Exit Only on Death – Quantum Measurement for Trade Closure

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Trade Execution, Quantum-Inspired Trading Systems

Closing a trade is like collapsing a quantum state—timing is everything. Dr. Glen Brown’s Law 5 of the Nine-Laws Framework enforces exit only on death, using death-stops and fractional break-evens, inspired by quantum measurement. This article explores how GATS1 to GATS43200 apply this law, ensuring disciplined exits across timeframes from minutes to months, maximizing profits in volatile markets.

-

Exposure & Death-Stop – Sub-Linear Scaling with √P

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Risk Control, Quantum-Inspired Trading Systems

Trading is like navigating a quantum path where past moves shape future risks. Dr. Glen Brown’s Law 4 of the Nine-Laws Framework introduces sub-linear √P scaling and death-stops to manage exposure, inspired by path-dependent memory. This article explores how GATS1 to GATS43200 apply this law, adjusting stops and exits across timeframes from minutes to months, ensuring disciplined risk management in volatile markets.

-

Macro Shock Propagation – Navigating Phase Transitions

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Systemic Risk Management, Quantum-Inspired Trading Systems

Market shocks, like sudden phase changes in a quantum system, can ripple through assets, disrupting trends. Dr. Glen Brown’s Law 3 of the Nine-Laws Framework counters this with DAATS ratcheting during VIX or credit-spread surges, inspired by quantum phase transitions. This article explores how GATS1 to GATS43200 navigate these shocks, adjusting stops and hedging risks across timeframes from minutes to months, ensuring robustness in turbulent markets.

-

Weighted Decay of DAATS – Smoothing Noise with Lindblad Dynamics

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Volatility Management, Quantum-Inspired Trading Systems

Market noise, like the random fluctuations of quantum particles, can disrupt trading precision. Dr. Glen Brown’s Law 2 of the Nine-Laws Framework refines the Dynamic Adaptive ATR Trailing Stop (DAATS) with a weighted decay mechanism, inspired by quantum decoherence, to smooth volatility. This article explores how GATS1 to GATS43200 apply this law, adjusting DAATS across timeframes from minutes to months, ensuring stability and adaptability in the face of market chaos.

-

Dow Jones (US30) Comprehensive Analysis

- April 29, 2025

- Posted by: Drglenbrown1

- Category: Indices / Market Analysis

“Comprehensive Dow Jones analysis for April 29, 2025: multi‐timeframe GATS Value-Zone envelopes, volatility-weighted fair‐value, and key fundamental catalysts for your trading roadmap.”

-

Global Traders Guidance Sheet: EUR/USD Week of April 27 – May 3, 2025

- April 27, 2025

- Posted by: Drglenbrown1

- Category: Forex Trading / Market Analysis

“A step-by-step guide to trading EUR/USD this week: from daily value-zone envelopes and fair-value metrics to H4/M60/M30 precision entries, underpinned by major US and Eurozone data events.”

-

Bridging Theory and Reality: Practical Applications of Financial Engineering

- March 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the journey from academic financial theories to real-world trading applications with the GATS framework, a revolutionary system that adapts dynamic strategies and risk controls for optimal market performance.

-

Global Financial Markets Insights by Dr. Glen Brown: USDJPY Analysis

- October 14, 2024

- Posted by: Drglenbrown1

- Category: Forex Technical Analysis, USDJPY Insights, GATS Methodology

Comprehensive USDJPY technical analysis by Dr. Glen Brown, using the GATS 369 Channel and multi-timeframe confirmations to identify potential trade setups for October 2024.

-

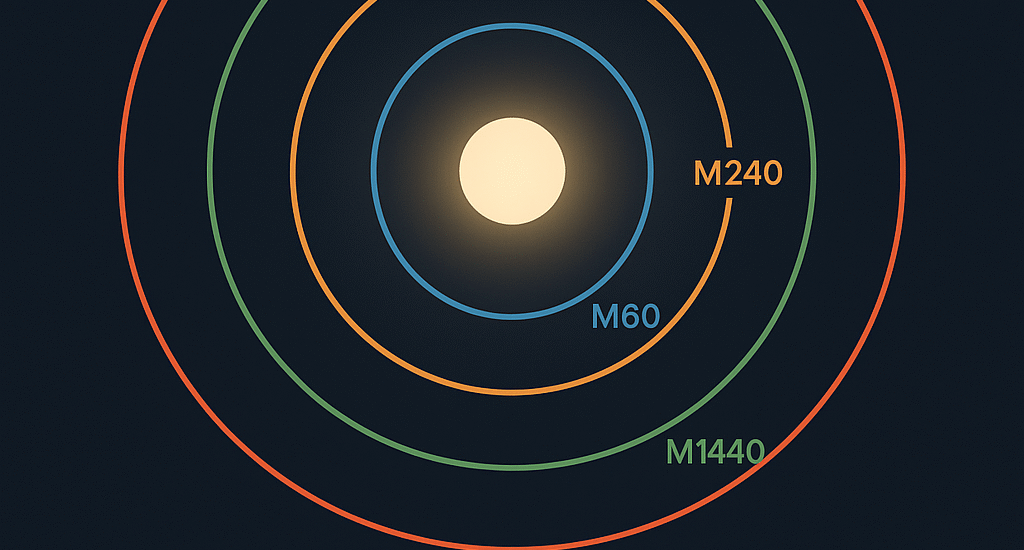

Directional and Momentum Bias Across Different Timeframes Within GATS

- June 26, 2024

- Posted by: Drglenbrown1

- Category: Financial Trading

Discover how GATS leverages directional and momentum bias across various timeframes using Heiken Ashi Smoothed candles and MACD indicators. Enhance your trading strategies with these insights.