-

Portfolio-Level Noise Budget – Managing Entangled Risks

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Portfolio Risk Management, Quantum-Inspired Trading Systems

No Comments

A portfolio is like a quantum system where entangled assets amplify noise during stress. Dr. Glen Brown’s Law 7 of the Nine-Laws Framework allocates a noise budget using DAATS and GNASD, inspired by quantum entanglement principles. This article explores how GATS1 to GATS43200 manage these risks, balancing exposure across timeframes from minutes to months, ensuring robust portfolio performance.

-

Adaptive Break-Even Decision – Clustering Regimes

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Market Regime Analysis, Quantum-Inspired Trading Systems

Markets shift like quantum states between calm and chaos, requiring smart exit points. Dr. Glen Brown’s Law 6 of the Nine-Laws Framework adapts break-even decisions using regime clustering, inspired by quantum density matrix principles. This article explores how GATS1 to GATS43200 apply this law, adjusting exits across timeframes from minutes to months, ensuring profit protection in dynamic conditions.

-

Exit Only on Death – Quantum Measurement for Trade Closure

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Trade Execution, Quantum-Inspired Trading Systems

Closing a trade is like collapsing a quantum state—timing is everything. Dr. Glen Brown’s Law 5 of the Nine-Laws Framework enforces exit only on death, using death-stops and fractional break-evens, inspired by quantum measurement. This article explores how GATS1 to GATS43200 apply this law, ensuring disciplined exits across timeframes from minutes to months, maximizing profits in volatile markets.

-

Macro Shock Propagation – Navigating Phase Transitions

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Systemic Risk Management, Quantum-Inspired Trading Systems

Market shocks, like sudden phase changes in a quantum system, can ripple through assets, disrupting trends. Dr. Glen Brown’s Law 3 of the Nine-Laws Framework counters this with DAATS ratcheting during VIX or credit-spread surges, inspired by quantum phase transitions. This article explores how GATS1 to GATS43200 navigate these shocks, adjusting stops and hedging risks across timeframes from minutes to months, ensuring robustness in turbulent markets.

-

Correlation Regime Transition – Detecting Systemic Stress with Entanglement

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Risk Management, Quantum-Inspired Trading Systems

Markets, like entangled quantum particles, can suddenly synchronize during systemic stress, amplifying volatility across assets. Dr. Glen Brown’s Law 1 of the Nine-Laws Framework, paired with the Global Algorithmic Trading Software (GATS), detects these correlation regime transitions using DAATS spikes and multi-timeframe alignments. This article explores how GATS1 to GATS43200 identify and respond to such stress, leveraging quantum entanglement principles to pause trades and hedge risks, ensuring resilience from minute-to-month timeframes.

-

The Nine GATS Strategies: A Quantum-Inspired Trading Spectrum

- June 28, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering, Algorithmic Trading, Quantum-Inspired Trading Systems

Financial markets, like quantum systems, are probabilistic and dynamic, oscillating between bullish, bearish, and choppy states. Dr. Glen Brown’s Nine-Laws Framework, powered by the Global Algorithmic Trading Software (GATS), harnesses this complexity through nine strategies, from the rapid Global Momentum Scalper (GATS1) to the enduring Global Monthly Trend Rider (GATS9). This article introduces these strategies, spanning timeframes from 1-minute to monthly, and their quantum-inspired design, rooted in the √Time Principle (√256 ≈ 16 exposures). By blending financial engineering with concepts like entanglement and path-dependent memory, GATS strategies offer a rigorous approach to trend-following and risk management, setting the stage for a series exploring the Nine Laws.

-

Introduction to Dr. Glen Brown’s Nine‑Laws Framework for Adaptive Volatility and Risk Management

- June 9, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Finance / Risk Management

-

Recalculating BE% & GNASD for GEMF – USA Sub‐Fund (June 1, 2025)

- June 1, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how to recalculate portfolio BE% and GNASD (one-sigma noise unit) for GEMF – USA Sub-Fund using updated M60 DAATS values on June 1, 2025. Includes formulae, examples, and implementation linked to Dr. Brown’s Seven Laws.

-

Applying M60 DAATS & GNASD Logic to Equities: GEMF – USA Sub‐Fund

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

Learn how GEMF – USA Sub-Fund uses M60 DAATS and GNASD to set stop floors, breakeven triggers, and trailing stops on micro-timeframes (M30, M15, M5, M1) under the Daily MACD bias and M60 EMA regime.

-

Micro‐Timeframe Stop Floors & Breakeven Logic Using M60 DAATS & GNASD

- May 31, 2025

- Posted by: Drglenbrown1

- Category: GATS Methodology

In this lecture, we demonstrate how GATS leverages M60 DAATS and the portfolio’s one‐sigma noise unit (GNASD) to establish robust stop‐loss floors, breakeven triggers, and trailing stops on M30, M15, M5, and M1. By anchoring micro‐timeframe stops to hourly volatility and applying a 1.39% breakeven rule per pair, traders can avoid routine hourly whipsaw while still capturing high‐probability moves under the Daily MACD bias and M60 EMA regime filters.

-

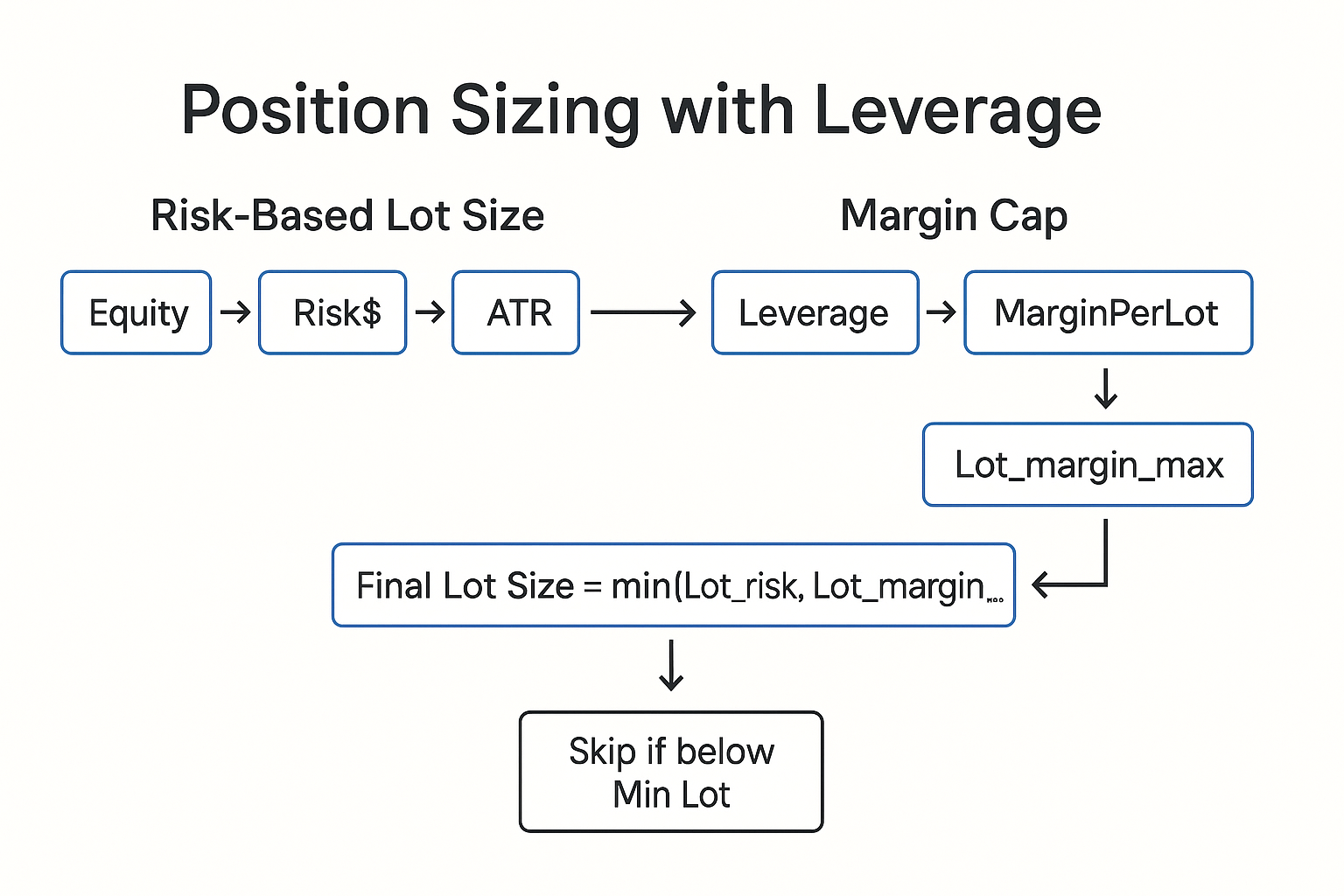

Position Sizing Under Extreme Leverage in Dr. Glen Brown’s Seven-Law Framework

- May 29, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Learn how to incorporate extreme leverage into Dr. Glen Brown’s Seven-Law volatility stop-loss framework for disciplined position sizing

-

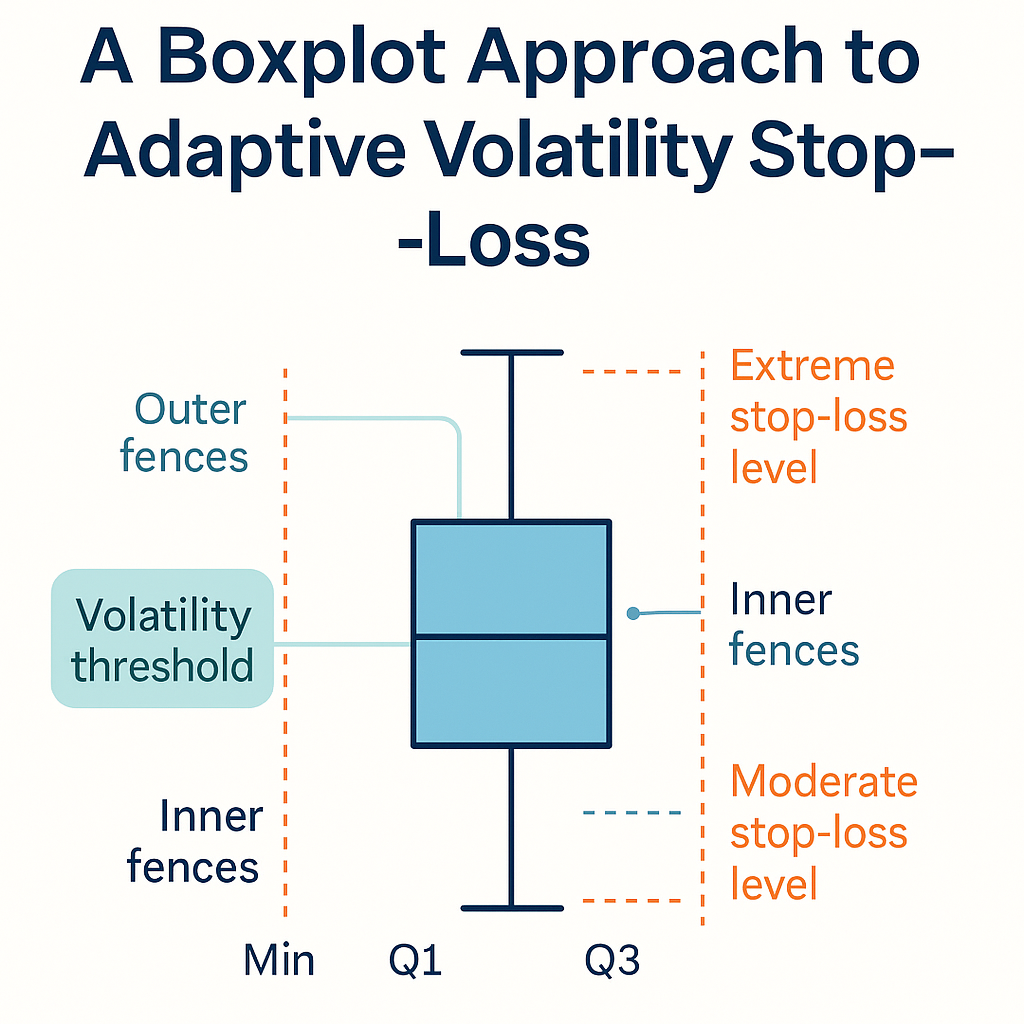

Whiskers & Fences: A Boxplot Approach to Adaptive Volatility Stop-Loss

- May 26, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to apply boxplot hinges, whiskers and fences to Dr. Glen Brown’s Seven Laws to detect regime shifts and dynamically adjust stop-loss buffers using ATR(200) exposures.

-

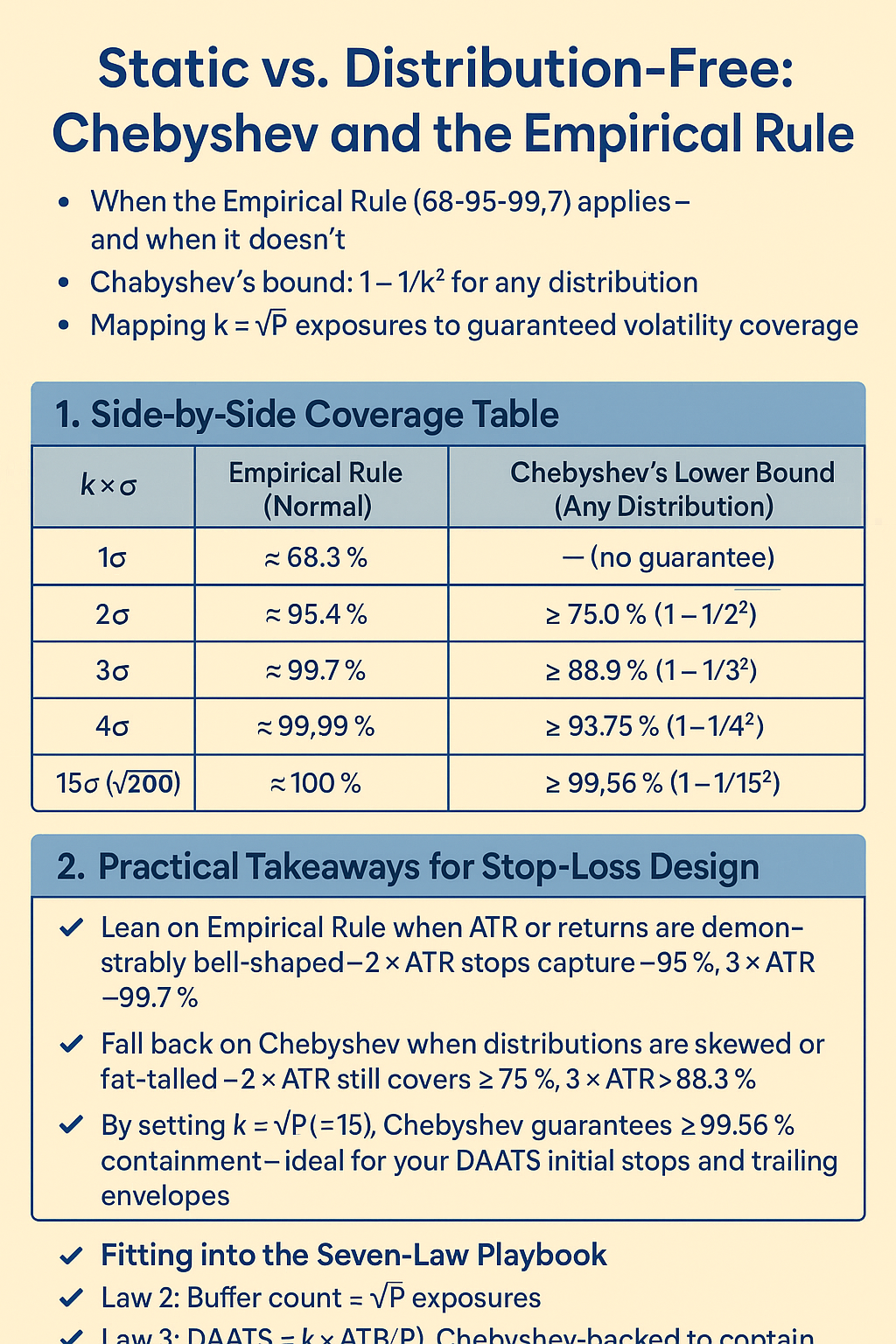

Static vs. Distribution-Free: Chebyshev and the Empirical Rule

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Compare the Empirical Rule for normal distributions with Chebyshev’s inequality for any distribution. Learn how k=√P exposures maps to guaranteed volatility coverage within Dr. Glen Brown’s Seven-Law framework.

-

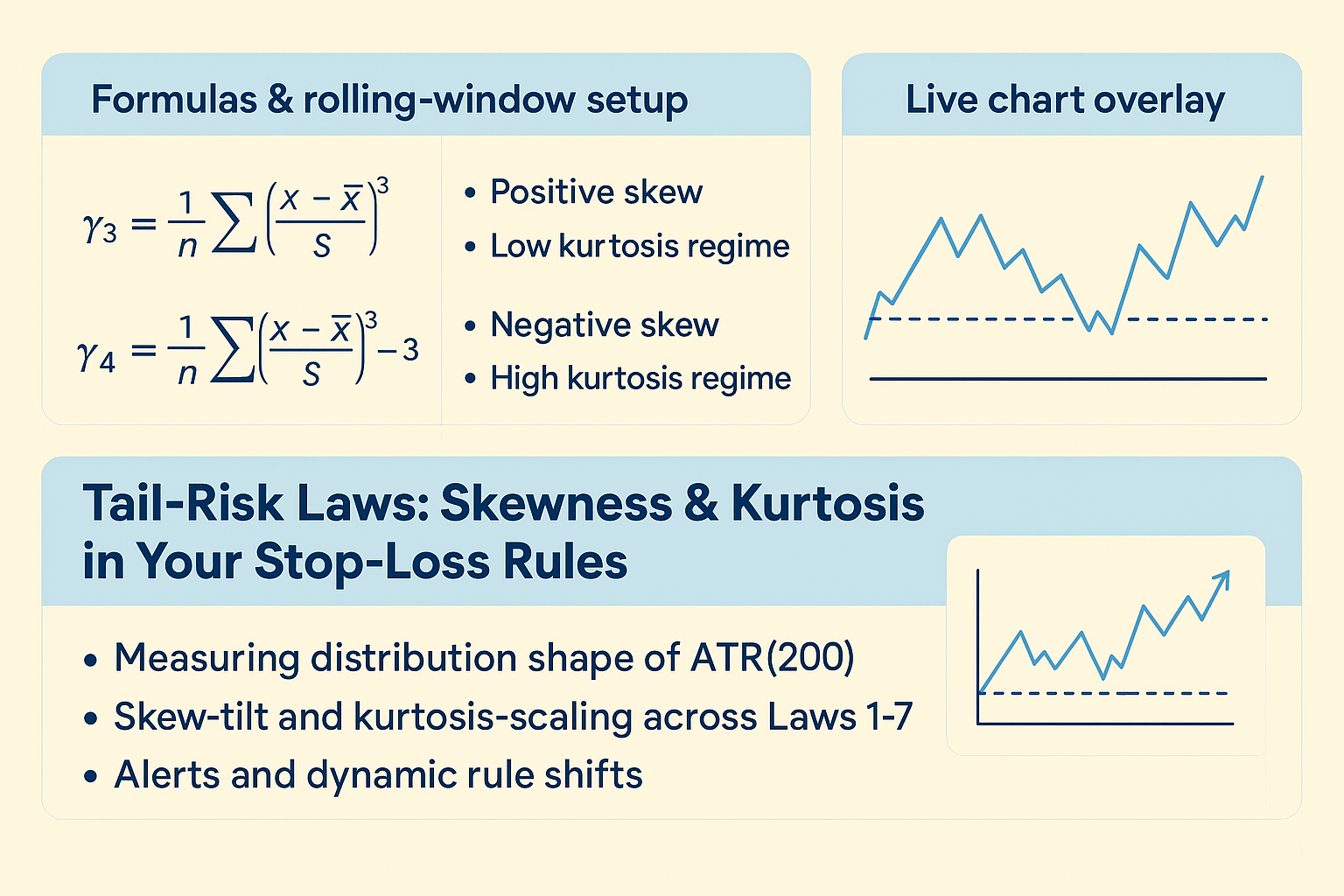

Tail-Risk Laws: Skewness & Kurtosis in Your Stop-Loss Rules

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to measure ATR(200) skewness and kurtosis, apply skew-tilt & kurtosis-scaling to Dr. Glen Brown’s Seven Laws, and view live chart overlays for dynamic stop adjustments.

-

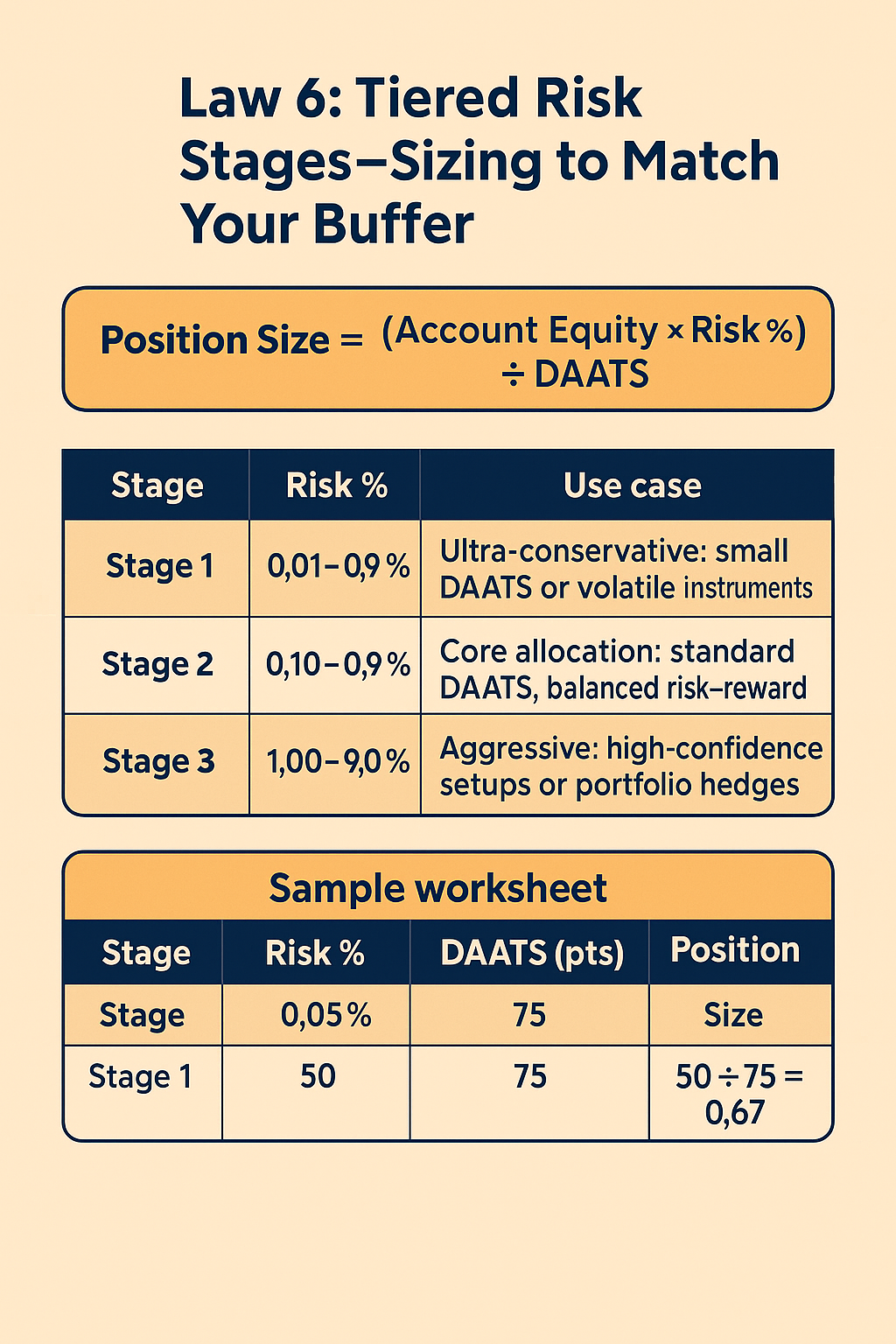

Law 6: Tiered Risk Stages—Sizing to Match Your Buffer

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn Law 6 of Dr. Glen Brown’s Seven Laws: position sizing via (Equity×Risk %) ÷ DAATS, explore Stage 1/2/3 risk tiers, and see case studies on dollar-at-risk levels.

-

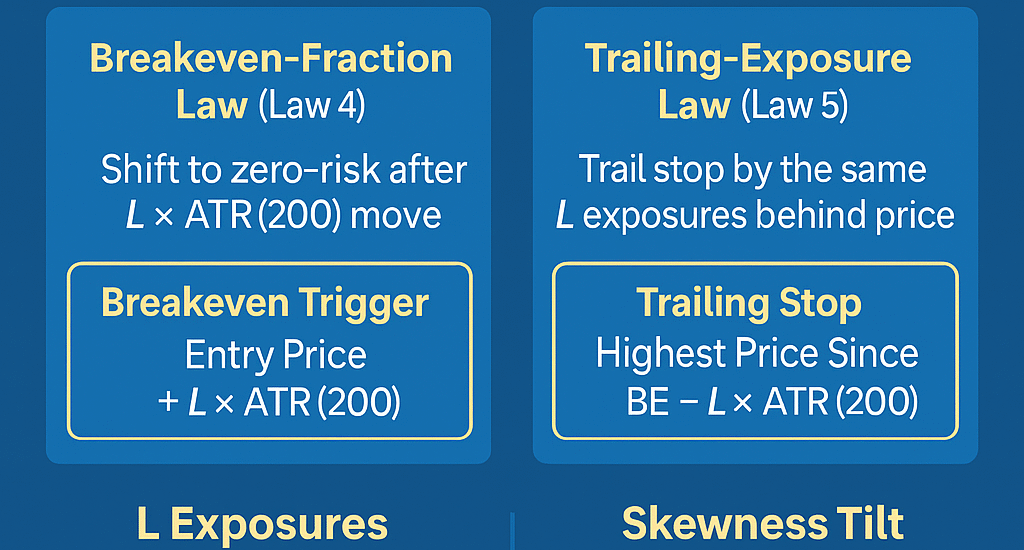

Laws 4–5: Lock in Zero-Risk & Let Winners Run

- May 25, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Master Laws 4–5 of Dr. Glen Brown’s framework—adaptive breakeven triggers and trailing stops using quartile/IQR and skewness—to lock in zero risk and let winners run.

-

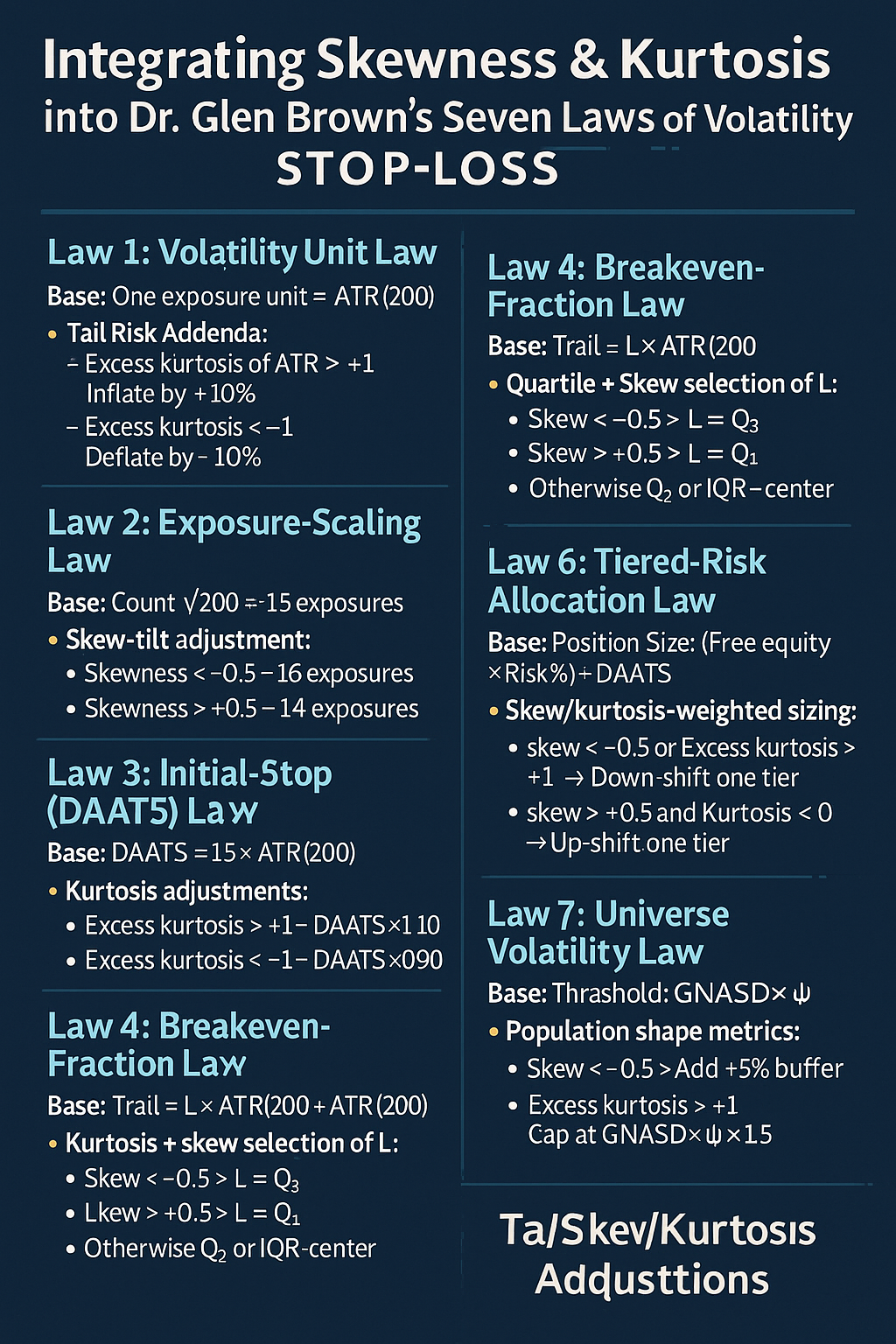

Integrating Skewness & Kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Learn how to integrate skewness and kurtosis into Dr. Glen Brown’s Seven Laws of Volatility Stop-Loss within the GATS framework for truly adaptive, tail-aware stops and breakeven rules.

-

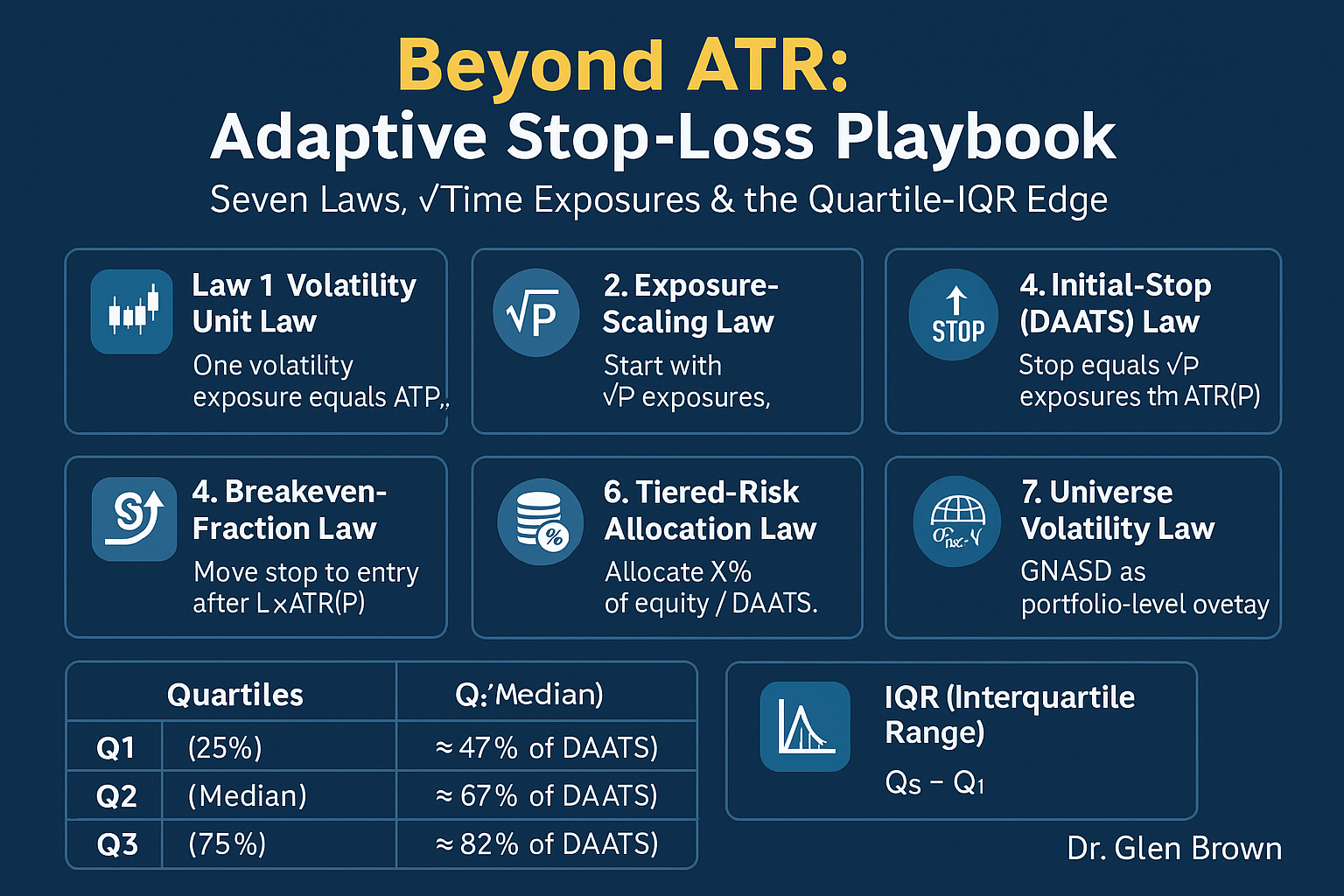

Beyond ATR: Dr. Glen Brown’s Adaptive Stop-Loss Playbook—Seven Laws, √Time Exposures & the Quartile-IQR Edge

- May 24, 2025

- Posted by: Drglenbrown1

- Category: Trading Methodology

Discover Dr. Glen Brown’s next-level stop-loss framework: seven universal laws, √time volatility exposures, and quartile/IQR techniques for adaptive breakeven and trailing stops.